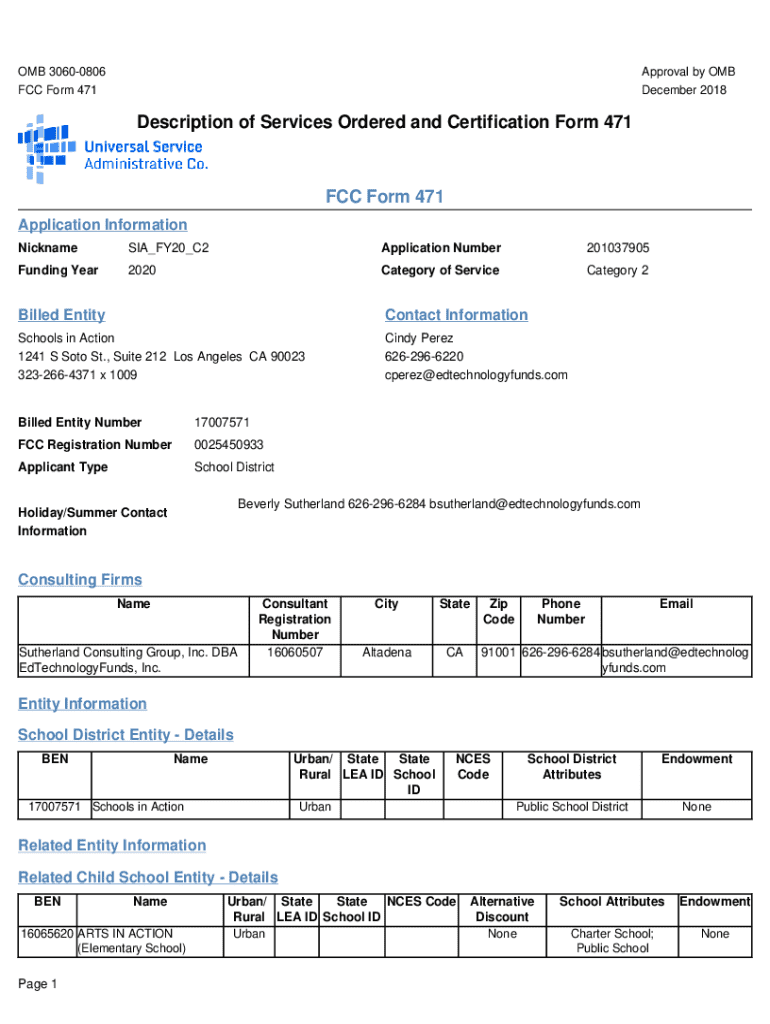

Get the free , Suite 212 Los Angeles CA 90023

Get, Create, Make and Sign suite 212 los angeles

Editing suite 212 los angeles online

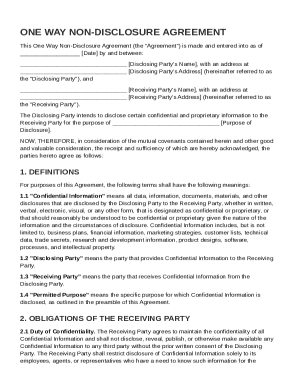

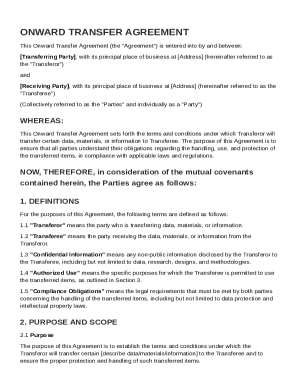

Uncompromising security for your PDF editing and eSignature needs

How to fill out suite 212 los angeles

How to fill out suite 212 los angeles

Who needs suite 212 los angeles?

The Complete Guide to the Suite 212 Los Angeles Form

Understanding the Suite 212 Los Angeles Form

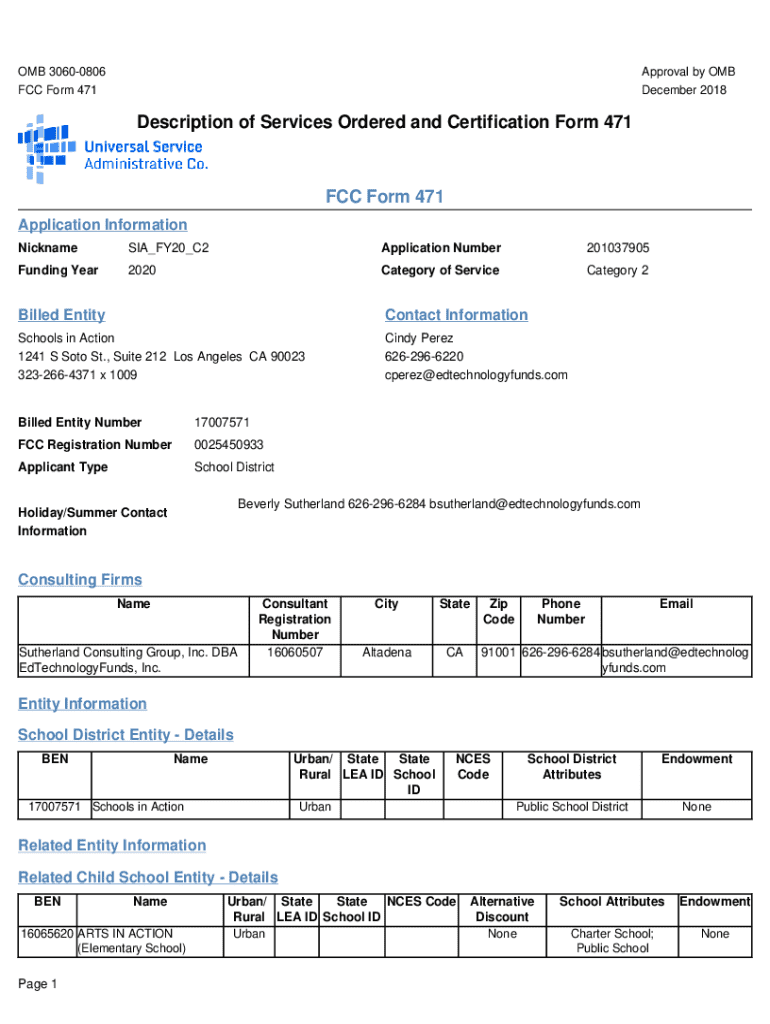

The Suite 212 Los Angeles Form is a critical document required for specific tax-related processes in Los Angeles, especially for non-resident aliens. This form serves multiple purposes, such as notifying the relevant authorities about the income earned in California by non-residents. Understanding the role of this form is crucial for individuals and organizations involved in financial dealings in the region.

In particular, this form is often utilized when individuals with foreign status must report income earned within the state. Its proper completion and submission are essential as they contribute to maintaining compliance with local and federal tax regulations. For anyone unfamiliar, navigating the tax landscape, especially regarding immigrant status or non-resident income, can be daunting.

Who needs the Suite 212 Form?

The Suite 212 Form is primarily targeted towards non-resident individuals and entities that earn income in Los Angeles. This includes foreign students, temporary workers, and international businesses that have transactions taking place in California. For non-residents who have received payments for services, contracts, or sales within the state, this form is a necessary tool for ensuring that their tax obligations are adequately reported.

In essence, if you fall under the category of a non-resident alien earning income through various channels, understanding when and why to utilize this form is paramount. It not only ensures that you comply with tax regulations, but also helps in preventing potential legal issues associated with misreporting or noncompliance that can stem from failure to submit the required documents.

Accessing the Suite 212 Los Angeles Form

To efficiently access the Suite 212 form, it is crucial to gather accurate information from reliable sources. The form can typically be found on official websites related to taxation and immigration, specifically those associated with the California Department of Tax and Fee Administration. Always ensure that you are using the most current form to avoid compliance issues.

Using authorized versions of the form safeguards against errors that can arise from outdated or incorrect documentation. By going directly to the official site, you can access the most accurate and relevant information needed for successful completion.

How to download the Suite 212 form

Downloading the Suite 212 Los Angeles Form is straightforward but requires attention to detail. Start by navigating to the official source where the form is located. Once you find the form, select the appropriate link to ensure that you’re downloading the correct document. After downloading, you may want to save the file in a designated folder to simplify future access.

It’s advisable to name the file logically, such as 'Suite_212_Form_[Year]' to avoid confusion later. Additionally, managing digital documents effectively helps in keeping track of submissions, revisions, and version control.

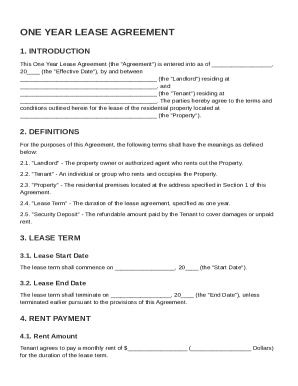

Filling out the Suite 212 form

The accuracy of the information you provide in the Suite 212 Form is critical. This form typically requires several essential details, including your personal identification information, type of income received, and your immigration status. Each section has a purpose, and filling it out correctly ensures that all notification requirements are met with clarity and precision.

Common pitfalls include providing incorrect income codes or failing to communicate your tax status effectively. To improve accuracy, consider reviewing each section thoroughly before submitting. If necessary, keeping records of your income and any supporting documents will provide the necessary evidence if questions arise.

Step-by-step instructions

When filling out the Suite 212 Form, start with your personal details. This section typically requests your name, contact details, and any identification numbers relevant to your tax status. Ensure that every detail aligns with official documentation to prevent mismatches. For instance, your income section should detail the nature of the revenue earned while in California.

After filling in your details, it'll be crucial to categorize your income accurately according to the income codes defined in your documentation. Once completed, review each section, ensuring completeness and accuracy before submitting.

Interactive tools for completion

Utilizing tools like pdfFiller enhances the simplicity of filling out the Suite 212 Form. With features that allow for easy editing, e-signature integration, and collaborative tools, users can ensure that their documents are completed accurately. The platform provides customizable fields that can adapt to the unique requirements of your form.

Additionally, pdfFiller offers users the ability to save drafts, making it convenient to work on forms over time. By using interactive editing tools, you can eliminate the need for lengthy paper trails and streamline the document management process.

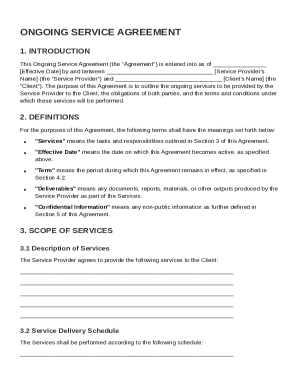

Submitting the Suite 212 form

Once your Suite 212 Form is entirely filled out, it’s time to submit it to the appropriate authorities. Depending on the nature of your circumstances, you may have the option to submit the form online or in person. Ensure you’re familiar with which method is preferred or required for your specific case.

If submitting in person, locate the correct office in Los Angeles and prepare any additional documents that might be required during submission. Alternatively, online submission through authorized state portals can offer a quicker and more efficient process, allowing for immediate confirmation of your submission.

Tracking your submission

After submitting your Suite 212 Form, confirming receipt is vital. If you submitted online, many platforms offer immediate confirmation alerts, allowing you to track your submission easily. If you opted for in-person submission, keep a record of any receipts or confirmations provided by the authorities.

Understanding the timeline for processing your form is also essential. While this can vary, knowing when to expect feedback or completion can help you manage your financial expectations moving forward.

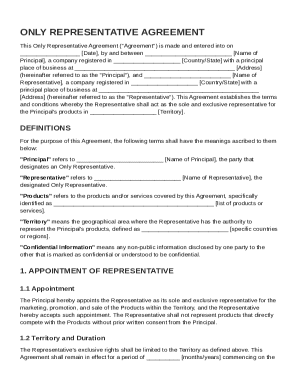

Managing your Suite 212 form

Post-submission documents, including the Suite 212 Form, can often require management or subsequent edits. Utilizing solutions such as pdfFiller makes it straightforward to amend your document if necessary. It’s important to know what amendments are permitted and how to initiate the process effectively.

Moreover, collaboration with teammates or advisors can enhance the overall experience. Leveraging collaborative tools available within pdfFiller makes it easy to share documents and obtain feedback, making revisions more manageable and effective.

Common issues and FAQs

Even with careful preparation, issues can arise when dealing with the Suite 212 Form. It’s essential to anticipate common challenges such as submitting the form late or having questions about the income codes. For those concerned about late submissions, it is crucial to reach out to taxation support for guidance on potential penalties or how to rectify the situation.

Additionally, retrieving a copy of your submitted form is typically straightforward if submitted through an official channel. Most platforms have features that allow users to access past submissions easily, maintaining a record for personal or tax purposes.

Best practices for document management

Effective document management goes beyond just filling and filing forms. By implementing robust strategies for organizing digital forms, you can ensure that accessing and referencing your documents is seamless. Use folders and ensure that all team members understand the filing system to maintain prompt access to necessary paperwork.

Furthermore, security is essential in handling sensitive data like that found in the Suite 212 Form. Utilizing encrypted solutions like pdfFiller will protect your personal and financial information, ensuring compliance with data protection regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send suite 212 los angeles for eSignature?

Can I create an electronic signature for signing my suite 212 los angeles in Gmail?

How do I complete suite 212 los angeles on an iOS device?

What is suite 212 los angeles?

Who is required to file suite 212 los angeles?

How to fill out suite 212 los angeles?

What is the purpose of suite 212 los angeles?

What information must be reported on suite 212 los angeles?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.