Get the free Property tax rate unchanged in Lake Worth ...

Get, Create, Make and Sign property tax rate unchanged

Editing property tax rate unchanged online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property tax rate unchanged

How to fill out property tax rate unchanged

Who needs property tax rate unchanged?

Property tax rate unchanged form: A comprehensive guide

Understanding property tax rates

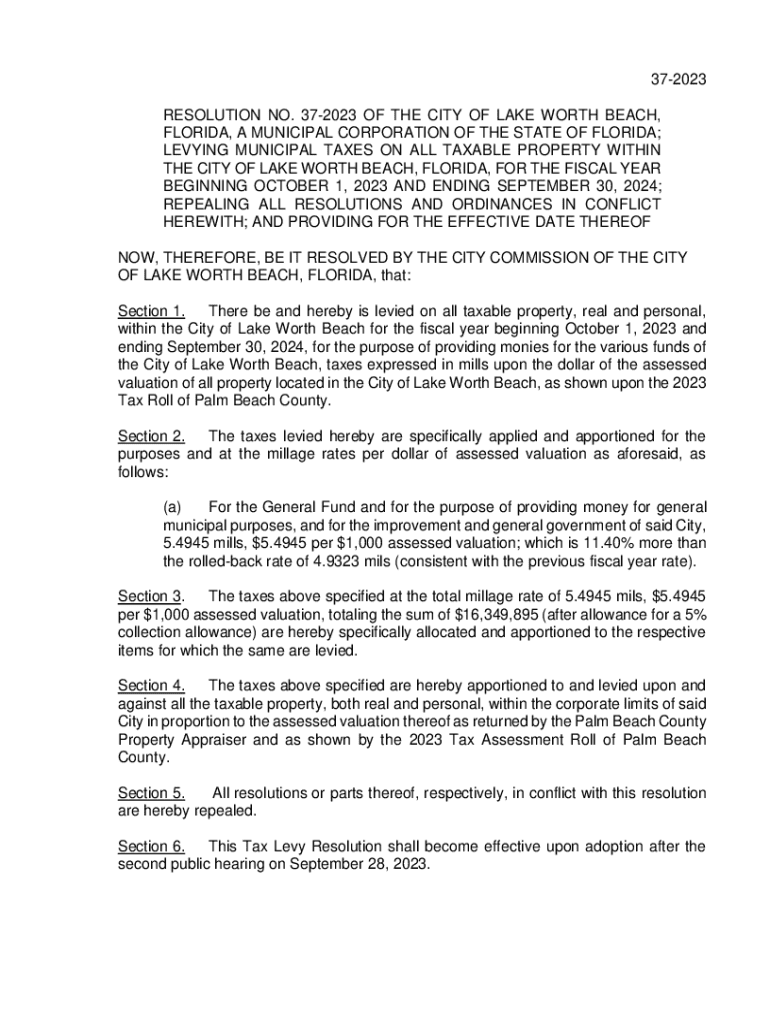

Property tax rates are rates set by local or state governments that generate revenue from real estate. These rates are essential for funding local services such as education, infrastructure, and public safety. Each jurisdiction determines its rate based on various factors, including the budgetary needs of local governments and the overall property values within the area.

Typically expressed as a percentage or a millage rate per $1,000 of assessed property value, property tax rates fluctuate based on municipal budgets and property market conditions. As property values increase, homeowners may see changes in their tax liabilities, prompting the need to monitor these rates closely.

Keeping track of unchanged property tax rates is vital for homeowners and businesses. Consistent rates can signal stability in local governance and financial planning, providing predictability in annual expenses.

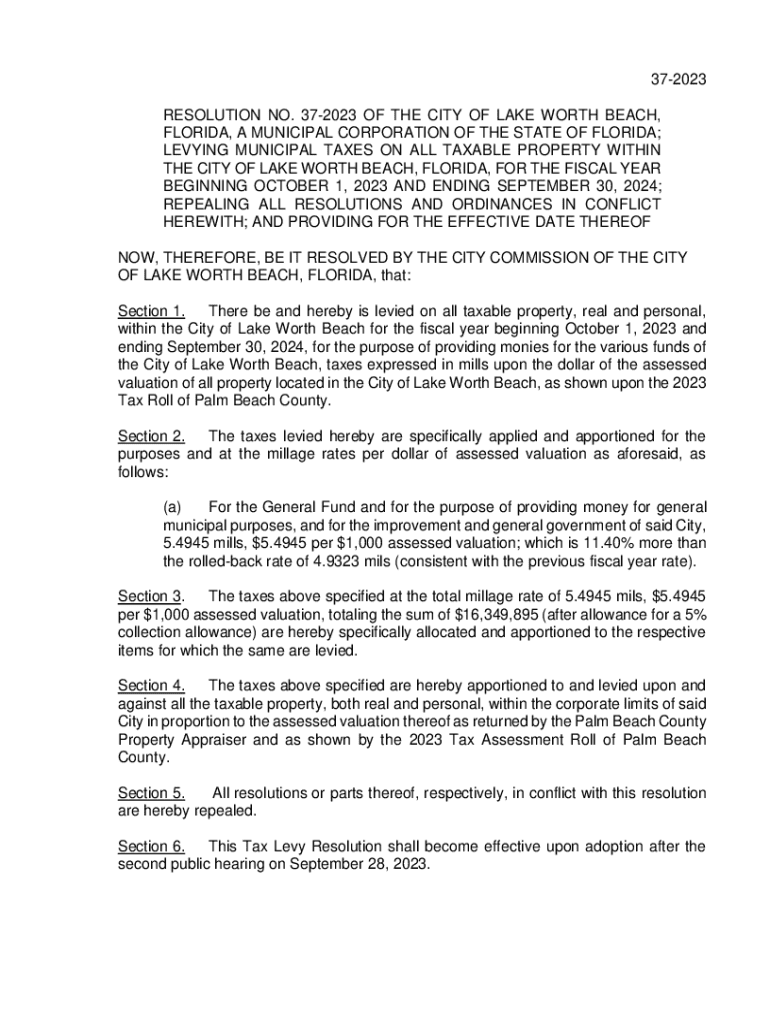

Overview of the property tax rate unchanged form

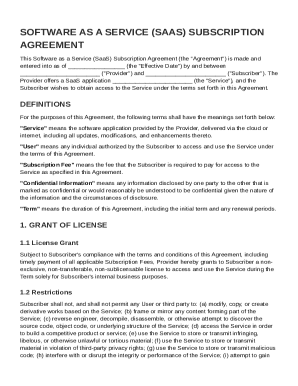

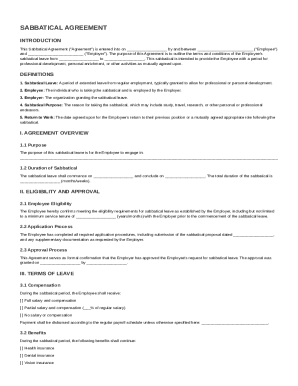

The property tax rate unchanged form is a specific document that confirms that a property's tax rate will remain the same for the upcoming tax year. This form is crucial for property owners, as it helps maintain consistent tax obligations without unexpected increases.

Typically utilized by local governments, the form must be filed during the tax assessment period. Anyone who owns property subject to taxes in the jurisdiction—especially homeowners, landlords, and businesses—should be aware of this form's requirements.

Understanding the key components of this form is crucial, as it often includes sections for property identification, tax district information, and relevant financial details pertaining to the property's assessed value.

Step-by-step instructions for completing the form

Completing the property tax rate unchanged form involves several important steps. First, gather the necessary information to ensure smooth filling. Essential documents might include the previous year's tax assessment notice, property deeds, and recent appraisals.

When collecting property details, ensure you have the correct property identification number, current assessed value, and relevant contact information. This foundational step helps avoid mistakes later in the process.

Once you've compiled the necessary information, the next step is filling out the form. Start with basic property details, ensuring accuracy in descriptions and values. Pay particular attention to common errors, such as transposing numbers or omitting critical information. A clean, legible form can prevent processing delays.

After filling out the form, take time to review your submission. This step is critical to ensuring that all information is accurate and complete before sending it to the tax authority.

Using pdfFiller for seamless editing

pdfFiller offers an intuitive platform for managing your property tax rate unchanged form. Users can upload their document directly, enabling real-time editing. With features like text editing and annotation, adjustments can be made quickly, ensuring that your form remains accurate and up-to-date.

Collaborative tools on pdfFiller allow multiple users to engage with the document simultaneously. This ability is particularly beneficial for teams who need to review or input data from different perspectives, whether in real estate firms, property management companies, or local councils.

Another significant advantage of pdfFiller lies in its eSignature integration. Users can securely sign their forms digitally, maintaining both legality and convenience. This feature streamlines the submission process as it eliminates the need for printing, scanning, or physical mailing.

Collaborating with teams on property tax forms

Collaboration is vital when it comes to completing property tax forms. Engaging different team members allows for a diverse range of inputs, which can enhance the overall accuracy of the submission. Having multiple perspectives on the content ensures all angles are considered, ultimately benefiting the property tax management process.

pdfFiller's collaboration tools provide an environment where team members can work together in real time, offering feedback and suggestions directly on the document. This eliminates confusion and fosters a smooth workflow where everyone’s input is valued.

By utilizing these collaborative features, teams can enhance productivity and ensure a thorough review process, leading to a final submitted form that reflects accurate and well-considered information.

Managing your property tax documents

Managing property tax documents can present challenges, especially during busy tax assessment periods. pdfFiller offers cloud-based document management that simplifies access and sharing. Storing documents in the cloud provides flexibility, allowing users to retrieve forms quickly from any device.

Organizing forms effectively can also enhance retrieval speed. Categories or folders for different property types or locations will make it easier for users to find specific forms when needed. Notably, pdfFiller also allows users to track changes over time, ensuring the integrity and history of tax-related documents are maintained.

By leveraging these tools, property owners and management teams can streamline their document management and ensure all necessary forms are readily available at tax time.

What to do after submission

After submitting your property tax rate unchanged form, it’s essential to understand the next steps in the process. Typically, local authorities will begin to process your submission, with timelines varying based on jurisdiction. Homeowners should keep an eye on communication from their local tax office for any updates or confirmations.

In the event of any issues or inquiries regarding your submission, effective communication is critical. Prepare and gather any evidence that can support your case if complications arise. This includes keeping documentation of your submission and any correspondence with tax authorities.

Ensuring timely follow-up can mitigate potential issues and allows for quick resolution if needed, maintaining your peace of mind as a property owner.

Staying updated on property tax guidelines

Local tax regulations can change frequently; therefore, it’s vital to stay informed about any modifications that may affect property tax obligations. As a property owner, understanding any new levy limits or adjustments in property assessments can significantly impact your finances.

Resources for ongoing updates include government websites, local tax authority newsletters, and community forums. Engaging with these platforms can provide valuable insights into potential tax increases or construction projects that might affect your property’s tax worth.

By actively engaging with these resources, property owners can remain well-informed and prepared for any changes related to their tax obligations.

Conclusion

Managing your property tax obligations effectively requires vigilance and informed decision-making. Utilizing tools like pdfFiller can simplify the complexities associated with the property tax rate unchanged form. Accessibility to document editing, collaboration, and seamless eSigning significantly reduce the logistical burdens when managing taxes.

Encouraging the use of such a streamlined approach will enhance your efficiency and ease when it comes to tax-related documents. pdfFiller empowers users to engage confidently with their property tax responsibilities, ensuring that issues are timely addressed, and forms submitted accurately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my property tax rate unchanged directly from Gmail?

How can I edit property tax rate unchanged from Google Drive?

How do I complete property tax rate unchanged on an Android device?

What is property tax rate unchanged?

Who is required to file property tax rate unchanged?

How to fill out property tax rate unchanged?

What is the purpose of property tax rate unchanged?

What information must be reported on property tax rate unchanged?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.