Get the free establishing the Proposed Millage Rate for fiscal year 2025 ...

Get, Create, Make and Sign establishing form proposed millage

How to edit establishing form proposed millage online

Uncompromising security for your PDF editing and eSignature needs

How to fill out establishing form proposed millage

How to fill out establishing form proposed millage

Who needs establishing form proposed millage?

Establishing Form Proposed Millage Form

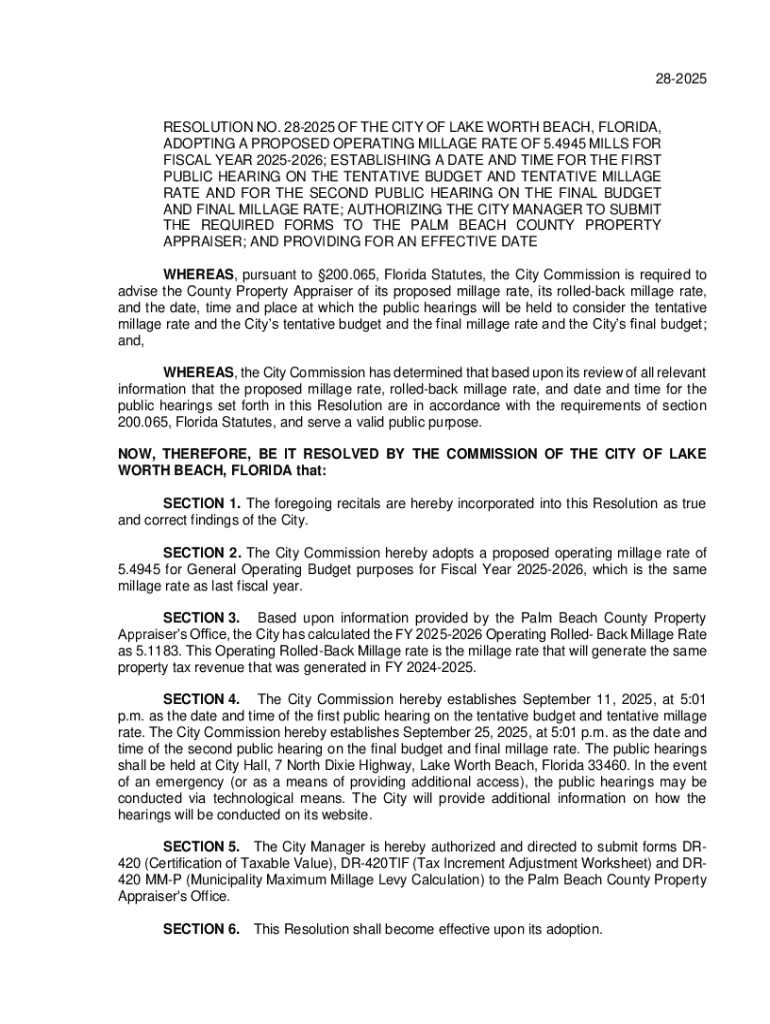

Understanding the proposed millage form

A proposed millage form is a crucial document used in municipalities to petition for a specific property tax rate, expressed in mills. One mill represents one dollar of tax for every thousand dollars of assessed property value. By establishing a proposed millage form, local government entities can articulate their financial needs and justify the requested tax rate to the community.

The importance of this form in local governance cannot be overstated. It plays a pivotal role in the budgeting process, guiding how funds will be allocated to essential services such as education, public safety, and infrastructure. Carefully outlining the rationale behind the proposed millage rate fosters transparency and public engagement, empowering citizens to make informed decisions during elections.

Key terms connected to millage rates include the millage rate itself, which determines the amount of tax levied per thousand dollars of property valuation. This rate can directly impact homeowners and businesses, influencing their property tax responsibilities and, consequently, their financial stability.

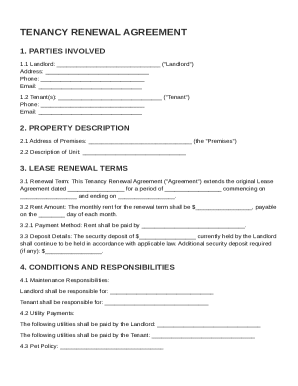

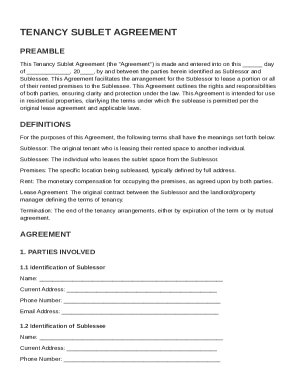

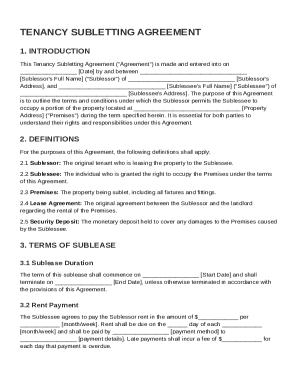

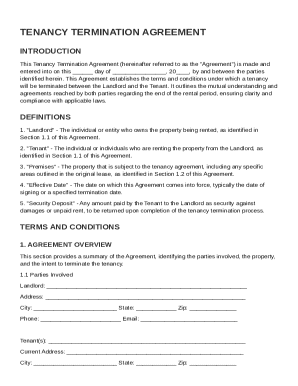

Detailed overview of the establishing form

The establishing form is specifically crafted to facilitate the proposal of millage rates. Its purpose is twofold: it streamlines the budgeting process and addresses the legal requirements for submitting a millage proposal to a local governing body. By ensuring all relevant data is included, the form supports a straightforward review process, allowing constituents to properly understand the proposed changes.

In terms of necessary data, the establishing form typically requires details about assessed property values, the proposed millage rates, budget needs, and justifications for the proposed changes. This data not only impacts how proposals are evaluated but also lays the groundwork for public discussions on fiscal responsibility and community investments.

Step-by-step instructions for completing the proposed millage form

Before you begin filling out the proposed millage form, preparation is essential. Gather necessary documents, such as property value assessments and historical data on funding and tax rates. Understanding your community’s financial landscape will provide a robust foundation for completing the form.

Here’s a detailed walkthrough of filling out the proposed millage form:

To ensure accuracy, double-check all figures and information before submission. Common mistakes include arithmetic errors, incomplete information, and misunderstanding legal requirements, which could delay the approval process.

Interactive tools for the proposed millage form

pdfFiller offers a range of interactive tools to simplify the process of completing a proposed millage form. Users can access customizable templates that streamline the task of filling out forms efficiently while maintaining accuracy.

To use these templates, simply navigate to the pdfFiller website, download the Proposed Millage Form template, and customize it to fit your specific needs. Features that assist in form completion include:

Managing your proposed millage form post-completion

Once you have completed the proposed millage form, you have options for editing and signing it. In case changes are necessary, pdfFiller allows users to easily make revisions. Navigate to the 'Edit' feature within the platform to alter any sections while maintaining a transparent record of changes.

To officially submit your form, you will need to sign it either digitally or by hand, depending on your locality's regulations. With pdfFiller, eSigning is straightforward. Simply select the eSignature option, follow the guided steps, and submit it per your chosen method, whether via email, online portal, or physical delivery. Adhering to submission deadlines ensures timely consideration of your proposed millage rates.

Tracking the status of your submission is equally important. Local government offices may provide a tracking system where you can monitor the progress of your proposed millage form and any subsequent actions.

Exploring additional resources on millage rates

To deepen your understanding of proposed millage forms, consider reviewing FAQs that address common queries about millage processes. These resources clarify nuances surrounding local tax rates, approval stages, and impacts on the community.

Additionally, engaging in workshops and webinars can augment your knowledge of local budgeting processes and the implications of millage rates on taxation. Staying informed helps community members advocate effectively for their financial interests and ensure transparency within local governance.

Contact information for assistance

Should you need assistance related to your proposed millage form, contacting local government offices is an excellent first step. They can provide guidance on specific requirements and procedures unique to your locality.

For support with pdfFiller, the customer service team is available via live chat, email, and phone. They are equipped to assist you with any inquiries regarding form completion, eSignature solutions, and navigating the platform.

Navigating related content

For those looking to expand their knowledge further, pdfFiller provides links to additional templates and articles related to the establishment of millage forms. Exploring content on local government budgeting processes and the implications of property taxes helps users become well-rounded advocates for their community’s financial health.

Understanding the nuances of property tax implications from millage rates can empower individuals and groups in fostering discussions on local funding initiatives and civic responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit establishing form proposed millage online?

How do I make edits in establishing form proposed millage without leaving Chrome?

How do I edit establishing form proposed millage on an iOS device?

What is establishing form proposed millage?

Who is required to file establishing form proposed millage?

How to fill out establishing form proposed millage?

What is the purpose of establishing form proposed millage?

What information must be reported on establishing form proposed millage?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.