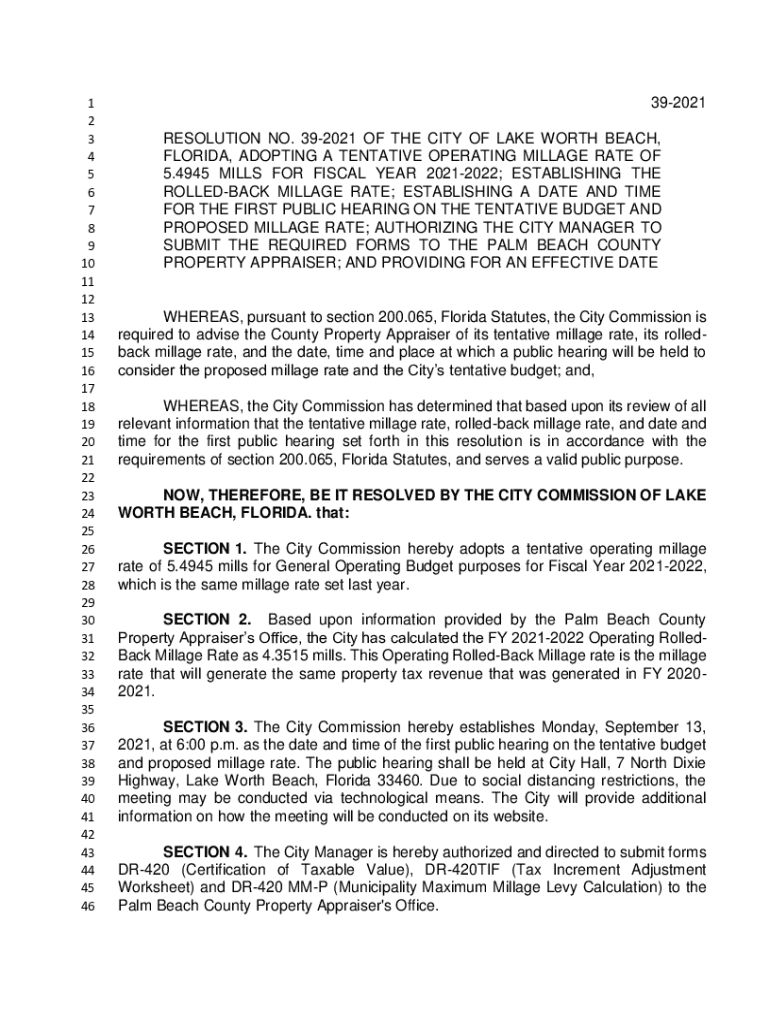

Get the free 39-2021 OF THE CITY OF LAKE WORTH BEACH,

Get, Create, Make and Sign 39-2021 of form city

How to edit 39-2021 of form city online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 39-2021 of form city

How to fill out 39-2021 of form city

Who needs 39-2021 of form city?

39-2021 City Form: A Comprehensive Guide to Filling Out, Managing, and Submitting the Form

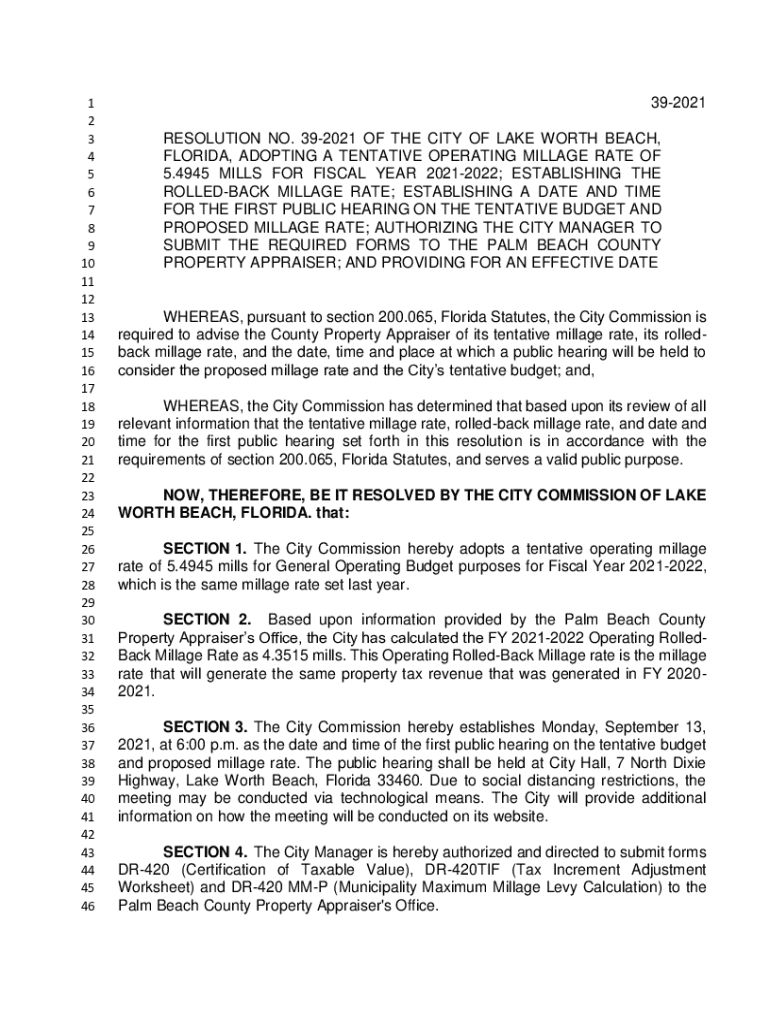

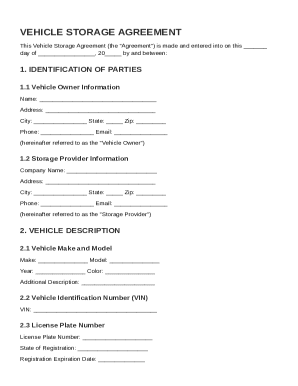

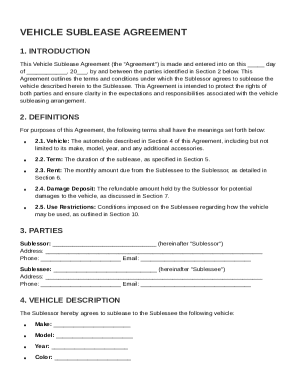

Overview of the 39-2021 City Form

The 39-2021 City Form serves as a crucial documentation tool for various city-related administrative processes. Designed to capture essential data pertaining to development fees and other financial requirements, the purpose of this form is to facilitate clear reporting and compliance with local regulations. Accurate completion of the 39-2021 is vital, as it directly impacts development fee calculations and compliance with government code sections. Stakeholders involved include city agencies, developers, and finance professionals who depend on precise entries to ensure that fees are calculated appropriately and that all city requirements are met.

Preparing to fill out the 39-2021 City Form

Preparation is key when tackling the 39-2021 City Form. Begin by gathering all necessary documents, such as property deeds, previous tax records, and any relevant communications from local government entities. This ensures that you have everything you need at your fingertips, which can greatly minimize frustration during the completion process.

Understanding the terminology associated with the 39-2021 City Form is equally important. Familiarizing yourself with terms like 'development fees' and 'government code section' will enable you to navigate the form more efficiently. Definitions can often be found in the form instructions or online resources provided by your city’s finance department.

Detailed step-by-step instructions for completing the form

Completing the 39-2021 City Form involves several critical sections, each requiring specific information. Start with Section 1, which focuses on personal information. It’s essential to provide accurate details such as your full name, contact information, and address.

Next, in Section 2, you will provide financial information pertinent to the development fees. This section often requires reporting income from various sources, outlining your obligations related to city fees, and summarizing total amounts due. Provide accurate figures and seek guidance if unsure of specific calculations.

Lastly, Section 3 addresses specific city requirements. Depending on your locality, this may include unique criteria or additional fee structures. Pay close attention to any notes or highlighted fields indicating special instructions, as failing to comply with these can hinder your submission process.

Utilizing interactive tools for enhancing your form experience

pdfFiller offers a suite of interactive tools designed to simplify the completion of the 39-2021 City Form. Utilizing their editable PDF options allows you to fill in fields at your own pace. You can also save your progress and return to your form later, which is particularly useful if you need to gather additional information.

To electronically sign documents, follow the step-by-step guide available within the pdfFiller platform. Make sure you start by choosing the area where the signature is needed. The eSignature is a legally binding alternative and eliminates the hassle of printing out forms, signing them, and scanning them back.

Common mistakes to avoid when completing the 39-2021 City Form

Many applicants make common mistakes that can jeopardize their submissions. Frequently, errors occur within personal and financial information sections, where inaccuracies can lead to serious compliance issues. Double-check calculations and ensure that figures correspond with the relevant statements, such as financial documents or past tax returns.

The consequences of inaccuracies in your submission can be significant, including delayed processing times and possible fines. Taking time to meticulously review your form before submission can save you from future hassles.

Alternatives for managing the 39-2021 City Form

When considering how to manage the 39-2021 City Form, you have options: traditional paper submissions versus modern digital solutions like pdfFiller. Choosing a digital method has clear advantages, including ease of access and collaboration capabilities. With pdfFiller, you can share the form with team members for feedback or to complete joint submissions, facilitating a smoother process.

Digital forms also streamline the submission process, enabling you to submit documents via e-filing, significantly reducing time spent on logistics. With pdfFiller, you can ensure your submissions are tracked and validated without physical paperwork.

Submitting the completed 39-2021 City Form

Once the form is completed, understanding submission protocols is vital for successful processing. You can choose between e-filing and physical submission based on what your city allows. Ensure you follow the prescribed protocols meticulously, as improper submission can lead to unnecessary delays.

After submission, be prepared for potential follow-up steps. Keep important references and documents on hand in case of inquiries or the need for further information. Maintaining communication with your local agency can significantly streamline any required actions.

Understanding the review process

Understanding what happens after you submit the 39-2021 City Form can help in managing expectations. Typically, the review process will begin with the corresponding city agency verifying the provided information. Depending on the volume of submissions, this can take anywhere from a few days to several weeks.

Always be prepared for potential amendments. Agencies may request changes or clarifications to ensure accurate fee assessments aligned with development requirements.

Additional support for form issues or queries

Navigating the 39-2021 City Form can present challenges. pdfFiller provides several support options that can aid you during the process. Customer support representatives are available to assist with platform-related queries.

These resources are invaluable for resolving any form-related issues you might face, ensuring that you complete the 39-2021 City Form correctly and effectively.

Keeping your form information up-to-date

After successfully submitting the 39-2021 City Form, it is essential to manage updates and revisions to your information. Regular reviews ensure that any changes in personal or financial status are accurately reflected. This practice not only helps maintain compliance but also prevents errors linked to outdated data.

Investing time in maintaining accurate records will serve you well in the long run, particularly when navigating the complexities of development fee accounting and compliance.

Leveraging pdfFiller for comprehensive document management

Using pdfFiller extends beyond just filling out the 39-2021 City Form; it’s an all-encompassing tool for document management. The platform integrates seamlessly with other document workflows, which means whether you’re working on multiple forms or collaborating with a team, you can streamline disparate tasks into a single platform.

The long-term benefits of using pdfFiller go beyond simply submitting forms—it's about enhancing overall productivity and ensuring compliance with local government requirements, like those outlined in the 39-2021 City Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 39-2021 of form city from Google Drive?

How do I make edits in 39-2021 of form city without leaving Chrome?

Can I sign the 39-2021 of form city electronically in Chrome?

What is 39-2021 of form city?

Who is required to file 39-2021 of form city?

How to fill out 39-2021 of form city?

What is the purpose of 39-2021 of form city?

What information must be reported on 39-2021 of form city?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.