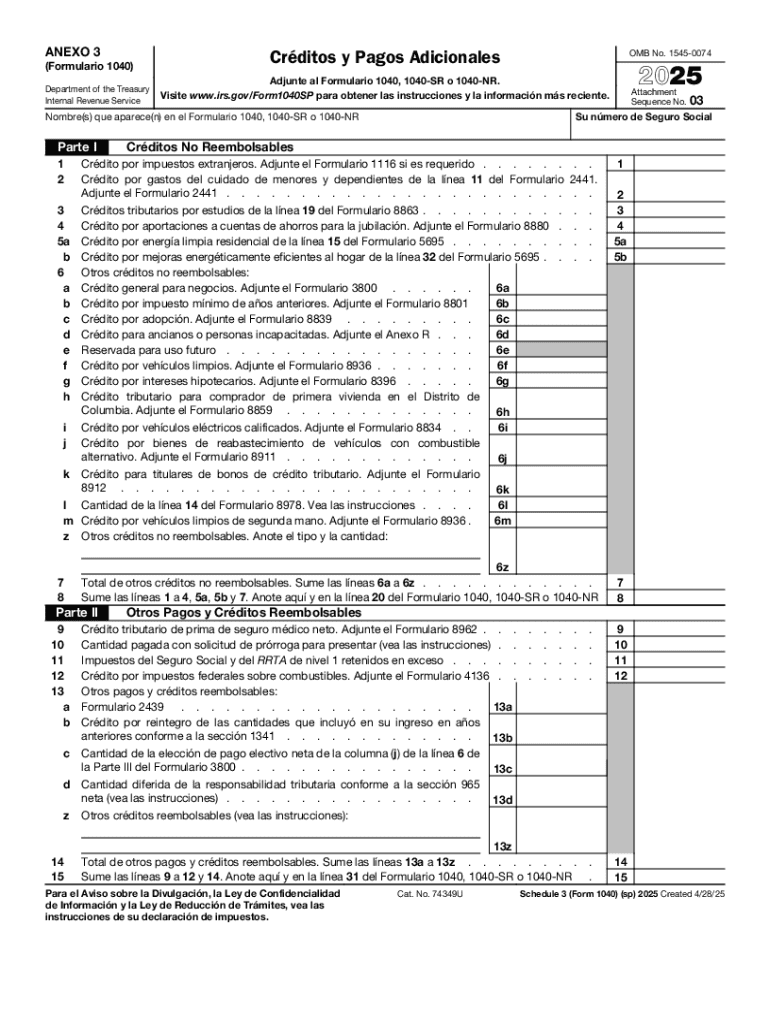

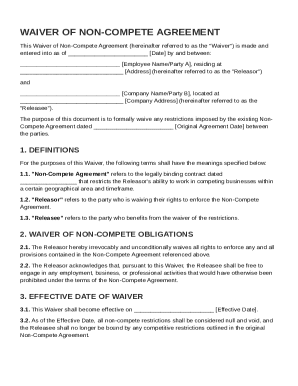

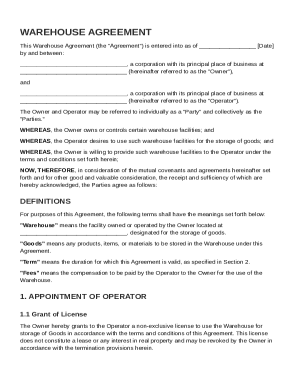

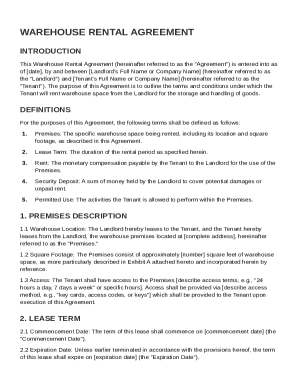

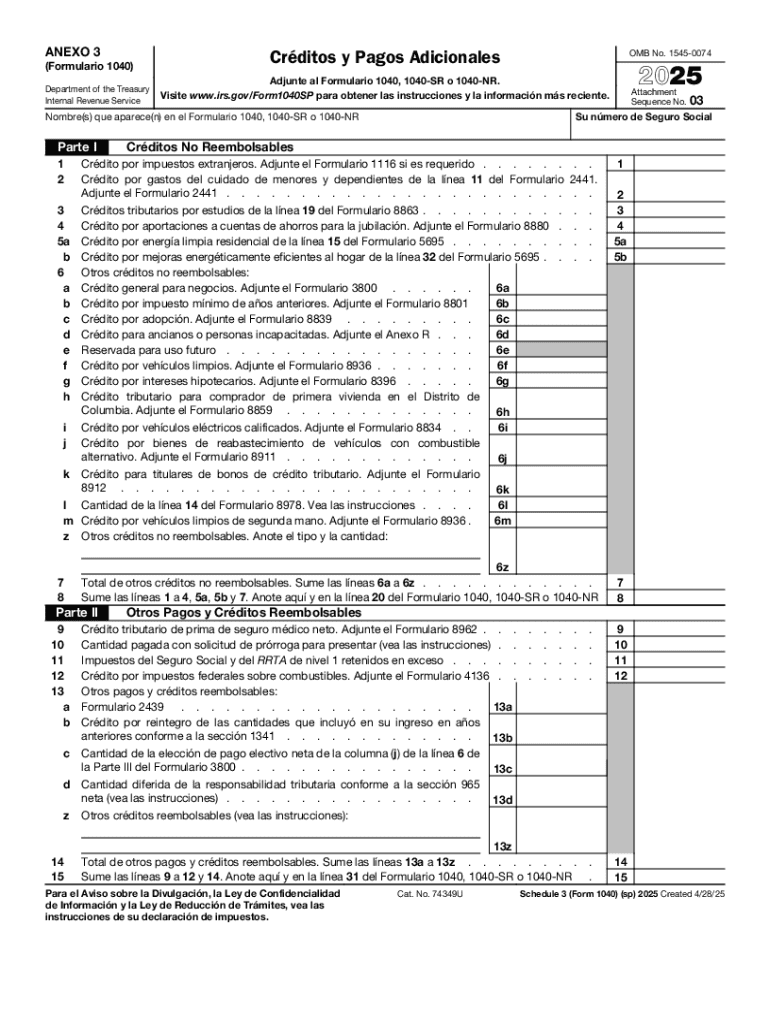

IRS 1040 - Schedule 3 (SP) 2025-2026 free printable template

Get, Create, Make and Sign IRS 1040 - Schedule 3 SP

How to edit IRS 1040 - Schedule 3 SP online

Uncompromising security for your PDF editing and eSignature needs

IRS 1040 - Schedule 3 (SP) Form Versions

How to fill out IRS 1040 - Schedule 3 SP

How to fill out 2025 schedule 3 form

Who needs 2025 schedule 3 form?

Your Comprehensive Guide to the 2025 Schedule 3 Form

Understanding the 2025 Schedule 3 Form

The 2025 Schedule 3 Form plays a crucial role in the U.S. income tax filing process, providing taxpayers with a streamlined way to report additional income, deductions, and credits. Specifically, this form is attached to the standard Form 1040, ensuring taxpayers give a holistic view of their financial situation. Understanding its structure and purpose is essential for proximity to compliant tax filing.

The importance of the Schedule 3 Form cannot be overstated; it not only aids in accurately reporting income that might not fit neatly in other sections of your tax return, but also facilitates claiming various tax credits. In 2025, the form includes several key features that make it more user-friendly and intuitive than in previous years.

Who needs to use the 2025 Schedule 3 Form?

The Schedule 3 Form is particularly beneficial for taxpayers who have unique income streams or are eligible for various tax credits. Individuals and families who earn additional income through investments, capital gains, or freelancing should consider using this form. Those with educational expenses or who qualify for the Foreign Tax Credit will also find the Schedule 3 Form essential in reporting this information accurately.

Specific circumstances that indicate you should use Schedule 3 include receiving distributions from pensions, claiming credits for state taxes, or having health coverage that provides premium assistance. Therefore, understanding whether you meet these criteria is vital for maximizing your tax benefits.

Key changes in the 2025 Schedule 3 Form

The 2025 version of the Schedule 3 Form includes several updates and changes that reflect the evolving tax landscape. Notably, there have been shifts in filing requirements; while most individuals will still complete the form from basic income and deduction entries, revised guidelines enhance clarity and engagement.

New sections focus on streamlining the depreciation and amortization reporting process, making it simpler for individuals who have investments contributing to their taxable income. Meanwhile, lines that previously caused confusion have been eliminated, allowing for a more straightforward input of data.

How to access the 2025 Schedule 3 Form

Accessing the 2025 Schedule 3 Form is straightforward. You can ensure you have the most current version by downloading it directly from the IRS website. Alternatively, utilizing pdfFiller’s platform allows users to access, fill, and manage the form easily with various tools at their disposal.

It’s crucial to use the latest version of the Schedule 3 Form for accurate filing. Using outdated forms can lead to errors that could delay your tax processing or, worse, result in penalties from the IRS.

Step-by-step instructions for filling out the 2025 Schedule 3 Form

Correctly filling out the 2025 Schedule 3 Form ensures compliance and maximizes your potential returns. Follow these precise steps to navigate the complexities of this form efficiently:

Editing and managing your 2025 Schedule 3 Form with pdfFiller

With pdfFiller, managing your 2025 Schedule 3 Form is streamlined and efficient. The platform offers robust editing tools to ensure your form is free from errors and presented clearly. From formatting adjustments to real-time collaboration features, pdfFiller allows users to create compliant tax documents without the typical hassles associated with paper forms.

Moreover, the eSignature feature accelerates the submission process, enabling you to sign documents securely and share them with tax professionals or team members seamlessly.

Common mistakes to avoid when filing the 2025 Schedule 3 Form

Filing taxes can be complex, and the 2025 Schedule 3 Form is no exception. To ensure a smooth process, here are some frequent errors to watch out for. Incorrectly reported income or missing entries can lead to delays or audits by the IRS, so attention to detail is crucial. Common mistakes include forgetting to sign the form, entering the wrong amounts, or neglecting to include necessary schedules.

To mitigate these risks, consider implementing a double-check system or using pdfFiller's built-in review functionality, which helps highlight discrepancies before submission.

Frequently asked questions about the 2025 Schedule 3 Form

Navigating tax documentation can lead to queries. Here are some frequently asked questions regarding the 2025 Schedule 3 Form to provide clarity to those filing their taxes:

Support resources for 2025 Schedule 3 Form users

Finding assistance while filing can alleviate stress. pdfFiller offers robust customer support for users facing difficulties with their 2025 Schedule 3 Form. Their platform is designed to make the process smooth, ensuring that you never feel stuck when completing your taxes.

Moreover, the IRS provides comprehensive resources, including detailed guides and FAQs designed to clarify issues that might arise during the filing process. Connecting with online community forums can also open avenues for solutions, while consultations with tax professionals ensure that you're making the best decisions for your financial situation.

Benefits of using pdfFiller for your 2025 Schedule 3 Form

Choosing pdfFiller for your 2025 Schedule 3 Form management comes with multiple advantages. Foremost, their cloud-based solution allows for seamless editing and document management from any device, making tax time less stressful. Users can collaborate in real-time with colleagues or tax professionals, ensuring all parties can contribute effectively to completing the form.

Additionally, pdfFiller’s robust security protocols guarantee that your sensitive tax information is handled with the utmost care. By facilitating a comprehensive and secure environment for document management, pdfFiller empowers you to file your 2025 Schedule 3 Form with confidence and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IRS 1040 - Schedule 3 SP without leaving Google Drive?

How do I edit IRS 1040 - Schedule 3 SP online?

How do I edit IRS 1040 - Schedule 3 SP on an iOS device?

What is 2025 schedule 3 form?

Who is required to file 2025 schedule 3 form?

How to fill out 2025 schedule 3 form?

What is the purpose of 2025 schedule 3 form?

What information must be reported on 2025 schedule 3 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.