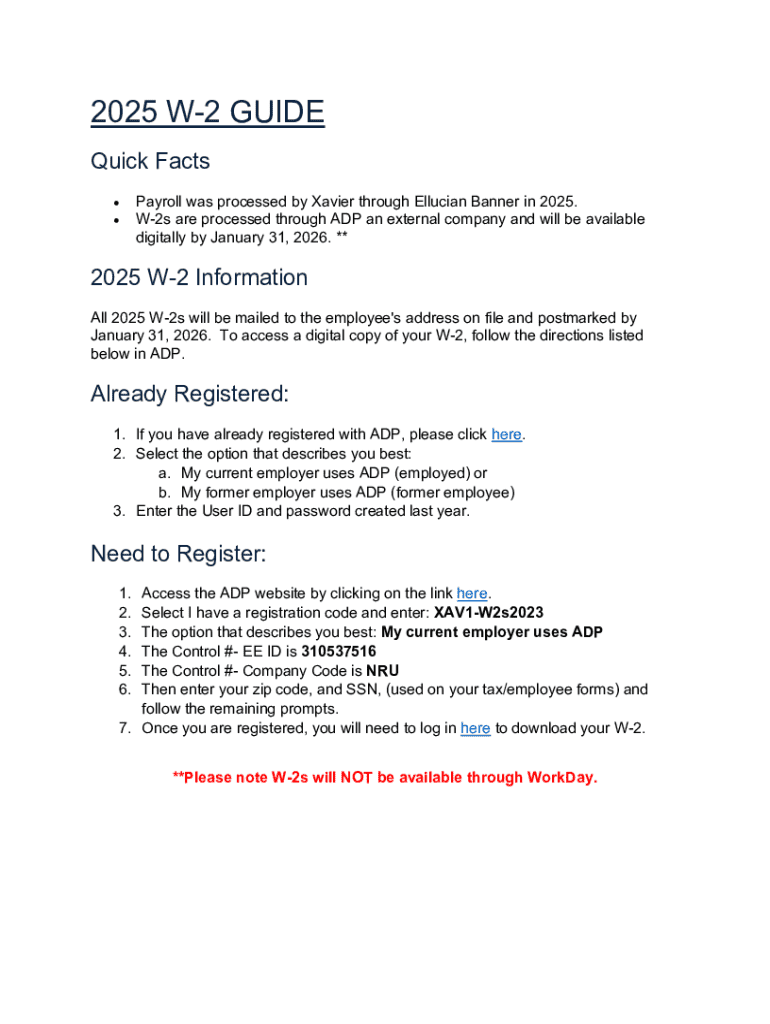

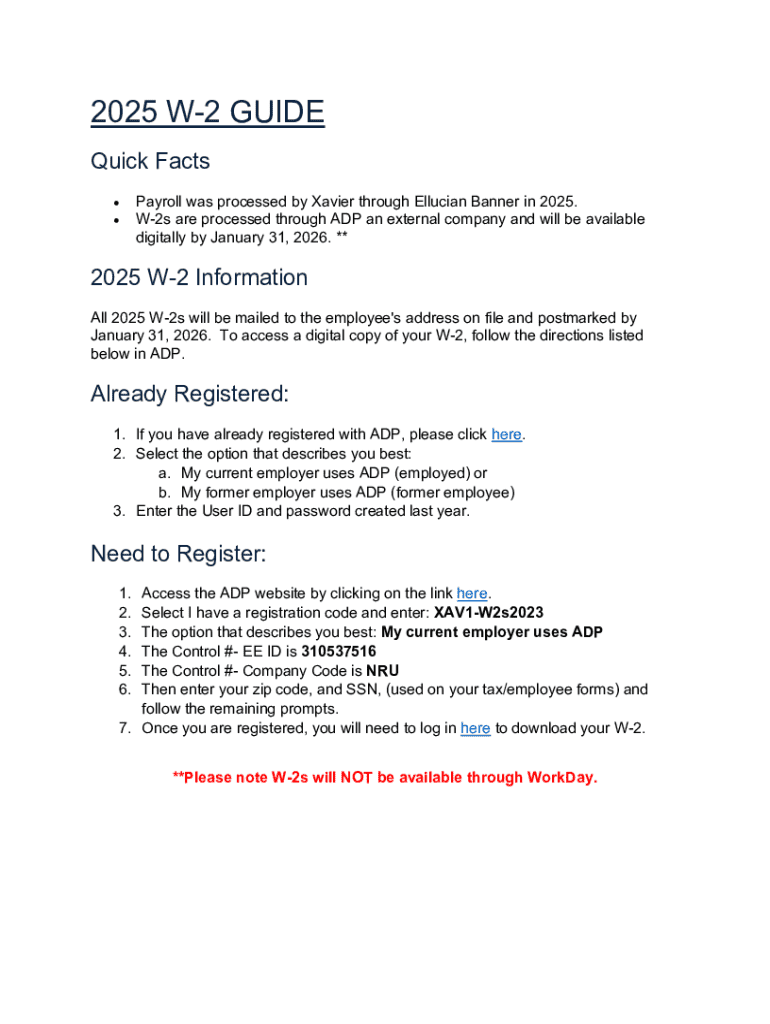

Get the free If your employer uses ADP check your portals for your W2's ...

Get, Create, Make and Sign if your employer uses

How to edit if your employer uses online

Uncompromising security for your PDF editing and eSignature needs

How to fill out if your employer uses

How to fill out if your employer uses

Who needs if your employer uses?

If Your Employer Uses Form: A Comprehensive Guide

Understanding employer-specific forms

Employer-specific forms are documents designed for a particular organization to gather information or facilitate processes relevant to employment. These can range from job applications to tax forms, performance reviews, and benefits enrollment. Every company implements these forms to maintain structured records and comply with legal obligations.

Being informed about these forms is crucial for employees. Company policies surrounding these forms can dictate how various employment situations are managed, from onboarding to retirement. Additionally, understanding how to complete these forms correctly ensures compliance and minimizes potential administrative errors.

The relevance of the form to your employment rights

Understanding employer-specific forms is vital to protecting your employment rights. Forms serve as official documentation that can leverage your entitlements and responsibilities within the workplace. For instance, a properly filled out W-4 form can help ensure that your federal tax withholdings are accurate, aligning your paychecks with your actual tax obligations.

Legal implications arise when forms are improperly completed or overlooked. For instance, submitting incorrect tax information may lead to penalties from the IRS. In some cases, failing to respond to performance review forms could impact your salary increases or promotion opportunities. An understanding of these forms helps employees navigate their rights more effectively.

Key considerations when filling out employer forms

When you are tasked with filling out a form from your employer, accuracy and completeness are paramount. Take time to read through each section of the form carefully before inputting any information. This attentiveness not only prevents delays but also demonstrates professionalism.

Recognizing required information is crucial as well. Forms often include mandatory sections denoted by asterisks or specific instructions. Missing these can result in rejection of the form and could even stall career advancements or benefits eligibility.

Step-by-step guide to completing your employer's form

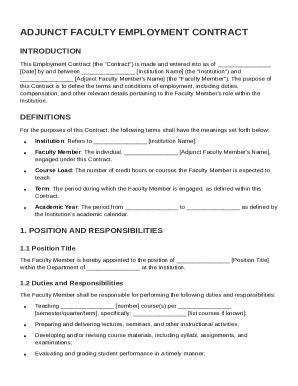

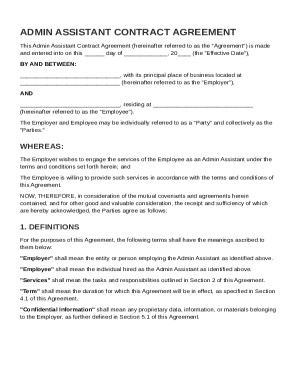

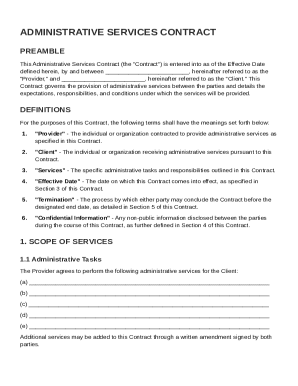

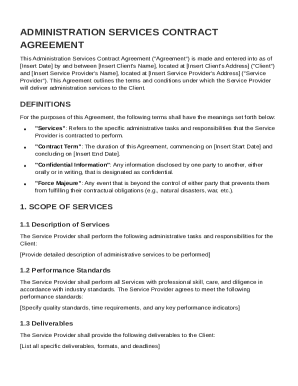

Understanding the structure of common employer forms can greatly improve your submission quality. Typically, forms will include sections for personal information, job-related details, and tax information if applicable.

For personal information, provide your full name, address, and date of birth. In job-related details, detail your employment history, qualifications, and responsibilities. If the form requests tax information, prepare to include your taxpayer identification number, which is essential for payroll purposes.

While filling each section, be sure to use clear language and avoid abbreviations unless specified. Common mistakes often arise from illegible handwriting or missing critical information, which can delay processing.

Editing and managing employer forms

Once you've filled out your employer's form, ensuring it is polished is essential. Using tools like pdfFiller can streamline the editing process. With pdfFiller, users can easily edit PDF forms, ensuring all necessary information is correctly captured before submission.

Additionally, pdfFiller provides collaboration features that allow you to engage directly with HR teams or managers. This is particularly beneficial when changes or approvals are needed quickly, efficiently managing document flow within the organization.

Signing forms: E-signature requirements

E-signatures have become standard in today’s digital offices, offering a legally binding way to validate your forms. Understanding their legality is crucial; e-signatures hold the same weight as handwritten signatures under laws such as the Electronic Signatures in Global and National Commerce Act (ESIGN).

Using tools like pdfFiller, eSigning documents is a straightforward process. Users can authenticate their identity securely while signing forms electronically. Keeping signed copies for your records is equally important — this ensures that you have proof of your submissions and agreements.

Interactive tools to facilitate form management

To ease the headache of repetitive form submissions, employing interactive tools is beneficial. pdfFiller provides quick access to frequently used forms and allows users to create templates for repeated submissions. This can save time and effort, ensuring that teams can focus on core responsibilities rather than paperwork.

Moreover, these interactive features enhance collaboration and communication within the workplace. Users can invite others to review forms, provide input, or approve documents, leading to a more seamless workflow.

Troubleshooting common issues with employer forms

Despite careful efforts, issues can arise with employer forms. If your form is rejected, it is critical to understand the reasons behind it. Common pitfalls include missing signatures, incomplete data, or failure to meet submission deadlines.

When you need to correct errors post-submission, it’s essential to act quickly. Reach out to HR to advise them of the required changes, and do so through professional channels. Maintaining a constructive dialogue can prevent larger issues affecting your employment status.

FAQs about employer forms

It’s not uncommon to have questions regarding employer forms. Understanding when to submit, what happens after submission, and how to handle missing or lost forms can help mitigate confusion and streamline processes.

When submitting employer forms, be aware of deadlines and regulatory compliance. Often, missing deadlines can result in a backlog or even legal complications, so stay informed about submission timelines specific to your employment situation.

Recent trends and updates in employment forms

The landscape of employment forms is continuously evolving. More companies are transitioning to digital forms to increase efficiency and minimize paper waste. This shift not only makes form submissions quicker but also allows for easier tracking of employee documentation.

Recent legislative changes have also impacted how employer forms are structured, particularly concerning tax documentation and employee rights. Staying abreast of these changes is vital for both employees and employers to ensure compliance.

Comparing document management solutions

Choosing the right document management solution can greatly enhance how you handle employer forms. Several popular providers offer a range of features. Understanding these options will help organizations select the best fit for their needs.

In comparison to other document management tools, pdfFiller stands out by offering unique features such as customizable templates, seamless e-signatures, and real-time collaboration capabilities. These features enhance user experiences and streamline repetitive tasks, making pdfFiller a top choice for businesses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get if your employer uses?

How do I make edits in if your employer uses without leaving Chrome?

How can I edit if your employer uses on a smartphone?

What is if your employer uses?

Who is required to file if your employer uses?

How to fill out if your employer uses?

What is the purpose of if your employer uses?

What information must be reported on if your employer uses?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.