Get the free IRS releases draft version of Forms 1040 and 1040-SR

Get, Create, Make and Sign irs releases draft version

Editing irs releases draft version online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs releases draft version

How to fill out irs releases draft version

Who needs irs releases draft version?

IRS Releases Draft Version Form: A Comprehensive Guide

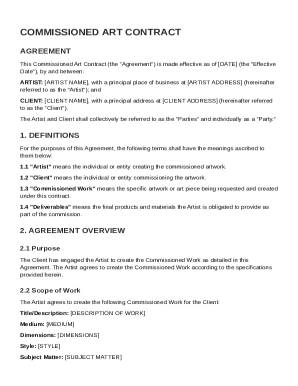

Overview of the draft version form

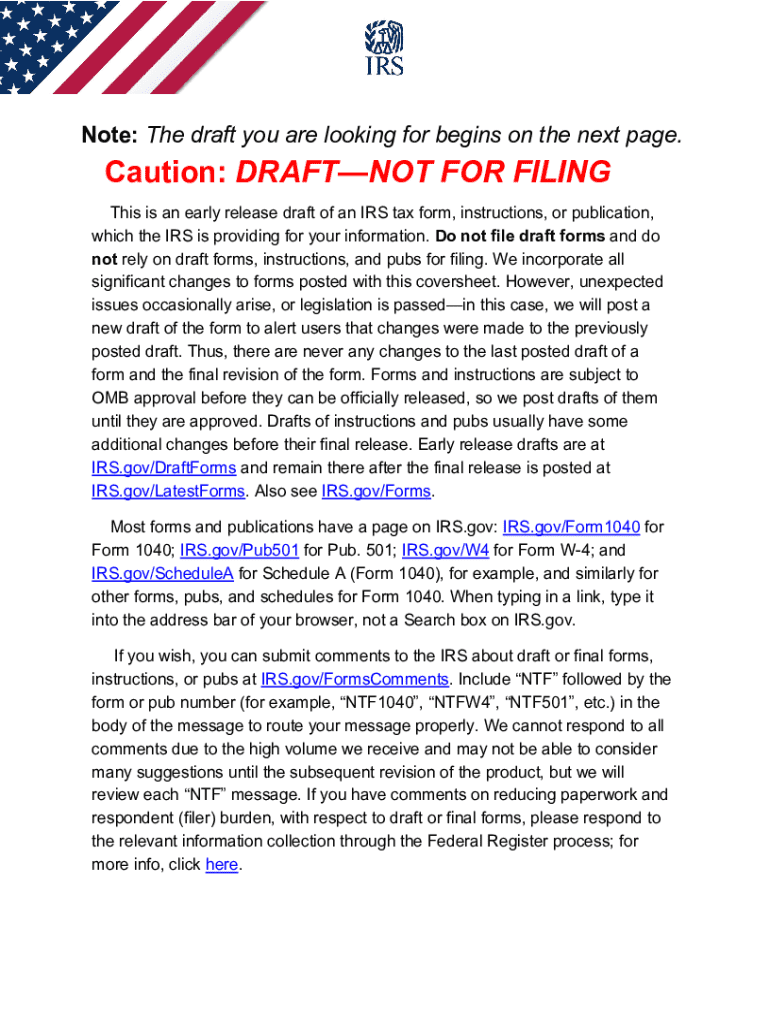

The IRS regularly releases draft versions of their tax forms, offering a preview of upcoming changes before the final versions are published. The draft version form serves as a crucial tool for preparers and taxpayers alike, enabling them to understand adjustments and take proactive steps in their filing processes. The importance of this draft release cannot be understated, as it encapsulates modifications that could directly influence tax calculations and deductions.

By reviewing the draft version, taxpayers can stay informed about new requirements, which enables accurate and timely submission. This is particularly crucial during high-traffic filing seasons. For quick access to specific areas of change, the IRS provides direct links in their announcements, making navigation easier for users.

Key features of the draft version form

The draft version of the IRS form showcases significant changes and improvements aimed at bolstering clarity and user-friendliness. Notably, the format may have undergone transformations that enhance visual appeal while guiding users through the completion process. The draft now incorporates user feedback meticulously gathered in prior filing seasons, optimizing sections that previously caused confusion.

Some highlights include newly added sections that address recent legal adjustments, alongside modifications to existing lines that clarify deduction amounts. This proactive approach enables smoother transitions for users adapting to the IRS's evolving requirements.

Understanding the specifics of the IRS draft forms

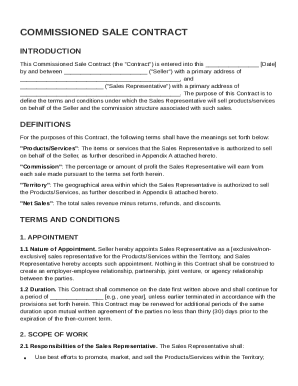

Focus on Form 1040 and Form 1040-SR

Individual taxpayers will find the updates to Form 1040 and Form 1040-SR particularly relevant. Key modifications may include adjustments to income thresholds for various deductions, which can affect the overall tax owed. Notably, Form 1040-SR caters primarily to seniors, featuring larger print and simplified language, making it accessible for older citizens.

Child Tax Credit and Additional Child Tax Credit updates

The IRS has permanently established the Child Tax Credit and Additional Child Tax Credit, providing families with crucial financial support. Recent updates clarify eligibility criteria, allowing more taxpayers to leverage these credits effectively, and thereby increase their potential refunds.

Refundable adoption credit adjustments

As part of the draft version, adjustments have also been made to the refundable Adoption Credit. These changes are pivotal for families navigating adoption, offering new opportunities for financial assistance. Individuals can refer to the accompanying FAQs for a better understanding of eligibility and specific application processes.

Key deductions and benefits

The draft also highlights significant deductions, including the Government Paid Family Leave Program Contributions and Qualified Farmland Installment Sale Payments. Taxpayers should review this section closely to maximize their refund potential and ensure they are in compliance when claiming these deductions.

Steps to fill out the draft version form

Completing the draft version form requires meticulously following a detailed process. Begin by gathering all necessary documentation, such as W-2s and 1099s, which aid in accurate reporting. Subsequent steps include filling out personal information, selecting appropriate filing status, and reporting income and deductions.

Common mistakes often occur with incorrect social security numbers or omitted income sources. To avoid confusion, users should cross-reference figures from their documentation. Here’s a handy checklist:

For a clearer understanding, example scenarios can illustrate how different taxpayers might approach the form completion to optimize their deductible amounts effectively.

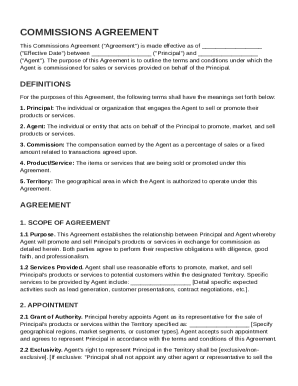

Tools available for managing IRS forms effectively

Managing IRS forms has become exponentially easier with solutions like pdfFiller. The platform’s document creation features allow users to edit in real time, sign documents electronically, and collaborate in an efficient environment. This capability is crucial during busy tax seasons when quick adjustments are often necessary.

pdfFiller users can access IRS draft forms readily, enabling straightforward navigation through complex documents. Testimonials from satisfied users highlight its efficiency and user-friendliness, emphasizing how it streamlines the usually daunting tax filing process.

Common challenges and how to overcome them

Working with draft forms can present unique challenges, including technical complications like software issues or misunderstandings about IRS guidelines. For those unaccustomed to tax paperwork, this can be especially daunting. However, by leveraging resources available through pdfFiller, users can troubleshoot common problems efficiently.

To facilitate a smoother experience, consider these solutions:

These strategies not only enhance user confidence but also facilitate successful form completion.

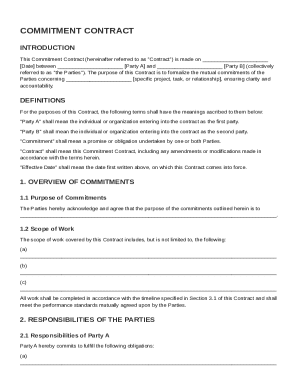

Future updates and IRS communication

Taxpayers should remain vigilant regarding future updates from the IRS. As tax laws evolve, so too will the forms and requirements. Staying informed ensures that individuals and teams can adapt to changes effectively, minimizing the risk of errors or missed opportunities in their filings.

With pdfFiller, users benefit from real-time updates regarding form modifications, ensuring they always have the latest information at their fingertips. This proactive approach allows taxpayers to be ahead of the curve regarding information critical to their obligations.

Interactive tools and resources

pdfFiller offers a suite of interactive tools designed to enhance the user experience. Online calculators help individuals estimate their tax liabilities, while access to how-to videos provides visual guidance through the nuances of the draft forms. Furthermore, links to real-time updates on IRS communications ensure users are never left in the dark.

Engaging with these resources can clarify complex tax matters, empowering users to make informed decisions as they fill out their draft version forms. By combining dynamic tools with comprehensive documentation access, pdfFiller positions itself as an essential platform for any taxpayer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my irs releases draft version in Gmail?

How can I edit irs releases draft version from Google Drive?

How do I complete irs releases draft version on an iOS device?

What is IRS releases draft version?

Who is required to file IRS releases draft version?

How to fill out IRS releases draft version?

What is the purpose of IRS releases draft version?

What information must be reported on IRS releases draft version?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.