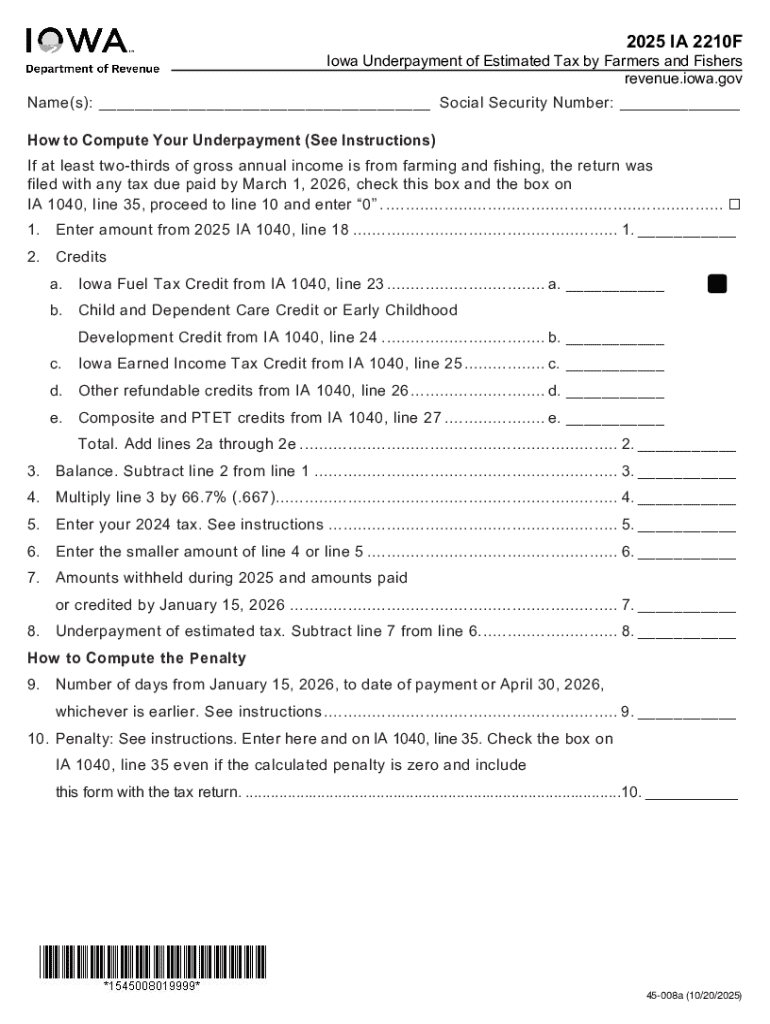

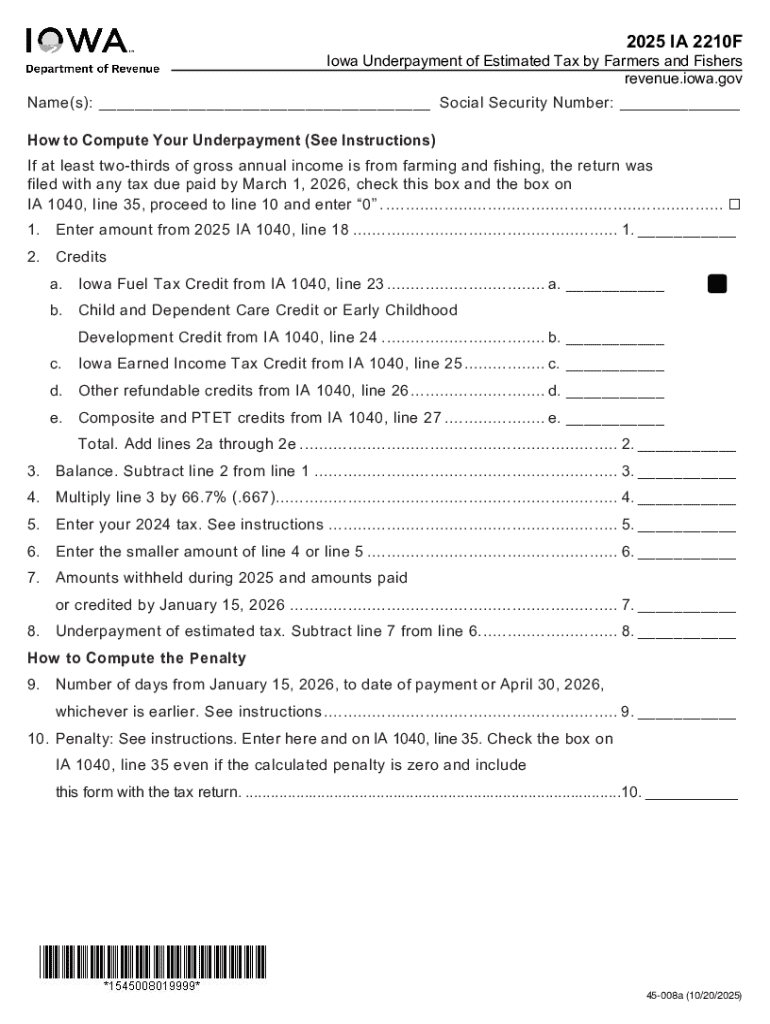

Get the free Iowa Underpayment of Estimated Tax by Farmers and Fishers

Get, Create, Make and Sign iowa underpayment of estimated

How to edit iowa underpayment of estimated online

Uncompromising security for your PDF editing and eSignature needs

How to fill out iowa underpayment of estimated

How to fill out iowa underpayment of estimated

Who needs iowa underpayment of estimated?

Understanding the Iowa underpayment of estimated form: A comprehensive guide

Understanding underpayment of estimated tax in Iowa

Estimated tax payments are required for taxpayers who do not have enough tax withheld from their income throughout the year to meet their tax obligations. This includes self-employed individuals, small business owners, and freelancers who receive income not subject to withholding. Underpayment occurs when the amount paid in estimated taxes is less than what is owed to the state of Iowa. Each taxpayer must accurately calculate their tax liability to avoid penalties.

Complying with Iowa tax regulations is crucial not only to avoid penalties but also to maintain financial health. Adhering to these regulations ensures that taxpayers are contributing their fair share toward public services and infrastructure in Iowa.

Who needs to file the Iowa underpayment of estimated tax form?

Several taxpayer categories in Iowa may need to file the underpayment of estimated tax form. This primarily includes:

In Iowa, taxpayers must make estimated tax payments if they expect to owe $1,000 or more in taxes after considering withholding. Common scenarios that lead to underpayment include unexpected income surges and failure to update tax calculations based on changing financial situations.

Key deadlines and important dates

Taxpayers should be aware of key deadlines for filing the Iowa underpayment of estimated tax form. Typically, estimated tax payments are made quarterly, with deadlines falling on the 15th of April, June, September, and January following the close of the tax year.

Failure to meet these deadlines can result in additional penalties and interest accruing on unpaid taxes. It's advisable for taxpayers to keep track of their income fluctuations and adjust their payments throughout the year to ensure compliance.

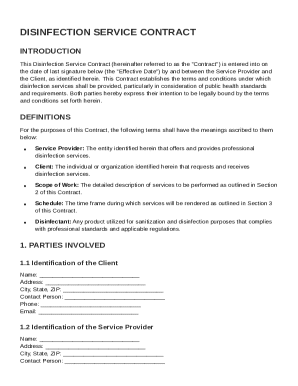

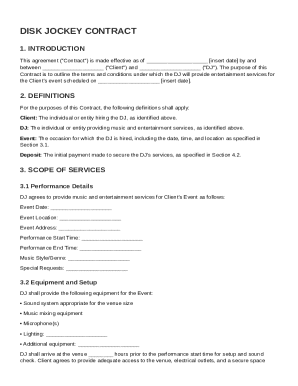

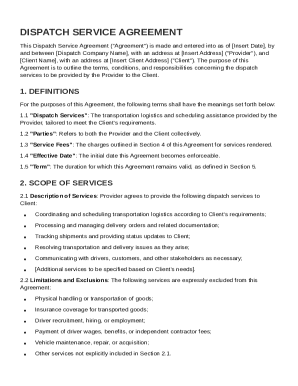

Navigating the Iowa underpayment of estimated tax form

The Iowa underpayment of estimated tax form is structured to simplify the reporting process. Key sections include personal information, income reporting requirements, and the estimated tax calculation section.

Filling out the form requires accuracy to ensure all income sources are reported correctly, and the calculations align with Iowa's tax regulations. When submitting, taxpayers must follow signature and submission guidelines detailed in the form's instructions.

Step-by-step instructions for completing the form

Completing the Iowa underpayment of estimated tax form can be straightforward when you gather the necessary documentation beforehand. This includes income records, previous year’s tax returns, and current year estimated income projections.

It’s essential to review your completed form against a checklist before submission to avoid errors that could delay processing.

Common mistakes to avoid when filing

Taxpayers should remain vigilant about several common pitfalls when filing the Iowa underpayment of estimated tax form. Miscalculating estimated income is a frequent issue that can lead to substantial penalties. Neglecting to monitor changes in income or deductions can also result in unexpected tax liabilities.

Additionally, it's critical to stay informed of state-specific tax laws, as these can change and impact your filing responsibilities. Ignoring these aspects may lead to unwarranted penalties or missed deductions.

Using pdfFiller to simplify the process

pdfFiller offers all the necessary features for seamless editing and management of the Iowa underpayment of estimated tax form. Users can easily collaborate with team members during tax preparation, ensuring that all crucial details are accounted for.

The platform also provides the ability to eSign documents quickly, facilitating timely submission. The cloud-based nature of pdfFiller means users can access and manage their forms from anywhere, which is particularly beneficial for busy taxpayers.

Interactive tools and calculators for estimated tax payments

For taxpayers seeking to simplify the estimated tax payment process, online calculators are available to help determine obligations. These tools allow users to input their expected income and calculate taxes owed accurately.

Utilizing these calculators effectively can enhance accuracy in tax planning. pdfFiller also offers interactive tools that link directly to these calculators, enabling users to easily access what they need for efficient planning.

Understanding penalties for underpayment in Iowa

The penalties for underpayment in Iowa can be substantial and involve both additional fees and interest accruing on unpaid amounts. Typically, if taxpayers owe more than $1,000 at the end of the tax year, they may face penalties, which are calculated based on the amount owed and the duration past due.

Certain situations may exempt taxpayers from these penalties. For example, if income fluctuated significantly throughout the year or if timely payments were consistently made in prior years, taxpayers may present cases to contest the penalties.

Frequently asked questions (FAQs)

What should you do if you miss a deadline? If a deadline is missed, it’s crucial to file the form as soon as possible to mitigate penalties. How can you amend your estimated tax payments? Amending can often be done by simply filing a new underpayment form with the corrected amounts. Can you contest a penalty for underpayment? Yes, taxpayers can appeal penalties based on the justification of income variations or on-time payments in previous years.

Additional tips for future tax years

Accurate estimated tax calculations result from keeping meticulous records throughout the year. Taxpayers should regularly assess their income to adjust estimated payments proactively, utilizing tools such as pdfFiller for constant management.

Consider adopting systematic filing habits to maintain updated records. Year-round tax management can prevent the stress of last-minute calculations and filings, ensuring compliance with Iowa tax regulations while maximizing potential savings.

Footer

For more information, contact Iowa’s Department of Revenue for specific inquiries. They can assist with guidance on forms and regulations. Additional links to related forms and resources can be found on official state webpages.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit iowa underpayment of estimated from Google Drive?

How do I edit iowa underpayment of estimated in Chrome?

How can I fill out iowa underpayment of estimated on an iOS device?

What is Iowa underpayment of estimated?

Who is required to file Iowa underpayment of estimated?

How to fill out Iowa underpayment of estimated?

What is the purpose of Iowa underpayment of estimated?

What information must be reported on Iowa underpayment of estimated?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.