Get the free Failure to provide all of the requested information will delay the processing of you...

Get, Create, Make and Sign failure to provide all

How to edit failure to provide all online

Uncompromising security for your PDF editing and eSignature needs

How to fill out failure to provide all

How to fill out failure to provide all

Who needs failure to provide all?

Failure to Provide All Form: A Comprehensive Guide

Understanding the importance of complete form submission

Forms serve as the backbone of documentation in both personal and professional environments. Whether it's applying for a government service, submitting a tax return, or entering into a business agreement, the accuracy and completeness of forms are paramount. Failing to provide all necessary information can undermine the entire process and lead to significant setbacks.

Incomplete forms can result in various negative consequences. Firstly, there are delays in processing time, as organizations must contact the submitter for missing information. This not only frustrates the person waiting for a resolution but can also cascade into workload bottlenecks within the organization. Secondly, incomplete forms can lead to financial repercussions, such as penalties for late submissions or rejection of critical applications. Lastly, the absence of needed information can skew decision-making processes, potentially leading to poor outcomes based on incomplete data.

Common scenarios of form incompletion

One of the most common reasons for a failure to provide all forms arises from misunderstanding the requirements. Each form comes with its specific criteria, which can often be convoluted or unclear, leading to critical information being overlooked. Furthermore, individuals may lack certain necessary documentation, such as identification or supporting attachments, at the time of submission.

Time constraints and the rush to complete forms can also be significant factors. Missed opportunities from hurried submissions can manifest in various forms, such as denial of loan applications or tax refunds. For example, an individual who wanted to claim a tax deduction but submitted an incomplete form missed out on significant savings, demonstrating the real-world implications of these errors.

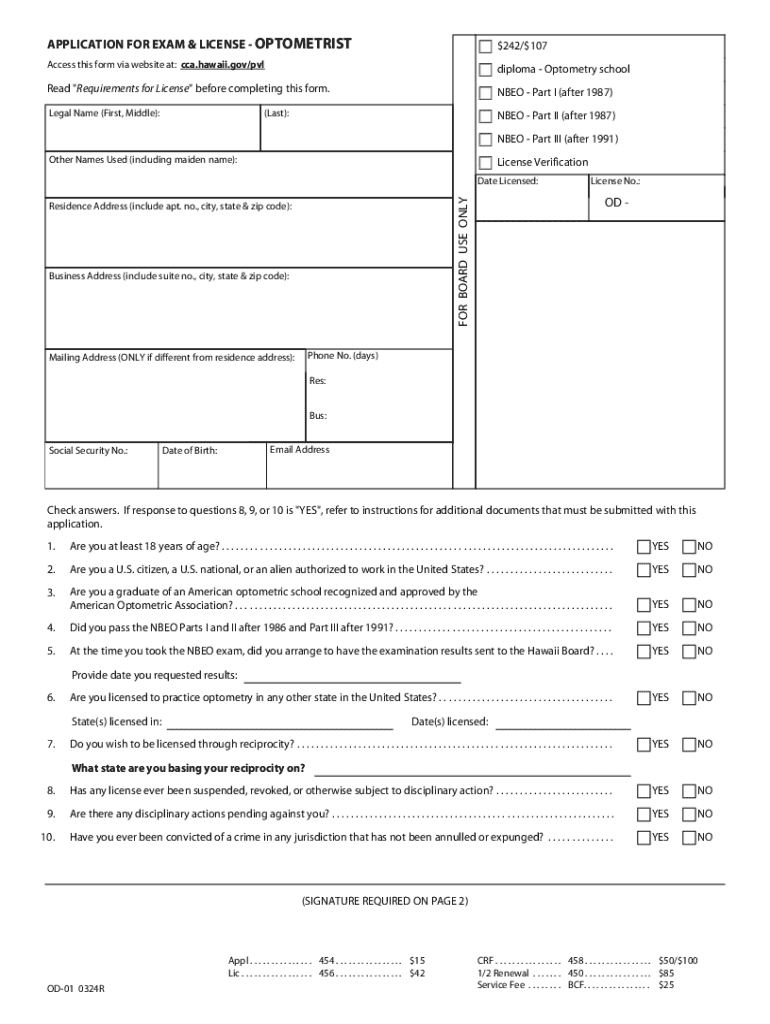

Highlighting specific forms often submitted incomplete

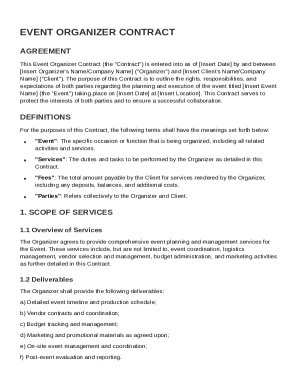

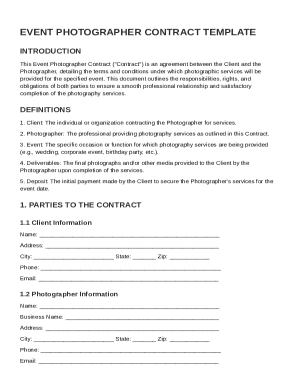

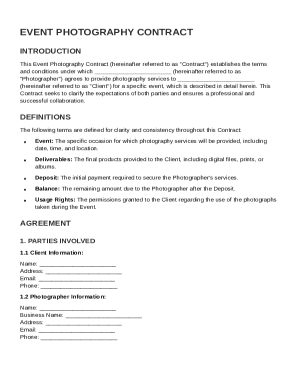

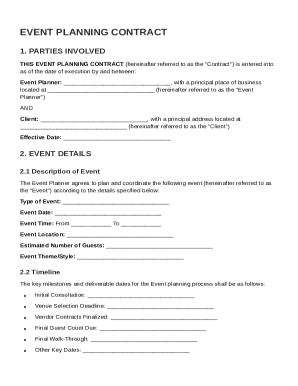

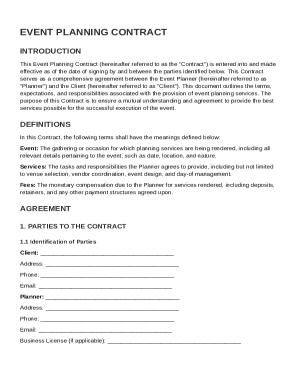

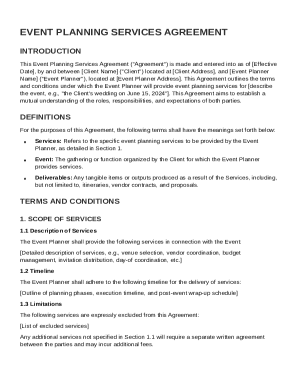

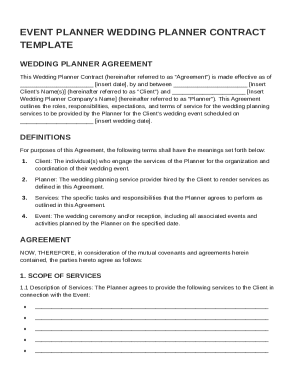

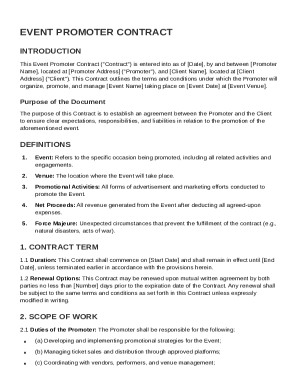

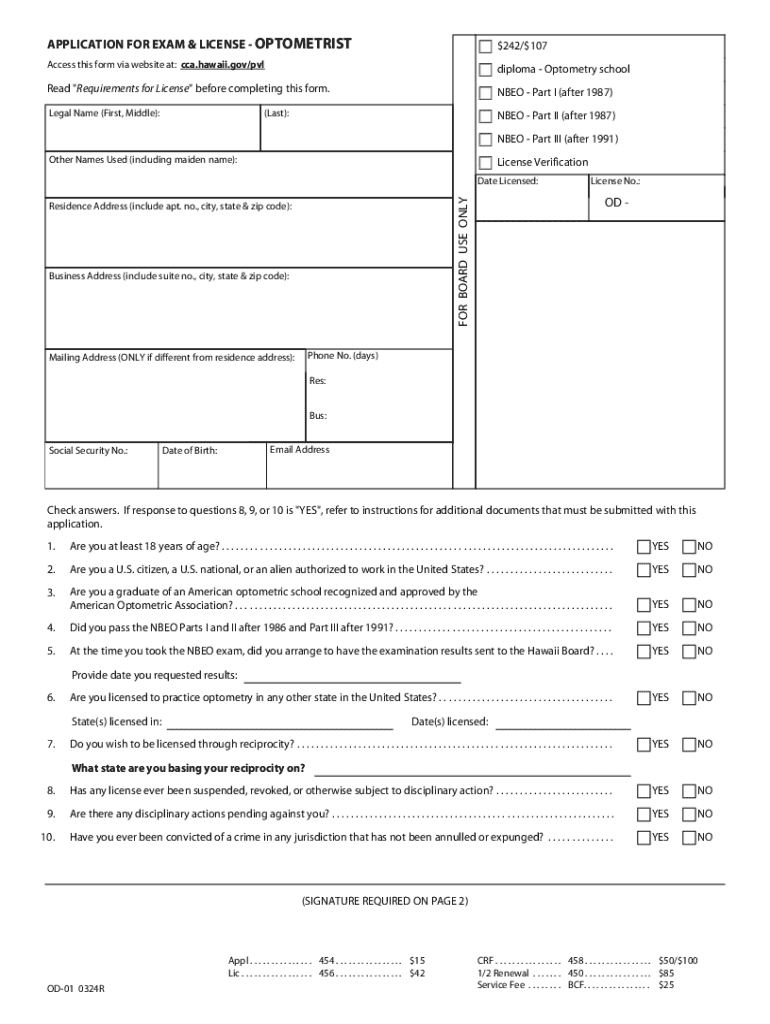

Certain forms are particularly susceptible to incompleteness. Government-related forms often require extensive data, including personal, financial, and legal information. Business contracts and agreements must be precise, containing terms and signatures from all relevant parties. Tax forms, on the other hand, demand accuracy, as even small mistakes can lead to audits or penalties.

Understanding the statutory requirements for these forms is crucial. Missing any component can render the entire submission invalid.

Step-by-step guide to ensuring full and accurate form completion

Conducting effective form submissions is essential for a smooth process. Follow this step-by-step guide to enhance your accuracy.

Errors to avoid when filling out forms

Common errors that lead to incomplete submissions include failing to read all the instructions, neglecting to provide necessary signatures, and overlooking required fields. These oversights can easily result in the return of forms, causing delays. To avert these issues, maintaining clarity in responses is crucial. For instance, clearly identifying yourself with full legal names and relevant identification details can eliminate confusion.

Implementing automated checks can dramatically reduce errors. Tools like pdfFiller can provide alerts for incomplete sections, thereby enhancing accuracy and confidence in submissions.

Leveraging technology for seamless form management

Technology plays a pivotal role in mitigating the risks associated with incomplete form submissions. pdfFiller offers an array of capabilities designed to streamline document handling, including e-signature solutions, document editing tools, and cloud-based storage benefits.

Real-world examples of successful form submissions using pdfFiller illustrate these benefits. Users have reported increased efficiency and fewer errors, leading to better results across the board.

Consequences of failing to provide all required information

Failing to provide all necessary information within a form can have significant legal ramifications. In many cases, incomplete submissions can result in legal penalties or disqualification from programs, such as grants or loans. The impacts aren’t just legal; they can extend to personal stress and ramifications for an organization, ranging from reputational damage to operational inefficiencies.

Case studies exemplify the fallout from these oversights. One instance involved an organization that submitted incomplete tax forms, leading to an IRS audit that resulted in fines, loss of reputation, and excessive resources spent on rectifying the mistakes.

Strategies for teams to avoid incomplete form submission

To prevent incomplete form submissions, establishing a protocol for form management is vital. Teams should consider incorporating regular training sessions focusing on the significance of completing forms effectively. Additionally, creating tailored internal checklists specific to the forms used can facilitate thoroughness and accountability.

FAQs on form completion and submission

When a form is submitted incomplete, it’s crucial to understand the steps to rectify the situation. Users often wonder how to amend their submissions effectively. Typically, the first step is to review the requirements and provide the missing information promptly. Best practices for future submissions emphasize careful preparation and double-checking before the actual submission is crucial.

Real-life testimonials from users who benefited from complete form management

Success stories highlight how users have leveraged pdfFiller to ensure completeness in their submissions. One user reported, "Using pdfFiller not only helps me check my forms but also gives me confidence to submit knowing every detail is covered." These testimonials underscore the ease and peace of mind achieved through effective form management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify failure to provide all without leaving Google Drive?

How can I get failure to provide all?

How do I edit failure to provide all straight from my smartphone?

What is failure to provide all?

Who is required to file failure to provide all?

How to fill out failure to provide all?

What is the purpose of failure to provide all?

What information must be reported on failure to provide all?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.