Get the free Pub 36Utah State Tax Commission

Get, Create, Make and Sign pub 36utah state tax

Editing pub 36utah state tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pub 36utah state tax

How to fill out pub 36utah state tax

Who needs pub 36utah state tax?

Understanding the Pub 36 Utah State Tax Form: A Comprehensive Guide

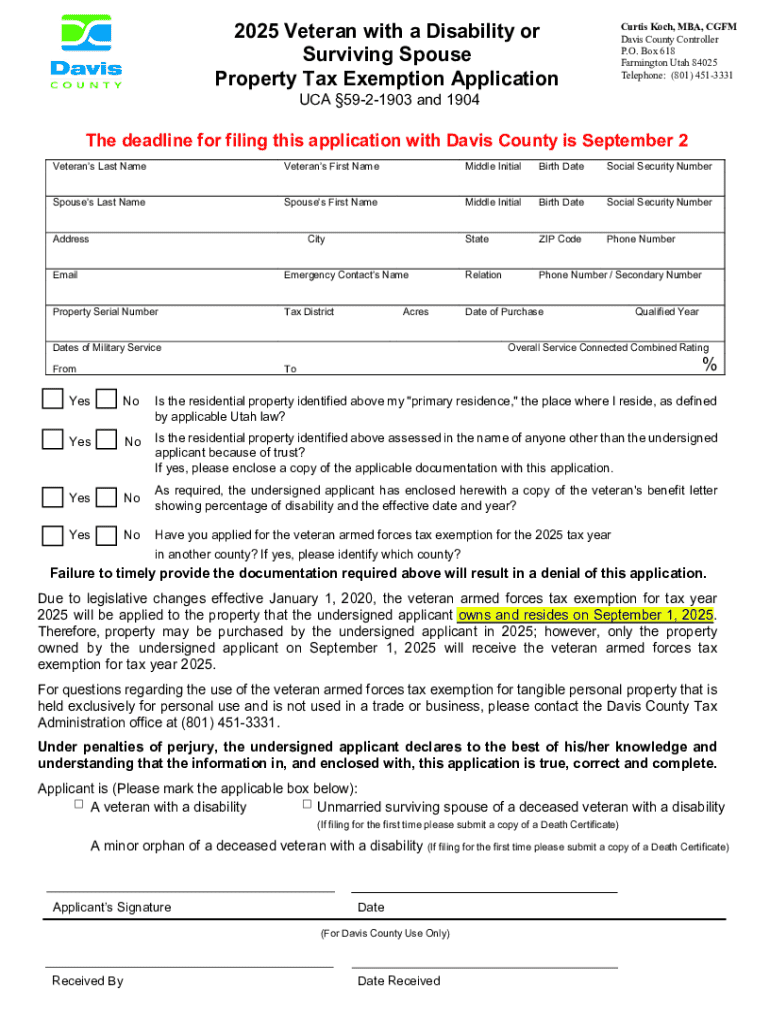

Overview of Form Pub 36: Utah State Tax Guide

Form Pub 36 serves as a crucial document for taxpayers in Utah, designed to provide clarity and guidance on the state's tax regulations. Essentially, this form is utilized for reporting various tax liabilities, ensuring compliance with state tax laws. Its importance lies in its detail-oriented structure that aids residents, businesses, and tax professionals in navigating the intricacies of state income tax.

The key uses of Form Pub 36 extend beyond mere reporting; it encapsulates a complete overview of income streams, deductions, and applicable credits, making it an indispensable tool for accurate tax filings. Every year, countless residents rely on this form to navigate their tax obligations effectively.

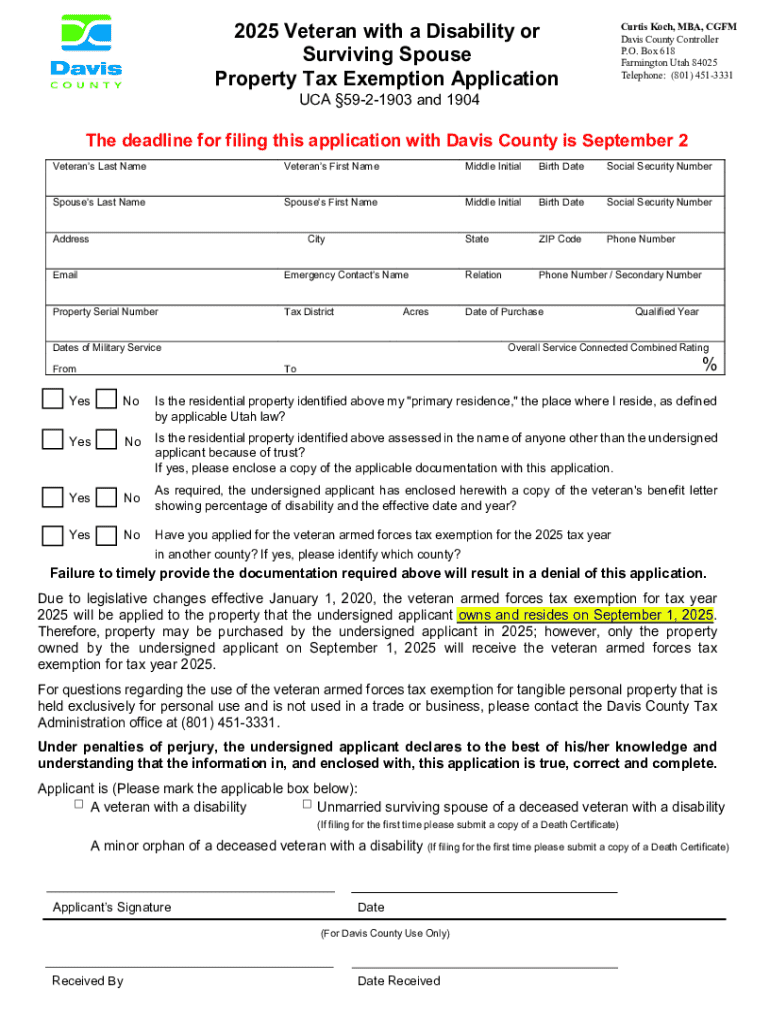

Eligibility requirements for filing Pub 36

Determining eligibility for using Form Pub 36 is fundamental for taxpayers in Utah. Both individual taxpayers and small businesses often find themselves needing to file this form. It is imperative to understand who should utilize it based on their income levels and tax scenarios.

Who should use Form Pub 36?

Specific eligibility conditions include factors like income brackets and the types of deductions or credits applicable to the filer. Understanding these criteria ensures that everyone uses Form Pub 36 correctly and beneficially.

Document preparation: What you need before filling out Pub 36

Preparation is key to filing Form Pub 36 successfully. Various documents must be gathered beforehand to ensure accurate completion. Important items include W-2 forms, 1099s, and records that substantiate any deductions and credits claimed.

Gather necessary documentation

A well-organized collection of financial information can significantly reduce stress during tax time. Establishing a filing system and adhering to a timeline for record-keeping will streamline the process and prevent last-minute scrambles.

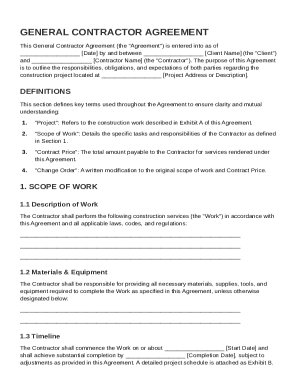

Step-by-step guide to filling out Pub 36

Filling out Form Pub 36 does not have to be a daunting task. By following a systematic approach, you can navigate each section with ease. Start with entering your personal information accurately. This includes your name, address, and Social Security number.

A complete breakdown of each section

Common mistakes in completing the form often include overlooking essential requirements or miscalculating income and deductions. By carefully reviewing each done section, you can avoid these pitfalls and ensure a successful filing.

Editing and signing the Pub 36 form

After filling out Form Pub 36, the next crucial step is editing and signing the document. Utilizing tools like pdfFiller for document management can significantly simplify this process. It allows users to upload and edit their Pub 36 form seamlessly.

Using pdfFiller for document management

Furthermore, pdfFiller features collaborative tools that allow you to share the document with team members or tax advisors for feedback before final submission, making the process more efficient.

Submitting your Pub 36 form: What you need to know

Once the Form Pub 36 is filled out and signed, the next step is submission. Taxpayers have several avenues for submitting their forms, including online portals or traditional mail. It's essential to choose the option that offers the best security and convenience.

Available submission methods

Be mindful of deadlines for both submission and payment. Marking these dates on your calendar or setting reminders can prevent any late fees or complications. For those who miss the filing deadline, there are procedures in place for filing late and avoiding penalties.

Post-submission tips: What happens next?

After submitting your Pub 36 form, tracking the submission status becomes extremely important. Taxpayers can confirm receipt with the Utah State Tax Commission to ensure their forms are processed accurately and timely.

Understanding possible outcomes

By being proactive in tracking your submission status, you can promptly address any issues that arise, ensuring a smoother tax experience.

Accessing support for Form Pub 36

Taxpayers in Utah don’t have to navigate their Pub 36 filing alone. The Utah State Tax Commission offers various resources for assistance with tax questions or concerns. Utilizing these resources can greatly enhance the efficiency of your filing process.

Contact information for Utah State Tax help

Additionally, engaging in forums or online communities can provide insights and shared experiences from fellow filers, enriching your understanding of the form.

FAQs: Common inquiries about Pub 36

Taxpayers often have questions regarding Form Pub 36 that may arise during preparation or post-filing. Addressing these common inquiries can assist in demystifying certain aspects of the tax process.

What to do if you make an error on the form?

If you notice an error after submission, it is essential to address it promptly by amending the return or contacting the tax office for guidance.

How to appeal a decision based on your Pub 36 submission?

In the case of a discrepancy or disagreement with a tax decision, you can initiate an appeal process as outlined by the Utah State Tax Commission.

Are there special considerations for non-residents or expatriates?

Yes, non-residents may have unique forms or additional considerations. Consulting with a tax professional can clarify these requirements and ensure compliance.

Additional state programs related to Pub 36

Beyond the personal income tax reporting that Form Pub 36 covers, various state programs offer additional tax incentives and relief options for residents. Taxpayers should familiarize themselves with these programs to potentially enhance their financial standing.

Overview of related tax incentives and programs

Understanding property tax relief programs, such as deferral options based on household income, allows taxpayers to make informed decisions that can lead to substantial savings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pub 36utah state tax to be eSigned by others?

How do I execute pub 36utah state tax online?

How do I edit pub 36utah state tax straight from my smartphone?

What is pub 36utah state tax?

Who is required to file pub 36utah state tax?

How to fill out pub 36utah state tax?

What is the purpose of pub 36utah state tax?

What information must be reported on pub 36utah state tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.