Get the free Form 777, Instructions for Resident Credit for Tax Imposed by ...

Get, Create, Make and Sign form 777 instructions for

How to edit form 777 instructions for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 777 instructions for

How to fill out form 777 instructions for

Who needs form 777 instructions for?

Form 777 instructions for form: A comprehensive guide

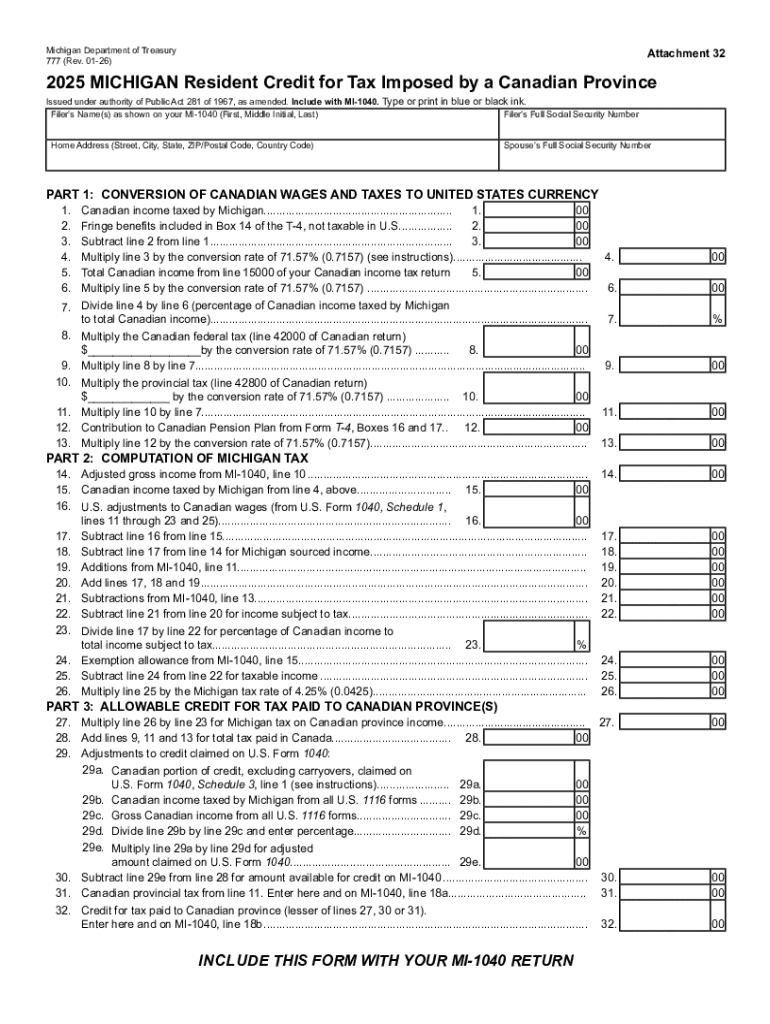

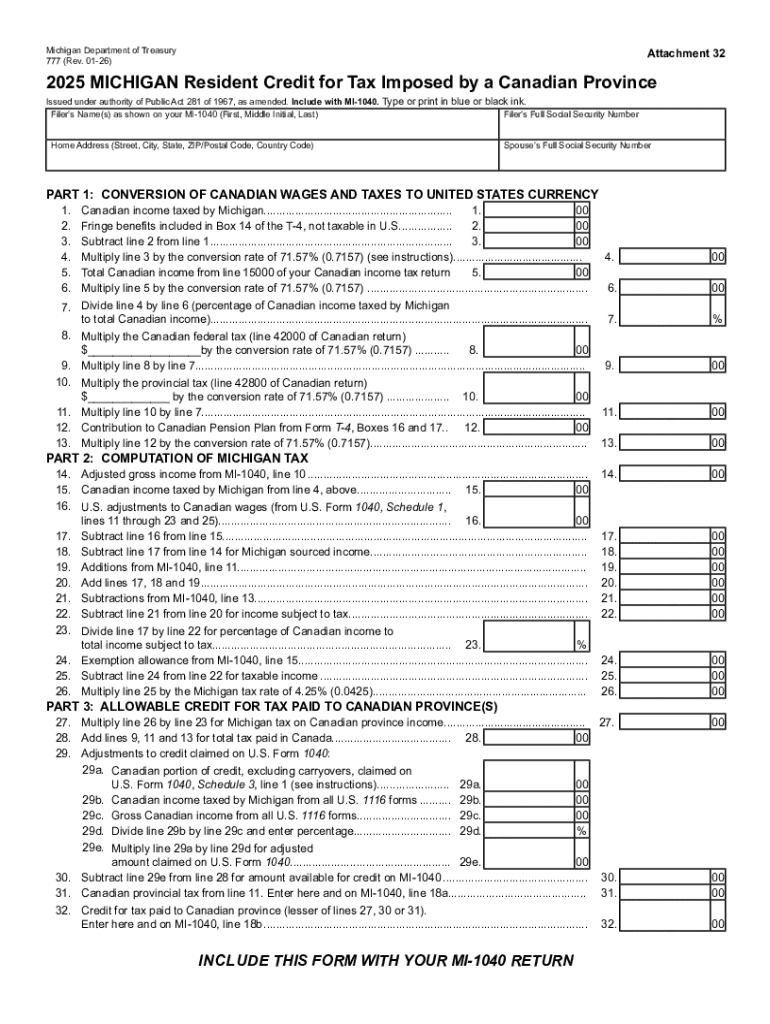

Overview of Form 777

Form 777 serves as a critical document for reporting and managing specific financial details relevant to various stakeholders, including the IRS and other governing bodies. Understanding its purpose can significantly impact compliance and record keeping.

This form is used primarily for the accurate capture of income, deductions, and credits during tax filing seasons, ensuring taxpayers are not only compliant but also maximizing their potential refunds.

Individuals who engage with Form 777 have the benefit of streamlined processes, allowing them to focus on their financial outcomes rather than bureaucratic complexities. By employing this form, users can conveniently consolidate all required information into one entity.

Preparing to fill out Form 777

Preparation is key when approaching Form 777. Ensuring you have all required documentation and information at hand can significantly reduce the chances of errors and delays during the submission process.

Important documents may include previous year's tax returns, receipts for deductions, and any additional supporting documentation that clarifies your financial situation. Establishing a comprehensive checklist can help expedite the preparation phase.

Common mistakes include skipping necessary steps or failing to double-check personal information. Engaging with mistakes may lead to unwanted scrutiny from tax authorities. Therefore, taking careful steps, such as verifying social security numbers and income calculations, can shield you from potential issues.

Detailed breakdown of Form 777 sections

Section A: Personal information

In Section A, users are required to input personal details including name, address, and social security number. Accurate information is critical here to establish identity and prevent any delays in processing.

Checking for accuracy is vital; any mismatch can lead to processing errors that may necessitate amendments or lead to further inquiries.

Section B: Income details

Section B focuses on income details, which must reflect all sources of income accurately. Reporting methods may vary, including self-reported income, wages, and other earnings.

Supporting documentation, such as W-2s and 1099 forms, must corroborate these figures to expedite form validity. Always ensure these documents are current and correctly matched to your declared income.

Section : Deductions and credits

This section allows for the declaration of eligible deductions and credits. Taxpayers should familiarize themselves with allowable deductions related to job-related expenses, charitable contributions, and other sectors.

Calculating these deductions can be complex; utilizing clear examples can aid in understanding how much you can claim effectively, ensuring that maximum benefits are secured. Remember, accurate calculations shield you from potential audits.

Section : Signature requirements

Finally, Section D covers the signature requirements necessary to validate Form 777. Users now have the option of utilizing electronic signatures through platforms such as pdfFiller for convenience.

Verifying that all signatures comply with the federal guidelines is essential. A proper verification process ensures authenticity and adheres to legal standards.

Using pdfFiller to complete Form 777

pdfFiller simplifies the process of accessing Form 777 online, making it a valuable resource for users needing to fill out this critical document.

Once accessed, users can employ a step-by-step approach to editing Form 777 conveniently in the web interface. Uploading the form is straightforward, and the interactive tools facilitate seamless entry of information.

After filling in the required fields, users can save and export the completed form effortlessly, ensuring a smooth transition from editing to submission.

Collaborating with team members

In a team environment, pdfFiller allows for effective collaboration, enabling each member to contribute to filling out Form 777. The platform supports comments and annotations, which enhance clarity and facilitate discussion.

Users can share documents with colleagues for real-time updates, ensuring that everyone involved can make contributions that enhance the quality and accuracy of the final submission.

Advanced features of pdfFiller for form management

eSigning through pdfFiller

The eSigning feature available on pdfFiller enhances the document completion process significantly. Benefits of electronic signing include time savings, reduced paper use, and streamlined workflows.

Moreover, pdfFiller maintains a high level of session security and compliance, ensuring that all signatures are legally binding and secure.

Document storage and organization

pdfFiller provides a centralized platform for document management. Users can create custom folders to organize Form 777 and other related documents for easy retrieval.

The search functionality can swiftly locate forms, eliminating frustration and saving time during critical periods.

Tracking changes and document history

Version control is a significant feature of pdfFiller, allowing users to keep track of Form 777 edits. Understanding how to restore previous versions can be a lifesaver in case of mistakes or last-minute changes.

This tracking functionality ensures that all changes can be audited, offering peace of mind when submitting critical forms to tax authorities.

Final steps after completing Form 777

Once Form 777 is completed, it’s vital to understand the submission guidelines. Each submission method carries its own requirements, whether you're submitting online or via traditional mail.

Users should also be aware of what to expect after submission, including possible timelines for processing and notifications from the tax authority regarding acceptance.

Lastly, troubleshooting common submission issues can mitigate future challenges. Being proactive in confirming receipt of submission and checking for errors is wise to avoid unnecessary complications.

Frequently asked questions (FAQs) about Form 777

Understanding commonly asked questions can clarify typical inquiries regarding Form 777. Users often have concerns about deadlines, eligibility requirements, and specific filing criteria.

Sharing user experiences can enhance your understanding and provide context, considering tips and tricks from seasoned filers can assist in streamlining your filing.

Enhancing your document preparation skills

Proficient document management skills not only streamline your experience with Form 777 but can translate to other forms and documents as well. Emphasizing attention to detail can organize your content effectively, saving time during filing seasons.

pdfFiller provides numerous learning resources to enhance your skills further, from tutorials to webinars that equip you with best practices for filling out, managing, and storing various forms.

It's important to adapt these skills to other forms and documents, as the foundational understanding of structure and requirements will carry over and benefit your overall document management efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 777 instructions for from Google Drive?

How do I make changes in form 777 instructions for?

Can I edit form 777 instructions for on an iOS device?

What is form 777 instructions for?

Who is required to file form 777 instructions for?

How to fill out form 777 instructions for?

What is the purpose of form 777 instructions for?

What information must be reported on form 777 instructions for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.