Get the free Abatement, Deferral and Exemption

Get, Create, Make and Sign abatement deferral and exemption

How to edit abatement deferral and exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out abatement deferral and exemption

How to fill out abatement deferral and exemption

Who needs abatement deferral and exemption?

Abatement deferral and exemption form: A how-to guide

Understanding abatement, deferral, and exemption

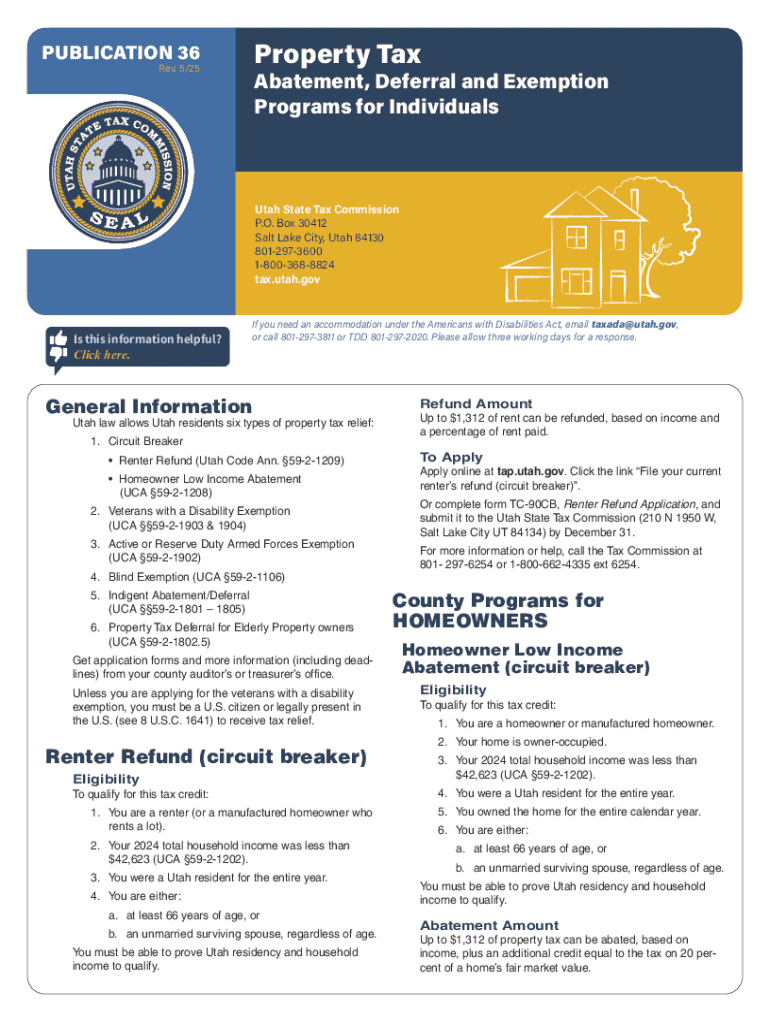

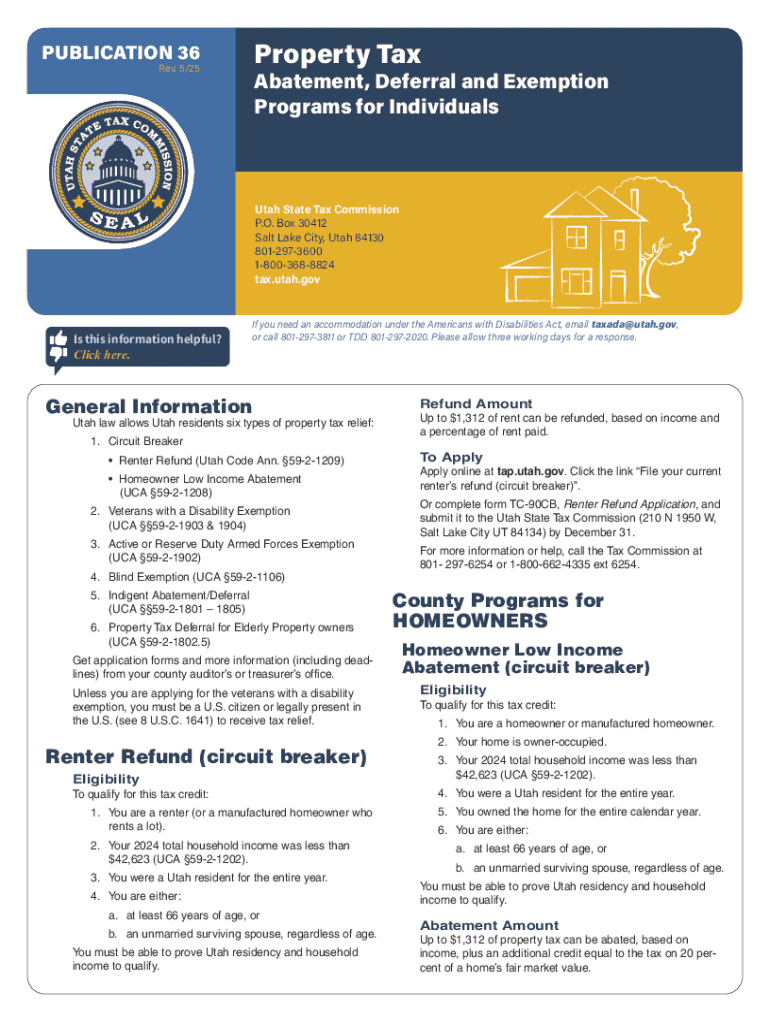

Abatement, deferral, and exemption programs are designed to provide economic relief to taxpayers, allowing for adjustments or reductions in property taxes based on certain criteria. Abatement refers to a reduction or elimination of property taxes owed, typically granted temporarily to relieve financial burdens. Deferral, on the other hand, allows taxpayers to postpone their tax payments, often until a later date or specific event occurs, such as selling the property. Exemption offers complete relief from property taxes for eligible individuals. Understanding these terms is vital, as they significantly impact financial planning for homeowners and renters alike.

These programs not only lighten the tax burden on eligible residents but also encourage community stability and improved financial health. For many, especially in areas with high property values like Utah, they can mean the difference between maintaining homeownership and facing financial difficulties.

Eligibility criteria for abatement, deferral, and exemption

To take advantage of abatement, deferral, and exemption programs, potential applicants must meet specific eligibility criteria. General requirements often include proof of residency, financial statements, and documentation proving ownership or tenancy. Different demographics may have varied qualifications, allowing more tailored support.

Essential documents typically required include proof of income, tax returns, property title deeds, and residency verification. By gathering these documents early, residents can streamline their application process and avoid potential delays.

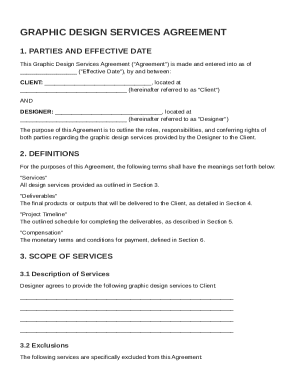

Document overview

The Abatement, Deferral, and Exemption Form encapsulates several vital components necessary for processing your application. Understanding these parts helps applicants complete the form accurately and efficiently.

Familiarizing yourself with key terms used in the form is crucial. For instance, ’household income’ may refer to combined incomes of all adults residing in the property, which may influence eligibility. It’s also common to find FAQs within the form to clarify any confusion around individual terms and requirements.

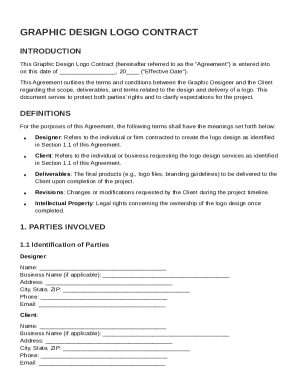

Step-by-step guide to filling out the form

Before you begin filling out the Abatement, Deferral, and Exemption Form, it’s essential to ensure that you have all necessary documents on hand, such as income statements and property details. Additionally, using a reliable platform like pdfFiller will streamline the process, enabling online access to the form in a user-friendly format.

Common mistakes to avoid include miscalculating income, providing incomplete property details, or omitting significant documentation. All these can lead to delays in processing your application or even denial due to discrepancies.

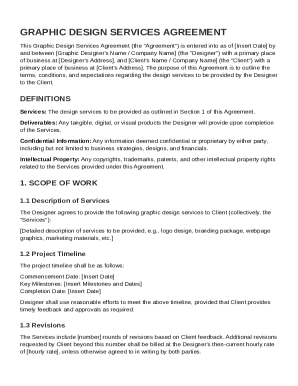

Editing and managing your form with pdfFiller

pdfFiller's platform offers extensive functionalities for editing your Abatement, Deferral, and Exemption Form before submission. Users can make modifications to their entries, ensuring that all information is accurate and complete.

Leveraging these features allows for a fully integrated document management experience, ensuring users can complete their forms in a timely and efficient manner.

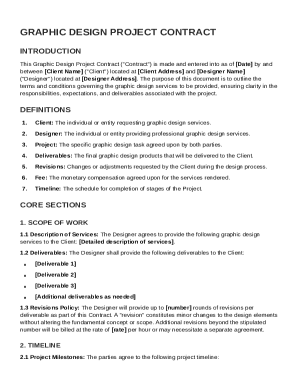

Submitting your form

After completing the Abatement, Deferral, and Exemption Form, the next step is submission. Various methods are available to cater to applicants' preferences and circumstances.

Be mindful of important deadlines for submission, as these can vary by region. In Utah, for instance, many applicants must submit their forms by the first week of June to qualify for the following tax year.

After submission: What to expect

Once you submit your Abatement, Deferral, and Exemption Form, it’s crucial to know the processing timeline. Generally, applications are processed within 4-6 weeks; however, this can vary based on the volume of applications received in a given timeframe.

Applicants can typically check the status of their forms by contacting the local auditor's office or checking the status on their official website. In cases of application denial, residents should receive a written explanation detailing the reasons for the denial, which can guide on potential next steps or reapplication opportunities.

Interactive tools for enhanced user experience

pdfFiller not only provides access to the Abatement, Deferral, and Exemption Form but also offers interactive tools for document management. These features are designed to enhance user experience significantly, particularly for taxpayers navigating this essential documentation.

Additional help and support

Navigating the Abatement, Deferral, and Exemption Form can be challenging without the right resources. Fortunately, various support options are available, designed to assist applicants through this process.

Success stories and testimonials

Personal stories from individuals who have benefited from abatement, deferral, and exemption programs provide valuable insight into the impact these initiatives can have on homes and lives. For instance, a Utah resident might share how the property tax deferral alleviated financial strain allowing them to remain in their home.

Testimonials about using pdfFiller often illustrate user satisfaction, highlighting its user-friendly platform, efficiency in document management, and the ability to seamlessly edit and submit forms.

Glossary of terms

Understanding the terminology associated with the Abatement, Deferral, and Exemption Form is essential for ensuring accurate completion and comprehension of the process. Terminology such as 'household income', 'property tax relief', and 'eligibility criteria' can play pivotal roles in your application.

Related forms and links

Residents may encounter several other relevant forms that pertain to property tax relief programs. Knowing these can facilitate an easier navigation of tax relief processes.

For further details, residents should access their county auditor’s website or respective local government resources to gather comprehensive information on these forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get abatement deferral and exemption?

How do I fill out abatement deferral and exemption using my mobile device?

How do I edit abatement deferral and exemption on an Android device?

What is abatement deferral and exemption?

Who is required to file abatement deferral and exemption?

How to fill out abatement deferral and exemption?

What is the purpose of abatement deferral and exemption?

What information must be reported on abatement deferral and exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.