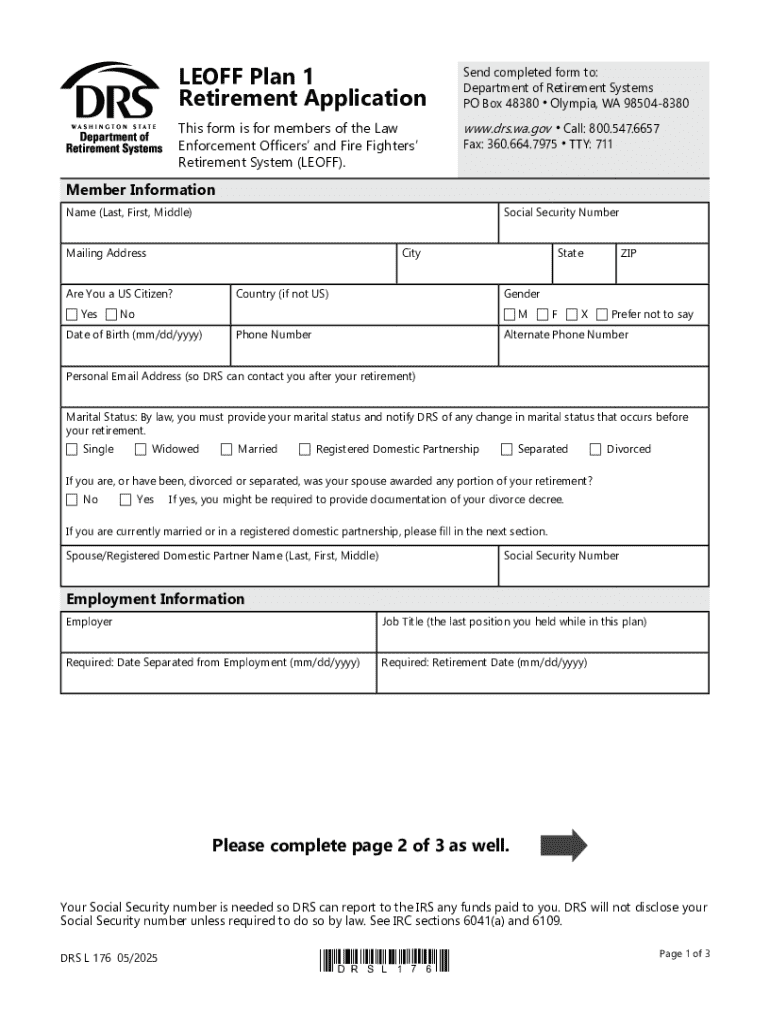

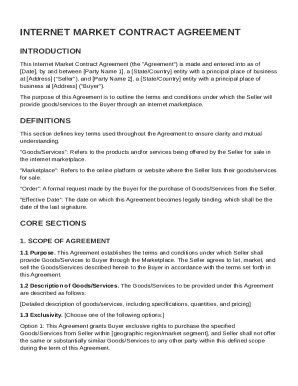

Get the free LEOFF Plan 1 Retirement Application *DRSL176*

Get, Create, Make and Sign leoff plan 1 retirement

Editing leoff plan 1 retirement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out leoff plan 1 retirement

How to fill out leoff plan 1 retirement

Who needs leoff plan 1 retirement?

A comprehensive guide to the LEOFF Plan 1 retirement form

Understanding the LEOFF Plan 1

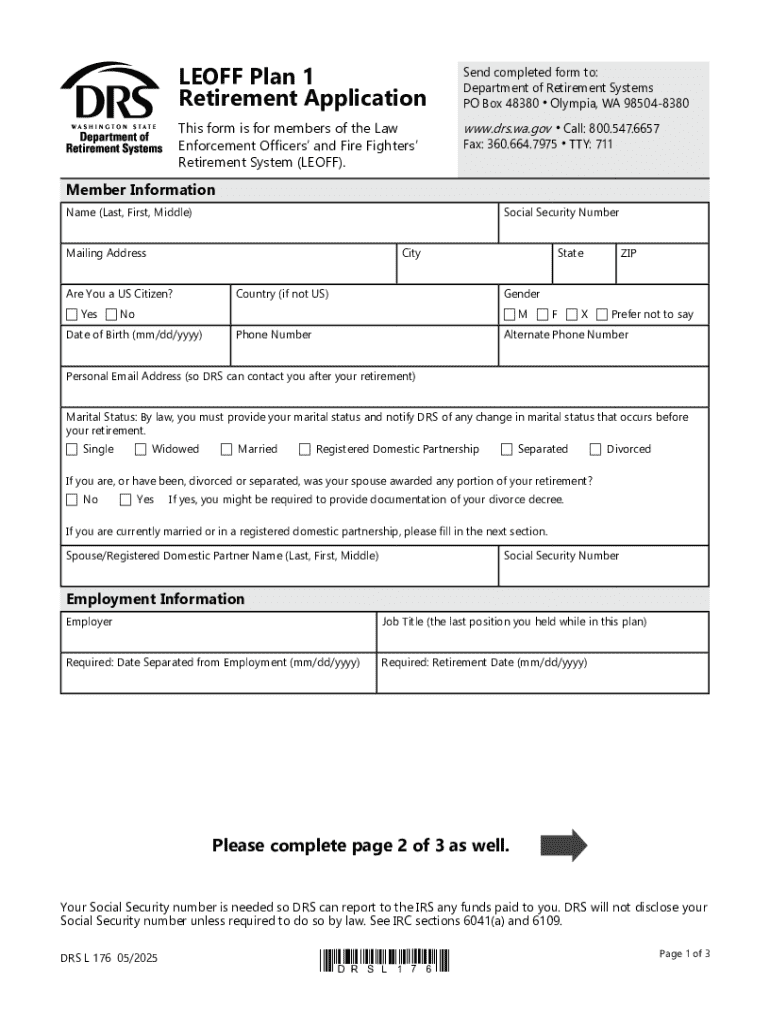

LEOFF Plan 1, or the Law Enforcement Officers' and Fire Fighters' Retirement System Plan 1, is a retirement plan specifically designed for law enforcement officers and firefighters in Washington state. It provides a critical safety net for those who have dedicated their careers to public service. Understanding this plan is indispensable for eligible members, as it outlines how retirement benefits are accrued, vested, and ultimately distributed upon retirement.

Key features of LEOFF Plan 1 include guaranteed lifetime pensions calculated based on the highest average salary over a specified period, typically two years. In addition to the pension, members may have access to survivor benefits, service credit options, and annuities. This structured benefit plan recognizes the unique sacrifices made by first responders and ensures a stable transition to retirement, contingent upon the completion of the necessary retirement form.

The LEOFF Plan 1 retirement form holds significant importance as it is the gateway to unlocking these benefits. Properly completing this form is essential to ensure that you receive the retirement benefits you have earned throughout your service. It can often seem daunting, but understanding it fully can ease the transition as you approach retirement.

Preparing for retirement with LEOFF Plan 1

Before diving into the specifics of the retirement form, it is crucial to assess your eligibility to retire under LEOFF Plan 1. Generally, members are eligible after 20 years of service or upon reaching 50 years of age, provided they have at least 5 years of service credit. Understanding these criteria is pivotal in planning your path to retirement. Evaluating factors such as your years of service and age will position you to make informed decisions regarding your retirement timing.

Several critical considerations come before filing your retirement form. First, assess your financial situation against your estimated retirement benefits to ensure you can sustain your desired lifestyle. Additionally, it pays to review potential health care needs, as medical expenses can significantly impact retirement finances. Coordinate with your employer to understand any additional plans or contributions that might enhance your benefits.

Key milestones leading to retirement include establishing the correct retirement date, understanding your benefit calculations, and ensuring all necessary documents are in order. Make an appointment with your benefits administrator to clarify these essentials. Being proactive in these steps can ease uncertain moments associated with your retirement journey.

Filling out the LEOFF Plan 1 retirement form

The LEOFF Plan 1 retirement form is a crucial document that captures vital information necessary to process your retirement benefits. Completing each section accurately is essential to avoid delays in receiving your benefits. This form typically covers personal information, employment history, benefit selections, designations of beneficiaries, and more.

Here’s a step-by-step guide on how to fill out the LEOFF Plan 1 retirement form:

It's vital to avoid common mistakes, such as incomplete sections or inconsistent information. Even minor errors can obstruct the processing of your retirement benefits, leading to unnecessary delays.

Modifying and managing your retirement form

After submitting the LEOFF Plan 1 retirement form, circumstances may change, requiring updates or modifications to your original submission. If you find that you need to request changes after submission, contact your benefits administrator promptly to inquire about the process. Most organizations will have established protocols to handle these requests efficiently.

Tracking the status of your retirement form is also essential. Many agencies provide online portals where you can view the status of your submission. Take the time to familiarize yourself with these tools, as they can provide peace of mind during the awaiting period. If your situation changes, such as a relocation or a change in your beneficiary information, address these changes as soon as possible to ensure your retirement benefits align with your current needs.

Interactive tools to enhance your retirement planning

Utilizing online tools can significantly enhance your retirement planning and ease the process involved with the LEOFF Plan 1 retirement form. Retirement calculators can help you estimate your expected benefits based on your age, years of service, and contributions made. These estimates can inform your planning and help you better prepare for your retirement lifestyle.

In addition, preparing a document checklist related to your LEOFF Plan 1 retirement can streamline the entire process. A comprehensive checklist may include:

Moreover, frequently asked questions related to LEOFF Plan 1 can provide clarity on common concerns. Engaging with these FAQs can offer insights that may help you feel more informed and confident as you navigate your retirement planning.

Collaborating with professionals

Seeking help from retirement advisors is an excellent strategy, especially when approaching the complexities of LEOFF Plan 1. Experts can provide tailored advice to help you maximize your benefits, ensuring that you fully leverage your earned retirement funds. Consider setting up regular consultations to keep your plans aligned with changing regulations and personal situations.

Platforms like pdfFiller enhance collaboration through their document management capabilities. These tools allow users to share forms, edit them collaboratively, and track changes easily. Additionally, utilizing eSignatures can facilitate faster processing, eliminating the need for paper forms and potentially speeding up your retirement benefit disbursement.

Life events and their impact on your retirement

Life events such as marriage or divorce can significantly impact your retirement benefits under LEOFF Plan 1. It's crucial to reassess your beneficiary designations and overall financial plans following such changes. An attorney who specializes in family law might be necessary to navigate the legal implications of these adjustments to ensure all details are adequately handled.

Changes in employment status can also affect your retirement plans. For instance, if you transition to another job or take a temporary leave, ensure you're still on track regarding your service credit and pension contributions. Maintaining a close relationship with your employer’s HR department can keep you updated on any implications arising from your employment changes.

Health events can further complicate your retirement plans. If you face unexpected medical issues, it may influence your required benefit amounts or adjustments to your payout selections. Staying in regular contact with financial advisors on how health costs could impact your retirement can help you prepare appropriately.

Real stories from retirees on LEOFF Plan 1

Hearing from others who have successfully transitioned into retirement through LEOFF Plan 1 can be incredibly informative. Many retirees share case studies that highlight their journey, discussing the preparatory steps they took, challenges they faced, and ultimately how they navigated the retirement process.

For instance, a common lesson learned among retirees is the importance of early and thorough research. Those who engaged with their benefits administrator early on often found out critical information that impacted their choices significantly. Others mention the value of financial planning to create a budget that aligns with their retirement lifestyle. By understanding the experiences of fellow retirees, you can prepare yourself better and avoid common pitfalls.

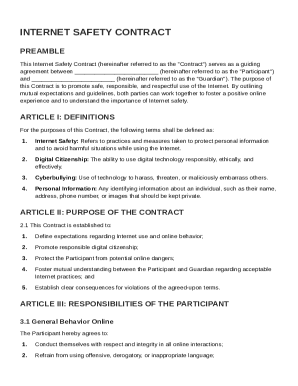

Keeping your retirement information secure

As you prepare your LEOFF Plan 1 retirement form, maintaining the security of your personal information should be a top priority. Best practices for keeping your data safe include using strong passwords for online accounts, being cautious about sharing sensitive information, and regularly monitoring your retirement account both online and through your provider.

Understanding privacy policies related to your retirement form is also vital. Familiarize yourself with how your information will be used, stored, and safeguarded by your retirement plan administrator. This diligence not only protects your financial interests but also instills confidence in the process.

Additional considerations for LEOFF Plan 1 participants

When planning your retirement, consider how other income sources may affect your LEOFF Plan 1 benefits. For instance, secondary income, such as part-time work or investments, could impact your overall financial plan. Being aware of how these additional funds interact with your pension can help you strategize your retirement income effectively.

It's also crucial to understand the vesting process in relation to your retirement plan. Vesting signifies the minimum amount of time you must work to qualify for retirement benefits—plus, it ensures you receive a portion of any employer contributions made to your plan. Enrolling in additional retirement savings plans can further complement your financial stability upon retirement.

User feedback and continuous improvement

The LEOFF Plan 1 process evolves based on user experiences and feedback. Engaging with the forms and administrative processes can lead to significant improvements within the system. Many retirees find that sharing their experiences helps to refine how forms are structured, making them more user-friendly for future applicants.

As you navigate your own retirement form and benefits, consider documenting your experiences and sharing feedback on what worked and what didn't. Inviting input from past and prospective retirees can pave the way for enhancements, ensuring future participants have an even easier experience.

Finally, tools such as pdfFiller continuously develop toward enhancing user experience in document management. By providing seamless editing, collaboration, and eSigning capabilities, pdfFiller positions itself as a critical ally in your retirement planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my leoff plan 1 retirement directly from Gmail?

How can I get leoff plan 1 retirement?

How do I complete leoff plan 1 retirement on an Android device?

What is leoff plan 1 retirement?

Who is required to file leoff plan 1 retirement?

How to fill out leoff plan 1 retirement?

What is the purpose of leoff plan 1 retirement?

What information must be reported on leoff plan 1 retirement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.