Get the free CORPORATION TAX RETURN 2025

Get, Create, Make and Sign corporation tax return 2025

How to edit corporation tax return 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporation tax return 2025

How to fill out corporation tax return 2025

Who needs corporation tax return 2025?

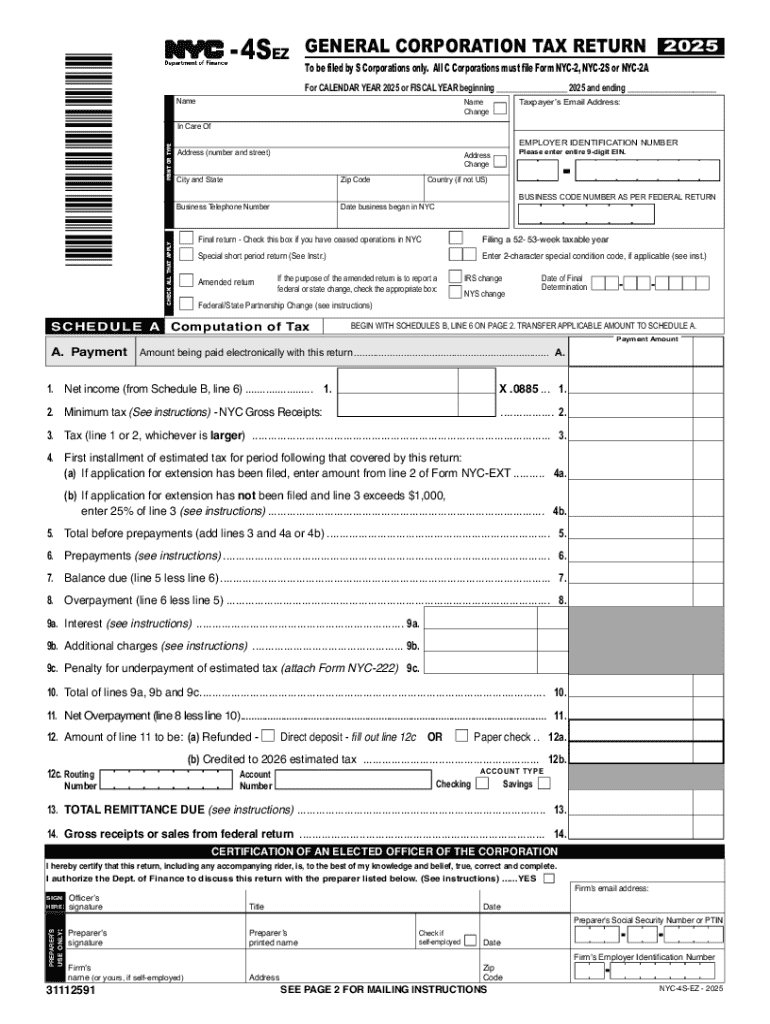

Comprehensive Guide to the Corporation Tax Return 2025 Form

Understanding corporation tax returns

Corporation tax refers to the tax levied by the government on the profits of corporations. Understanding this tax is crucial for any business entity, as it not only affects the company's bottom line but also mandates compliance with legal obligations. Particularly for the 2025 tax year, timely filing of the corporation tax return is essential to avoid penalties. Corporations are generally defined as legal entities that are separate from their owners, and they engage in commercial activities aimed at generating profits.

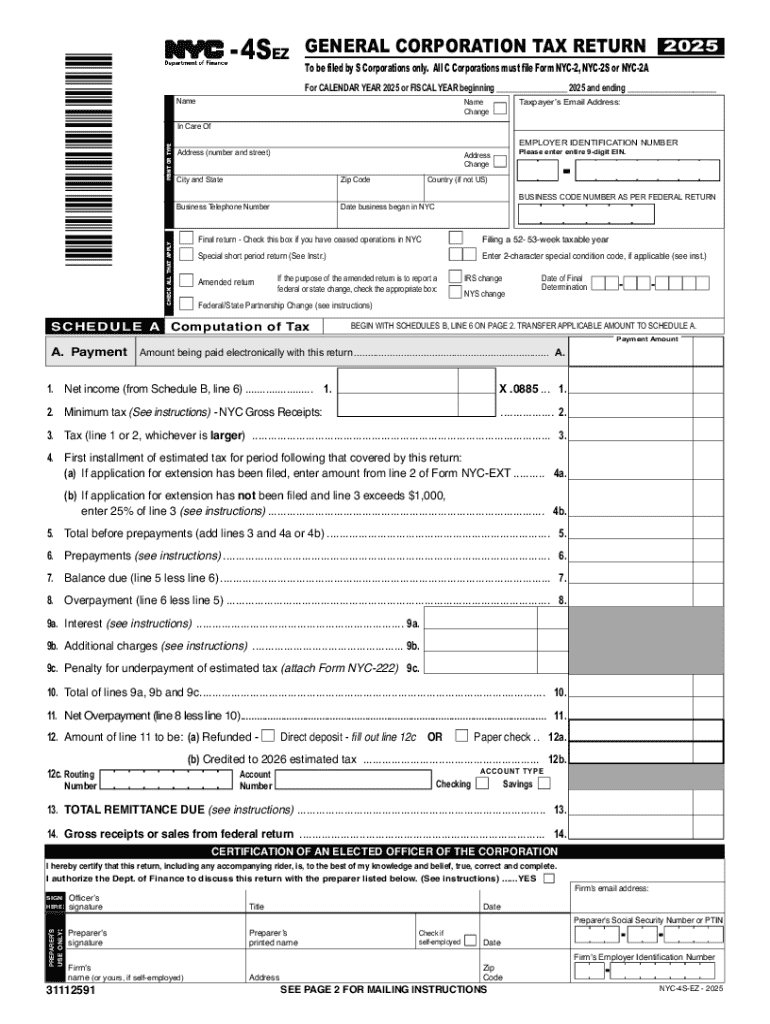

The 2025 corporation tax return form overview

The 2025 Corporation Tax Return form introduces updated procedures and requirements that differ from earlier versions. This form is integral for calculating your corporation tax liability for the year. The essential components of the 2025 form consist of three main parts: Basic Company Information, Financial Results and Adjustments, and Tax Computation.

Notably, the 2025 form features streamlined instructions and enhanced user experience, making it easier for corporations to navigate the complexities of tax filing.

Preparing to complete your corporation tax return

Before diving into the details of the corporation tax return 2025 form, it's imperative to gather all necessary documentation. Having complete and accurate financial statements easily accessible can simplify the process. Companies should also refer to previous tax returns for consistency and compliance.

Key considerations also come into play when assessing your tax liability. Deductions and credits available for your corporation can significantly impact the amount owed. Companies must also choose an accounting method that aligns with their operations, whether cash or accrual.

Step-by-step instructions for filling out the 2025 form

Filling out the 2025 Corporation Tax Return form demands a strategic approach. Here’s a step-by-step breakdown:

Editing and managing your document

Utilizing pdfFiller to edit your corporation tax return enhances the filing experience. Users can easily upload, modify, and manage their forms while collaborating with team members. Here's how to make the most of pdfFiller's features:

For signature management, pdfFiller offers an efficient eSigning feature that allows users to sign their returns digitally. Tracking document status and updates ensures transparency throughout the filing process.

Common errors to avoid

Navigating the intricacies of the corporation tax return can come with pitfalls. Common errors can significantly jeopardize approval of your filing. Awareness is one of the best defenses against these missteps.

Frequently asked questions

Questions often arise during the tax filing process. Here are some common inquiries related to the corporation tax return 2025 form: What to do if I missed the deadline? It’s key to contact tax authorities promptly and potentially file for an extension. How do I amend a submitted return? Amendments can usually be filed online or via mail, but specific instructions will have to be followed based on your jurisdiction.

Benefits of using pdfFiller for your corporation tax return

Leveraging pdfFiller for your corporation tax return provides distinct advantages. Its cloud-based platform offers incredible accessibility, allowing users to access documents anytime, anywhere. Additionally, the real-time collaboration feature empowers teams to work together efficiently, making document management streamlined and effective.

Conclusion and next steps

After filing your corporation tax return, it's vital to maintain accurate records of your submission and all supporting documents. This not only prepares your business for future audits but also provides clear insights for subsequent years. Consider implementing an organized system for retaining these records. Preparing for next year’s return can begin now by reviewing the current year's performance and anticipating any changes in tax policy or business structure.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit corporation tax return 2025 from Google Drive?

How can I get corporation tax return 2025?

Can I create an eSignature for the corporation tax return 2025 in Gmail?

What is corporation tax return 2025?

Who is required to file corporation tax return 2025?

How to fill out corporation tax return 2025?

What is the purpose of corporation tax return 2025?

What information must be reported on corporation tax return 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.