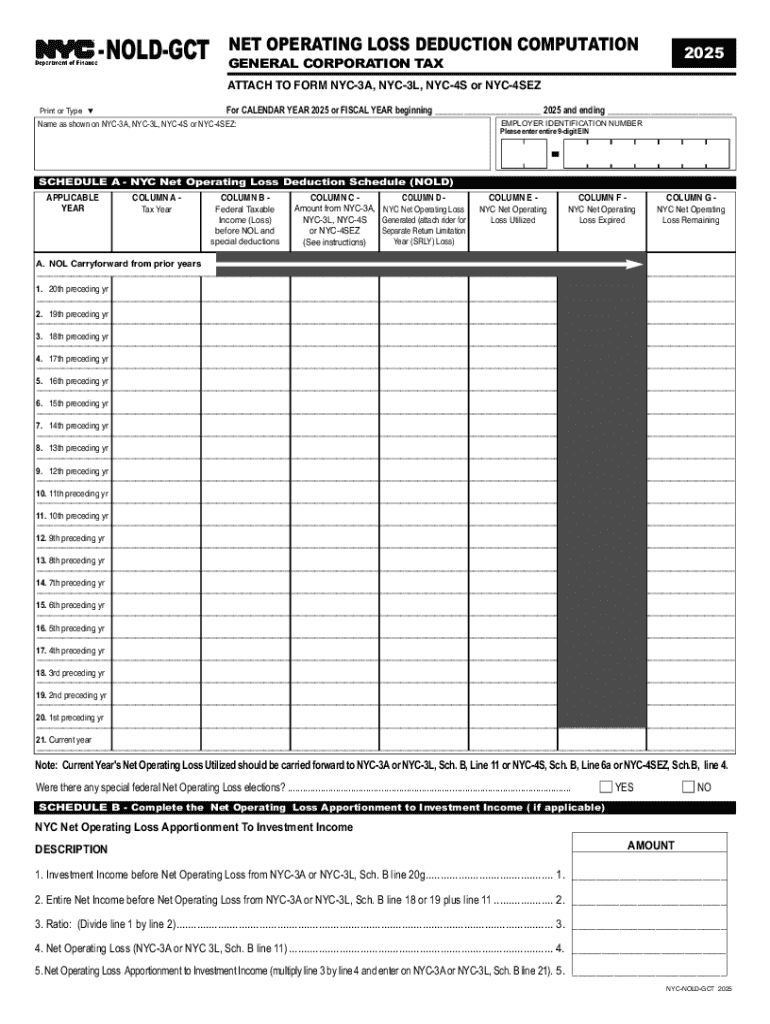

Get the free How to Calculate Net Operating Loss for Corporations

Get, Create, Make and Sign how to calculate net

How to edit how to calculate net online

Uncompromising security for your PDF editing and eSignature needs

How to fill out how to calculate net

How to fill out how to calculate net

Who needs how to calculate net?

How to calculate net form

Understanding the concept of net calculation

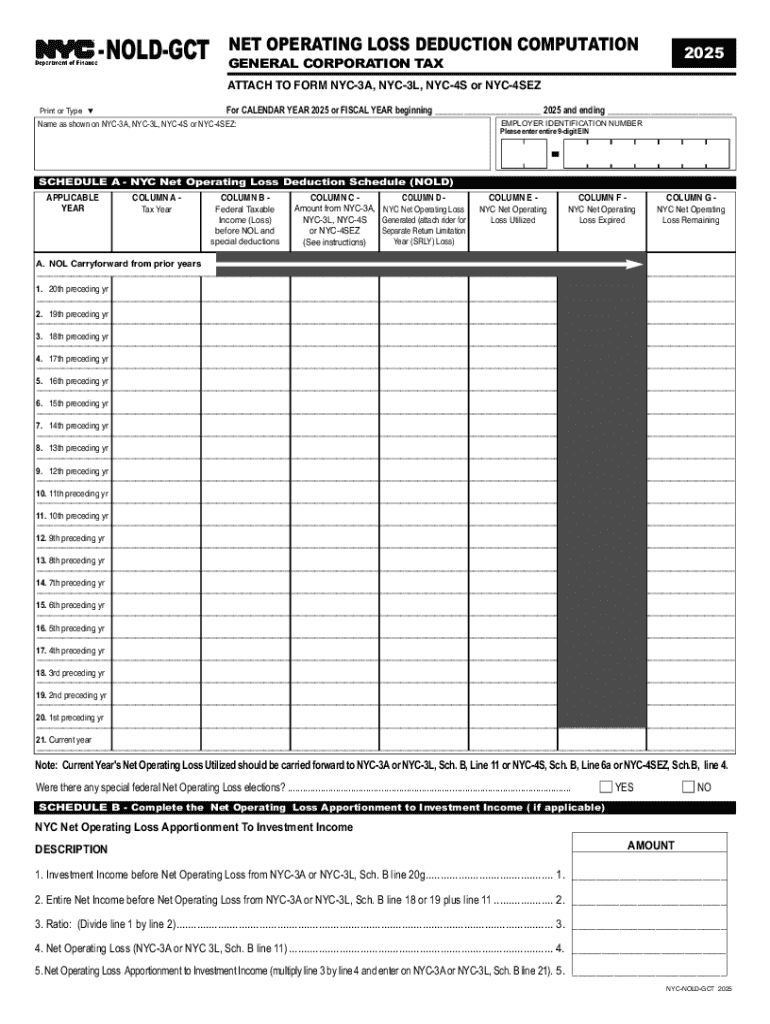

Calculating net form begins with understanding what net calculation truly represents. Net form refers to the actual amount of money that an individual takes home after all applicable deductions have been accounted for. This includes taxes, benefits, and other withholdings that impact the gross income. Given that many employees rely on their net income to budget their living expenses, accurate calculations are crucial.

Accurate net calculations are fundamental not just for employees but also for businesses, especially payroll departments tasked with ensuring correct payments. Wrong calculations can lead to employee dissatisfaction and potential legal implications. Common situations requiring net calculation encompass payroll processing, loan applications, and financial planning.

Key components of net calculation

To compute your net income, it's essential to grasp the key components involved in net calculations. First and foremost is the gross amount, which is the total earnings before any deductions. This figure can come from various sources, such as salaries, bonuses, and overtime pay.

Identifying deductions is the next step. Common deductions include federal, state, and local taxes. For instance, federal income tax varies based on income brackets and filing status, while state taxes can vary significantly across different states. Additionally, benefits such as health insurance and retirement contributions also reduce your gross income. Other withholdings might include court-ordered garnishments or child support payments. Ultimately, the net amount—the figure you receive in your paycheck—signifies your actual take-home pay.

Step-by-step guide to calculating net form

Calculating your net form involves a systematic approach. You'll begin by gathering necessary documents, such as pay stubs, benefit statements, and tax information. This foundation is crucial to ensure your numbers are accurate.

Next, list your gross earnings. This may include salary for full-time employees or hourly wages for part-time workers. Don’t forget to add other income sources, like freelance work or bonuses. The next step requires you to identify deductions: distinguish between fixed, like taxes, and variable deductions, such as contributions to a 401(k). Understanding these distinctions can clear up confusion about your final figures.

Now, perform your calculations by applying the net calculation formula. Typically, this is Gross Income - Total Deductions = Net Income. For example, if your gross income is $5,000, and you have $1,500 in deductions, your net income would be $3,500. Following this structured approach ensures you achieve an accurate and reliable net form calculation.

Understanding taxes taken out of paycheck

Taxes play a significant role in determining net income. Understanding how they impact your paycheck requires some insight into various types of taxes. Federal income tax is typically calculated using progressive tax brackets, meaning higher income levels are taxed at higher rates. Employees receive allowances that can reduce the taxable amount, depending on their filing status and exemptions.

State and local taxes vary widely based on geographical location. While some states have a flat tax rate, others employ a progressive system. Moreover, Social Security and Medicare contributions are federally mandated, with a fixed percentage deducted from gross earnings. Keeping abreast of any changes in tax law is pivotal, as these can have an immediate impact on withholding amounts.

How to read a paycheck for net calculation

Reading a paycheck accurately is critical for understanding your net income. A typical paycheck includes several key components: gross earnings, deductions, and the net amount. Familiarize yourself with how each of these figures appears on your paycheck. For example, gross income is generally displayed prominently at the top, while deductions are listed in a clear itemized format, ensuring clarity.

Look out for key figures relevant to net calculation such as total deductions and the taxable income after withholdings. Common mistakes include misinterpreting deduction amounts or overlooking specific line items that may affect the net amount. Being diligent here is important; the clearer your understanding of each component, the more accurate your self-assessment will be.

Factors influencing your net income

Several factors can influence your net income significantly. Employment status plays a pivotal role; for example, full-time employees often enjoy more extensive benefits and fixed salaries, while part-time or freelance workers might face variable income. This can complicate net calculations if you have multiple income streams.

Changes in tax law and healthcare legislation also directly affect net income calculations. For small businesses or organizations employing multiple individuals, understanding these implications can pose challenges. Keeping abreast of the evolving financial landscape is essential for optimizing withholdings and maximizing take-home pay.

Practical tools for net calculation

In the digital age, several practical tools exist to streamline net calculation processes. Interactive calculators provide instant insights and can easily calculate net income based on user inputs, freeing time for other organizational tasks. Standards vary, so selecting a calculator that is user-friendly yet comprehensive is paramount.

Additionally, pdfFiller offers user guides and templates that simplify these calculations. Cloud-based solutions for document management also benefit teams by enhancing collaboration and making information readily accessible from anywhere. Utilizing such tools fosters a more organized approach to handling payroll data, ultimately aiding in accurate net calculation.

Frequently asked questions about net calculation

How often should you calculate your net income? Regular calculations can help you keep track of your financial health. Many recommend recalculating after every pay cycle or at least quarterly to ensure your withholdings remain accurate and reflective of your lifestyle changes.

If your paycheck doesn't align with your estimated net amount, it’s important to verify your deductions and consult your payroll department to address discrepancies. Adjusting your withholdings proactively can help maintain the accuracy of future paychecks.

Best practices for managing and documenting net calculation

Maintaining accurate records is imperative when managing net calculations. Regular reviews of pay stubs, tax documents, and any changes in financial circumstances help ensure that all figures are correct. This practice fosters transparency and accuracy for both individuals and businesses.

Collaborating with financial advisors can also enhance accuracy. Advisors can provide insights into your specific financial situation, especially when tax laws change and influence your deductions. Implementing these best practices will ensure more reliable management of net calculations.

Switching payroll providers: understanding its impact on net calculation

When organizations switch payroll providers, they must understand the implications for net calculations. Different providers may employ varying methodologies in calculating payments and withholdings, prompting a need for careful review of the process during transitions.

Certain provider features can enhance the accuracy of net calculations, while others may add complexity. Ensuring that all payroll data and documents transition seamlessly is critical for maintaining consistency and reliability in net form calculations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit how to calculate net in Chrome?

Can I edit how to calculate net on an iOS device?

How do I complete how to calculate net on an iOS device?

What is how to calculate net?

Who is required to file how to calculate net?

How to fill out how to calculate net?

What is the purpose of how to calculate net?

What information must be reported on how to calculate net?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.