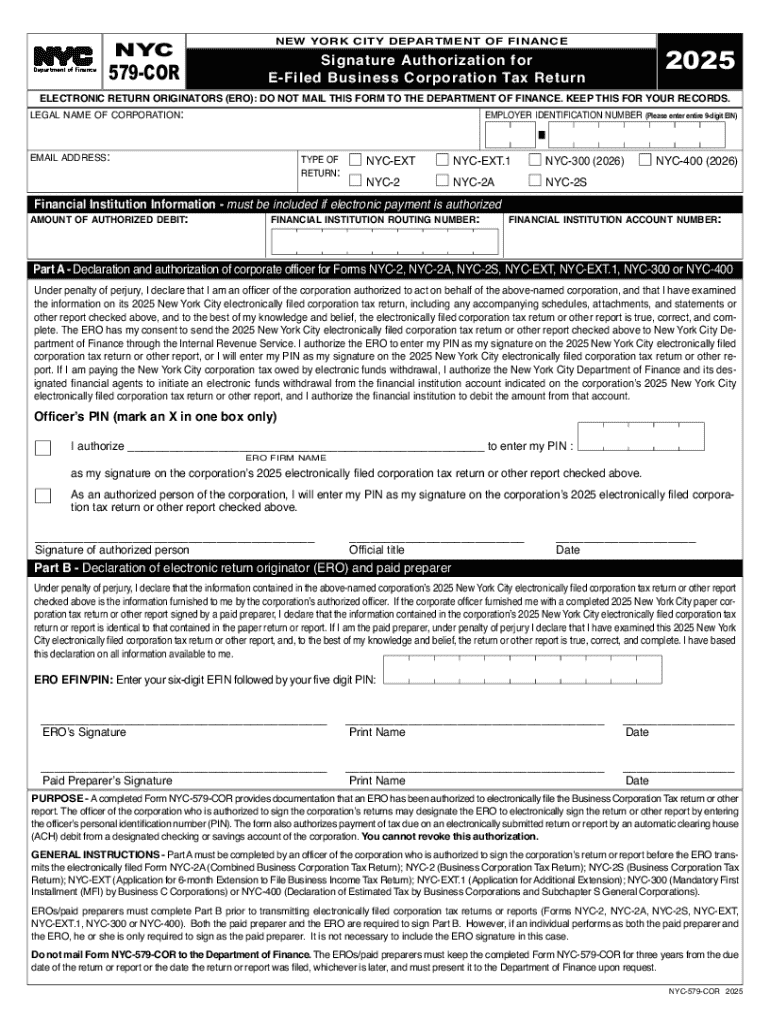

Get the free electronic return originators (ero): do not mail this form to ...

Get, Create, Make and Sign electronic return originators ero

Editing electronic return originators ero online

Uncompromising security for your PDF editing and eSignature needs

How to fill out electronic return originators ero

How to fill out electronic return originators ero

Who needs electronic return originators ero?

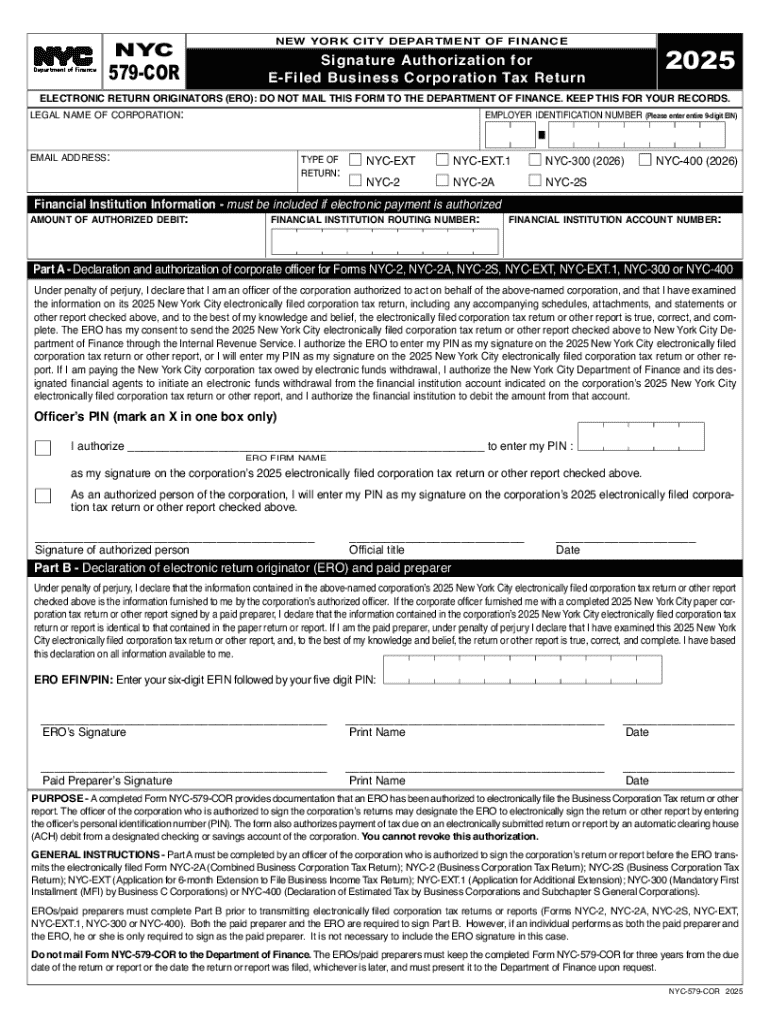

Electronic Return Originators (ERO) Form: A Comprehensive Guide

Understanding electronic return originators (ERO)

Electronic Return Originators (EROs) play a critical role in the history of tax filing, acting as intermediaries between taxpayers and the IRS. An ERO is a tax professional or organization authorized to submit electronic tax returns on behalf of clients, ensuring a smoother and faster process compared to traditional methods.

The importance of EROs in expediting the electronic filing process cannot be overstated. With their guidance, taxpayers can navigate the complexities of the tax code while enjoying reduced wait times for returns and refunds. Unlike traditional paper filing, the allied technologies facilitate a quick turnaround for both tax preparation and submission.

A comparison of traditional and electronic filing highlights the efficiency and reduced stress associated with the ERO model. By utilizing advanced tools, EROs not only expedite the filing process but also enhance client satisfaction.

The ERO form: Key features and benefits

The ERO form serves as a foundational document for tax professionals handling electronic returns. It certifies that the ERO is authorized to submit returns electronically and helps establish a legal framework for client interactions.

For EROs, the form is vital, as it not only assures compliance with IRS regulations but also frames their responsibilities and client interactions. Having this form completed ensures that clients are fully informed about the submission process.

The benefits extend to taxpayers as well, who enjoy a more efficient filing experience with the assurance of accuracy and the support of a knowledgeable professional.

Detailed insights on filling out the ERO form

Filling out the ERO form accurately is critical for compliance and smooth processing. The first section focuses on ERO identification where tax professionals must provide their ERO identification number, business name, and contact details.

Next, it's essential to gather pertinent client information. This includes the taxpayer's Social Security number and address, ensuring that the details provided are accurate and up to date to maintain IRS expectations.

The final section addresses taxpayer consent and necessitates signatures both from the ERO and the taxpayer, validating the information presented. This step is crucial as it protects both parties and maintains the integrity of the process.

It’s important to approach this process meticulously, as data entry errors can lead to submission rejections and delays.

Common pitfalls during this process include neglecting to ensure all fields are filled completely or inaccurately entering taxpayer identification numbers. Awareness of these issues can prevent complications during submission.

Editing and managing ERO forms with pdfFiller

pdfFiller provides a robust platform for editing and managing ERO forms, allowing tax professionals the flexibility they need to ensure accuracy. Users can upload ERO forms to the platform easily, gaining immediate access for editing.

The tools offered by pdfFiller, such as text editing and adding checkmark options, facilitate providing clear information in ERO forms. Users can also incorporate signature fields for easy completion.

Beyond individual use, pdfFiller boasts collaborative features that make teamwork easy. Team members can work on forms in real-time, enhancing the efficiency of the workflow through robust comment and annotation tools.

E-signature workflow for ERO forms

E-signatures are essential in modern business practices and hold legal validity, streamlining workflows and expediting processes. By integrating e-signatures into the ERO form process, EROs can enhance client satisfaction and speed up the submission times.

To collect electronic signatures, pdfFiller offers an easy-to-follow workflow. Users can send the ERO form directly to clients for signatures with the option to track the signing status in real time, providing added transparency and assurance.

This workflow not only boosts efficiency but also reinforces the legal integrity of the documents processed, making it an indispensable element of modern ERO practices.

Best practices for EROs using the ERO form

Maintaining data security is vital for EROs and their clients. Best practices include regularly backing up data, using encrypted platforms for sensitive information, and ensuring compliance with all IRS regulations.

ERO professionals should stay informed of the latest IRS standards and guidelines relevant to electronic filing. Regular training and updates can help mitigate risks associated with compliance.

Establishing these best practices helps reinforce a trusting relationship with clients, as they can feel confident in the security and accuracy of the services provided.

Interactive tools and resources for EROs

Access to specific ERO templates and forms on pdfFiller is a game-changer for tax professionals. With a range of tailored resources available, EROs can efficiently create and manage the necessary documents.

Furthermore, pdfFiller’s knowledge base provides invaluable information, addressing frequently asked questions and troubleshooting common issues encountered when filling out ERO forms.

These resources enable EROs to streamline their processes, making them more productive and efficient, particularly during the peak tax season.

Maximizing efficiency with pdfFiller’s unique features

pdfFiller offers features that significantly enhance productivity for EROs, notably during tax season when time is of the essence. Efficient document management across devices allows EROs to work seamlessly, regardless of location.

Exclusive PRO features add even more value, enabling EROs to customize forms according to their specific needs. Using analytics and reporting tools, tax professionals can track performance and identify areas for improvement.

These capabilities empower EROs to not only meet the demands of tax season but also position themselves competitively in an increasingly digital environment.

Transforming your tax filing with an ERO approach

Creating a seamless client experience is at the heart of ERO practices. By leveraging advanced technologies and tools provided by pdfFiller, EROs can optimize their tax filing processes and build lasting relationships with clients.

Real-life case studies highlight successful implementations of ERO systems that have utilized pdfFiller’s capabilities, showcasing improved client satisfaction and enhanced operational efficiency.

Each transformation makes the ERO's service offering more attractive, setting a benchmark within the industry for quality and client reliability.

Next steps for EROs

Getting started with pdfFiller's platform is straightforward; users can easily access resources and guides to enhance their understanding of electronic filing. As EROs take the next steps, they should consider continuous learning to stay ahead of the curve in electronic filing practices.

Encouraging collaboration within the ERO network will yield optimal results, leveraging shared experiences and collective knowledge to navigate challenges and innovate solutions in electronic filing.

By embracing these next steps, EROs can ensure they are well-equipped to serve their clients effectively while adapting to the ever-evolving landscape of tax preparation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get electronic return originators ero?

How do I complete electronic return originators ero online?

How do I make edits in electronic return originators ero without leaving Chrome?

What is electronic return originators ero?

Who is required to file electronic return originators ero?

How to fill out electronic return originators ero?

What is the purpose of electronic return originators ero?

What information must be reported on electronic return originators ero?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.