Get the free TR-579-CT - Tax.NY.gov

Get, Create, Make and Sign tr-579-ct - taxnygov

How to edit tr-579-ct - taxnygov online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tr-579-ct - taxnygov

How to fill out tr-579-ct - taxnygov

Who needs tr-579-ct - taxnygov?

Understanding the TR-579-CT TaxNYGov Form: A Complete Guide

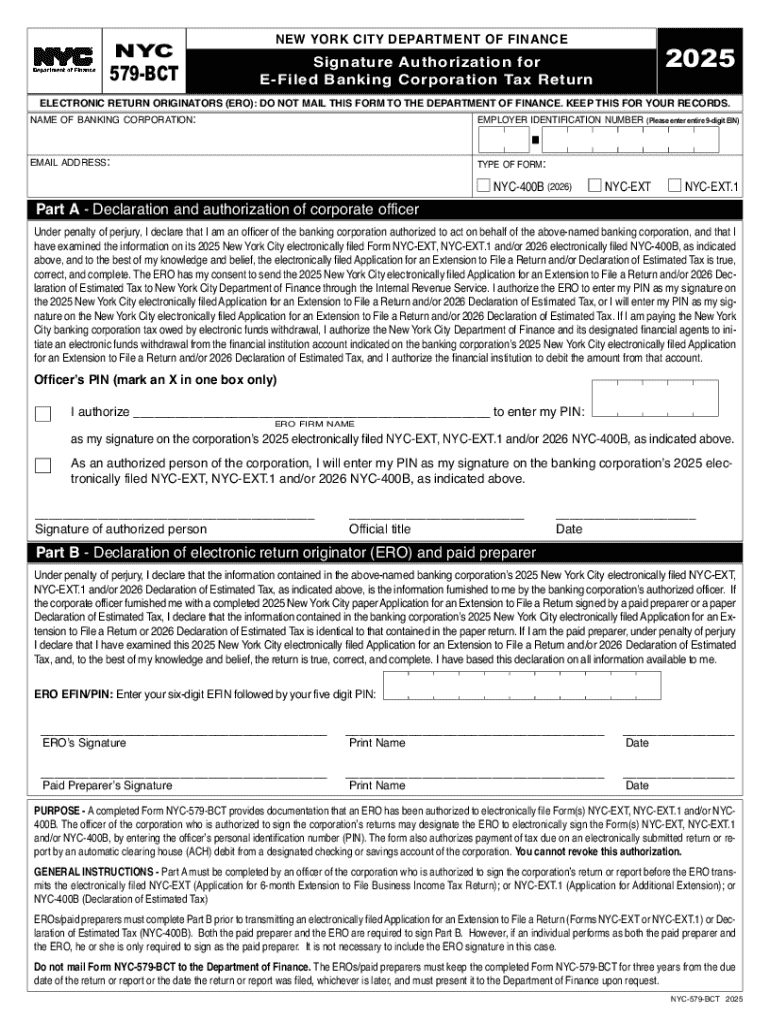

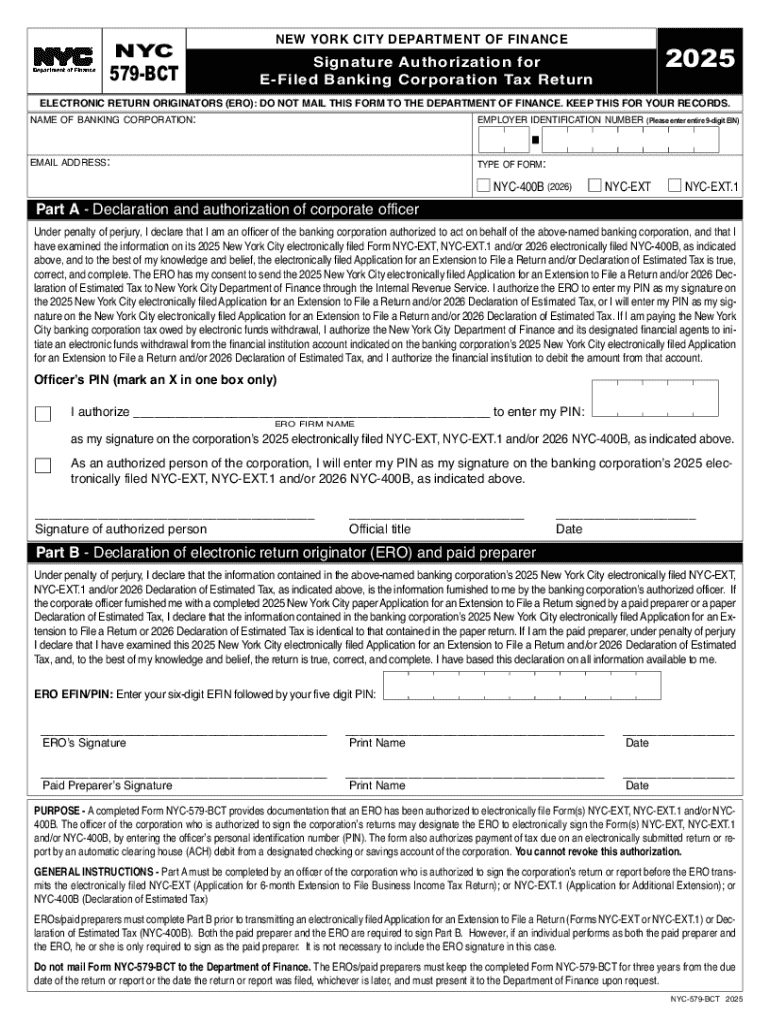

Overview of TR-579-CT Tax Form

The TR-579-CT form is a key submission required by the New York State Department of Taxation and Finance, utilized for reporting various tax-related obligations. Specifically, it caters primarily to the consolidation of tax information for particular entities. Understanding this form is crucial as it represents not just compliance with tax regulations but also facilitates the taxpayer's rights to claim refunds or credits that may apply.

The TR-579-CT form holds significant importance for both individuals and businesses, resonating as a pivotal element in New York's tax framework. Failing to file this form correctly could lead to complications such as delayed refunds, penalties, or audits. Common scenarios where this form is used include business filings, adjustments of prior returns, and the reporting of certain credits.

Who needs to complete the TR-579-CT form?

Eligibility to file the TR-579-CT largely depends on the nature of the taxpayer's activities in New York state. Typically, businesses, including corporations, partnerships, and certain non-profit organizations, are required to complete this form if they fit specific tax brackets. For individuals, self-employed persons or those claiming particular tax credits also need to fill out this form.

Common situations requiring the completion of the TR-579-CT include declaring changes in business operations, claiming tax credits associated with New York taxation, or rectifying previously submitted tax forms. Understanding whether you fall within these categories can significantly impact your tax situation, either enhancing your refund potential or ensuring compliance with state laws.

Detailed instructions for filling out the TR-579-CT form

Completing the TR-579-CT form requires careful attention to detail to ensure accuracy and compliance. Here’s a step-by-step guide to help you navigate the process:

One common mistake to avoid is neglecting to double-check figures before submission. Additionally, many filers forget to include necessary supporting documentation, which is crucial for justifying claims made on the form.

How to access the TR-579-CT form

Finding the TR-579-CT form is straightforward. You can locate it online by visiting the New York State Department of Taxation and Finance website. They provide downloadable versions of the form in PDF format, ensuring ease of access.

If you prefer digital customization, utilizing pdfFiller can be beneficial. It offers interactive tools that not only allow you to find the TR-579-CT form but also provides facilities for filling it out directly in your browser. This reduces the hassle of printing and scanning while allowing for easy edits.

Editing and customizing the TR-579-CT form

Editing the TR-579-CT form is simple with pdfFiller’s tools. After locating the form, you can easily insert your signature electronically, making the process both time-efficient and straightforward.

These features significantly streamline the document management process, especially for teams coordinating on filings.

Signing and submitting the TR-579-CT form

Once you have completed the TR-579-CT form, the next step is signing and submitting it. The eSigning process is straightforward with pdfFiller, allowing you to sign directly within the platform without needing to print anything physically.

Be mindful of deadlines when choosing your submission method, as timely submission can alleviate late penalties and fines.

Managing your tax documents with pdfFiller

With pdfFiller, managing your tax documents becomes less cumbersome. The platform allows for organizing all your tax documents in one place, which simplifies retrieval as tax season approaches.

This empowers users to work more efficiently while maintaining organization and oversight throughout the filing process.

FAQs about the TR-579-CT form

Navigating the complexities of tax forms can lead to confusion. Here are some common questions related to the TR-579-CT form:

These FAQs serve as a starting point for addressing typical queries and enhancing your understanding of the filing process.

Addendum: Filing deadlines and important dates

Staying informed about filing deadlines is crucial for avoiding penalties. Tax season timelines vary, but generally, tax forms such as TR-579-CT need to be submitted by the state’s stipulated deadlines.

Awareness of these timelines fosters preparation and compliance, significantly reducing worries as deadlines approach.

Support and resources

For assistance with the TR-579-CT form, several resources are available. Taxpayers can reach out to the New York State Department of Taxation and Finance directly for specific questions.

Engaging these resources ensures that taxpayers aren't left in the dark and have confidence while completing their TR-579-CT form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tr-579-ct - taxnygov directly from Gmail?

Can I create an eSignature for the tr-579-ct - taxnygov in Gmail?

How do I complete tr-579-ct - taxnygov on an Android device?

What is tr-579-ct - taxnygov?

Who is required to file tr-579-ct - taxnygov?

How to fill out tr-579-ct - taxnygov?

What is the purpose of tr-579-ct - taxnygov?

What information must be reported on tr-579-ct - taxnygov?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.