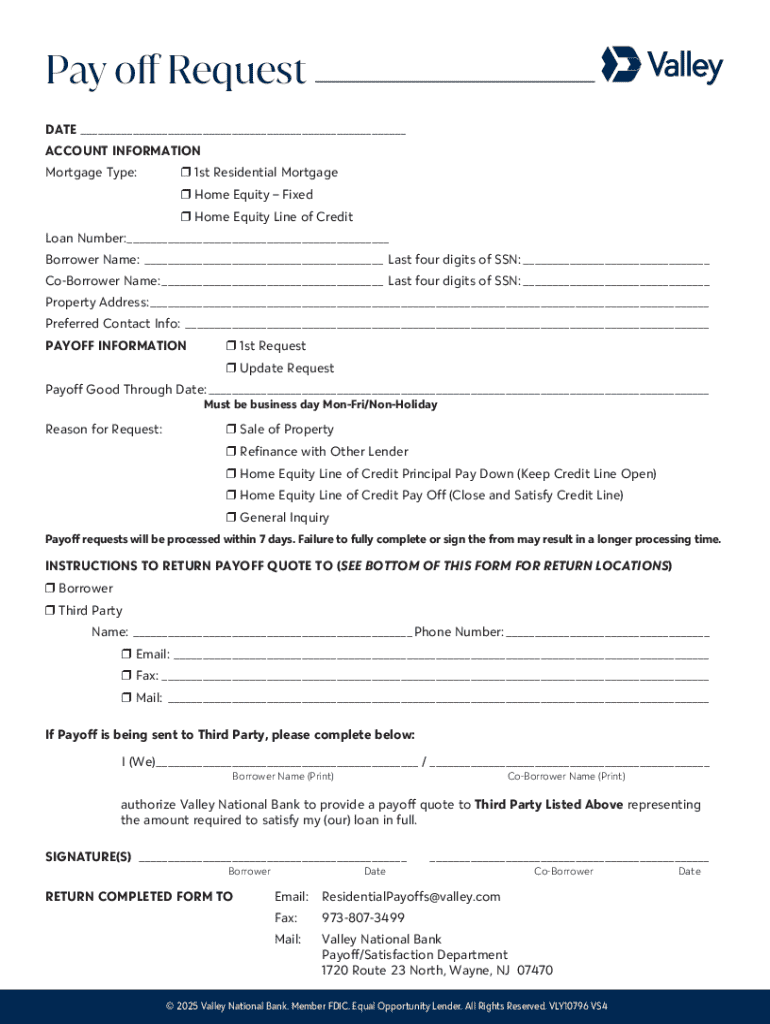

Get the free Pay off request

Get, Create, Make and Sign pay off request

How to edit pay off request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pay off request

How to fill out pay off request

Who needs pay off request?

Pay Off Request Form - How-to Guide

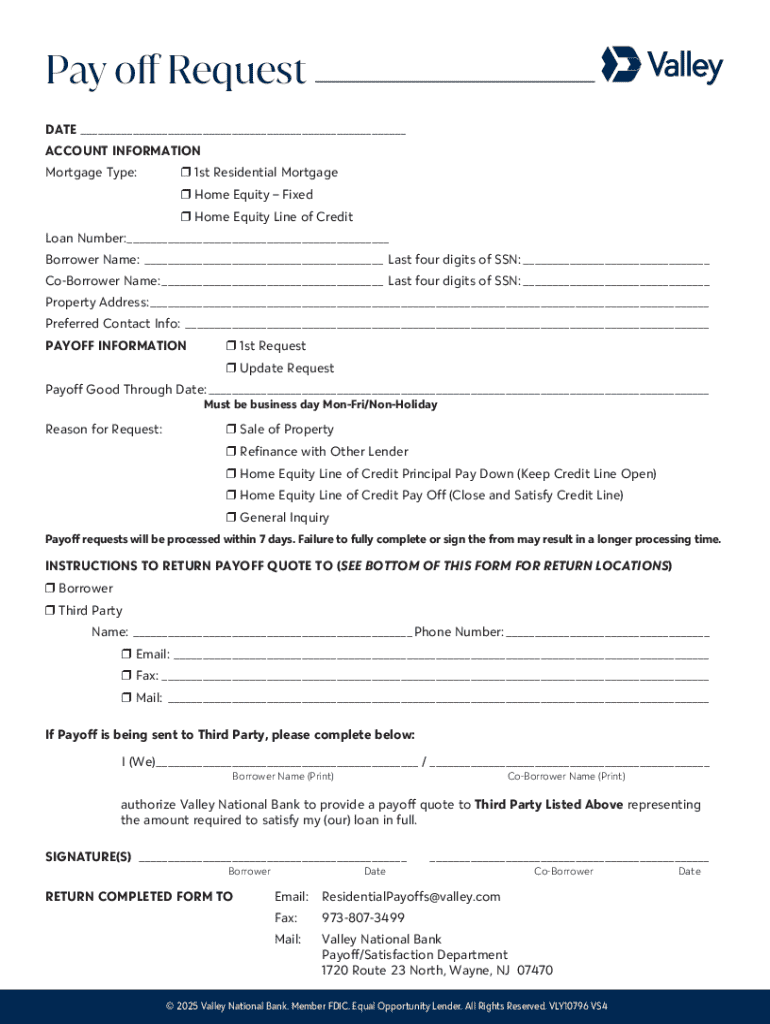

Understanding the pay off request form

A pay off request form is an essential document used by individuals and businesses to formally request the total amount required to pay off a loan or lease. The primary purpose of this form is to provide a clear and systematic way for borrowers to communicate with lenders, ensuring that all parties are on the same page regarding outstanding balances. This form plays a crucial role in financial transactions as it helps streamline the payoff process, particularly in instances of real estate or automobile loans.

The importance of a pay off request form cannot be overstated. It not only specifies the exact amount needed to settle a debt but also establishes a record of communication between the borrower and lender. This clarity can prevent misunderstandings and disputes over incorrect payment amounts. Therefore, understanding how to properly utilize this form is in your best financial interest.

Who needs to use the pay off request form?

Various individuals and organizations may find the pay off request form essential. Personal loan borrowers—whether mortgages, auto loans, or personal loans—often require a pay off request form to ascertain the amount needed to fully settle their debts. For homeowners seeking to sell their property, receiving a payoff statement is necessary to understand the outstanding mortgage balance ahead of closing, ensuring maximum proceeds from the sale.

Additionally, businesses that lease equipment or property also rely on this form. When leasing arrangements come to an end, companies request payoff letters to ascertain the total remaining balance, ensuring that they fulfill their contractual obligations and avoid further financial penalties. In essence, anyone with a loan or lease should become familiar with and utilize the pay off request form efficiently.

Key components of a pay off request form

Completing a pay off request form requires specific essential information to ensure accurate processing. The form typically asks for personal details such as your name, address, and contact information. For businesses, the company name and designation of the authorized signatory are also necessary. Furthermore, you will need to provide loan details, including the type of loan, account number, and the balance you wish to pay off. Accurate information reduces the chances of errors during processing.

In addition to your core identification and loan information, you may need to attach additional documentation as supporting evidence. This could include financial documents that prove your identity or a government-issued ID for individual borrowers. Properly preparing and documenting these entries will streamline the processing of your pay off request, making it quick and efficient.

Step-by-step process for filling out the pay off request form

Step 1: Gathering necessary information

Before filling out the pay off request form, it’s crucial to gather all required information. This means collecting personal and loan details, like your name, address, loan type, and account number. Check your most recent statements for accuracy and ensure that you have the current balance readily available. Errors at this point can result in delays or complications in processing your request.

Step 2: Completing the form

Once you’ve gathered the necessary information, start completing the pay off request form. Pay special attention not to overlook any sections, and take care to adhere to any specific instructions your lender may have regarding the form. Remember to double-check for typos or inaccuracies, as they can create confusion or even lead to financial loss. Key tips include writing legibly and using precise terminology.

Step 3: Submitting your form

After filling out the form, choose your method of submission. Most lenders allow multiple submission methods, including online submission through a secure portal, mailing the form, or even faxing it. Check your lender’s specific preferences to ensure your request reaches the right department promptly. Additionally, be mindful of processing timelines and inquire about how soon you can expect a response.

Step 4: Following up on your request

Once you’ve submitted your pay off request, it’s wise to follow up. Keep a record of your submission date and any confirmation number provided. Depending on the lender's processing times, contacting them for updates if you haven’t received a response within the expected timeframe can help expedite your request. Be polite and to the point; this proactive approach is often appreciated.

What to expect after submitting a pay off request form

After you've submitted your pay off request form, the next step is to await the response from your lender. One of the first communications you can expect is the receipt of a payoff letter. This document outlines the exact amount needed to discharge the debt fully, including any applicable fees. It’s important to keep this letter as it serves as proof of the payoff amount and the closure of your loan.

The processing time for receiving a payoff letter can vary depending on the lending institution. Common timeframes can range from a few days to several weeks. Factors influencing this time include the lender’s workload and the complexity of your account. Staying in touch with your lender can often help clarify any unexpected delays.

Common challenges and solutions

One common challenge is submitting incorrect information on your pay off request form. Errors can delay processing and may require you to resubmit the request. If you realize an error after submission, immediately contact your lender with the correct information; they may offer guidance on how to update your request. Quick action can ideally mitigate potential setbacks and expedite the correction process.

Another frequent issue is delays in the lender's response time. Various factors—such as high volume during peak seasons—can result in slower processing. To help expedite this, keep a checklist of whom to contact for updates and when to reach out. A friendly reminder can go a long way in promoting timely responses.

Interactive tools to simplify the process

Utilizing tools such as pdfFiller can significantly enhance your experience when handling a pay off request form. The platform allows you to edit and eSign your form seamlessly, ensuring that every detail is accurate and updated with ease. Engaging with pdfFiller's features means you can ensure your form reflects precise information while maintaining compliance.

Another advantageous feature of pdfFiller is the ability to collaborate with others directly on the document. This functionality is especially beneficial if multiple stakeholders are involved, such as business managers reviewing the payoff request. Moreover, with its cloud-based documentation capabilities, you can access your form from anywhere, making it an excellent solution for busy professionals.

Additional tips for effective management

Managing payoff documents effectively is crucial for your financial health. Consider utilizing document storage solutions that support digital filing and organization. Many platforms like pdfFiller allow for labeling and categorizing your documents, making it easy to retrieve your pay off letters and other important financial information when needed. Furthermore, digital storage adds an extra layer of security, protecting sensitive documents against loss or theft.

Once your loan is paid off, it's wise to look ahead regarding your financial future. Understanding your next steps after loan payoff can include adjusting your budget and savings strategies to reflect your new financial landscape. Consider consulting with a financial advisor for sound advice tailored to your new circumstances, ensuring you make informed decisions moving forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my pay off request directly from Gmail?

How do I edit pay off request online?

How can I fill out pay off request on an iOS device?

What is pay off request?

Who is required to file pay off request?

How to fill out pay off request?

What is the purpose of pay off request?

What information must be reported on pay off request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.