Get the free Taxpayer Authorization Forms : State of Oregon

Get, Create, Make and Sign taxpayer authorization forms state

Editing taxpayer authorization forms state online

Uncompromising security for your PDF editing and eSignature needs

How to fill out taxpayer authorization forms state

How to fill out taxpayer authorization forms state

Who needs taxpayer authorization forms state?

Understanding Taxpayer Authorization Forms: A Comprehensive Guide

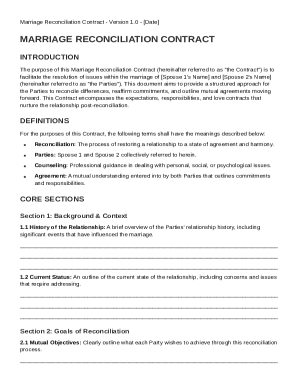

Understanding taxpayer authorization forms

Taxpayer authorization forms are official documents that allow individuals or businesses to grant permission to a third party, such as tax preparers or accountants, to act on their behalf with state tax authorities. This can include matters related to income tax, registration, and various other tax-related activities. These forms play a crucial role in the efficient processing of tax returns and inquiries, ensuring that sensitive information is handled properly while meeting legal requirements.

Moreover, authorization forms not only ease the burden of tax preparation for individuals and small businesses but also provide a streamlined way for tax professionals to address issues or respond to inquiries from the tax authority. Understanding the significance of these forms is essential, especially when considering state-specific variations that may affect the filing process and the requirements for authorization.

Types of taxpayer authorization forms

Taxpayer authorization forms can vary significantly depending on whether they are federal or state forms. For instance, the IRS offers Form 2848 (Power of Attorney and Declaration of Representative) for federal purposes, while each state has its own set of authorization forms tailored to its specific tax regulations. It’s crucial for taxpayers to understand the differences between these forms to ensure compliance and accurate filing.

Common state taxpayer authorization forms include unique identifiers for the respective states. For example, State A may utilize the ST-555 form for income tax representation, while State B might use the Form 1122 for business companies looking to designate agents for tax matters. The use cases for each form also vary significantly based on individual circumstances, such as whether the taxpayer is filing personal taxes or representing a business.

How to obtain state taxpayer authorization forms

Obtaining state taxpayer authorization forms is a straightforward process that can often be completed online. Most state tax authorities maintain websites where forms can be accessed and downloaded directly. Users can typically find these forms in the section dedicated to taxpayers or forms and publications related to income tax, registration, and other taxation matters.

Additionally, platforms like pdfFiller provide convenient access to these forms through their document repository. Users can download the necessary forms in a PDF format or utilize pdfFiller’s interactive tools to fill out the forms directly on their platform, making it easier to capture all required information accurately.

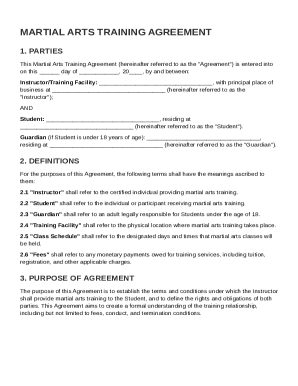

Step-by-step guide to completing your taxpayer authorization form

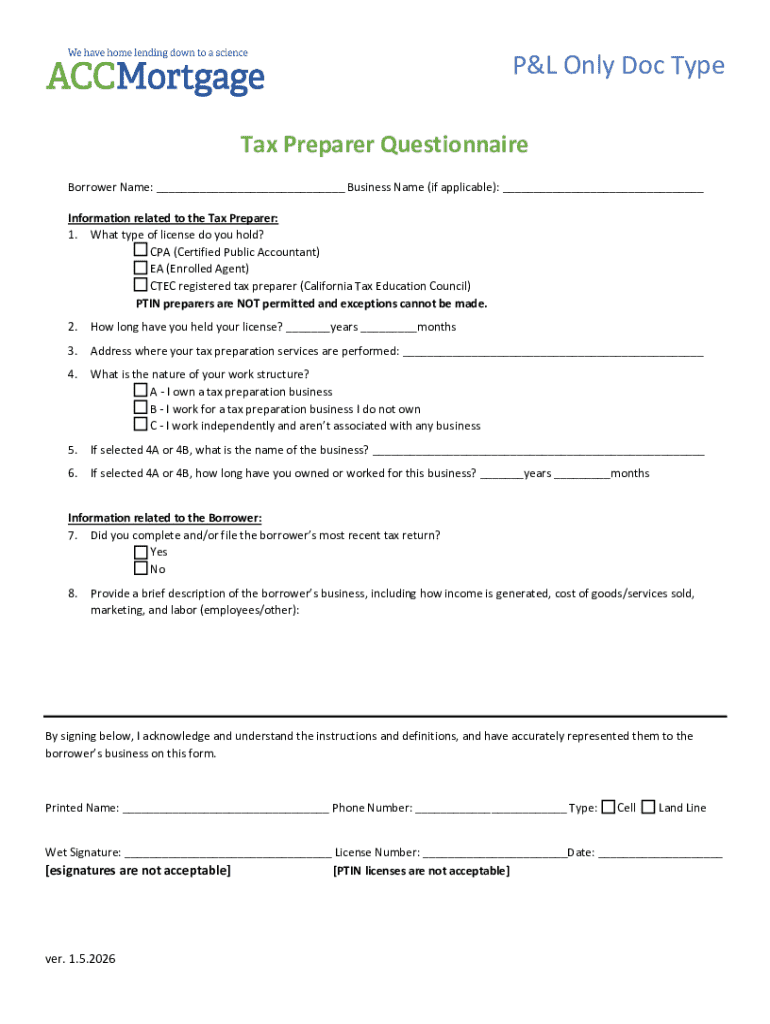

Completing a taxpayer authorization form correctly is vital for ensuring that your submission is accepted without issues. Start by gathering the necessary information, which typically includes your Social Security Number (SSN), tax ID, and details about the third party representing you. Understanding the form structure is also important; familiarize yourself with the sections that require input, which may include taxpayer information, representative details, and specific powers being granted.

As you fill out the form, pay close attention to each section. For example, when entering names, ensure the spelling is correct to avoid any discrepancies. Common pitfalls include missing signatures or providing incomplete information, any of which could delay processing time. Once completed, it’s crucial to review the entire form for accuracy and ensure that all necessary signatures are provided to validate the authorization.

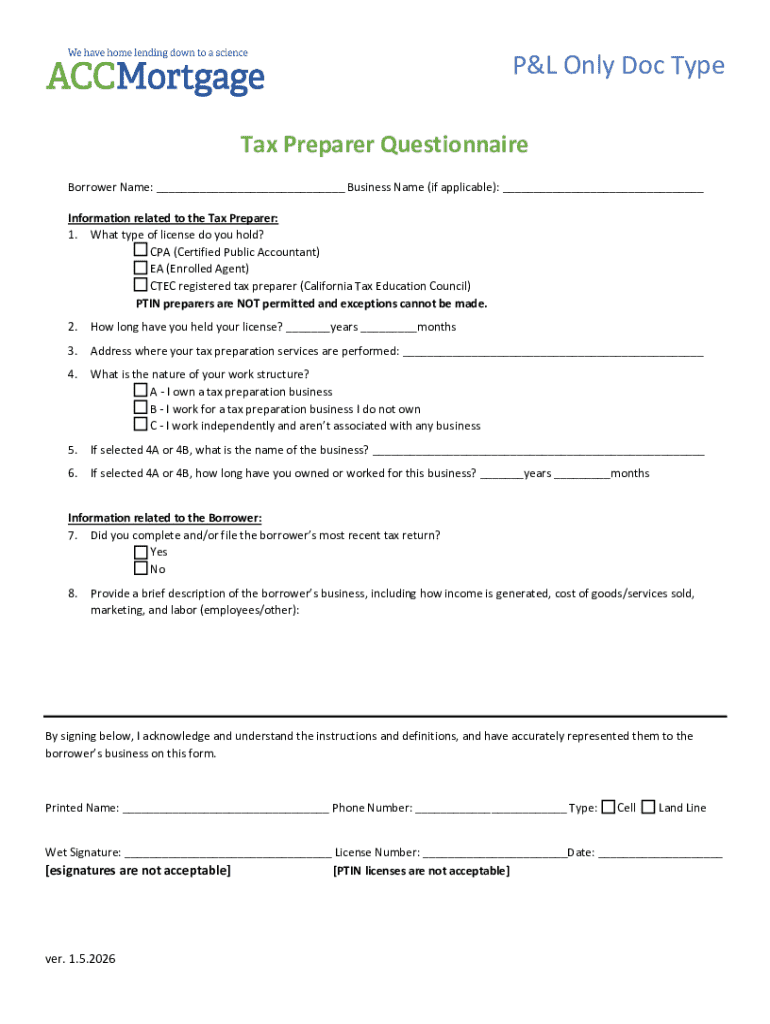

eSigning your taxpayer authorization form

The trend towards eSigning taxpayer authorization forms offers numerous benefits, especially in terms of convenience and speed. With pdfFiller, users can eSign their forms electronically, saving time typically spent on printing, signing, scanning, and mailing. This digital approach streamlines the entire process, allowing individuals and business owners to finalize their documents from virtually anywhere.

The eSignature process is straightforward: once the form is filled out, users can upload it to pdfFiller, add their electronic signature in the designated area, and save the document securely. It’s important to remember that the validity of eSignatures can vary by state. However, most states accept electronic signatures on tax forms, provided they meet necessary legal standards.

Submitting your taxpayer authorization form

Once you have completed and signed your taxpayer authorization form, the next step involves submitting the document to the appropriate state tax authority. Submission methods can vary; many states offer online submission via their tax authority portal, providing a fast and efficient way to send your form. Alternatively, for those preferring traditional methods, mailing the form is still an option. If using postal service, consider mailing tips such as using registered mail for tracking.

After submission, you may wonder what to expect in terms of processing. Generally, taxpayers can anticipate an acknowledgment from the tax authority confirming receipt of the form. Tracking submission status varies by state, but many offer tools that allow taxpayers to check the progress of their authorization requests online, providing peace of mind.

Managing your taxpayer authorization forms with pdfFiller

Managing taxpayer authorization forms effectively is vital for individuals and businesses aiming to keep track of important tax documents. With pdfFiller’s cloud-based platform, users can store their forms for future reference, ensuring easy access at any time. This feature is particularly useful for small businesses that may have multiple authorization forms for various clients or tax services.

In addition to storage, pdfFiller allows for the organization of multiple documents, making it easy to locate specific forms when needed. Collaborative features within the platform enable team members to work together seamlessly on form preparation and ensure that everything is captured correctly before submission. The ability to manage documents efficiently reduces the stress associated with tax season and helps maintain organization.

Troubleshooting common issues

While the process of obtaining and submitting taxpayer authorization forms is designed to be clear, issues may arise for some users. Problems accessing or downloading forms can often be due to website issues or incorrect links. In such cases, checking the state tax authority's website for updates or alternative links can be helpful. pdfFiller also offers tools to assist in accessing forms, making it easier for users.

Common filling errors include incorrect information in key fields, missing signatures, or misallocation of authority granted on the form. To mitigate these errors, double-checking each section before submitting is vital. Should you encounter persistent challenges, reaching out to the state tax authorities for assistance or seeking support from pdfFiller can provide you with the help needed to navigate these situations.

Additional features of pdfFiller relevant to taxpayer authorization

pdfFiller provides a comprehensive suite of document management tools tailored to enhance the experience of completing taxpayer authorization forms. Users can customize forms as needed, edit content directly within their interface, and transform documents effortlessly. This level of versatility is especially beneficial when dealing with forms that require specific information for registration or business-related tax matters.

Moreover, pdfFiller's collaboration features allow for real-time input from team members, ensuring that all necessary details and corrections can be addressed promptly. This collaborative approach not only increases efficiency but also allows for better case management, especially for small business owners seeking to streamline their financial processes. Overall, the ability to manage and customize documents in one place empowers users to handle their taxes with greater confidence.

Frequently asked questions (FAQs)

As questions often arise regarding taxpayer authorization forms, several commonly asked questions have significant importance. Many users wonder what steps to take if they need to revoke an authorization granted to a third party. Generally, revocation can be accomplished by submitting a new authorization or a specific revocation form provided by the state tax authority.

Another frequent concern is whether updates can be made to the authorization form after it has been submitted. In such cases, taxpayers should reach out to their state tax authority as they may require an updated form reflecting any changes. Additionally, a robust support system is available through pdfFiller, offering users guidance on utilizing features effectively and accessing the necessary forms.

Helpful tools and resources

For taxpayers seeking additional guidance, various tools and resources can be invaluable. pdfFiller offers interactive tutorials and video guides that walk users through the form filling, eSigning, and submission processes. These resources can clarify complexities often associated with taxpayer authorization forms and ensure users feel confident in navigating requirements.

Furthermore, links to state tax authority contact information can provide direct support should additional questions arise. Having access to reliable resources empowers individuals and teams alike to tackle their tax responsibilities effectively, leading to a smoother tax experience overall.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete taxpayer authorization forms state online?

Can I sign the taxpayer authorization forms state electronically in Chrome?

Can I create an eSignature for the taxpayer authorization forms state in Gmail?

What is taxpayer authorization forms state?

Who is required to file taxpayer authorization forms state?

How to fill out taxpayer authorization forms state?

What is the purpose of taxpayer authorization forms state?

What information must be reported on taxpayer authorization forms state?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.