Get the free TOTAL ITEMIZED MONETARY CONTRIBUTIONS:

Get, Create, Make and Sign total itemized monetary contributions

Editing total itemized monetary contributions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out total itemized monetary contributions

How to fill out total itemized monetary contributions

Who needs total itemized monetary contributions?

Total itemized monetary contributions form: A how-to guide

Understanding the total itemized monetary contributions form

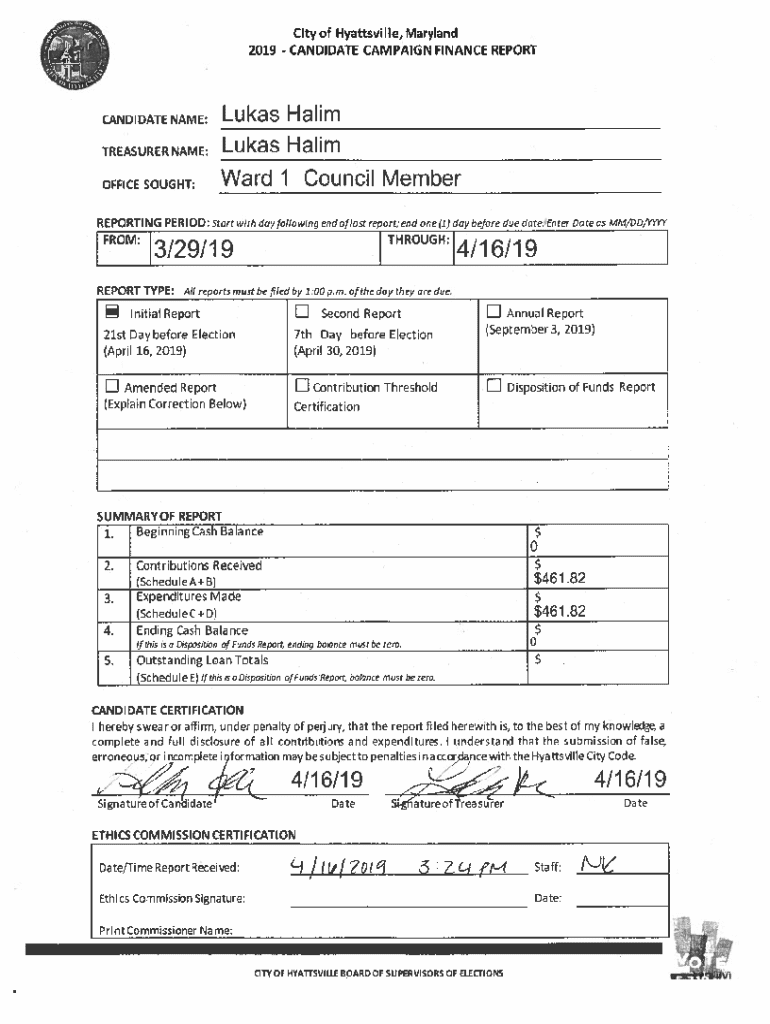

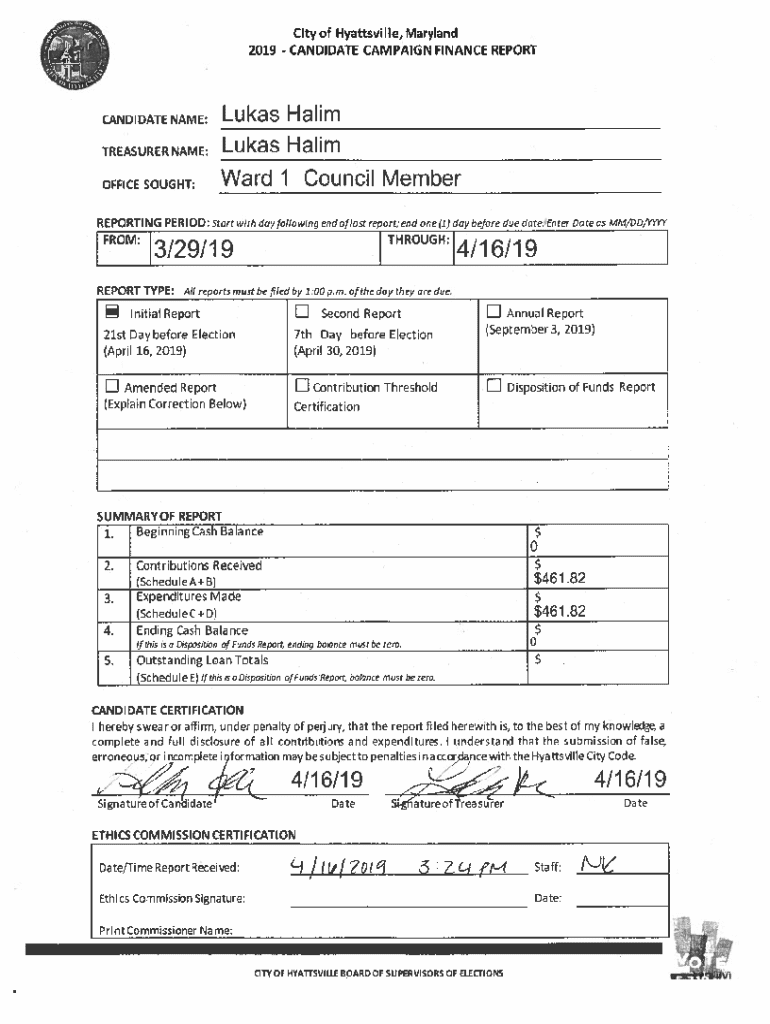

The total itemized monetary contributions form serves a vital purpose in transparently documenting financial contributions to various entities, particularly in the realm of political campaigns and charitable organizations. It is crucial for maintaining compliance with federal and state regulations concerning campaign finance. Understanding this form is particularly important for individuals and organizations attempting to manage their finances responsibly and ethically, ensuring that all contributions are accurately reported and accounted for.

Anyone who contributes financially to campaigns or organizations that are subject to reporting requirements must typically file this form. This includes individuals, businesses, and nonprofit entities. In doing so, they fulfill their obligation under the law to report contributions, thereby enhancing transparency in political financing and fundraising.

Legal context is paramount when discussing the total itemized monetary contributions form; failure to file accurately can lead to significant repercussions, including penalties and reputational damage. Thus, understanding not only how to complete the form, but also its implications in the broader context of fundraising and contributions, is essential.

Overview of the form structure

The form is structured to collect a wide range of information necessary to document contributions thoroughly. Each section plays a critical role in ensuring that all details are captured accurately, contributing to the integrity of financial reporting.

Common terminologies found on the form include 'contribution limits,' which pertain to the maximum amount that can be legally contributed, and 'source of funds,' which indicates where the money for the contributions originated. Familiarizing yourself with these terms can greatly enhance your ability to fill out the form accurately.

Step-by-step instructions for completing the form

Completing the total itemized monetary contributions form may seem daunting, but breaking it down into manageable steps can simplify the process. The first essential step is gathering all necessary information.

Next, begin filling out the basic personal information. This includes providing your name, address, and contact information clearly to avoid any discrepancies. If you are filing on behalf of an organization, include relevant organizational details as well.

When detailing contributions, follow these guidelines: record each contribution individually, including the date, amount, and the name of the recipient organization. This detail is critical for compliance and clarity, ensuring that all contributions are accounted for accurately.

Finally, review your information meticulously. Double-check that all amounts and details match your documentation. Common mistakes include mathematical errors and incorrect names or addresses, which can lead to complications when your submission is reviewed.

Editing and signing the form

Once you have completed the form, you may need to edit it to correct errors or update information. Utilizing online tools for editing can make this process seamless. pdfFiller offers an intuitive platform designed for easy modifications, enabling users to resolve issues swiftly.

To edit your form using pdfFiller, simply upload it to the platform. You can make changes directly on your document by selecting the areas you wish to edit. For those who require even more comprehensive editing capabilities, pdfFiller allows users to access templates and previous submissions, streamlining the process.

Signing the form electronically adds another layer of convenience. To eSign, follow these steps: choose the eSignature option, click on 'Add Signature,' and select your preferred signing method, which can range from using a stylus on a tablet to typing your name. This step holds legal validity, ensuring your submission complies with regulatory standards.

Managing your submitted form

After submitting your total itemized monetary contributions form, managing it is crucial for accurate record-keeping and compliance. First, ensure that you properly save and store your completed submission. Utilizing a digital platform like pdfFiller allows you to keep your documents organized and easily accessible from anywhere.

Best practices for tracking contributions also include maintaining a spreadsheet or ledger, where you can log contributions as they occur. If amendments to your submission are necessary, consult the requirements for amending submissions as laws and regulations can vary—reaching out to the appropriate organization for guidance is recommended.

Interactive tools and resources

To further enhance the experience of managing your contributions, access interactive tools available on pdfFiller. One such tool is the interactive contribution calculator, which can help you gauge your potential limits based on different scenarios and states. This resource is particularly useful to ensure that you remain compliant with contribution limits.

Utilize collaborative features of pdfFiller, allowing multiple team members to review and edit documents together, thus reducing the likelihood of errors and ensuring everyone is on the same page. Additional templates related to monetary contributions, tailored for specific states or regulations, can also be found on the platform.

Frequently asked questions (FAQs)

Many common queries arise regarding the total itemized monetary contributions form. Questions may include the proper way to report specific types of contributions, deadlines for submission, or the implications of failing to submit on time.

If you encounter troubleshooting issues with submission, check common errors like incorrect file formats or incomplete sections. The resources available on pdfFiller can guide you through resolving these issue efficiently.

Related forms and next steps

Navigating the landscape of financial contributions involves understanding related forms as well. Familiarity with other important filing requirements can help streamline your reporting process. You may also need to consider additional documentation such as donor lists or fundraising reports relevant to your contributions.

For further insights, pdfFiller includes links to related resources and guidelines that can assist users in navigating compliance with contribution regulations.

Testimonials from users

Real-world experiences shed light on the functionality and effectiveness of the total itemized monetary contributions form when used through pdfFiller. Users have praised the platform for its user-friendly interface that streamlines document management processes. Many individuals and teams have noted how the tool simplifies filing requirements and minimizes the hassles traditionally associated with paperwork.

For instance, a campaign manager shared how using pdfFiller transformed their approach to contribution tracking. 'The collaborative features allowed my team to work together seamlessly, ensuring we met all deadlines without unnecessary stress.' Such experiences illustrate that pdfFiller empowers users to master their contribution management tasks—making compliance less daunting and far more achievable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my total itemized monetary contributions in Gmail?

How can I get total itemized monetary contributions?

How do I make changes in total itemized monetary contributions?

What is total itemized monetary contributions?

Who is required to file total itemized monetary contributions?

How to fill out total itemized monetary contributions?

What is the purpose of total itemized monetary contributions?

What information must be reported on total itemized monetary contributions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.