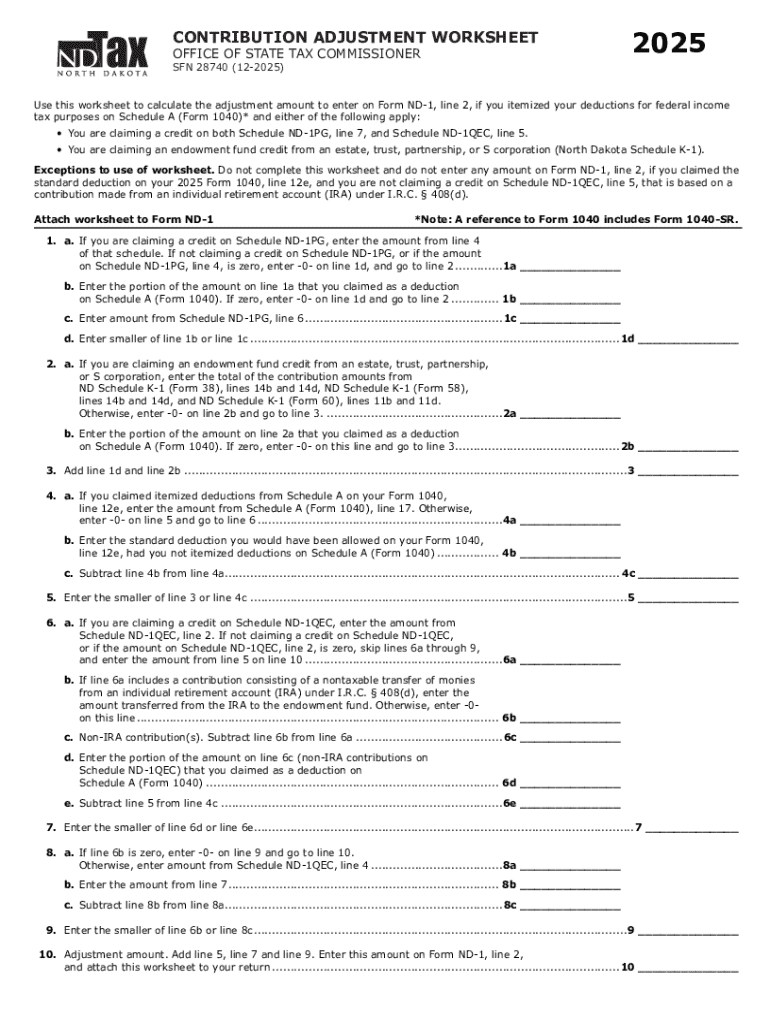

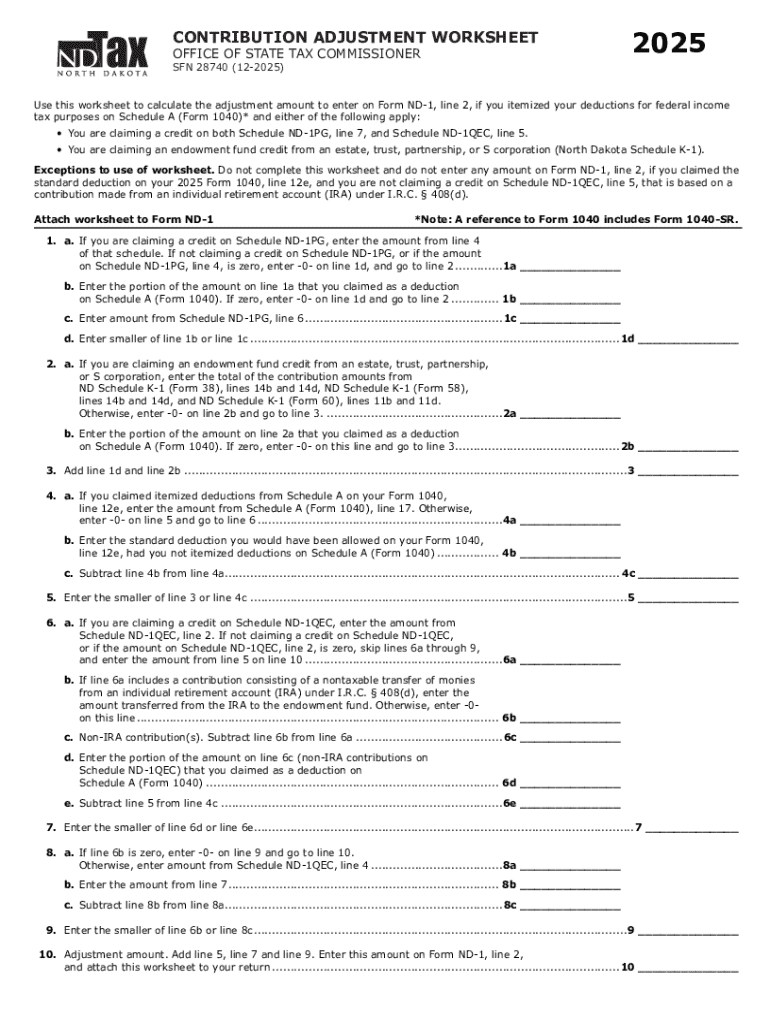

Get the free Contribution Adjustment Worksheet 2025. Contribution Adjustment Worksheet 2025

Get, Create, Make and Sign contribution adjustment worksheet 2025

How to edit contribution adjustment worksheet 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out contribution adjustment worksheet 2025

How to fill out contribution adjustment worksheet 2025

Who needs contribution adjustment worksheet 2025?

Contribution Adjustment Worksheet 2025 Form: A Comprehensive Guide

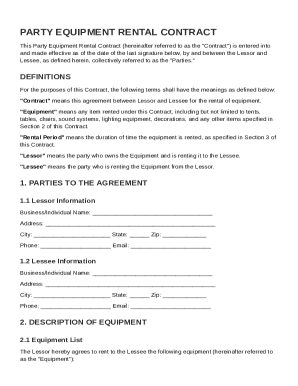

Understanding the contribution adjustment worksheet

The Contribution Adjustment Worksheet 2025 Form serves as a critical tool for managing and adjusting financial contributions in various settings, including charity, retirement funds, and organizational budgets. This form is designed to facilitate accurate tracking and modification of contributions to reflect the necessary adjustments based on individual or organizational changes.

Its primary objectives include simplifying the calculation of contributions, providing a structured approach to adjustments, and ensuring that individuals and teams have the necessary documentation for financial review and planning. The form empowers users to maintain clear records that can be referenced for future financial decisions, making it indispensable for both personal and professional contexts.

Key features of the contribution adjustment worksheet 2025 form

The 2025 version of the Contribution Adjustment Worksheet includes several interactive tools that enhance user experience. One notable feature is the ability to fill out and edit information digitally, ensuring that users can modify fields as needed without the hassle of printing or scanning. The ease of access promotes a smoother process for making necessary adjustments.

Additionally, the worksheet supports collaboration within teams through features that allow multiple users to work on the document simultaneously. This is crucial for businesses or organizations where input from various departments is essential. Users can seamlessly integrate eSignature functionality, simplifying the signing process and maintaining an organized document workflow.

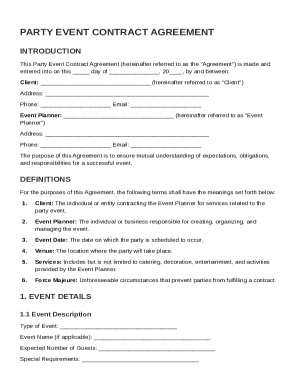

Step-by-step guide to filling out the contribution adjustment worksheet

To successfully fill out the Contribution Adjustment Worksheet 2025 Form, you should gather necessary data beforehand. This includes personal identification details, contribution records, and the adjustments you wish to implement. Once gathered, you can easily access the form through pdfFiller, ensuring you utilize all the digital editing tools available.

Begin by entering your personal information as accurately as possible; this includes your name, contact details, and any pertinent identification numbers required by your organization. Moving on to the contribution details section, it’s important to clearly state the amounts contributing to each fund for 2025. Adjustments can be calculated based on previous contributions or new financial insights.

Finally, a verification of information is crucial. Each entry should be re-evaluated to prevent common mistakes, such as wrong figures or misreported data. Ensuring accuracy maximizes the integrity of your financial documentation, which can influence future planning and compliance.

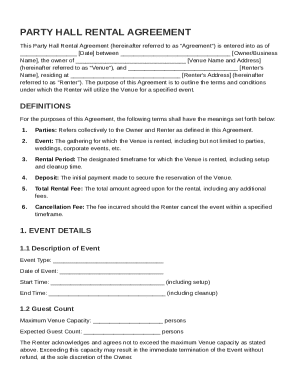

Editing your form: tools and features

Once your Contribution Adjustment Worksheet is filled out, utilization of pdfFiller's editing tools becomes essential for refining your document. These tools allow you to modify sections easily – whether you need to correct an error, add additional notes, or provide clarifications regarding specific entries.

Users can add comments directly on the form or attach annotations to provide context, which is particularly useful during the review phase. Moreover, pdfFiller supports version control, making it easy to manage different iterations of the document, ensuring all modifications are tracked and that you’re working with the most updated information.

Collaborating with teams on the worksheet

Collaboration is streamlined with pdfFiller, as it allows users to set up team access to the Contribution Adjustment Worksheet 2025 Form. Sharing options include generating links or inviting users through email, ensuring that all team members can contribute effectively and efficiently.

The real-time collaboration tools enable multiple users to work on the document simultaneously. This feature not only increases productivity but also enhances feedback channels, as team discussions and comments can occur directly on the document. It’s an effective approach for organizations that emphasize teamwork and collective input in financial decision-making.

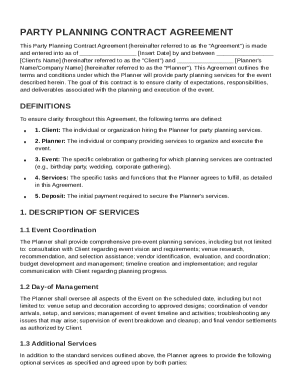

Signing and finalizing the contribution adjustment worksheet

Applying eSignatures within pdfFiller transforms the finalization of the Contribution Adjustment Worksheet from a cumbersome task to a swift process. To apply an electronic signature, select the designated field and follow the prompts to sign securely online, which eliminates the need for printouts and physical signatures.

Before submission, a thorough final review is recommended. Use a checklist to ensure every section is completed, calculations are accurate, and all team members have reviewed the document. This final step helps in catching any errors that might have been overlooked during the initial filling.

Managing your contribution adjustment worksheet post-submission

After submitting the Contribution Adjustment Worksheet, it’s crucial to track its status. pdfFiller provides users with updates on the submission process, helping you stay informed and ensuring that necessary follow-ups can be made in a timely manner.

Furthermore, best practices for document management include storing and archiving your worksheet securely in the cloud. This ensures ease of access and retrieval whenever needed. Efficiently accessing historical data becomes vital for previous contributions, compliance audits, or future financial planning, reinforcing the importance of organized digital documentation.

FAQs about the contribution adjustment worksheet 2025 form

Users often have common questions regarding the Contribution Adjustment Worksheet 2025 Form. For instance, they might inquire about the details needed for specific sections or how to handle multiple adjustments in one worksheet. Addressing such concerns involves providing clear instructions and examples during the filling process.

Additionally, troubleshooting issues can arise, such as difficulties accessing the form or problems signing electronically. In such cases, having a step-by-step guide ready can alleviate user concerns, ensuring a smoother experience with comparatively minimal hiccups.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete contribution adjustment worksheet 2025 online?

How do I edit contribution adjustment worksheet 2025 online?

Can I create an electronic signature for signing my contribution adjustment worksheet 2025 in Gmail?

What is contribution adjustment worksheet 2025?

Who is required to file contribution adjustment worksheet 2025?

How to fill out contribution adjustment worksheet 2025?

What is the purpose of contribution adjustment worksheet 2025?

What information must be reported on contribution adjustment worksheet 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.