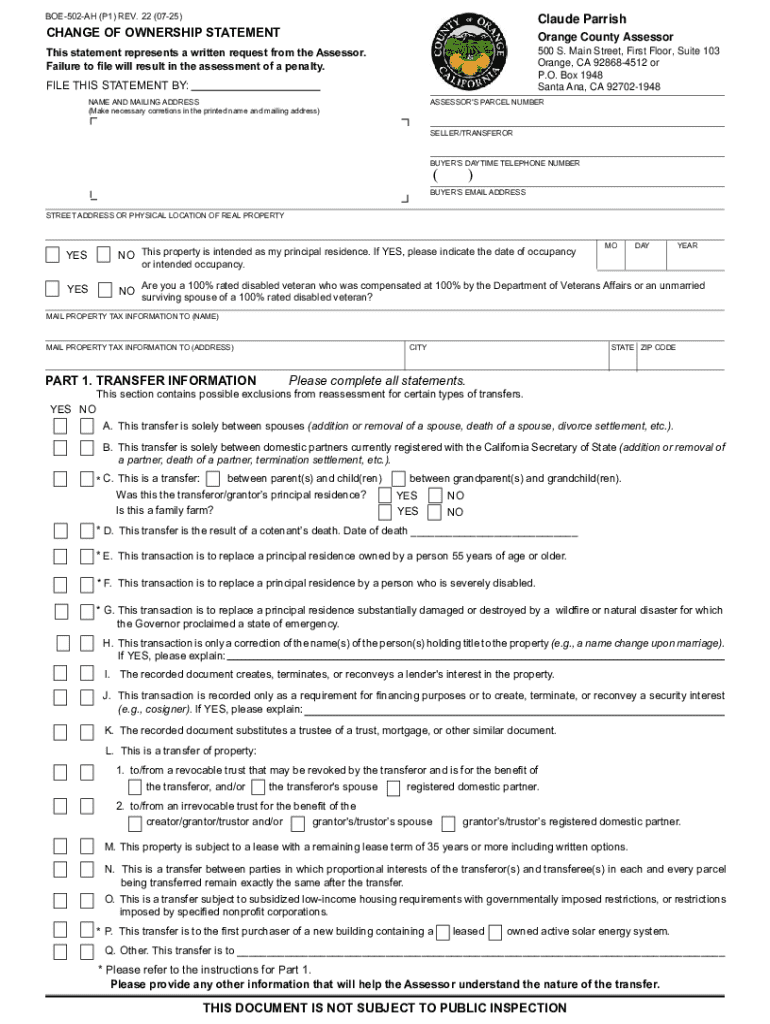

Get the free CHANGE IN OWNERSHIP STATEMENT PART 1. ...

Get, Create, Make and Sign change in ownership statement

Editing change in ownership statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out change in ownership statement

How to fill out change in ownership statement

Who needs change in ownership statement?

Change in Ownership Statement Form: Your Comprehensive Guide

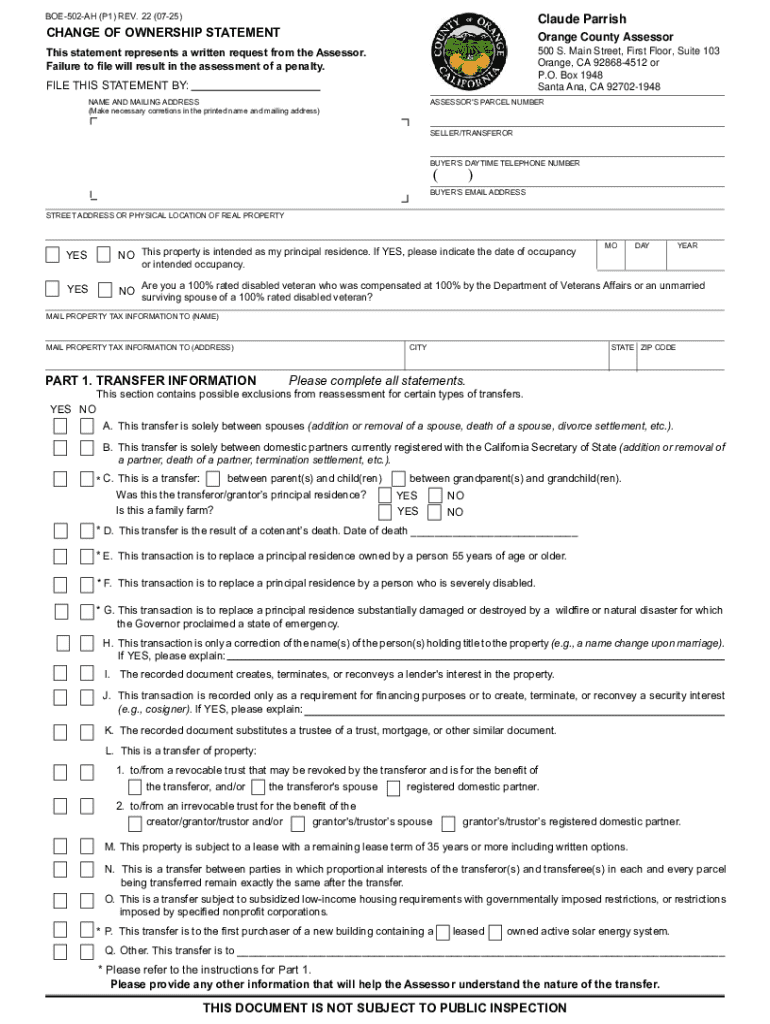

Understanding the change in ownership statement

A Change in Ownership Statement, often colloquially referred to as a property transfer form, is a legal document that officially records a transfer of property ownership. This document serves multiple purposes, primarily to notify local authorities, such as tax assessors and county clerks, of a change in ownership status. Additionally, maintaining accurate documentation is crucial for resolving any potential disputes regarding ownership and ensuring proper tax assessments.

The importance of accurate documentation cannot be overstated, especially in property transfers where disputes can arise over ownership, especially during inheritance, divorce, or sales. An accurate change in ownership statement will prevent misunderstandings that could lead to costly legal battles or incorrect tax liabilities.

When is a change in ownership statement required?

Certain scenarios invariably require a change in ownership statement to be filed. The most common scenarios include the sale of a property, the transfer of property through inheritance due to death, or in cases relating to divorce where property division occurs. Understanding when this document is needed can save time and prevent legal issues.

Moreover, state-specific regulations vary significantly regarding the requirement for and the specifics of the change in ownership statements. For instance, California might necessitate a Statement of Change of Ownership when real estate is sold, while other states might have different protocols or nuances. Hence, it’s essential for individuals to verify local requirements.

Preparing to complete the change in ownership statement

Preparing to fill out the change in ownership statement form involves a few essential steps. Knowing what information is required is crucial for a seamless submission process. Typically, you will need the property’s identification details—such as tax ID numbers and the complete address—alongside the names and contact details of all parties involved in the ownership change. Furthermore, specific information about the valuation and sale details, including sale price and date, should be readily available.

Collecting supporting documents is equally important. Essential documents may include title deeds, purchase agreements, and in the case of inheritance, relevant wills or death certificates. Without these documents, the processing of your change in ownership statement may be delayed or even rejected.

Step-by-step guide to filling out the change in ownership statement form

To access the change in ownership statement template, you can visit [pdfFiller]() and navigate to the relevant section where forms are available. They offer a user-friendly interface where you can easily find the desired document. If you prefer customizing a PDF, tools like pdfFiller are excellent for accessing and editing forms conveniently.

When filling out each section of the form, make sure to follow detailed instructions for accuracy. Each form typically includes various sections, such as current ownership, new ownership, and details concerning the property transaction. Leveraging example illustrations can greatly enhance clarity—look for them in your form template. In addition, be aware of common mistakes to avoid, such as typos in names or incorrect property IDs, as these could lead to complications down the line.

Submitting the change in ownership statement

Once you have completed the change in ownership statement form, the next step is submission. You can follow multiple methods of submission, including online through services like pdfFiller or physical mail to your local jurisdiction. Opting for online submission often results in quicker processing, as electronic submissions can be directly entered into state systems, reducing the risk of document loss or delay.

To ensure that your submission is processed without issues, make sure to confirm receipt. Many jurisdictions offer ways to track your submission status, such as online portals where you can check whether your statement has been accepted or if it’s still awaiting processing.

Post-submission: What happens next?

After submission, it’s critical to be aware of the processing timeline. Generally, the time taken to process a change in ownership statement varies based on the local government’s workload, with extensive backlogs potentially leading to delays. Expect a typical duration of a few weeks for processing, although it can differ significantly from one jurisdiction to another.

Should your submission be accepted, you will receive a notification confirming the details are duly recorded. Conversely, if rejected, it is crucial to understand the reasons behind this outcome and what corrections must be made before resubmission. Keep all records related to this submission for future reference.

Common questions and troubleshooting

Navigating the intricacies of the change in ownership statement form can prompt a variety of questions. One frequent query is what to do if a mistake is made on the form. If this happens, it’s often advisable to correct the error with an amendment and submit a new copy instead of attempting to fix it on the original form.

Another common concern is how to update a previously submitted statement. Slight modifications or re-submissions are typically necessary when names or property details change. For those facing technical difficulties with pdfFiller or other relevant platforms, seeking assistance from their support teams can provide necessary guidance. In complex cases where legal uncertainties arise, consulting with a legal professional can ensure compliance with all local laws.

Conclusion on the importance of document management

Proper document management is pivotal when it comes to property transactions, and the change in ownership statement form is no exception. Keeping accurate records will not only support clarity for current ownership but also facilitate smoother transactions in the future. Relying on versatile tools like pdfFiller can significantly streamline this process, enabling users to edit PDFs, ensure secure eSigning, and collaborate on documents seamlessly from a single, cloud-based platform.

Through pdfFiller’s features, managing your document-related needs becomes a hassle-free experience. Given the complexities of property ownership, tools that offer accessibility and ease of use can enhance efficiency and increase confidence in managing your documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete change in ownership statement online?

Can I sign the change in ownership statement electronically in Chrome?

How can I edit change in ownership statement on a smartphone?

What is change in ownership statement?

Who is required to file change in ownership statement?

How to fill out change in ownership statement?

What is the purpose of change in ownership statement?

What information must be reported on change in ownership statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.