Get the free How to meet financial proof requirements for I-20 form as ...

Get, Create, Make and Sign how to meet financial

Editing how to meet financial online

Uncompromising security for your PDF editing and eSignature needs

How to fill out how to meet financial

How to fill out how to meet financial

Who needs how to meet financial?

How to meet financial form

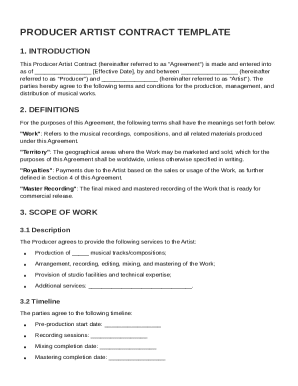

Understanding financial forms

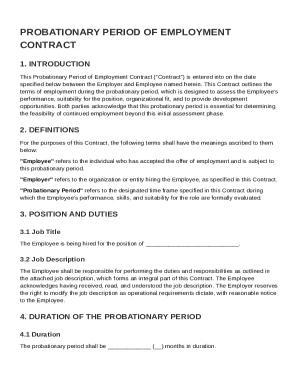

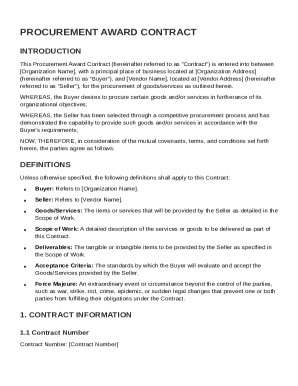

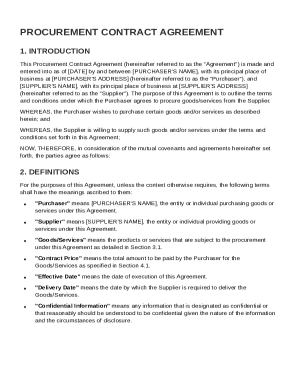

Financial forms are essential documents that provide critical information regarding an individual's or a business's financial status. Understanding these forms is vital for effective money management, whether for tax purposes, applying for loans, or maintaining personal records. In essence, financial forms are utilized for collecting, reporting, and verifying financial data.

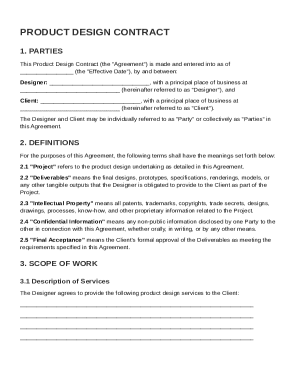

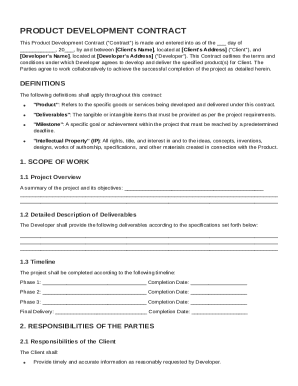

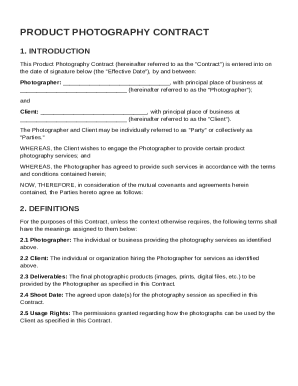

There are several types of financial forms you may encounter, which can be broadly categorized into personal finance forms, business financial forms, and government financial forms. Each category serves unique purposes and includes specific documents tailored to meet diverse financial needs. Knowing the right forms to use is crucial in maintaining accurate financial records.

Essential financial forms you NEED to know about

Several financial forms are critical for everyday financial management and compliance with legal obligations. Knowing how to meet these financial forms ensures that you are well-prepared to address your financial responsibilities.

Income and employment forms

Banking and saving forms

Credit and loans

Taxes

Step-by-step guide to filling financial forms

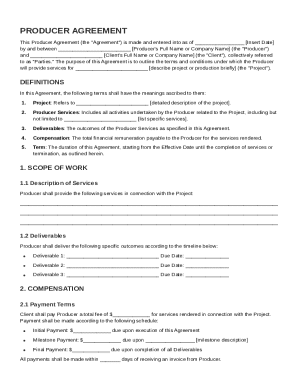

To successfully meet financial forms, organizing your information is crucial. Start by gathering necessary information that typically includes personal identification details, financial data, and employment information.

Using pdfFiller streamlines the process of managing financial forms. You can access financial forms online, edit and customize them with interactive tools, and add eSignatures for quick approval. This capability allows you to collaborate easily with teammates and ensure compliance with financial requirements.

By centralizing your document management on a platform like pdfFiller, you can simplify the task of meeting financial forms and reduce the chances of errors in your submissions.

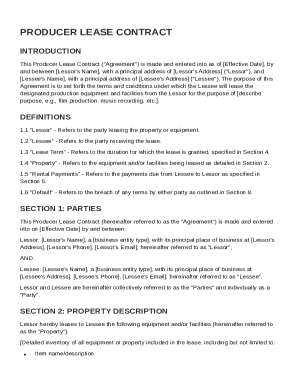

Common mistakes to avoid when completing financial forms

When filling out financial forms, common errors can lead to delays, rejections, or further complications. Being aware of these mistakes and learning to avoid them can save you time and headaches.

Reviewing your forms thoroughly before submission can help identify these issues. Implementing a checklist can also serve as a useful reference to ensure every section is completed correctly.

Tips for maintaining your financial forms

Once you have successfully filled and submitted your financial forms, maintaining them becomes essential. Keeping accurate records allows for easier reference and helps prepare for future financial needs.

Troubleshooting common issues with financial forms

Despite careful efforts to meet financial forms, issues can still arise. Understanding how to handle these challenges is crucial for staying on track with your finances.

Real-life scenarios and case studies

Understanding how others have navigated the complexities of financial forms can offer valuable insights. Many individuals and businesses have faced challenges but have successfully overcome them through diligence and strategic approaches.

These case studies emphasize the importance of preparation and the utilization of tools like pdfFiller that enhance the process of meeting financial forms.

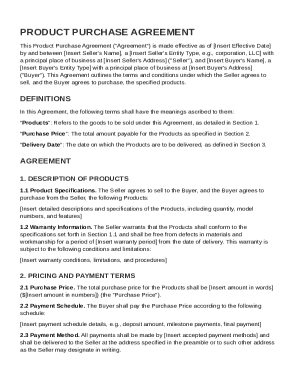

Interactive tools and resources

Utilizing interactive tools can greatly enhance your financial form experience. pdfFiller offers a range of integrated tools that streamline the entire process.

Engaging with these resources and tools equips you to confidently meet financial forms, ensuring compliance and clarity in your financial dealings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my how to meet financial in Gmail?

How do I fill out how to meet financial using my mobile device?

Can I edit how to meet financial on an Android device?

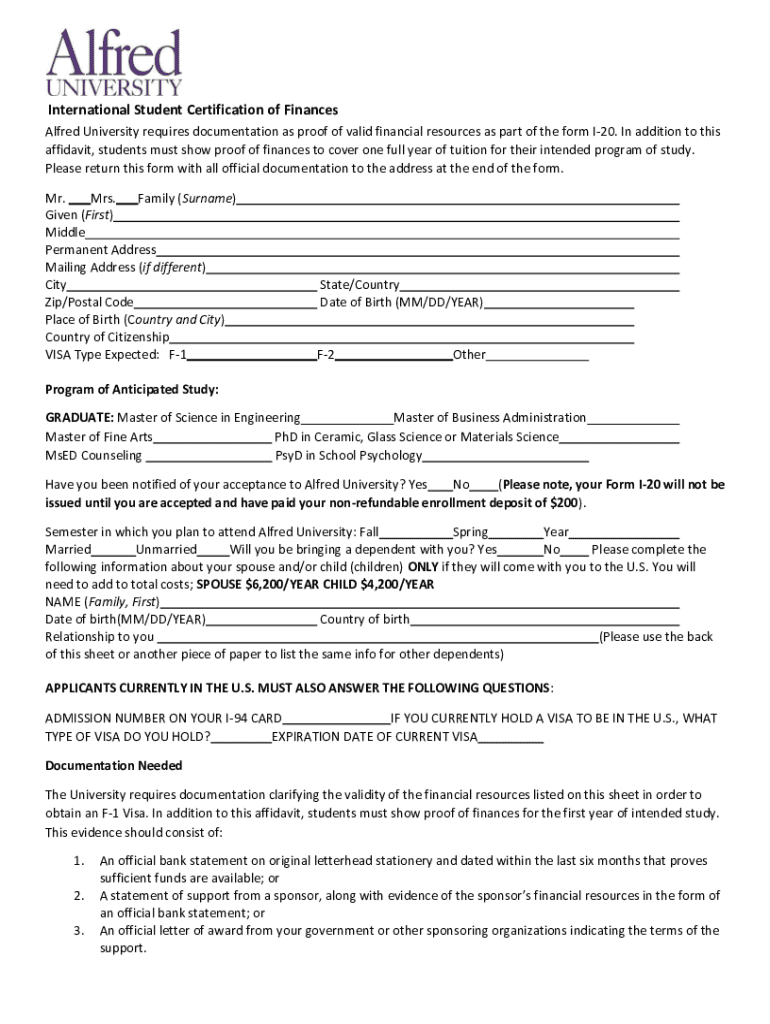

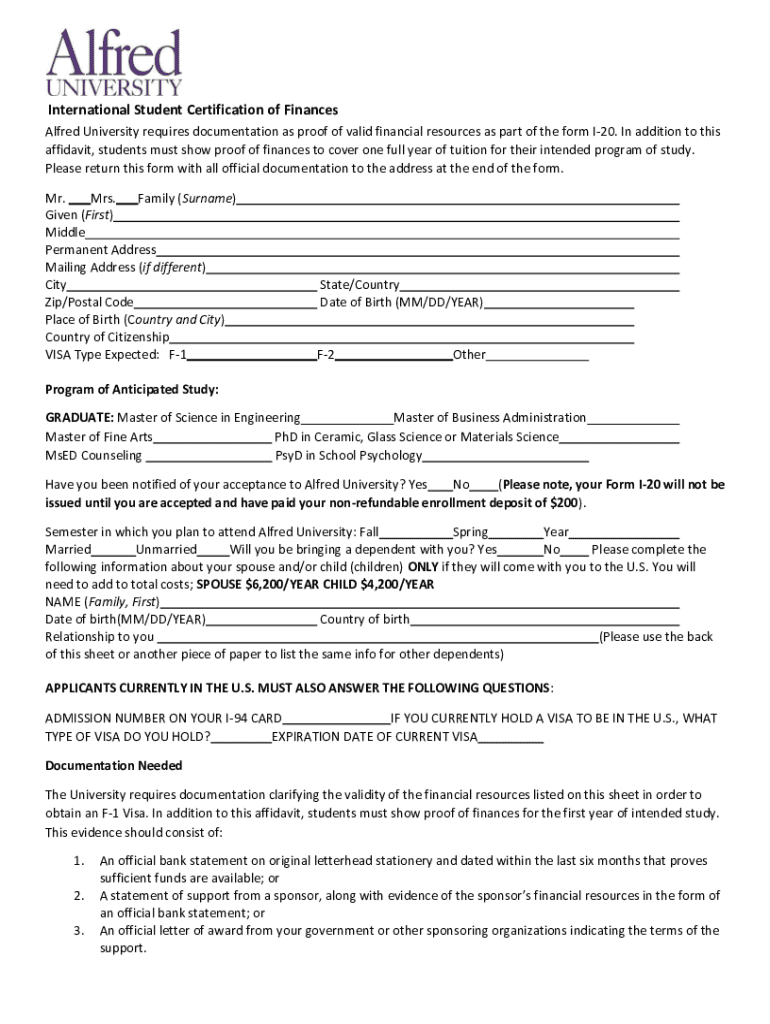

What is how to meet financial?

Who is required to file how to meet financial?

How to fill out how to meet financial?

What is the purpose of how to meet financial?

What information must be reported on how to meet financial?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.