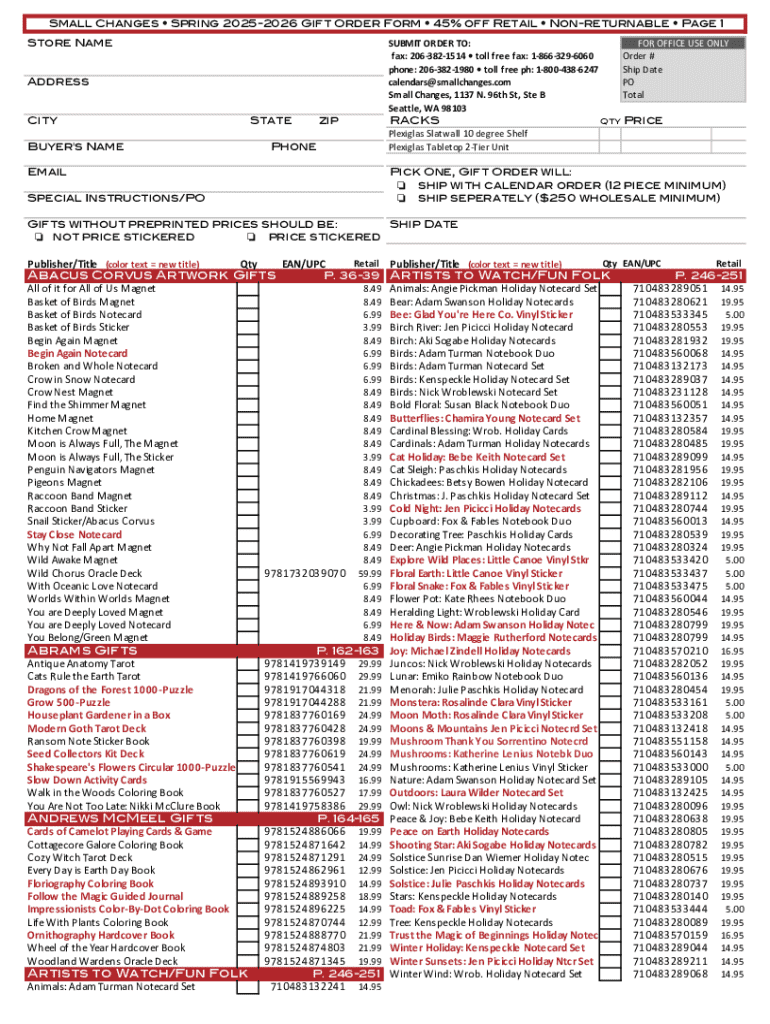

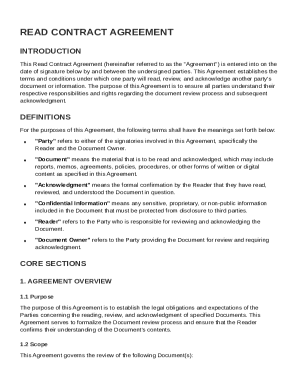

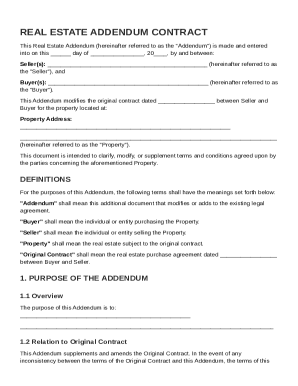

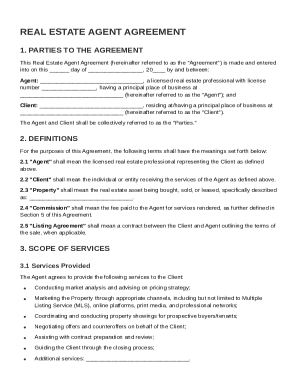

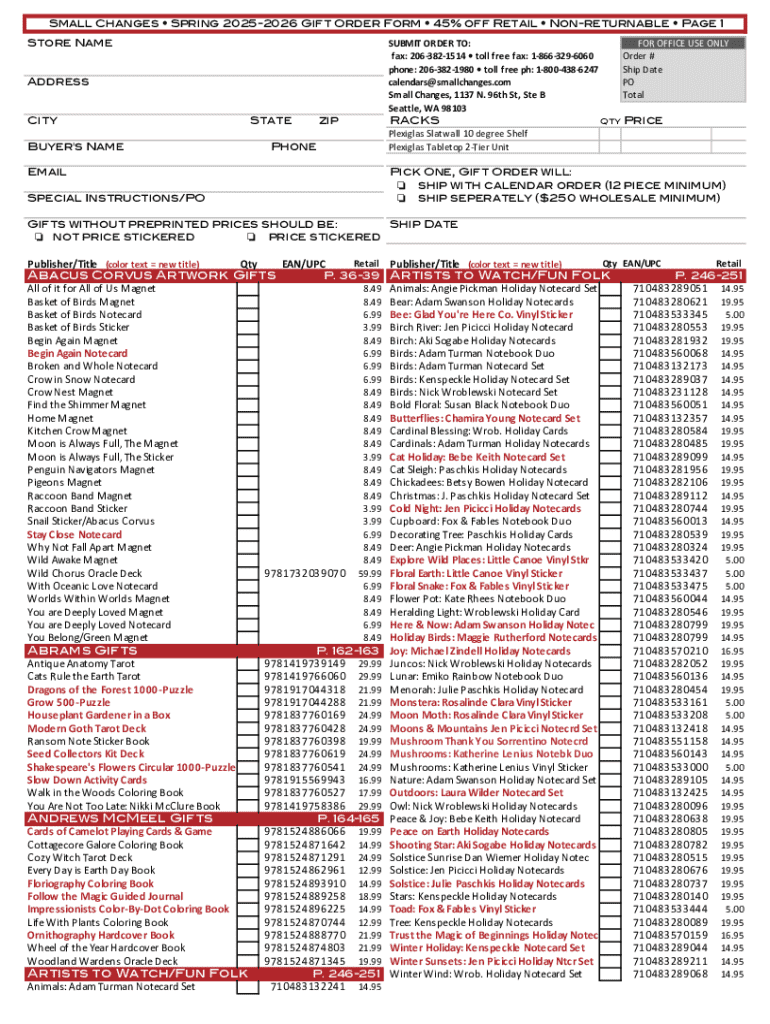

Get the free 2026 Gift Order Form Print Original.xlsx

Get, Create, Make and Sign 2026 gift order form

How to edit 2026 gift order form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026 gift order form

How to fill out 2026 gift order form

Who needs 2026 gift order form?

Your Complete Guide to the 2026 Gift Order Form

Overview of the 2026 Gift Order Form

The 2026 Gift Order Form is a crucial document for individuals and organizations planning to make significant gifts while navigating the complexities of tax considerations. With strict regulations surrounding gift transactions, this form serves as both a record and compliance tool, ensuring that both donors and recipients are aware of their obligations under current tax laws. Whether you're a parent wishing to gift to your children or a business looking to reward employees, this form simplifies the process of affirming the nature and value of the gift while also addressing critical tax implications.

Incorporating the 2026 Gift Order Form into your gifting strategy can provide significant advantages. It helps clarify the gifting process, ensuring transparency between parties and supporting any necessary financial reporting. Moreover, understanding how this form fits into the larger framework of gift tax exclusions and lifetime exemptions can help you maximize your gifts while minimizing potential tax burdens.

Key features of the 2026 Gift Order Form

One of the standout features of the 2026 Gift Order Form is its interactive templates, allowing users to customize their documentation easily. With options to fill in specific details such as gift value and recipient information, you can tailor the form to meet individual circumstances. This customization enhances clarity, enabling both donors and recipients to understand their gift.

Additionally, the 2026 Gift Order Form is accessible via a cloud-based platform. This feature allows individuals and teams to work collaboratively, regardless of geographic location. All necessary parties can access the form, make edits, and share information seamlessly. The platform also incorporates secure electronic signatures, ensuring that all collaborations meet legal standards and that the integrity of the process is maintained.

Steps for completing the 2026 Gift Order Form

Completing the 2026 Gift Order Form is straightforward if you follow a few structured steps. The process begins with gathering necessary information, which includes personal details from both the donor and recipient, such as names, addresses, and identification numbers, alongside relevant financial details like the type and value of the gift.

Moving to Step 2, customizing the form using tools like pdfFiller is essential. The editing tools available will allow you to format the document as needed, making sure that it accurately reflects the specifics of the transaction. After customization, it’s crucial to review the form for accuracy. Double-checking every detail can save headaches later on.

Next, you will sign the document electronically, which is an efficient process through the platform’s eSigning features. Finally, submit the form; you have the choice between electronic submission or more traditional paper filing. Each option comes with its own set of benefits depending on your circumstances.

Common mistakes to avoid when using the 2026 Gift Order Form

When filling out the 2026 Gift Order Form, being aware of common mistakes can help ensure a smooth process. One of the most frequent errors involves miscalculating the gift's value, which can lead to unexpected tax consequences. It’s essential to consider not only the monetary worth but also the particular assets involved in the gifting process.

Another common mistake is the failure to include all requisite signatures, particularly in joint gifting cases. Without proper consent from all stakeholders, the document may be deemed invalid, leading to complications during tax reporting. Lastly, always remember to keep a copy of the submitted form for personal records. An accessible reference can be invaluable in case of any future inquiries or needs for verification regarding the gift.

Understanding tax implications of your gifts

Gift tax implications are an integral aspect of the 2026 Gift Order Form, especially given the annual and lifetime limits established by the IRS. For 2026, the gift tax exclusion sits at a specific limit, which allows individuals to gift a certain amount without the necessity of filing a tax return. Knowing these limits upfront can help you plan your gifting effectively and strategically.

Gifts that exceed the exclusion limit will require careful documentation, including filing Form 709, the U.S. Gift (and Generation-Skipping Transfer) Tax Return. Understanding how the gift tax works in the context of this form is crucial for compliance. Additionally, certain gifts can qualify as taxable gifts, triggering a tax liability for the giver, so consulting with a financial advisor may be beneficial if you are uncertain about the specific nature or qualifying criteria of your gifts.

Frequently asked questions about the 2026 Gift Order Form

Questions often arise regarding the 2026 Gift Order Form, particularly concerned with potential penalties and legal ramifications. A common query is, 'What happens if I exceed gift tax limits?' Exceeding the threshold necessitates filing a gift tax return and potentially incurring liabilities, which underscores the importance of accurate calculations.

Another relevant question is whether gifts can be altered after submission. Generally, once submitted, substantial changes cannot be easily made without formal amendments, hence why accuracy during the initial filling process is crucial. Additionally, joint gifts from multiple donors raise their own set of questions regarding documentation responsibility and coordinating signatures, which are essential for a compliant submission.

Utilizing pdfFiller for managing your gift order forms

pdfFiller is an excellent resource for managing your 2026 Gift Order Forms and offers various advantages. The platform facilitates efficient document management, allowing you to access files from anywhere, making it easy to manage your documents whether you are at home or in the office. Interactive tools, such as filling and eSigning capabilities, further simplify the process, ensuring that you can complete your forms without unnecessary delays.

Moreover, pdfFiller's collaborative features enable multiple users to work on the same document, making it ideal for team scenarios where several stakeholders need to be involved. Utilizing these tools effectively can help smooth out the intricacies of documenting gifts, driving efficiency and reducing the potential for error.

Real-life scenarios: when and why you need a gift order form

There are numerous scenarios in which the 2026 Gift Order Form proves invaluable. For instance, gifting for special occasions—be it birthdays, weddings, or anniversaries—often prompts questions about tax implications if the gifts exceed certain thresholds. Having this form processed and completed can help mitigate the risks associated with these larger transactions.

Additionally, parents looking to gift assets to their children can utilize the form to track their gifting strategy over time, minimizing tax burdens and maximizing the effectiveness of their financial planning. In the business sphere, gifting practices such as bonuses or incentives can benefit significantly from the clarity that the form provides, preserving both the giver's and recipient's financial integrity.

Next steps after filling out the 2026 Gift Order Form

Once you’ve completed and submitted the 2026 Gift Order Form, it's essential to track the status of your submission. Make sure to follow up with any governing bodies or financial institutions regarding receipt confirmation. This follow-up ensures that all parties have recorded the transaction correctly and that you comply with any necessary regulations.

Important follow-up actions also include organizing records related to the gifted assets for future reference. Keep a systematic record of all gift transactions, including supporting documents, to ensure you have necessary information readily available. Organizing gift records can assist in future financial planning and litigation if necessary.

Enhancing your gift planning strategy with pdfFiller

Long-term gift planning is critical to avoiding tax pitfalls, and using pdfFiller can enhance this strategy exponentially. By combining the 2026 Gift Order Form with other financial documentation like an estate plan or investment portfolios, you can craft a more cohesive financial strategy that minimizes exposure to gift tax liabilities.

Furthermore, leveraging the resources and tools available on pdfFiller—such as integration options with financial planning software or access to financial advisors—can simplify the gifting process. This streamlined approach ensures better tracking of gift tax exclusions and lifetime exemptions, positioning you to maximize your gifts effectively while adhering to tax regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 2026 gift order form?

How do I edit 2026 gift order form in Chrome?

Can I edit 2026 gift order form on an Android device?

What is 2026 gift order form?

Who is required to file 2026 gift order form?

How to fill out 2026 gift order form?

What is the purpose of 2026 gift order form?

What information must be reported on 2026 gift order form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.