Get the free Internal Revenue Service Regulations on 415 Plan ...

Get, Create, Make and Sign internal revenue service regulations

How to edit internal revenue service regulations online

Uncompromising security for your PDF editing and eSignature needs

How to fill out internal revenue service regulations

How to fill out internal revenue service regulations

Who needs internal revenue service regulations?

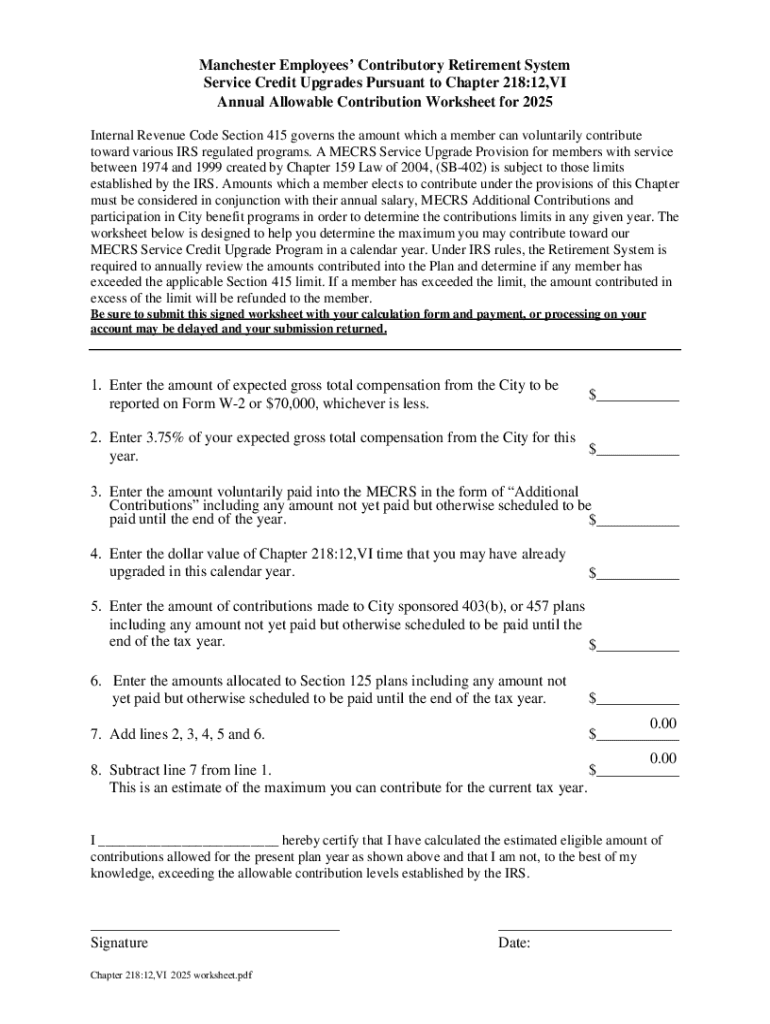

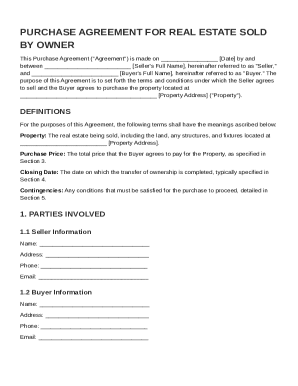

Navigating the Internal Revenue Service Regulations Form

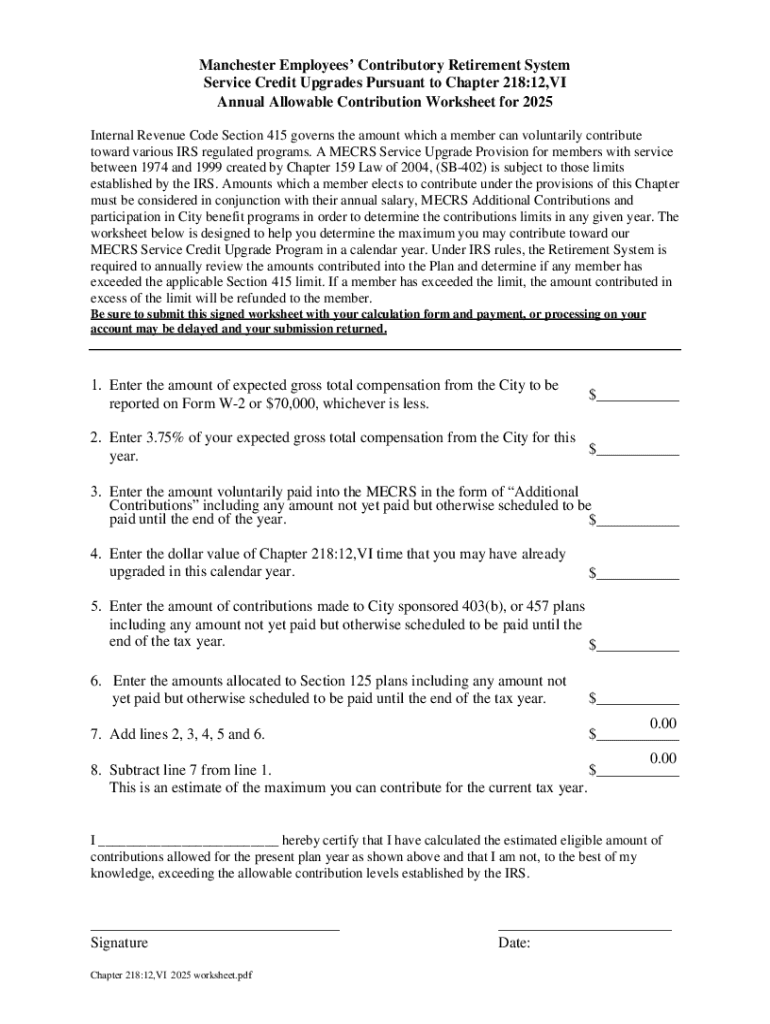

Understanding Internal Revenue Service (IRS) regulations

Internal Revenue Service (IRS) regulations serve as a crucial framework for tax compliance in the United States. These regulations dictate how individuals and businesses must report their income, deductions, and credits. The importance of understanding these regulations cannot be overstated, as they ensure adherence to tax laws, potentially minimizing liabilities and avoiding penalties.

IRS forms play a pivotal role in complying with these regulations. Each form has a specific purpose, guiding users through the complexities of tax obligations. For those looking to navigate this landscape effectively, several resources are available, including the IRS website, tax preparation software, and professional advisors.

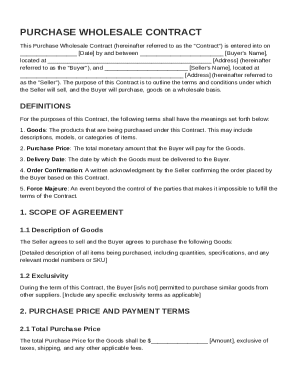

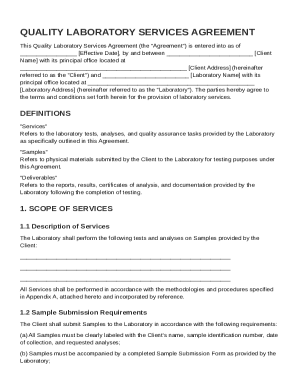

The specifics of IRS regulations forms

IRS forms are categorized primarily into three types: Individual Forms, Business Forms, and Informational Returns. Individual forms, such as the Form 1040, are designed for personal tax filing. Business forms, including Form 941 and Form 2290 for Heavy Vehicle Use Tax (HVUT), are specific to business operations and tax responsibilities. Informational returns, like Form 1099, provide the IRS with third-party reporting of various income types.

Completing and submitting these forms accurately is vital for tax compliance. Mistakes can lead to delayed refunds, penalties, or audits, making diligence during the tax preparation process essential.

Navigating the IRS regulatory landscape

IRS regulations impact both individuals and businesses, though the implications differ. For individuals, the IRS regulations dictate how to resolve tax obligations while claiming eligible deductions and credits. It's crucial for all taxpayers to stay informed about their responsibilities to avoid non-compliance and maximally benefit from tax provisions.

Businesses face more extensive reporting obligations, including payroll taxes and specific industry regulations. Recent changes in regulations can also affect form requirements and deadlines, especially with modifications made to the HVUT forms since July 20, 2011. Keeping updated on these changes is vital for compliance.

Step-by-step guide to completing IRS forms

When tackling IRS forms, identifying the correct one is critical. Tools and templates on pdfFiller can streamline this process. Common forms like Form 1040, Form 941, and Form 2290 can be easily recognized by their numbers and specific purposes. A detailed walkthrough on how to fill out these forms, including understanding sections and line items, is fundamental for accurate completion.

Engaging with interactive tools available on pdfFiller can enhance the experience of form creation. Features for editing, signing, and managing IRS documents enable users to handle their obligations seamlessly.

eSigning and document management for IRS forms

The rise of eSigning IRS forms offers speed, security, and legal compliance. Utilizing digital signatures not only accelerates the submission process but also provides a layer of audit protection.

To eSign IRS forms using pdfFiller, simply upload your document, use the eSign feature to add your digital signature, and save the document securely in the cloud. This process ensures that your forms are ready for submission while keeping your data organized.

Collaborating on IRS forms with your team

Collaboration on IRS forms can significantly enhance accuracy and efficiency, especially in a team environment. Best practices include establishing clear roles, maintaining effective communication, and utilizing shared tools.

pdfFiller provides features for real-time collaboration, allowing multiple users to contribute to document preparation. Tools for commenting and tracking changes ensure everyone stays informed during the process. Organizations that have successfully utilized these features report reduced errors and expedited form completion.

Common issues and troubleshooting

Navigating IRS forms can lead to a variety of common issues. Taxpayers often have questions regarding specific forms or submission deadlines, making it essential to consult the FAQ section provided by pdfFiller.

Additionally, troubleshooting errors during form submission often requires patience. Issues such as incorrect information, improper signatures, or misfiled forms can all lead to complications. When faced with persistent difficulties or unique tax situations, seeking professional help is advisable.

Interactive tools and resources available on pdfFiller

pdfFiller boasts a comprehensive library of IRS forms and templates, making it a valuable resource for both individuals and teams. Users can access ready-to-fill forms, eliminating the hassle of finding the right documents online.

Moreover, pdfFiller integrates seamlessly with other software, enhancing functionality. User testimonials indicate high satisfaction with how these tools simplify IRS-related tasks, from initial form setup to final eSignature.

Staying updated on IRS regulations

As IRS regulations evolve, it is essential for users to stay informed. Resources for monitoring regulatory changes include the IRS website, tax professional newsletters, and dedicated websites like pdfFiller.

Adapting to new forms and requirements ensures compliance and reduces the risk of errors during filing. With pdfFiller, users benefit from alerts and updates about changes, securing their ability to remain compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify internal revenue service regulations without leaving Google Drive?

How can I send internal revenue service regulations to be eSigned by others?

Can I create an electronic signature for signing my internal revenue service regulations in Gmail?

What is internal revenue service regulations?

Who is required to file internal revenue service regulations?

How to fill out internal revenue service regulations?

What is the purpose of internal revenue service regulations?

What information must be reported on internal revenue service regulations?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.