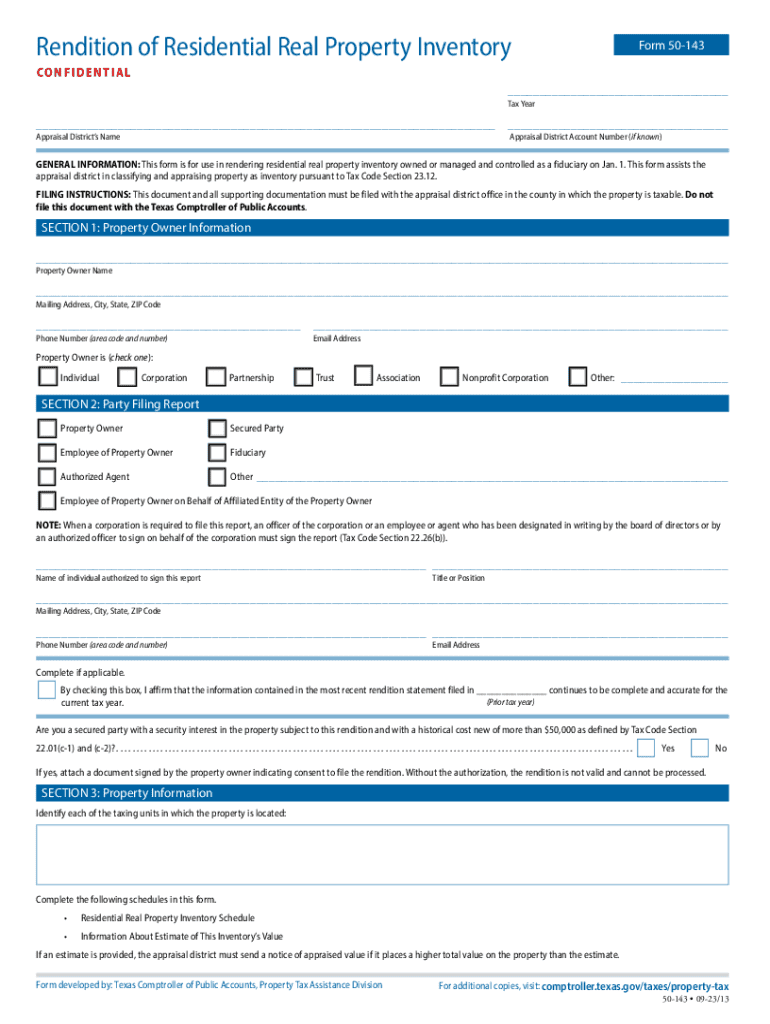

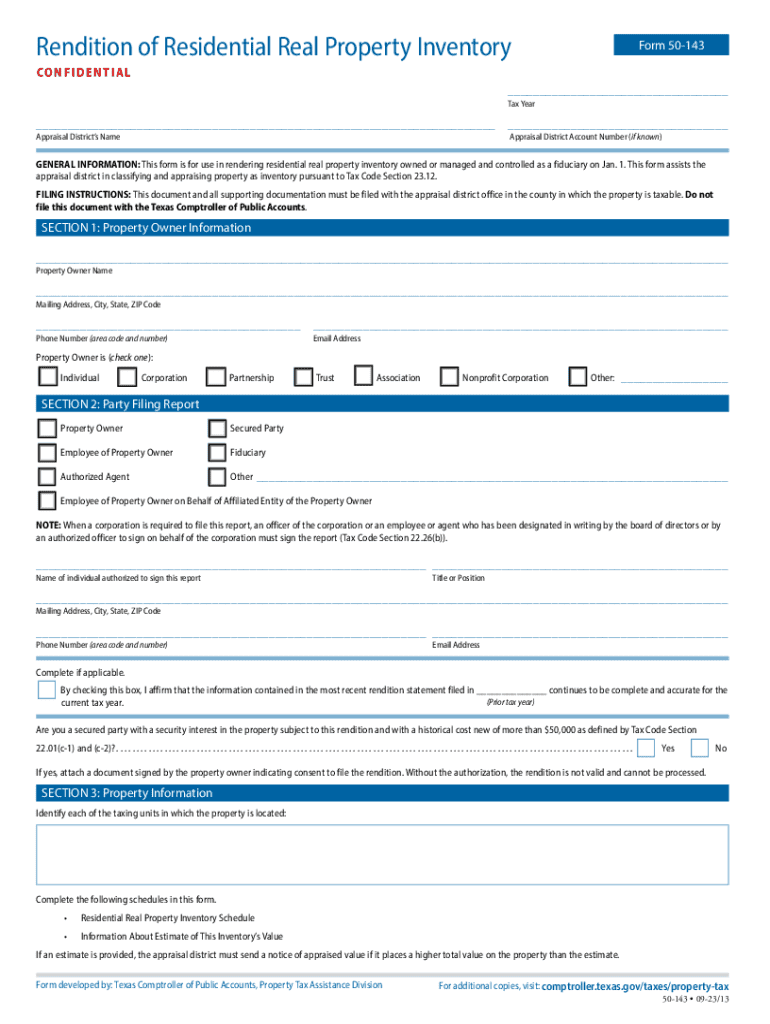

Get the free appraisal district in classifying and appraising property as inventory pursuant to T...

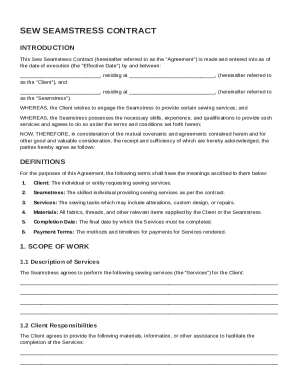

Get, Create, Make and Sign appraisal district in classifying

Editing appraisal district in classifying online

Uncompromising security for your PDF editing and eSignature needs

How to fill out appraisal district in classifying

How to fill out appraisal district in classifying

Who needs appraisal district in classifying?

Understanding Appraisal Districts in Classifying Form

Understanding the appraisal district

Appraisal districts serve as local administrative entities responsible for appraising properties to determine their market value for tax purposes. Each appraisal district operates within a specific geographic area, ensuring that property owners are fairly assessed based on their property's current market value. This is crucial for establishing tax rolls that local governments rely on to fund public services.

The role of appraisal districts extends beyond valuation. They also provide property owners with essential information about their assessments, along with guidance on property tax exemptions and the processes involved in contesting appraisals that seem inaccurate. For property owners and investors, understanding how everything from classifying forms to assessment processes works within the appraisal district is key to navigating tax implications effectively.

Types of appraisal forms used by districts

Appraisal districts utilize a variety of classification forms to assess properties accurately. Each form designed for a specific type of property or situation ensures that the assessment process considers unique characteristics relevant to property valuation.

The appraisal process: Step-by-step guide

The appraisal process typically unfolds in several stages to ensure thorough valuation and transparency. Initially, data is collected from various sources to evaluate properties accurately.

Key filing periods and their impact on rolls

Understanding key filing periods is essential for property owners looking to engage effectively with their appraisal district. Each year, there are designated timelines by which specific forms must be submitted to ensure a property’s value is correctly reflected.

How is your property appraised?

When appraising properties, appraisal districts consider several evaluation criteria to arrive at a fair market value. A strong understanding of these criteria can help property owners anticipate their assessments.

Utilizing pdfFiller for appraisal district forms

With donation management systems moving to the cloud, pdfFiller emerges as a crucial tool for managing appraisal district forms efficiently. The platform offers features tailored to meet the needs of property owners and teams accessing necessary documentation seamlessly.

Best practices for engaging with your appraisal district

Building a strong relationship with your appraisal district can facilitate smoother interactions and lead to better understanding of property valuation processes. Maintaining open lines of communication is key.

The future of appraisal processes

As technology rapidly shapes various sectors, the appraisal process is no exception. Future practices are likely to integrate advanced analytics and automated valuation models (AVMs) to enhance property assessments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my appraisal district in classifying in Gmail?

How do I complete appraisal district in classifying online?

Can I create an electronic signature for the appraisal district in classifying in Chrome?

What is appraisal district in classifying?

Who is required to file appraisal district in classifying?

How to fill out appraisal district in classifying?

What is the purpose of appraisal district in classifying?

What information must be reported on appraisal district in classifying?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.