Get the free adm / nach / direct debit form

Get, Create, Make and Sign adm nach direct debit

How to edit adm nach direct debit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out adm nach direct debit

How to fill out adm nach direct debit

Who needs adm nach direct debit?

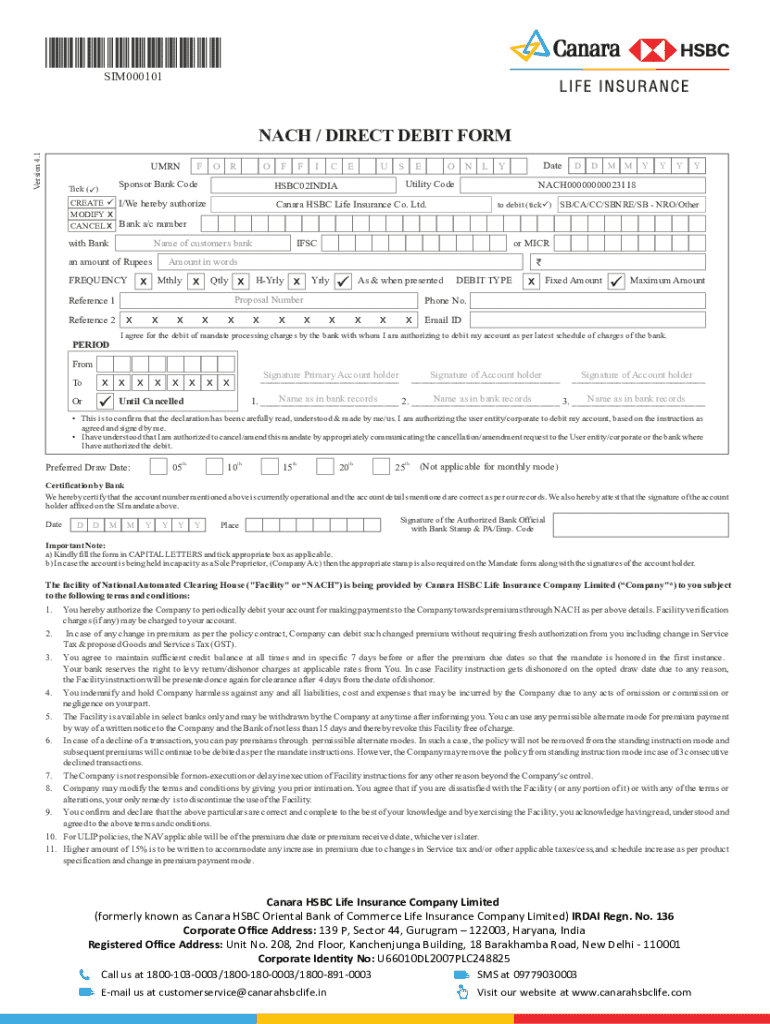

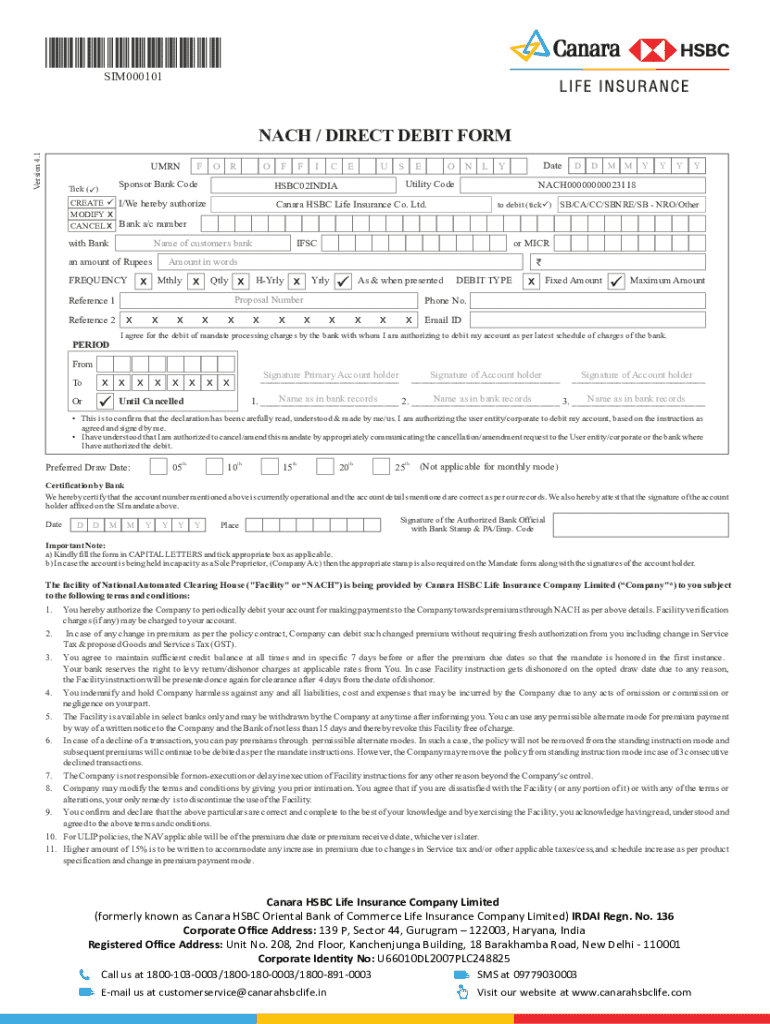

Understanding the ADM NACH Direct Debit Form

Understanding NACH (National Automated Clearing House)

NACH, or the National Automated Clearing House, is a payment system established to facilitate interbank transactions in India. It plays a crucial role in handling bulk electronic payment transactions and is primarily used for processing direct debits and credits, making it a backbone for automated payments. This system simplifies the payment process for various types of transactions, such as utility bills, loan repayments, and subscription services, enabling a seamless exchange of funds between accounts.

The NACH system streamlines the entire payment process, reducing the complexities involved in direct debits. By utilizing this framework, businesses and individuals can ensure timely payment collection and convenient funds transfer. NACH not only enhances efficiency but also minimizes the manual errors often associated with paper-based methods, leading to improved trust in digital banking.

ADM NACH Direct Debit Form: An Overview

The ADM NACH Direct Debit Form is a specific document used to authorize NACH transactions. This form serves as a mandate for initiating direct debits from a customer's bank account on a recurring basis. By filling out this form, individuals and businesses can authorize regular payments for services like insurance premiums, loan repayments, and subscription fees.

Utilizing the ADM NACH Direct Debit Form ensures that both the payer and the payee have a clear understanding of the terms of the transaction, such as payment amounts, frequency, and duration. The importance of using this form cannot be overstated, as it adds a layer of security and trust in financial transactions, making it essential for both businesses and customers.

Benefits of utilizing the ADM NACH Direct Debit Form

Using the ADM NACH Direct Debit Form streamlines payment processes by automating transactions that may otherwise require manual intervention. This automation not only saves time but also ensures timely payments, reducing the risk of late fees and service interruptions. For businesses, the reliability of knowing that payments will be processed as scheduled allows for better cash flow management.

In terms of security, NACH is designed with multiple layers of verification, enhancing the reliability of direct debit transactions. With electronic authentication, users can be assured that their sensitive banking details are securely processed. Enhanced record-keeping capabilities allow both individuals and businesses to track payment histories and maintain accurate financial records, a feature especially crucial in today's regulatory environment.

Accessibility from any device through platforms like pdfFiller enables users to manage their documents on the go, accommodating busy lifestyles. Users can fill out, edit, and sign the ADM NACH Direct Debit Form from anywhere, ensuring that they can handle their payment responsibilities without being constrained by location or time.

Who should use the ADM NACH Direct Debit Form?

The ADM NACH Direct Debit Form is ideal for a wide range of users, including individuals who prefer hassle-free payment solutions and businesses that manage recurring payments. For individuals, this form simplifies monthly obligations such as utility bills or loan repayments, making budgeting more predictable. Meanwhile, businesses utilize it to automate collections from customers, ensuring a steady cash flow and minimizing the administrative burden.

Various scenarios exemplify practical applications of the ADM NACH Direct Debit Form. An individual might use it to authorize automatic deductions for their insurance premiums, while a business could implement it for collecting subscription fees from its customers. By deploying the ADM NACH form, both parties can enjoy the peace of mind that comes with assured, timely payments.

How to complete the ADM NACH Direct Debit Form

Completing the ADM NACH Direct Debit Form is straightforward, especially with guidance on how to navigate the process effectively. Here's a step-by-step guide to help you fill out the form with ease:

Editing and customizing your direct debit form

pdfFiller provides powerful editing tools to tailor the ADM NACH Direct Debit Form to your specific needs. Users can modify existing fields or add new ones to better align with their requirements. For instance, businesses may want to include their logos to maintain brand consistency, while individuals might need to add additional fields for personal identifiers.

Common modifications include adjusting the payment frequency, updating the payment amounts, or specifying particular payment instructions. Customizing the form not only ensures clarity but also enhances the overall user experience by allowing individuals and teams to fill out forms that align precisely with their objectives and workflows.

Signing and sending the ADM NACH Direct Debit Form

E-signature features provided by pdfFiller allow for rapid authentication of the ADM NACH Direct Debit Form, offering a secure way to finalize your transactions. Users can quickly sign the document electronically, ensuring that it is legally binding and valid. Once signed, sending the completed form to relevant parties is as simple as a few clicks.

Additionally, pdfFiller enables users to track changes made to the document, maintaining oversight on any edits or updates. This transparency reduces potential disputes and fosters trust among all parties involved, assuring that everyone is on the same page with the terms of the direct debit agreement.

Managing recurring payments with NACH

NACH is a powerful tool for facilitating automatic recurring transactions. Upon setting up your direct debit mandate using the ADM NACH Form, individuals and businesses don’t have to worry about making regular payments manually. This automated approach assures that funds are transferred on time, which is particularly beneficial for bills with variable due dates.

To set up standing instructions with NACH, it’s essential to clearly outline the terms within the ADM NACH Direct Debit Form. In situations where you may want to stop or modify direct debits, a user-friendly guide is available to navigate those changes quickly, ensuring that users can maintain control over their finances easily.

Common issues and solutions with NACH

As with any payment system, users might encounter common issues when handling NACH transactions. To address delays in payments, it’s crucial to check with your bank to confirm that the transmission of the NACH request was successful. Additionally, reviewing bank statements for discrepancies can help in pinpointing problems early.

For rectifying errors in submitted forms, users should act quickly, contacting the concerned entity to correct inaccuracies. Ensuring security when handling sensitive information is paramount; always double-check the details entered on the ADM NACH Direct Debit Form, and avoid sharing personal banking information via unverified channels.

The future of direct debit payments

Trends in digital banking are significantly impacting direct debit systems like NACH. The growing preference for online financial services and a rise in contactless payments encourage more users to explore automated systems like the ADM NACH Direct Debit Form. Financial technology advancements are promoting ease of use, security, and integration with personal finance management tools.

pdfFiller is well-positioned to evolve alongside these trends, offering innovative features that enhance user experience. As the demand for digital solutions increases, pdfFiller remains committed to providing seamless document management that caters to changing consumer needs and preferences in managing payments and records efficiently.

Quick tips for effective document management

Efficient document management is key to ensuring that your direct debit forms are organized and accessible. Start by categorizing your forms logically—arranging them by type, due date, or organization can help streamline your workflow. Keeping records of all transactions allows for easy reference and helps in tracking payments.

Utilizing pdfFiller’s features for optimal document workflow can greatly enhance your productivity. Employing templates for frequently used forms can save time while maintaining consistency. Moreover, regularly reviewing and updating your direct debit forms ensures that all information remains current and accurate, minimizing errors in future transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the adm nach direct debit electronically in Chrome?

Can I create an eSignature for the adm nach direct debit in Gmail?

How do I edit adm nach direct debit straight from my smartphone?

What is adm nach direct debit?

Who is required to file adm nach direct debit?

How to fill out adm nach direct debit?

What is the purpose of adm nach direct debit?

What information must be reported on adm nach direct debit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.