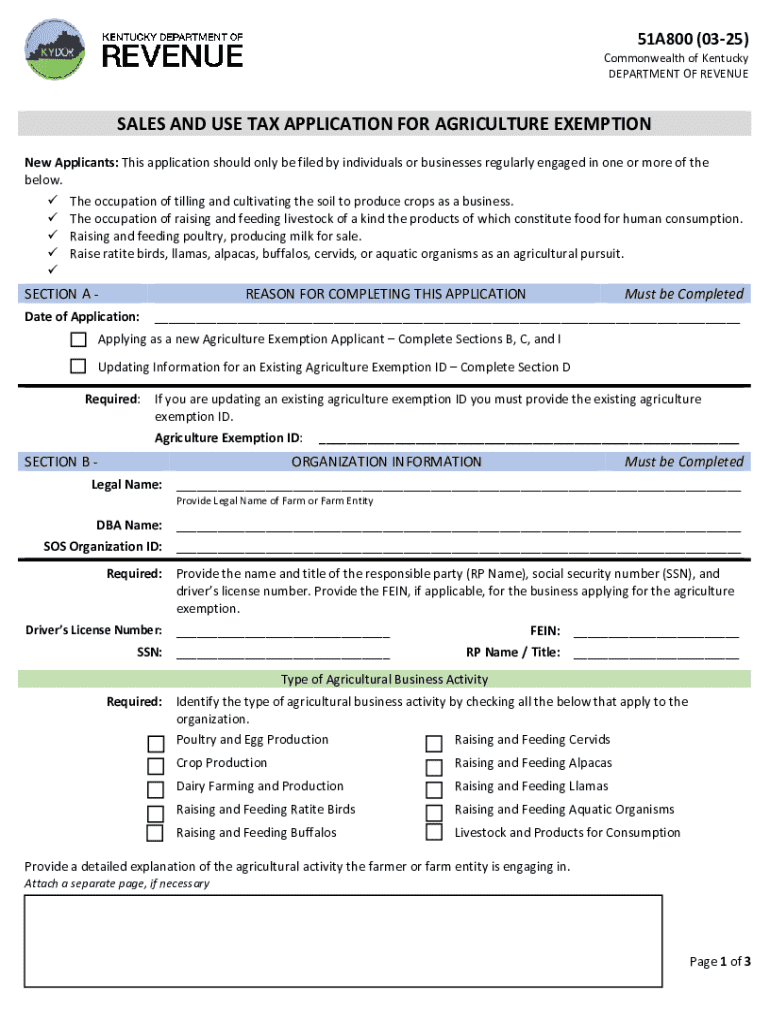

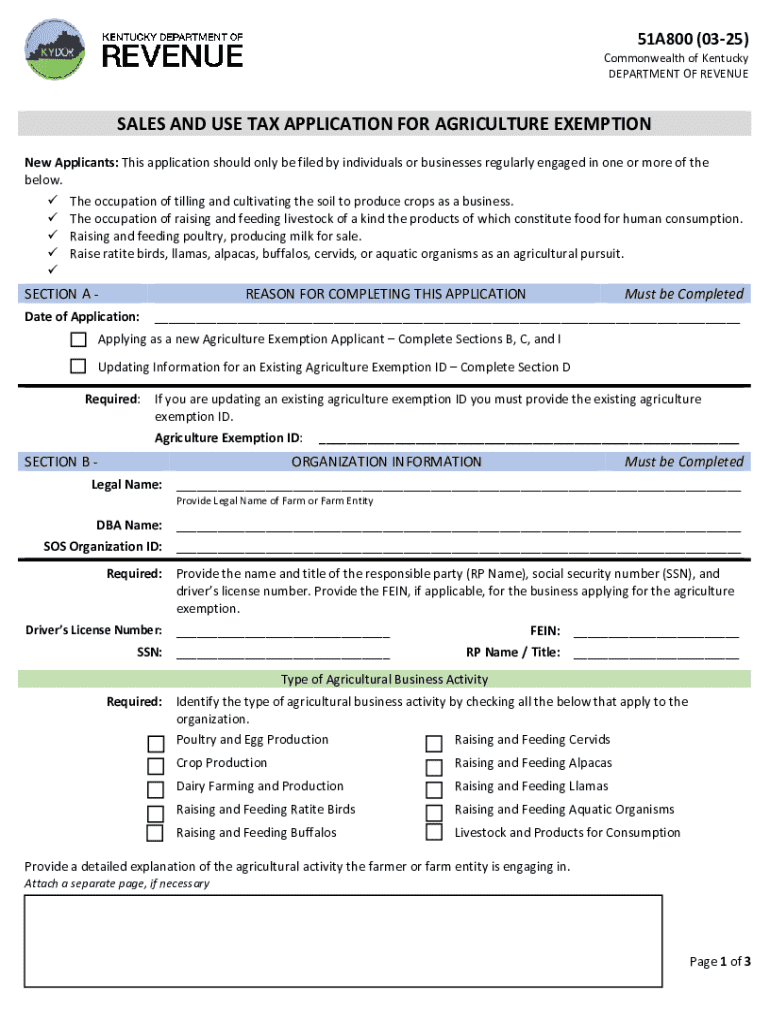

Get the free What is the AE Tax Exemption application process?

Get, Create, Make and Sign what is form ae

How to edit what is form ae online

Uncompromising security for your PDF editing and eSignature needs

How to fill out what is form ae

How to fill out what is form ae

Who needs what is form ae?

What is Form AE Form?

Understanding Form AE

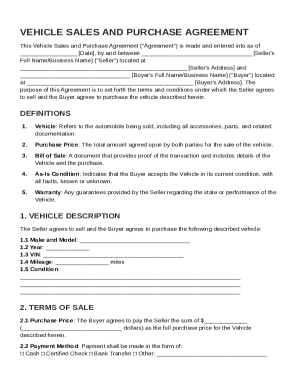

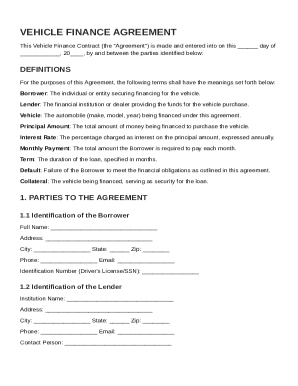

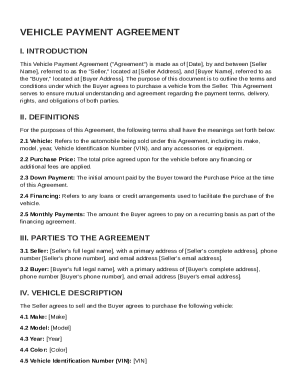

Form AE is a specialized document used primarily in the context of accounting and finance. It serves as an essential vehicle for individuals and businesses to provide pertinent information concerning their financial situation, particularly for loan applications, grants, and other financial opportunities. The reliability and transparency of the data presented in Form AE can be pivotal for financial institutions when assessing creditworthiness or making lending decisions.

Originally conceptualized to standardize the financial reporting process, Form AE has evolved to encompass a wider range of financial disclosures and personal data. Its significance lies in its ability to provide a clear, structured framework that allows both lenders and applicants to understand the financial landscape clearly. Understanding the nuances of Form AE is thus critical for anyone considering a financial transaction that requires detailed financial disclosure.

Historical context

The origins of Form AE can be traced back to the need for standardized reporting in financial environments, particularly during the mid-20th century. As financial systems grew more complex, the demand for a structured template that could consolidate various financial data became apparent. Over the years, Form AE has undergone significant transformations, adapting to changes in regulatory requirements and technological advancements.

For example, amendments have been introduced to streamline the form, reducing the redundancy of information required. More recently, digital formats have made it easier to accessible and manageable, ensuring that it meets contemporary users' needs. These updates reflect a commitment to not only maintain relevance in a rapidly changing financial landscape but also to enhance user experience.

Key features of Form AE

The core elements of Form AE include distinct sections that cover personal information, financial information, and any additional considerations necessary for a complete submission. Each section serves a specific purpose in allowing lenders or regulatory bodies to assess the applicant's suitability for financial products.

Form AE is typically utilized across various scenarios, including loan applications, budget evaluations, and financial aid requests. Different industries, such as banking, education, and real estate, frequently engage with this form. For instance, a mortgage lender may require Form AE from potential borrowers to assess their financial qualifications before approving a home loan.

Step-by-step guide to completing Form AE

To effectively complete Form AE, proper preparation is essential. You will need specific documents such as recent tax returns, bank statements, and details of your financial assets. Gathering all necessary information beforehand can streamline the process and reduce errors during submission.

Filling out the form

When filling out the form, begin with the Personal Information section, which requires the following details:

Next, move to the Financial Information section. Accurately report your income and assets; this includes:

Lastly, thoroughly review the Additional Considerations section to identify any special circumstances that need to be taken into account. Common pitfalls to avoid here include omitting information or presenting anything inaccurately, as these could adversely affect your application.

Reviewing your submission

Before submitting Form AE, it's crucial to perform a detailed review. Utilize a checklist to ensure that all required fields are completed and free from errors. Double-checking all entries not only minimizes the risk of rejection but also builds a stronger case for your application.

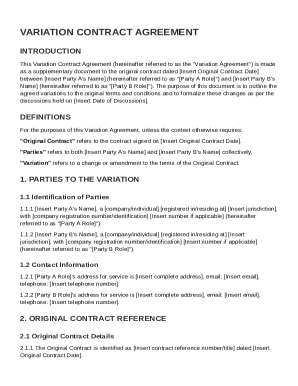

Editing and updating Form AE

There are numerous situations that may require you to edit or update Form AE, such as changes in your financial situation or personal information. For instance, if you receive a new job with a substantial salary increase, updating your Form AE would be essential to reflect this new financial status.

To make edits to an already submitted form, revisit the same platform where you submitted it. Most platforms provide a straightforward process for amendments. If using pdfFiller, users can take advantage of its intuitive tools to amend existing entries or even utilize electronic signatures for a seamless update.

Signing and submitting Form AE

eSigning Form AE is a straightforward process that offers a secure and time-saving means of providing your consent and approval. Digital signatures are legally valid, ensuring that your form is recognized as legitimate without the need for physical signatures.

Submission methods for Form AE vary. You may submit it online through platforms like pdfFiller, by traditional mail, or even in person at designated locations. Be sure to consider the submission method that aligns best with your timeline, as different methods may have different processing times for confirmation.

Managing your Form AE post-submission

Once you have submitted Form AE, tracking its status is essential to ensure that your application is being processed. Tools embedded within pdfFiller allow you to monitor the progress of your submission, providing peace of mind as you await a response.

Common issues might arise during the submission process, such as missing information or delays in processing. It is advisable to have a troubleshooting approach in place. Familiarize yourself with the specific guidelines provided by the financial institution or organization receiving your form to promptly address any queries or concerns.

Frequently asked questions (FAQs) about Form AE

When it comes to Form AE, many users have similar questions. Some of the most common queries involve the time frame for processing applications, the necessity of all sections being filled out, and the implications of inaccuracies in submitted data.

User experiences reveal the significance of thoroughness when filling out Form AE. Testimonials from individuals highlight how a well-prepared submission can significantly enhance approval chances.

Utilizing pdfFiller for Form AE

Users benefit significantly from pdfFiller's suite of tools designed specifically for managing Form AE. This cloud-based platform offers an array of features including convenient editing, eSigning, and collaborative document sharing. These capabilities enhance the form-filling process, combining efficiency with user-friendly access.

With interactive tools such as auto-population of data fields and the ability to collaborate in real-time, pdfFiller simplifies the workflow for individuals and teams alike. The integration of these features means that users can manage their documents from anywhere, making the process of completing Form AE not only easier but also more efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in what is form ae?

Can I create an electronic signature for signing my what is form ae in Gmail?

How can I fill out what is form ae on an iOS device?

What is Form AE?

Who is required to file Form AE?

How to fill out Form AE?

What is the purpose of Form AE?

What information must be reported on Form AE?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.