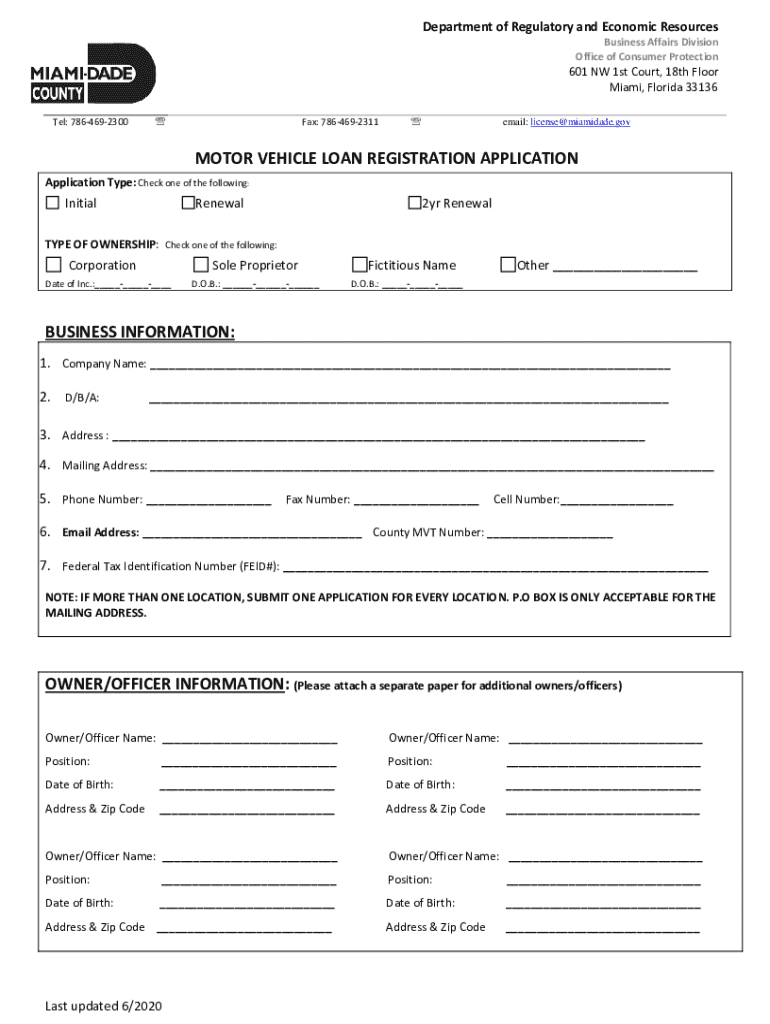

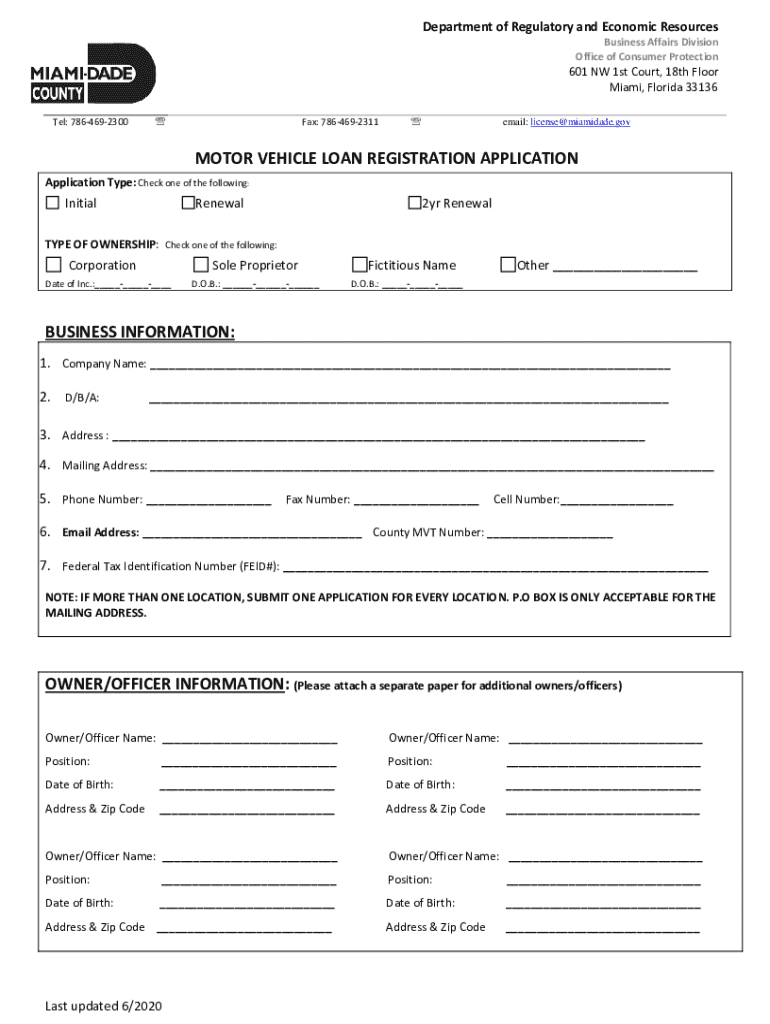

Get the free Motor Vehicle Loan Registration Application

Get, Create, Make and Sign motor vehicle loan registration

Editing motor vehicle loan registration online

Uncompromising security for your PDF editing and eSignature needs

How to fill out motor vehicle loan registration

How to fill out motor vehicle loan registration

Who needs motor vehicle loan registration?

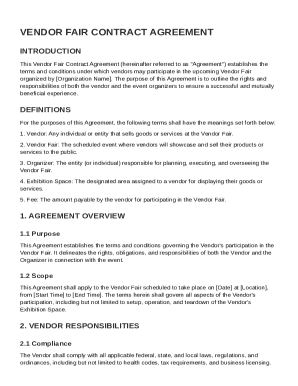

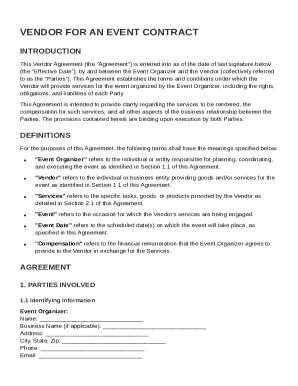

Comprehensive Guide to the Motor Vehicle Loan Registration Form

Understanding the motor vehicle loan registration form

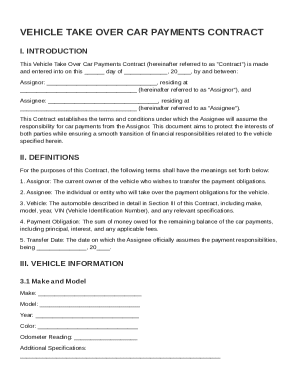

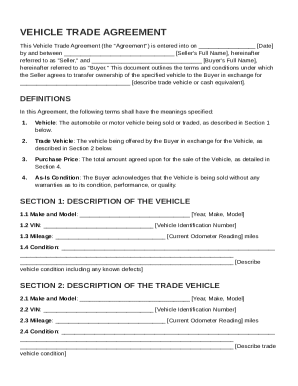

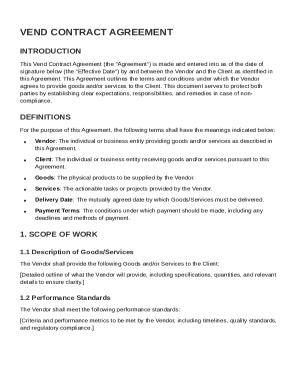

The motor vehicle loan registration form serves as a pivotal instrument for borrowers seeking financial assistance for vehicle purchases. The primary purpose of this form is to document the details of the loan and the vehicle being financed. By submitting this form, a borrower formally requests the lender to process the loan and ensure the vehicle is registered in accordance with state laws. Accurate registration is not just a procedural formality; it directly influences the loan approval process and the timely disbursement of funds. Common scenarios that require this form include when purchasing a new or used vehicle through a dealership or a private sale, refinancing an existing loan, or transferring a loan from one financial institution to another.

Key features of pdfFiller for motor vehicle loan registration

pdfFiller stands out as an exceptional tool for managing the motor vehicle loan registration form. Its cloud-based platform allows users to access their forms from anywhere, offering unmatched convenience for individuals and teams on the go. Additionally, pdfFiller provides user-friendly editing tools that simplify form completion, making it easy to add or modify information seamlessly. Another strong point of pdfFiller is its eSigning capabilities, allowing users to sign documents electronically and expedite the signing process, which is particularly vital for time-sensitive transactions. The platform also enhances collaboration through real-time features that enable users to work together on forms, whether they are in the same office or across the globe.

Detailed steps for filling out the motor vehicle loan registration form

Filling out the motor vehicle loan registration form requires careful attention to detail and accurate information. Start by gathering all necessary information, which includes your personal details (name, address, contact information), vehicle specifics (make, model, year, VIN), and loan information (amount, term, interest rate). With this information ready, you can follow these step-by-step instructions to complete the form accurately, ensuring that no important fields are left blank.

When completing each section of the form, be mindful of common mistakes such as misspellings, incorrect vehicle identification numbers, or incomplete personal details. Double-check each entry to enhance accuracy. It's also helpful to keep a copy of your completed form for your records and future reference.

Editing and customizing your form

Utilizing pdfFiller’s editor is a breeze, making the process of editing and customizing the motor vehicle loan registration form user-friendly. You can insert text and images directly into the form, enhancing clarity and personalization. With a variety of formatting options available, you can adjust font sizes, styles, and spacing to ensure the document meets your aesthetic and professional standards.

Moreover, pdfFiller offers collaborative features that enable you to share the form with team members based on preferred settings and permissions. This ensures that everyone involved can contribute effectively to the review and completion process. You can also utilize the commenting and notes section for discussions right within the document, which streamlines communication.

Signing the motor vehicle loan registration form

Understanding eSignature laws can save time and streamline processes when dealing with the motor vehicle loan registration form. Electronic signatures are legally recognized in many jurisdictions, simplifying the signing process without the need for physical documentation. Within pdfFiller, signing a document electronically is straightforward; users can eSign directly within the platform with a few clicks. This enhances the efficiency of getting required approvals and speeds up the overall registration process.

Ensuring the security and compliance of electronic signatures is paramount. pdfFiller incorporates robust security measures to protect user information, ensuring that every signed document is valid and verifiable.

Managing your motor vehicle loan registration form

Once you’ve completed and signed your motor vehicle loan registration form, managing it effectively is essential. pdfFiller allows you to save and store your completed form securely in the cloud, which offers both convenience and safety. You can access your form from any device with internet connectivity, making it simple to retrieve when needed.

Moreover, with additional document management options available, users can categorize, share, and organize their forms efficiently. Version control and history tracking ensures that you’re always aware of updates or changes made, maintaining clarity across your documentation process.

Commonly asked questions about the motor vehicle loan registration process

Navigating the motor vehicle loan registration process can generate numerous questions. One common concern users face is what happens if a mistake is made on the form. Generally, errors can be rectified by contacting the lender promptly to correct the inaccuracies. The registration process duration can vary significantly based on the lender's policies, ranging from a few hours to several days, especially if additional documentation is required. Therefore, keeping the lender’s contact information handy is crucial for any questions or assistance during the submission process.

Integrating the motor vehicle loan registration form into your workflow

For teams managing multiple loan registrations, integrating the motor vehicle loan registration form into your workflow is essential for efficiency. Implementing best practices such as establishing standardized procedures for completing and submitting forms can significantly reduce errors and save time. Automating document processes with pdfFiller allows for a streamlined approach, making it easier to track the status of loans and manage documentation.

By tracking and updating loan statuses efficiently, teams can reduce bottlenecks and maintain superior communication with borrowers, ensuring that everyone remains informed throughout the registration process.

Looking to the future: innovations in document management

Document management continues to evolve with new innovations paving the way for enhanced user experiences. Trends in document automation suggest that the future will see even more sophisticated systems that streamline form completion and improve accuracy. Mobile solutions are poised to play an integral role, allowing users to access and edit forms on-the-go, ensuring that important documents are always accessible.

Innovative collaborative tools are likely to improve team dynamics, ensuring that every member can contribute to form completion effortlessly. By staying informed and adopting these advancements, users can optimize their document management strategies.

Feedback and continuous improvement

To refine the motor vehicle loan registration form process continuously, gathering user feedback is critical. This feedback can provide actionable insights into potential areas for improvement. pdfFiller’s tools allow users to make iterative advancements based on user interactions and suggestions, ensuring that the service aligns well with user expectations. Participating in community forums can also yield valuable insights and shared experiences that enhance understanding and execution.

Implementing suggestions and insights from fellow users can lead to more streamlined processes, ensuring that the motor vehicle loan registration form remains efficient and user-friendly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my motor vehicle loan registration directly from Gmail?

Can I create an electronic signature for the motor vehicle loan registration in Chrome?

Can I edit motor vehicle loan registration on an Android device?

What is motor vehicle loan registration?

Who is required to file motor vehicle loan registration?

How to fill out motor vehicle loan registration?

What is the purpose of motor vehicle loan registration?

What information must be reported on motor vehicle loan registration?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.