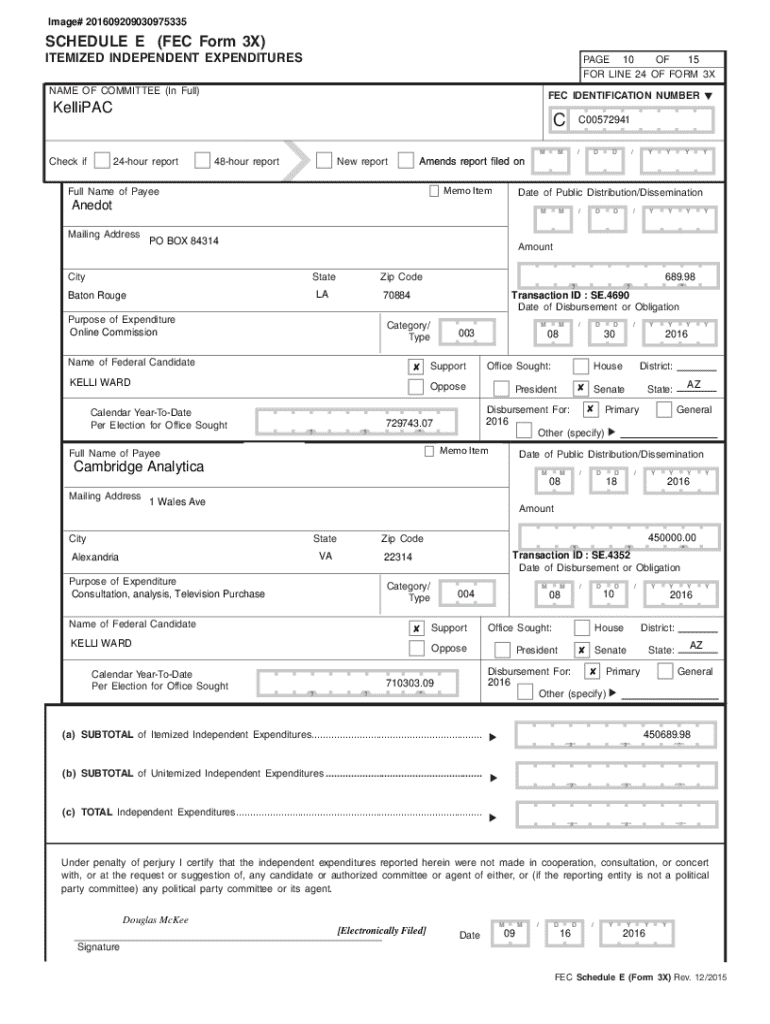

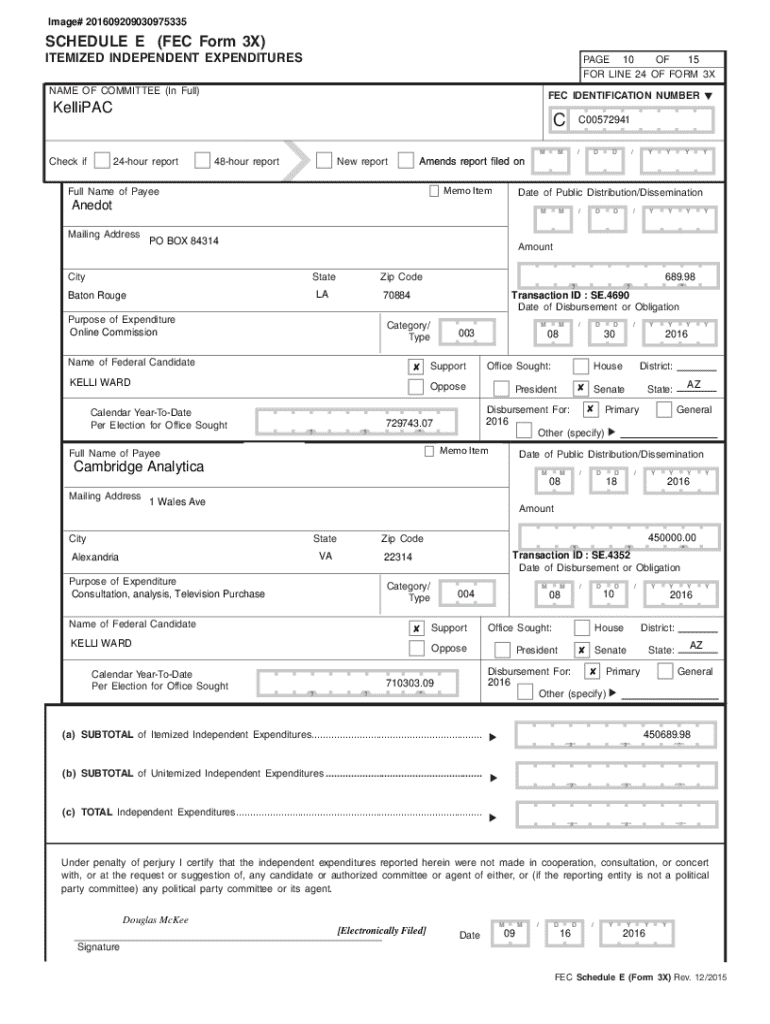

Get the free SCHEDULE E (FEC Form 3X) KelliPAC

Get, Create, Make and Sign schedule e fec form

How to edit schedule e fec form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule e fec form

How to fill out schedule e fec form

Who needs schedule e fec form?

Comprehensive Guide to the Schedule E FEC Form

Understanding the Schedule E FEC form

Federal campaign finance is governed by a series of regulations intended to ensure transparency and accountability. At the forefront of this system is the Federal Election Commission (FEC), responsible for overseeing the contribution and expenditure of campaign funds. One of the critical forms used in this process is the Schedule E FEC form. This particular form is specifically designed for reporting independent expenditures, which are funds spent on communications advocating for or against political candidates but are not coordinated with any candidate or party.

Who must file Schedule E? Any entity or individual making independent expenditures over a certain threshold must complete this form. This includes political action committees (PACs), individuals supporting candidates, and various organizations engaging in political advertising. Understanding when and how to file this form is vital to maintaining compliance with federal regulations.

Key components of the Schedule E form

The Schedule E form consists of several critical fields that require meticulous attention to detail. Proper completion of these components is essential for ensuring compliance and accuracy in reporting expenditures.

Understanding the terminology and abbreviations within the Schedule E form can also streamline the filing process. Terms such as 'independent expenditure' and abbreviations relevant to campaign financing enable users to navigate the form more efficiently.

Detailed instructions for filling out Schedule E

Filling out the Schedule E form requires careful preparation and attention to detail. Here's a structured approach to ensure accuracy and compliance.

Common questions and issues with Schedule E

Submitting the Schedule E form may evoke various concerns for filers. Here are common queries and their resolutions.

Important considerations when filing Schedule E

Filing deadlines are critical in the context of federal elections. It is essential to stay updated on these timelines to avoid penalties.

Related forms and resources

Several other FEC forms work in tandem with Schedule E, creating a comprehensive reporting framework.

Take advantage of interactive tools offered by pdfFiller to manage not just the Schedule E but the entire spectrum of forms necessary for campaign finance compliance efficiently.

Expert tips for efficient workflow

Maximizing efficiency in completing the Schedule E FEC form can save valuable time and resources, especially for busy campaign teams.

Final thoughts on mastering the Schedule E FEC form

Mastering the Schedule E FEC form is critical for any entity engaged in independent expenditures during federal campaigns. By leveraging robust document management tools like pdfFiller, users are empowered to maintain compliance while simplifying the reporting process.

Encouraging a proactive approach towards document management not only aids in timely filing but ensures that updates are seamlessly integrated as requirements change. Cloud-based tools facilitate continuous access, ensuring that campaign teams can adapt dynamically as the political landscape evolves.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send schedule e fec form to be eSigned by others?

How do I fill out schedule e fec form using my mobile device?

Can I edit schedule e fec form on an Android device?

What is schedule e fec form?

Who is required to file schedule e fec form?

How to fill out schedule e fec form?

What is the purpose of schedule e fec form?

What information must be reported on schedule e fec form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.