Get the free GETTING TO KNOW US4

Get, Create, Make and Sign getting to know us4

Editing getting to know us4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out getting to know us4

How to fill out getting to know us4

Who needs getting to know us4?

Getting to know the W-4 form

Understanding the W-4 form

The W-4 form, officially known as the Employee's Withholding Certificate, serves a critical function in the tax arena. Its primary purpose is to inform your employer how much federal income tax to withhold from your paycheck. Filling out the W-4 accurately ensures that enough tax is deducted throughout the year to meet your tax liability when you file your returns. This is vital as it helps prevent under-withholding, which could lead to large tax bills and potential penalties during tax season.

Anyone who is an employee needs to complete a W-4 form, especially if they’re starting a new job or experiencing life changes such as marriage or having a child. For new hires, the W-4 allows employers to calculate withholding based on the employee’s financial situation and family status. When life changes occur, updating the W-4 not only helps adjust tax withholdings to prevent future under- or over-withholding but also reflects any new dependents or income sources.

The purpose of the W-4 form

Accurately completing your W-4 form is paramount. The details provided dictate how much money is withheld from your paycheck, directly influencing your tax refund or liability at year's end. If too little tax is withheld, you might face a larger tax bill when filing. Conversely, excessive withholding results in lower take-home pay throughout the year. This financial juggling act underscores the importance of attention to detail as it directly affects your budget and financial planning.

Employers rely on the W-4 form to set up payroll deductions correctly. The IRS requires businesses to maintain compliant withholding practices, thereby ensuring that federal taxes are withheld accurately based on the information employees provide. Regular updates to your W-4 form, especially after significant life events or changes in financial status, are essential for remaining in alignment with the IRS guidelines and for maintaining optimal cash flow throughout the year.

Detailed breakdown of the W-4 form sections

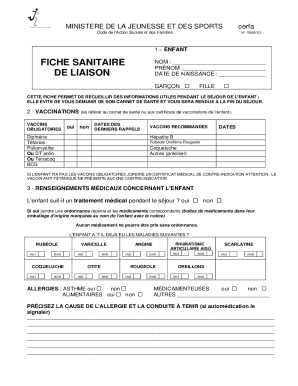

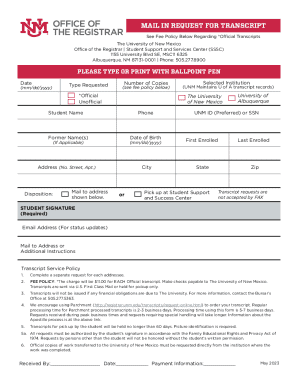

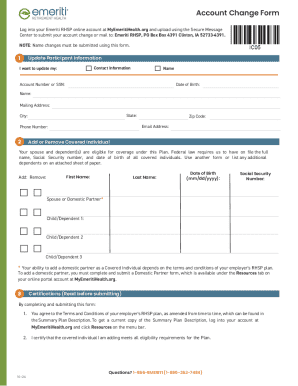

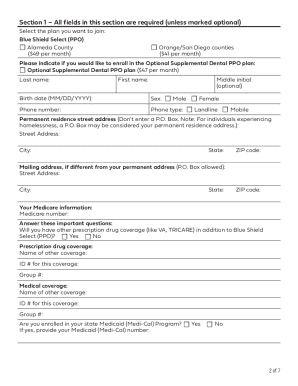

Filling out the W-4 form involves several key sections, each designed to gather pertinent information for accurate tax withholding calculations. The first section collects your personal information—full name, address, and Social Security number. It's crucial to ensure these details are up-to-date and correct, as inaccuracies can lead to delays or issues with your tax filings. The second section addresses your employment situation; if you have multiple jobs or your spouse works, you may need to check additional boxes that reflect your total household income.

Claiming dependents represents the third section where you detail qualifying dependents—this can significantly affect your tax withholding amount. Lastly, any additional adjustments such as other income or specific deductions are accounted for in the fourth section. Common mistakes include failing to account for all income sources, neglecting to update information after life changes, or omitting dependents. Ensuring accuracy throughout these sections can help streamline tax processes and lead to a healthier financial forecast.

Changes to the W-4 form in 2025

In 2025, updates to the W-4 form will come into effect, which may necessitate additional revisions for both new and existing employees. These changes typically involve adjustments in the dependents' calculations or modifications in the fields for income adjustments, aimed at simplifying the user experience and making compliance easier for employers. It's essential to stay informed regarding these updates, as they can impact withholding amounts and how individuals approach their tax obligations.

A proactive approach to reassessing your withholding when the changes take effect will guarantee that your first paycheck in 2025 aligns with your tax planning goals. Reviewing your W-4 and potentially working alongside payroll or HR services to ensure compliance with the new regulations can help ease this transition. Utilizing platforms such as pdfFiller that provide user-friendly interfaces can aid in making the transition as seamless as possible.

Adjusting your withholdings

Many life changes necessitate updating your W-4. Events such as marriage, the birth of a child, or significant changes in financial status can warrant a review of your withholdings to ensure they reflect your current situation. As a best practice, scheduling an annual review of your W-4 ensures that you are not caught off guard when tax season arrives. If your financial circumstances have altered during the year, it is advisable to reassess your W-4 immediately to avoid potential tax pitfalls.

When you decide it’s time to revise your W-4, the process is straightforward. Just reach out to your employer’s HR department, indicate you intend to update your W-4, and provide the necessary information. With tools like pdfFiller, you can easily edit your form, digitally sign it, and submit it without the need for cumbersome paper processes. This flexibility makes it convenient for employees to maintain their tax withholding records up-to-date.

Understanding W-4 vs. W-2 forms

The W-4 and W-2 forms serve unique yet interlinked purposes in the tax landscape. While the W-4 indicates how much tax an employer should withhold from an employee’s earnings throughout the year, the W-2, or Wage and Tax Statement, summarizes the total wages earned and taxes withheld for the year during tax filing. Thus, the W-4 is crucial for ongoing compliance and cash flow, while the W-2 provides the essential year-end snapshot needed for filing accurate tax returns.

Both forms work in symbiosis within the tax process. An accurate W-4 ensures that your W-2 aligns with your actual earnings and tax liabilities, minimizing surprises during tax returns. Employees should take time to understand the relationships between these forms, as doing so can lead to more informed financial decisions and strategic planning for tax season.

Employer responsibilities with W-4

Employers hold significant responsibilities concerning the W-4 form. Upon receipt, they must process and retain these forms meticulously as part of their payroll procedures. Compliance with tax laws and regulations hinges on the accurate collection of W-4s. Employers are responsible for correctly interpreting the data provided on these forms, ensuring they calculate the necessary withholdings accurately according to updated guidelines.

Providing proper training to employees about filling out the W-4 helps foster understanding of how withholding works. Ensuring employees are informed about the implications of their withholding decisions can lead to a conscientious approach to filling out the W-4. Adopting best practices, including regular reviews and feedback mechanisms, can enhance overall compliance and promote fiscal responsibility within the organization.

Managing your W-4 with pdfFiller

pdfFiller offers an efficient solution for managing your W-4 forms, tailored for the needs of individuals and teams. By leveraging this cloud-based platform, users can easily fill out, edit, e-sign, and collaborate on document submissions. The user-friendly interface simplifies the process of updating your W-4 as needed, ensuring that you can keep track of the latest changes and comply with IRS regulations effortlessly.

Moreover, for organizations dealing with numerous employees, pdfFiller provides features that streamline managing multiple W-4 forms. Secure and accessible document management allows HR professionals to collaborate effectively with employees, ensuring compliance is maintained. With pdfFiller, the arduous task of handling paper forms is transformed into a digital process, enhancing efficiency and organization-wide compliance.

Frequently asked questions (FAQs)

Addressing common inquiries about the W-4 form can clarify many of the uncertainties surrounding it. If mistakes are made on the W-4, it’s crucial to instruct employees to correct the form and submit an updated version to their employer as soon as possible. Failure to correct these mistakes in a timely manner could result in incorrect withholdings, impacting take-home pay and year-end tax returns.

Understanding how your W-4 impacts your take-home pay is essential. The more allowances claimed, the less tax withheld, potentially increasing the amount you bring home each paycheck. Conversely, more withholding can result in a larger tax refund but lower current cash flow. Employees can change their W-4 mid-year, which is beneficial when faced with life changes or financial shifts, ensuring their withholding reflects their situation accurately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify getting to know us4 without leaving Google Drive?

Can I create an eSignature for the getting to know us4 in Gmail?

How do I edit getting to know us4 straight from my smartphone?

What is getting to know us4?

Who is required to file getting to know us4?

How to fill out getting to know us4?

What is the purpose of getting to know us4?

What information must be reported on getting to know us4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.