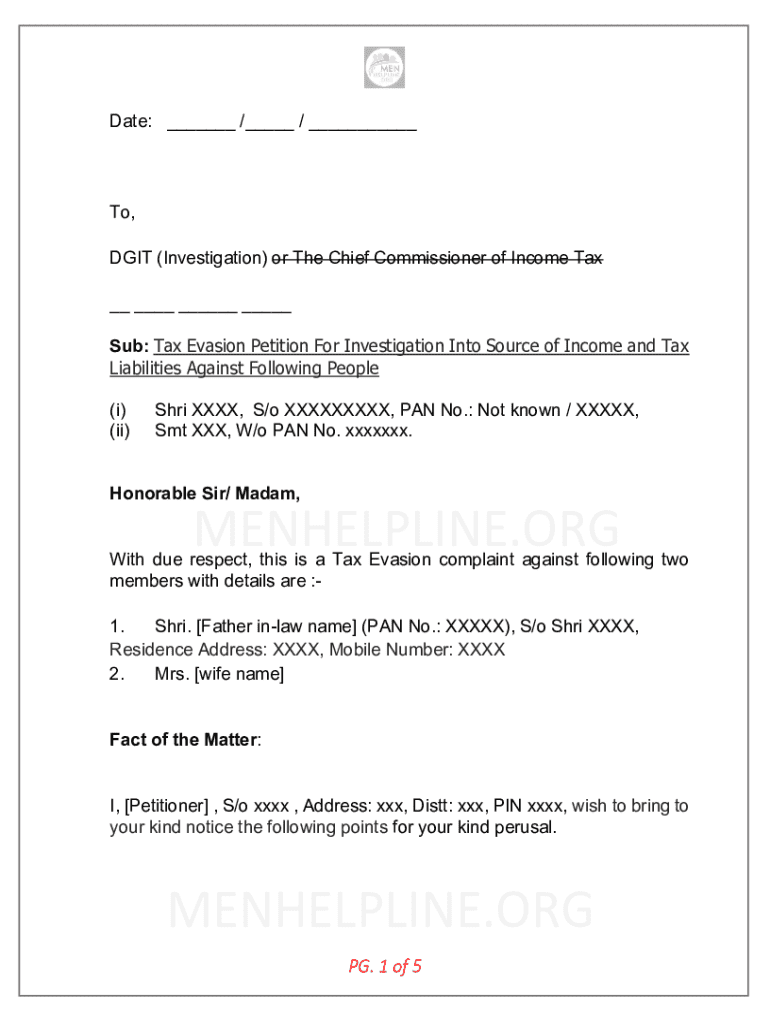

Get the free SampleTAX EVASION PETITION

Get, Create, Make and Sign sampletax evasion petition

Editing sampletax evasion petition online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sampletax evasion petition

How to fill out sampletax evasion petition

Who needs sampletax evasion petition?

Sample Tax Evasion Petition Form: A Comprehensive Guide

Understanding tax evasion and its legal implications

Tax evasion is the illegal practice of not paying taxes owed to the government. This can occur through misrepresentation of income, false deductions, or hiding money in offshore accounts, among other tactics. It's essential to grasp what constitutes tax evasion, as misunderstanding it can lead to severe repercussions.

Some common forms of tax evasion include underreporting income, inflating deductions, and not filing tax returns altogether. The legal consequences can be dire. Individuals may face hefty fines, interest on unpaid taxes, and even imprisonment in severe cases. Thus, understanding these implications highlights the importance of filing a petition when wrongfully accused or seeking resolution.

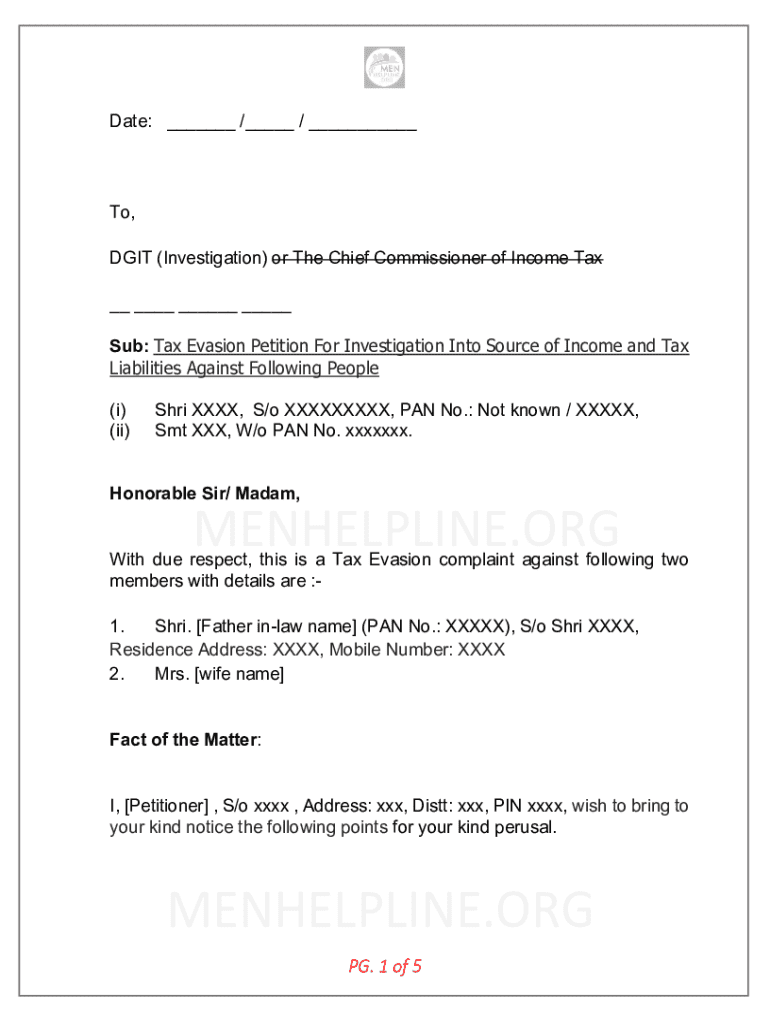

Overview of the tax evasion petition form

The tax evasion petition form serves as a formal request to contest allegations of tax evasion or appeal a decision made by tax authorities. Its primary purpose is to provide a structured format for individuals or entities to formally present their case.

Key elements required in the form include personal information, detailed allegations against the accused, proposed remedies, and a section to affirm the validity of the claims. Completing this form accurately is crucial as it can significantly influence the outcome of legal proceedings.

Step-by-step instructions to fill out the tax evasion petition form

Filling out the tax evasion petition form requires careful preparation. Start by gathering all necessary documentation related to your case. This might include financial records, correspondence with tax authorities, and any relevant legal notices.

Once you have your documents, you can proceed to fill out the form. Here’s a breakdown of how to do it:

Before submitting your petition, conduct a thorough review using a checklist to ensure it is complete and accurate, preventing potential delays in the process.

Editing and finalizing your petition

After filling out your tax evasion petition form, editing is a crucial step. Utilizing pdfFiller’s editing tools can enhance clarity and correctness. This platform offers features that allow you to modify text, add comments, and adjust formatting to present your petition professionally.

Moreover, pdfFiller provides various saving options. You can save your document in multiple file formats such as PDF, Word, or images. Using cloud storage means easy access from anywhere, ensuring you can manage your petitions on the go.

Signing the petition: An essential step

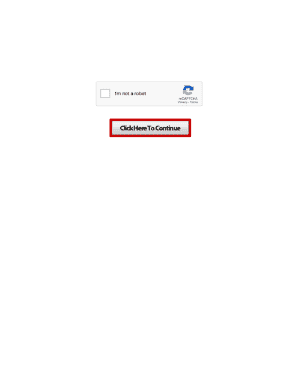

The electronic signing of your petition is a vital step in the legal process. eSigning validates the document, ensuring it is legally binding. You can sign your document within the pdfFiller platform, which includes easy-to-use tools for electronic signatures.

When electronic signing, follow these steps: first, navigate to the signing option in your document. Next, select or create your signature. Lastly, position it correctly within the document. Signature authentication is crucial, as it verifies your identity and affirms the authenticity of your petition.

Submitting your tax evasion petition form

Submitting the tax evasion petition form can be done via various channels, depending on local regulations and preferences. Common methods include online submission through tax authority websites, mailing the hard copy, or delivering it in person at designated tax offices.

Once you submit your form, it’s crucial to have realistic expectations. The timeline for processing can vary based on the complexity of your case and the workload of the tax authority. Typically, you will receive confirmation of your submission and further instructions on the next steps in the legal process.

Managing follow-up and communication

After submitting your petition, managing follow-up is essential. Keeping track of your petition's status can provide peace of mind and prepare you for any upcoming communications with tax authorities. Utilizing tools like pdfFiller enables you to efficiently manage your documents and maintain organized records.

Engaging with legal representatives can also streamline the process. Regular updates from them are vital in navigating the complexities of tax law. pdfFiller supports collaboration, allowing legal teams to access documents quickly and provide timely feedback.

User experiences with tax evasion petitions

Examining case studies can be beneficial in understanding the nuances of tax evasion petitions. Successful petitions often illustrate the importance of clear arguments and thorough documentation. Users have shared their experiences of submitting effective petitions that resulted in favorable outcomes, emphasizing the significance of meticulous preparation.

Moreover, learning from common mistakes can save future petitioners from the same fate. For instance, failing to provide adequate evidence can weaken your position. Testimonials from users of pdfFiller frequently highlight how utilizing its platform made the document preparation process smoother and less stressful.

Advanced tips for effective petition writing

When crafting your tax evasion petition, clarity and conciseness are paramount. Use straightforward language while articulating your claims clearly to avoid misinterpretations. Providing supporting evidence enhances your argument's credibility.

Additionally, using persuasive language in your petition can help present a stronger case. Ensure that your arguments are logically structured, leading the reader through your points effectively. Keeping your narrative direct and focused on the resolution will engage the reader and improve the chances of a favorable outcome.

Interactive tools for petition preparation

pdfFiller offers a range of interactive features designed to simplify petition preparation. These tools include user-friendly templates that allow for quick edits, ensuring you meet legal standards without extensive effort. Tutorials on document management and eSigning guide you through the process smoothly.

Utilizing these interactive features can enhance your experience significantly. From securely editing your documents to ensuring timely electronic signing, pdfFiller caters to all your document management needs in one convenient platform.

Frequently asked questions (FAQ)

As with any legal processes, users often have questions regarding the tax evasion petition. Common inquiries can include how to file properly, the expected duration of the review process, and the potential impact of submissions on existing tax obligations.

pdfFiller supports users throughout their journey, providing resources that address these queries and more. By offering clarity on the submission process, users can feel more confident as they navigate through legal complexities.

Engaging with the community

Engagement is crucial in understanding and navigating the tax evasion petition landscape. pdfFiller encourages community interaction through a dedicated comment section, allowing users to share insights, experiences, and advice.

Joining the community forum can also provide ongoing support and discussions among users facing similar challenges. This interconnectedness fosters an environment of shared knowledge, helping individuals to maneuver the intricacies involved in filing tax evasion petitions effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in sampletax evasion petition without leaving Chrome?

Can I create an electronic signature for the sampletax evasion petition in Chrome?

How do I complete sampletax evasion petition on an Android device?

What is sample tax evasion petition?

Who is required to file sample tax evasion petition?

How to fill out sample tax evasion petition?

What is the purpose of sample tax evasion petition?

What information must be reported on sample tax evasion petition?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.