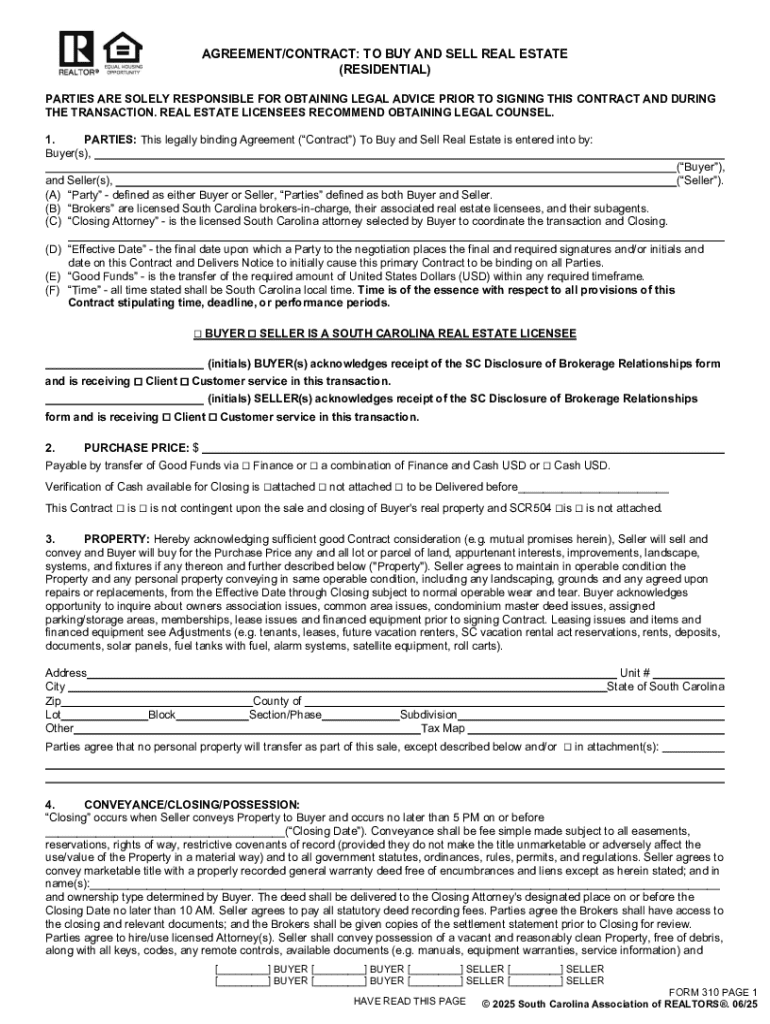

Get the free 2020-2026 SC Form 310 Agreement/Contract: to Buy and Sell ...

Get, Create, Make and Sign 2020-2026 sc form 310

How to edit 2020-2026 sc form 310 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2020-2026 sc form 310

How to fill out 2020-2026 sc form 310

Who needs 2020-2026 sc form 310?

Understanding the 2 SC Form 310 Form: A Comprehensive Guide

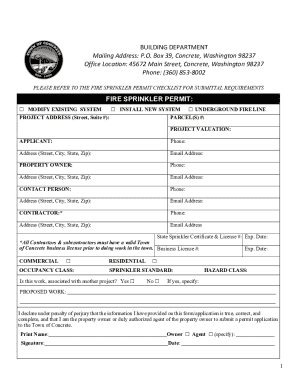

Overview of the SC Form 310

The SC Form 310 is a critical document utilized for various tax-related purposes, particularly in the context of South Carolina state taxes. Designed primarily for individuals and businesses, this form serves multiple functions, including reporting income, filing for deductions, and claiming credits under specific regulations set forth by the South Carolina Department of Revenue. Understanding the intricacies of this form is essential for ensuring compliance and making the most of available tax benefits.

For individuals, the SC Form 310 may be used to report income from various sources, while businesses may need it to reconcile state taxes owed against their federal tax filings. With evolving fiscal policies, the role of the SC Form 310 and its updates have become increasingly significant, influencing decision-making for taxpayers across South Carolina.

Key features of SC Form 310

The SC Form 310 consists of several sections that require detailed information for accurate submission. Each section is designed to collect specific data essential for the proper processing of tax obligations. Familiarizing oneself with these sections not only aids in completing the form accurately but also helps in recognizing areas where deductions or credits can be applied.

Notable changes to the SC Form 310 from 2020 to 2026 include revisions in the reporting guidelines, updates in tax credits available, and the introduction of new sections addressing recent financial regulations. These modifications can directly impact users, influencing how they prepare their tax returns and the benefits they may apply for.

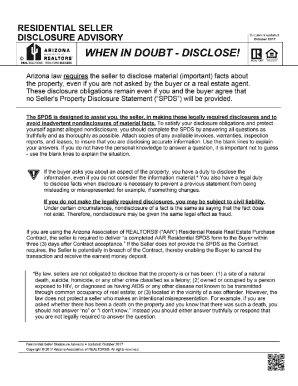

Step-by-step guide to completing SC Form 310

When preparing to complete the SC Form 310, it is crucial to gather all required information and documentation beforehand. Key documents may include previous tax returns, W-2 forms, evidence of deductions, and any necessary financial statements. Having these materials at hand will streamline the process and reduce the likelihood of errors.

Filling out the form should be done methodically. Begin with the first section, typically requiring personal identification and income details. Progress through each section diligently, ensuring to double-check entries for accuracy. Common mistakes to avoid include incorrect calculations, failing to include all sources of income, and neglecting to sign the form.

Once the form is completed, a thorough review is essential. Look for any disparities or omissions, and consider utilizing tools like pdfFiller, which allow for easy editing and changes in a digital format. This step can save you from potential headaches caused by inaccuracies.

Submission process for SC Form 310

The submission process for the SC Form 310 can vary depending on individual preferences. Taxpayers can submit electronically through designated online portals, which often expedite processing times, or opt for physical submission via mail. It's essential to be aware of the various submission options available to ensure timely filing.

Moreover, keeping track of important deadlines is vital. For the fiscal years 2, the deadlines for submission coincide with the general tax season periods, typically falling on April 15th, unless otherwise specified. Following submission, it is crucial to understand the expected processing times, which can vary based on whether the form was submitted electronically or through mail.

Troubleshooting common issues

Common errors associated with the SC Form 310 can range from incorrect personal information to deficiencies in tax calculations. These mistakes can lead to delays in processing and potential penalties. Identifying these common pitfalls beforehand can significantly enhance the submission experience.

In case issues arise that cannot be resolved independently, reaching out for assistance is crucial. The South Carolina Department of Revenue provides resources for taxpayers to seek help regarding their forms. Utilizing available support services can clarify doubts and offer guidance.

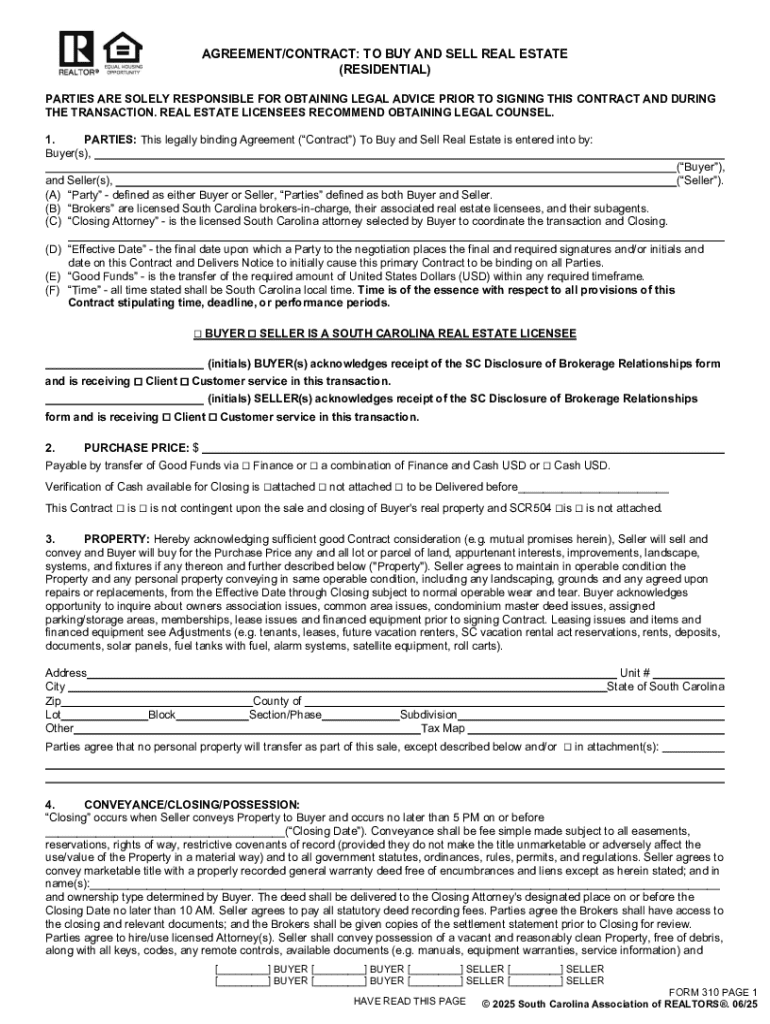

Using pdfFiller for enhanced document management

pdfFiller offers a variety of features designed to facilitate easier document management when dealing with forms such as the SC Form 310. Beyond basic editing capabilities, pdfFiller allows users to eSign and share documents seamlessly, making it an invaluable tool for efficient tax preparation.

Using pdfFiller, users can quickly upload the SC Form 310, make necessary edits, and apply digital signatures, all within a secure cloud-based environment. This streamlines the entire document management process, reducing the time and effort required for document handling.

Furthermore, organizations can benefit from collaborative features within pdfFiller, allowing team members to review, comment, and provide feedback on the SC Form 310 before final submission. This collaborative approach fosters greater accuracy and compliance.

Interactive tools available on pdfFiller

One of the standout features of pdfFiller is its fillable form capabilities. Users can take advantage of interactive fields within the SC Form 310, enabling easy input of relevant data without the hassle of printing and scanning.

The platform also incorporates robust e-signature capabilities, providing a secure method for digitally signing the SC Form 310. This feature is particularly beneficial for users seeking to streamline the signing process and maintain compliance with legal standards for electronic documents.

Real-life examples and case studies

Numerous individuals have successfully navigated the complexities of the SC Form 310. For example, a small business owner managed to claim significant tax credits by carefully documenting income and expenses, ultimately leading to a substantial refund. This case underscores the importance of thorough preparation.

Similarly, a freelancer utilized the SC Form 310 to reconcile discrepancies in their reported income, simplifying their tax filings and ensuring compliance with state regulations. Such examples highlight the effective use of the SC Form 310 in maximizing tax benefits.

Future changes and considerations

Looking ahead, predictions for changes to the SC Form 310 from 2026 and beyond suggest potential adjustments in tax credits, changes in reporting requirements, and adaptations to reflect emerging economic trends. Staying informed about these changes is crucial for taxpayers aiming to maintain compliance.

To ensure ongoing compliance and awareness, taxpayers should regularly review updates from the South Carolina Department of Revenue and adjust their filing practices accordingly. Developing a habit of staying current with regulatory changes can save taxpayers from potential complications in the future.

Summary of key points

A thorough understanding of the SC Form 310 is essential for effective tax management in South Carolina. Key tips for completing the form include detailed preparation, precise information entry, and utilizing tools like pdfFiller to facilitate the process.

The value of employing pdfFiller as a document management tool cannot be overstated. Its features promote enhanced accuracy, collaboration, and efficiency, making it an ideal solution for individuals and teams navigating the complexities of tax documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2020-2026 sc form 310 directly from Gmail?

How can I edit 2020-2026 sc form 310 on a smartphone?

How do I fill out the 2020-2026 sc form 310 form on my smartphone?

What is 2020-2026 sc form 310?

Who is required to file 2020-2026 sc form 310?

How to fill out 2020-2026 sc form 310?

What is the purpose of 2020-2026 sc form 310?

What information must be reported on 2020-2026 sc form 310?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.