Get the free Return of Allotment of SharesSH01 form

Get, Create, Make and Sign return of allotment of

Editing return of allotment of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return of allotment of

How to fill out return of allotment of

Who needs return of allotment of?

Understanding the Return of Allotment of Form: A Comprehensive Guide

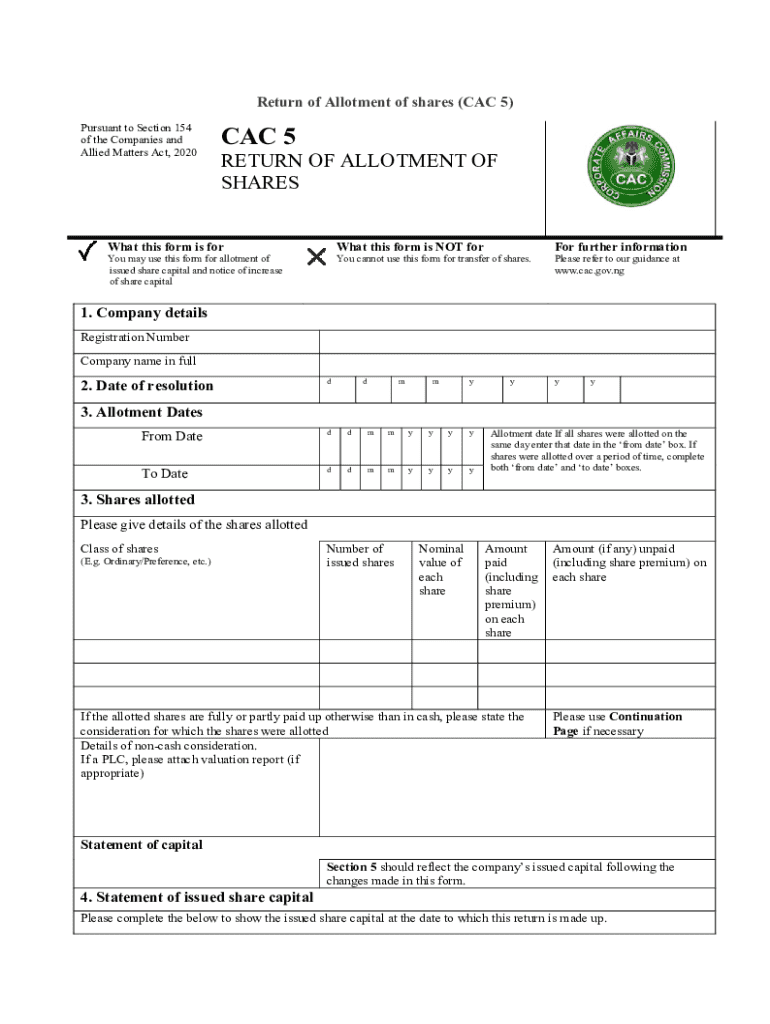

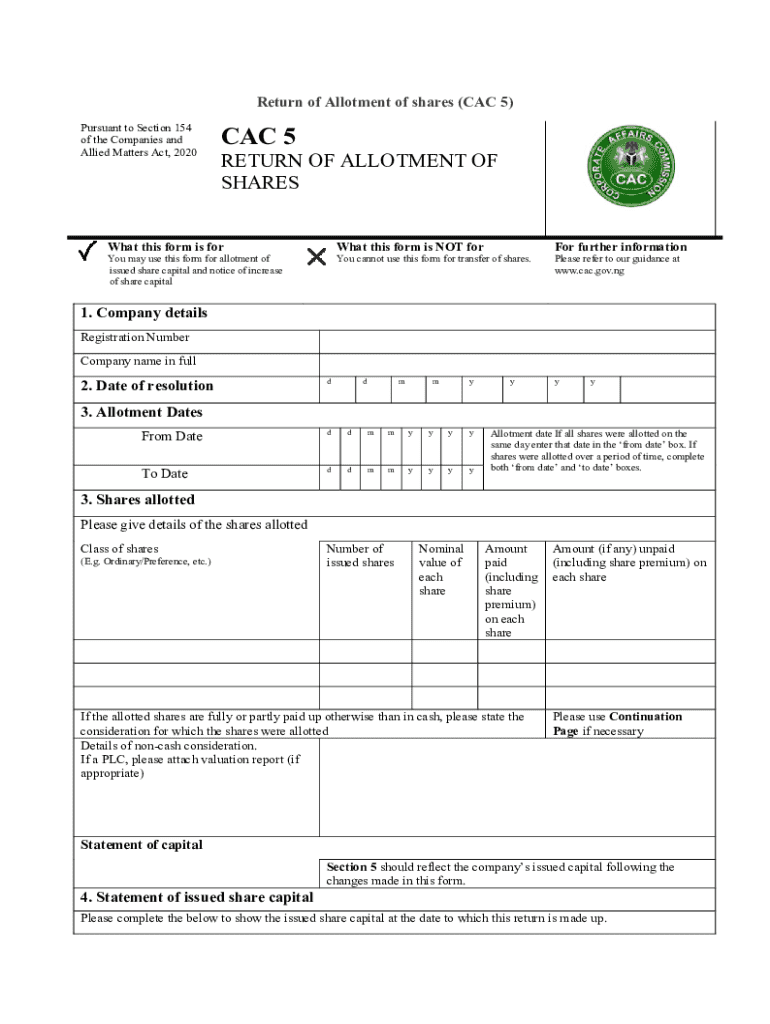

Understanding the return of allotment of shares

The return of allotment of shares is a formal document submitted by companies to notify the relevant authorities about the issuance of new shares. It serves as a critical component in maintaining transparency and regulatory compliance within the corporate structure. The main purpose of filing this return is to inform stakeholders about the changes in the company’s capital structure, thereby ensuring that newly allotted shares are officially recorded.

Filing the return of allotment is crucial as it not only legally protects the company’s interests but also informs shareholders and potential investors of changes in shareholding. This process is especially important for companies looking to boost their capital and attract new investments. Understanding key terminology such as share classes, allotment, and director authorization within this context can help stakeholders navigate the complexities of share issuance.

Key takeaways about the return of allotment

A few summarized insights on the return of allotment of form include its necessity in fostering trust among shareholders and regulatory bodies. It reinforces the validity of new shares issued and prevents potential disputes over ownership. Compliance with filing deadlines also builds credibility, ensuring that the company's documents are always up-to-date.

A common misconception is that smaller companies can disregard this paperwork as it's only for larger corporations. In reality, every company, regardless of size, must comply with these requirements to ensure transparency and legal protection for both the company and shareholders.

How to complete a return of allotment of shares

Completing a return of allotment of shares can be straightforward if approached systematically. This section provides a step-by-step guide to effectively prepare and file the form.

Taking the time to meticulously gather documents and verify information can save significant hassle later. Resources like pdfFiller can facilitate this process, especially when it comes to electronic submissions.

Directors' authority in share allotments

The authority of directors in share allotments is a significant aspect of corporate governance. Directors typically have the power to allot shares as dictated by the company's articles of association. Understanding the legal framework governing this authority is essential for ensuring compliance. Generally, board meetings must approve any share allotment and keep clear records of the resolutions passed.

Best practices for documentation include maintaining accurate minutes of meetings and ensuring that all relevant documents, such as confirmation statements, are current. By adhering to these practices, companies can ensure transparency and mitigate potential disputes among shareholders.

Checking for pre-emption rights and other considerations

Pre-emption rights grant existing shareholders the right to purchase new shares before they are offered to external parties. Understanding these rights is crucial, as failing to comply could lead to legal challenges from shareholders feeling entitled to partake in an allotment. Verify the rights of existing shareholders according to company statutes to ensure compliance and prevent litigation.

Regular checks and balances concerning compliance with pre-emption rights not only safeguard against potential disputes but also reinforce shareholder trust in the company's governance.

Common issues and troubleshooting tips

While filing the return of allotment of form is generally straightforward, issues can arise. Common errors include missing information, incorrect shareholder details, and delays in submission. To avoid these pitfalls, it's advisable to clarify all requirements well in advance of deadlines and seek help if needed.

Actively streamlining the process and having a dedicated compliance team can significantly minimize issues related to the submission of the return of allotment of form.

Interactive tools and resources

Using tools like pdfFiller can streamline the document creation and management process, especially in relation to the return of allotment of form. Several features allow users to fill out forms interactively, ensuring an efficient and accurate submission cycle.

By integrating these resources into your workflow, you can drastically improve the efficiency of your document management processes.

Real-world examples and case studies

Numerous companies have successfully navigated share allotments while ensuring compliance. For instance, a growth-stage startup that meticulously documented its allotment process not only secured additional funding but also retained the trust of its shareholders. On the flip side, a well-established firm faced backlash and legal challenges due to improper handling of share issuance, prompting a revision of their internal compliance protocols.

These real-world scenarios illustrate the importance of vigilance and diligence throughout the return of allotment process. Lessons learned can serve as valuable insights for companies of all sizes.

About the author

The author is an experienced business consultant specializing in corporate governance and compliance. With extensive knowledge in managing corporate documents and regulatory requirements, they provide insights that empower companies to navigate the complexities of share allotments and other legal necessities.

Having written a series of articles on corporate compliance and document management, the author aims to make intricate subjects accessible to a wider audience.

Engage and share your thoughts

We encourage readers to engage in the discussion. Share experiences, ask questions, or provide insights regarding their own practices concerning share allotments. The comments section is an essential platform for fostering a community of knowledgeable stakeholders.

Related content and further reading

For those interested in delving deeper into related topics, numerous articles on corporate compliance, share issuance processes, and effective document management strategies are available. These guides provide practical insights that can assist in aligning business practices with legal requirements.

Stay updated with pdfFiller

Subscribing for updates from pdfFiller can keep you informed about the latest document management solutions, upcoming webinars, and workshops designed to enhance your proficiency in handling essential business documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my return of allotment of directly from Gmail?

How do I edit return of allotment of in Chrome?

How do I edit return of allotment of on an Android device?

What is return of allotment of?

Who is required to file return of allotment of?

How to fill out return of allotment of?

What is the purpose of return of allotment of?

What information must be reported on return of allotment of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.