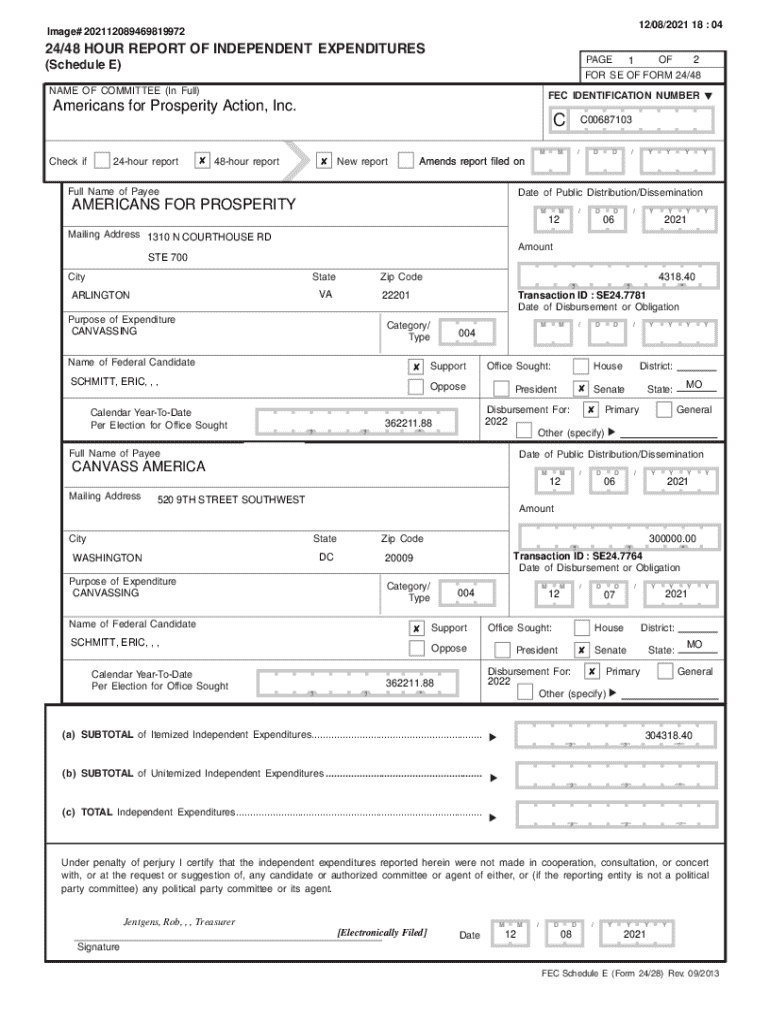

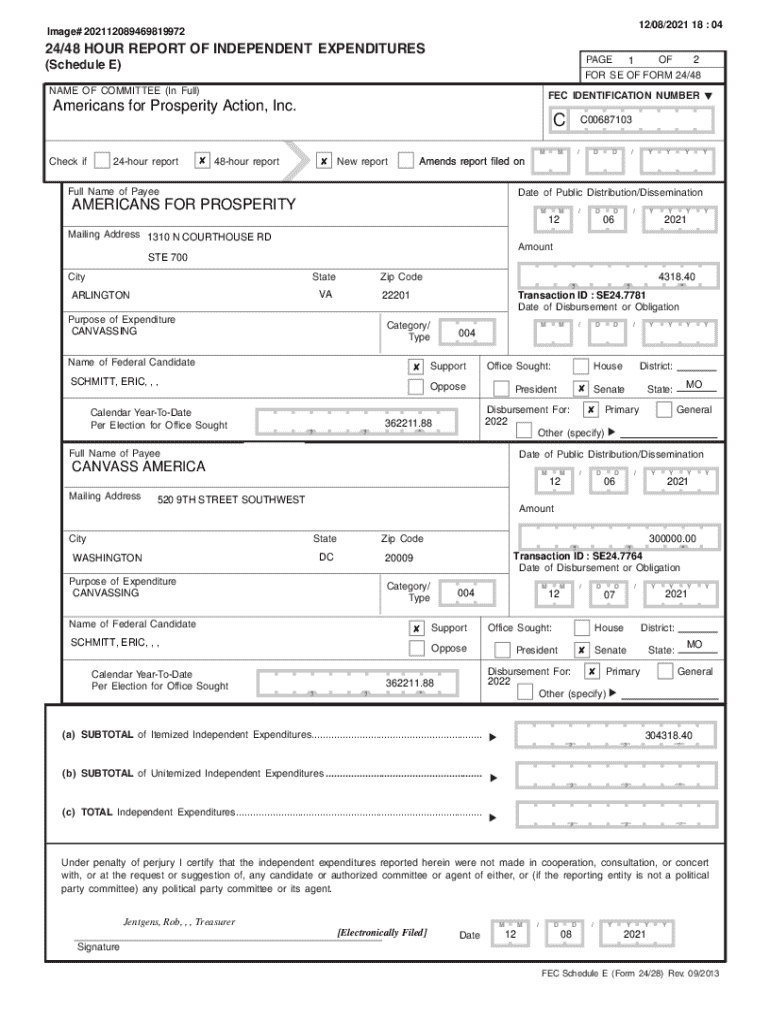

Get the free Mailing Address 1310 N COURTHOUSE RD

Get, Create, Make and Sign mailing address 1310 n

Editing mailing address 1310 n online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mailing address 1310 n

How to fill out mailing address 1310 n

Who needs mailing address 1310 n?

Complete Guide to the Mailing Address on the 1310 N Form

Understanding the importance of the mailing address

Accurate mailing addresses are crucial for proper communication and document receipt. When filling out the 1310 N Form, the mailing address ensures that the intended recipient receives essential notifications and confirmations regarding tax matters. Errors in mailing addresses can lead to delays in processing, missed communications, and potential legal ramifications.

Common scenarios requiring precise mailing addresses include tax filings, legal documents, and government correspondence. For instance, when submitting the 1310 N Form to the IRS, an incorrect address may result in lost tax refunds or demands for additional documentation. Therefore, understanding how to correctly fill out the mailing address section is vital to ensuring smooth communication.

Overview of the 1310 N Form

The 1310 N Form is utilized to claim a refund on behalf of a deceased taxpayer. This form is essential for beneficiaries and surviving family members to retrieve any tax refunds owed before the taxpayer's passing. By completing the form accurately, claimants can navigate the tax implications associated with such claims.

Key features of the 1310 N Form include its requirement for detailed taxpayer information, the relationship of the claimant to the deceased, and the mailing address section that ensures correspondence reaches the right hands. The form must be filed with the IRS under certain conditions involving refunds, and it’s crucial for filers to understand when and where to submit it to avoid complications.

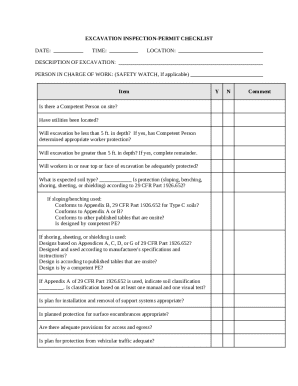

Step-by-step guide to filling out the mailing address section of the 1310 N Form

Locating the mailing address section

The mailing address section is typically found in the upper portion of the 1310 N Form. It precedes the sections requiring personal information about the deceased taxpayer and claimant. Spotting this area early ensures you can allocate adequate attention to ensure accuracy.

Inputting your information

When entering your mailing address, follow these guidelines: first, use a clear and consistent format. Start with the street address, followed by the city, state, and zip code. Avoid using abbreviations unless they are standard, such as 'St' for 'Street.' It's important to enter your address exactly as it appears in your utility bills or other official documents to ensure consistency.

Special considerations

If you have multiple addresses, such as a P.O. Box and a physical address, use the one where you would like to receive correspondence. It’s crucial to select an address where you can securely access mail, especially given the sensitive nature of tax documents.

For added reliability, consider validating your mailing address before submission. Use online validation tools or check databases to make sure your address is recognized and formatted correctly.

Interactive tools for filling out the 1310 N Form

pdfFiller offers robust online tools to streamline the completion of the 1310 N Form. Utilizing features like auto-fill, users can save time by setting up profiles that retain their common information. This tool is incredibly beneficial for those who frequently fill out forms or manage similar documents.

Additionally, pdfFiller provides templates specifically designed for the 1310 N Form, allowing users to complete their submissions more quickly and efficiently. With its real-time collaboration features, teams can work together on the same document, making it easier to ensure accuracy before submission.

Troubleshooting common issues with the mailing address

Users occasionally encounter issues with their mailing addresses being rejected or flagged during submission. Common scenarios include addresses not matching IRS databases or improper formatting. If your address is rejected, double-check every detail for accuracy, and consider contacting the IRS or pdfFiller support for clarification. Keeping a record of your previous communications can expedite resolution processes.

For more unusual issues, having reliable contact details for support will be invaluable. Utilize pdfFiller’s extensive help resources for quick answers or reach out to the IRS directly for tax-related inquiries.

Managing your 1310 N Form effectively with pdfFiller

Saving and storing your form

pdfFiller provides excellent cloud storage options, allowing users to save their 1310 N Forms securely. Users can easily access their documents from various devices and never worry about losing important information due to physical damage or loss. The platform's organization features allow for easy retrieval when needed.

Sharing and collaborating

Sharing your completed 1310 N Form with other stakeholders is straightforward. With pdfFiller, users can send documents securely while ensuring that sensitive data remains protected. Collaborating on form edits is easier when each member can comment and suggest adjustments in real time, enhancing productivity and accuracy.

Keeping track of changes

Maintaining version control for your forms is critical. pdfFiller offers features that allow users to audit changes made to the mailing address section and other parts of the document. By tracking edits and versions, you ensure that you can revert back if necessary and maintain a clear history of how the form has changed.

Legal aspects of using the 1310 N Form

Completing the 1310 N Form requires compliance with both federal and state tax regulations. Understanding these can help avoid legal issues. It's crucial to ensure the accuracy of all information submitted, especially the mailing address, as incorrect submissions could result in penalties or paperwork delays.

Privacy concerns also play an important role when submitting personal and sensitive information through the 1310 N Form. Be cautious and ensure you’re using secure methods when sharing your form, either through pdfFiller or other platforms, to avoid data breaches.

Frequently asked questions about the mailing address and 1310 N Form

Many users have questions regarding the 1310 N Form, particularly about the mailing address. One common misconception is that any address can be used. In reality, it is essential to provide a mailing address where you can receive official IRS correspondence reliably.

Another frequent inquiry relates to the timeframe for submitting the form. Users often wonder about deadlines and how they affect their claims. It's wise to check the IRS website for up-to-date filing deadlines and guidance to avoid complications.

How pdfFiller enhances your form completion experience

The cloud-based nature of pdfFiller offers significant advantages for document management, especially for tasks like completing the 1310 N Form. Accessing your documents from anywhere allows for flexibility and convenience, making it easier for users to manage their forms on the go.

Moreover, pdfFiller's features simplify the form-filling process immensely. Users benefit from elimination of paper forms, the efficiency of electronic submission, and streamlined collaboration options. The combination empowers individuals and teams to manage their documentation effortlessly and effectively.

Using the 1310 N Form in different scenarios

Adaptation of the 1310 N Form and the accompanying mailing address is necessary based on user needs. For individuals settling estates or claiming refunds, ensuring accuracy in all sections, including the mailing address, is imperative to facilitate smooth transitions and claims.

In business scenarios, understanding when the 1310 N Form applies enables companies to manage finances better, particularly in instances of a key employee’s passing. Tailoring the information to fit professional standards can make substantial differences, helping to maintain compliance and nurture transparency within the organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find mailing address 1310 n?

Can I create an electronic signature for signing my mailing address 1310 n in Gmail?

How do I complete mailing address 1310 n on an iOS device?

What is mailing address 1310 n?

Who is required to file mailing address 1310 n?

How to fill out mailing address 1310 n?

What is the purpose of mailing address 1310 n?

What information must be reported on mailing address 1310 n?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.