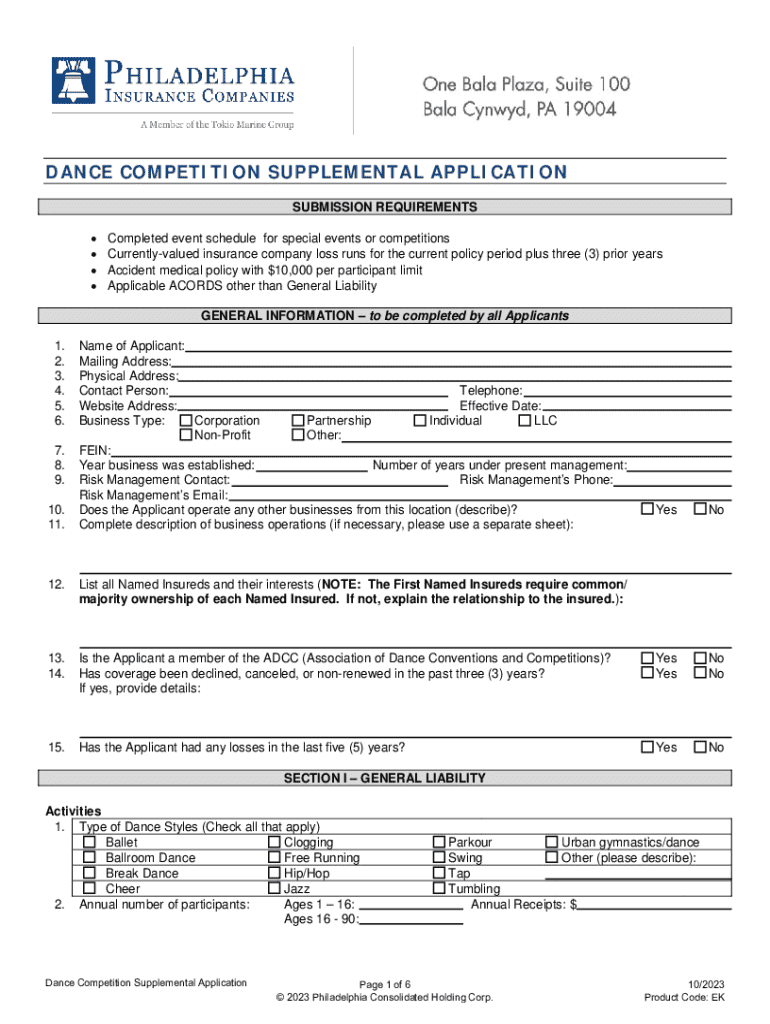

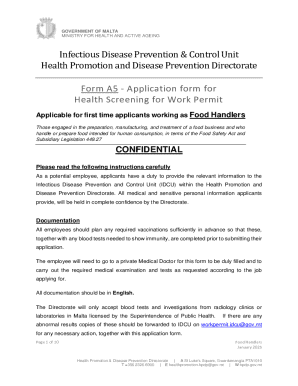

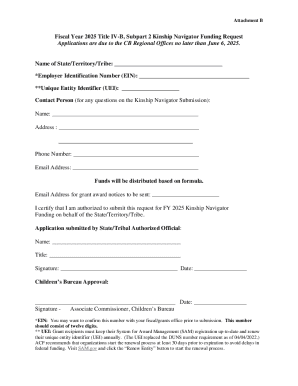

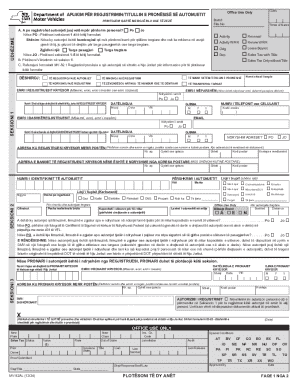

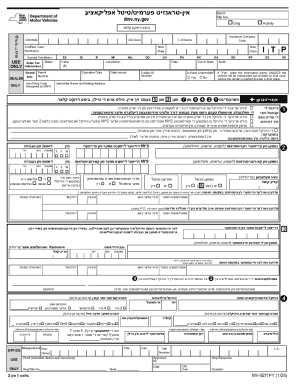

Get the free Fill out Tax Form For Industrial Automation

Get, Create, Make and Sign fill out tax form

How to edit fill out tax form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fill out tax form

How to fill out fill out tax form

Who needs fill out tax form?

A Comprehensive Guide to Filling Out Your Tax Form

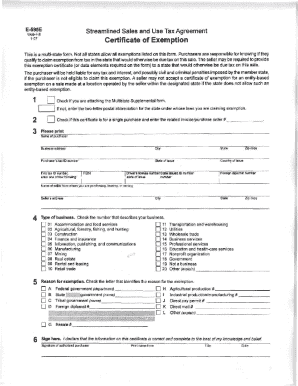

Understanding tax forms

Tax forms are crucial documents that aid in reporting your income, deductions, and credits to the government. Navigating the maze of tax forms can be intimidating, but understanding them is the first step to successful tax filing.

Tax forms primarily come in two categories: federal and state. Federal forms are standardized across the country, while state forms vary by jurisdiction, reflecting the unique tax regulations of each state. Some of the most commonly used tax forms include the 1040 (Individual Income Tax Return), W-2 (Wage and Tax Statement), and 1099 forms (various types for reporting income).

Accurate tax filing is vital, as mistakes can lead to discrepancies and even penalties, causing unnecessary stress during tax season.

Preparing to fill out your tax form

Before diving into filling out your tax form, preparation is key. Gather necessary documents to streamline the process and ensure accuracy. Begin with personal identification information such as your Social Security number and address. Having this on hand will make filling out your form much smoother.

Next, collect income statements, including W-2s from your employer and 1099s if you have additional income sources. If you are a student, remember to include any scholarship funds as well. Additionally, it's essential to have documentation for any deductions and credits you plan to claim.

Choosing the right tax form is essential based on your situation. Analyze your income sources, and determine whether you qualify for standard deductions or if itemizing fits your scenario better. This decision largely depends on your specific income situation, as some students working part-time may be eligible for education-related deductions, providing significant savings.

Step-by-step guide to filling out your tax form

Filling out your tax form can seem daunting, but following a structured process helps simplify it. Start with the personal information section. This part is critical—ensure you spell everything correctly, as errors here can lead to delays or issues with your submission.

Move on to income reporting, where each income type must be accurately recorded. Employment income is typically straightforward, as it flows from your W-2 forms. For investment income, you'll need to account for dividends, interest, or capital gains which are reported on various 1099 forms.

If you are self-employed, you'll complete a Schedule C alongside your 1040 form to report your earnings accurately. This step requires attention to detail, as it will impact your overall tax liability.

Next, claim deductions and credits. This part can significantly reduce your taxable income, so understanding your eligibility is vital. For students, tax credits like the American Opportunity Credit or the Lifetime Learning Credit may be available.

Now proceed to calculate your tax liability using the tax tables provided by the IRS. This data helps you determine how much tax you owe based on your income bracket.

Finally, ensure your form is signed and submitted properly. eSigning options can be found on pdfFiller, facilitating a more efficient submission process compared to traditional mail. You have the option of e-filing, which is faster and often provides quick processing times, or mailing your tax return through the postal service.

Tips for a smooth tax filing experience

Making the tax filing process easy is about organization and knowledge. Utilize interactive tools that guide you throughout the process, helping to prevent confusion and ensuring you meet all requirements. Using a checklist for document preparation and form completion is beneficial.

Common mistakes involve miscalculating income or overlooking deductions, which can be mutual pitfalls. Double-check your entries to avoid such disruptions.

Tracking your tax submission

After submitting your tax form, tracking your submission status is essential. The IRS provides a tool for checking the status of your return, offering peace of mind that your filing was successfully received.

Should you discover that an amendment is necessary, know the steps for altering your tax form. File an amended return using Form 1040-X, keeping thorough records of why you are making changes. Be aware that the IRS may notify you if there are discrepancies or if further information is required.

Managing your tax documents post-filing

Once your taxes are filed, managing your documents effectively is crucial. Store your records securely in both digital and physical formats. The IRS recommends keeping records for at least three years to support your returns in case of an audit.

The ease of access to your past filings will also help you prepare future taxes, as they provide a reference for income and deductions claimed.

Frequently asked questions about tax filing

Questions often arise during the tax filing process. For example, what should you do if you miss the filing deadline? Understand that filing an extension is an option, but late fees may apply to any unpaid taxes.

If you face complexities with your tax form, reaching out to customer support or tax professionals can help clarify any confusion. Furthermore, handling audits require careful documentation, so always ensure your information is well-organized.

Staying updated on tax changes

Tax laws can frequently change, affecting how you fill out tax forms. Regularly checking the IRS website and other reliable resources helps you stay informed about new regulations or deductions.

Monitoring these updates ensures that you are not missing out on potential savings and allows for compliance with updated tax laws.

Conclusion on the tax filing journey

Filing your taxes may seem overwhelming, particularly for first-time filers. However, by leveraging tools like pdfFiller, the process becomes less cumbersome as you access templates and guidance throughout each step.

Remember, the benefits of accurate tax filing and organized document management extend beyond the current year, helping you maintain good standing with the IRS and manage your finances effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get fill out tax form?

How do I edit fill out tax form online?

How do I complete fill out tax form on an iOS device?

What is fill out tax form?

Who is required to file fill out tax form?

How to fill out fill out tax form?

What is the purpose of fill out tax form?

What information must be reported on fill out tax form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.