Get the free SBA 504 Loan Application Checklist: All Documents You'll ...

Get, Create, Make and Sign sba 504 loan application

Editing sba 504 loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sba 504 loan application

How to fill out sba 504 loan application

Who needs sba 504 loan application?

Comprehensive Guide to the SBA 504 Loan Application Form

Understanding the SBA 504 Loan Program

The SBA 504 loan program is designed to promote economic development by providing long-term financing to small businesses for fixed assets. By offering below-market rates and terms, the SBA 504 loans help businesses acquire real estate, purchase equipment, or modernize facilities while preserving working capital.

Eligibility for the SBA 504 loans typically extends to small businesses that meet certain size standards, operated for profit, and have a tangible net worth of up to $15 million. This makes it an attractive option for many small businesses looking to fund significant projects.

Detailed overview of the SBA 504 Loan Application Form

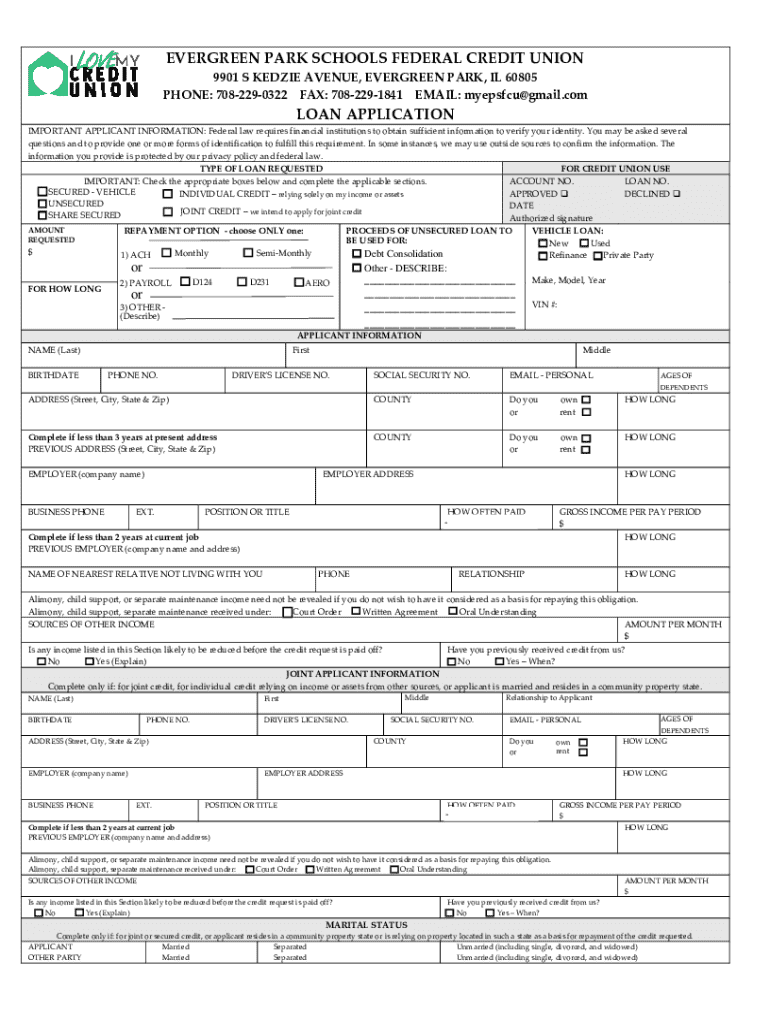

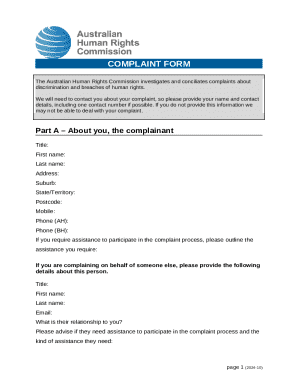

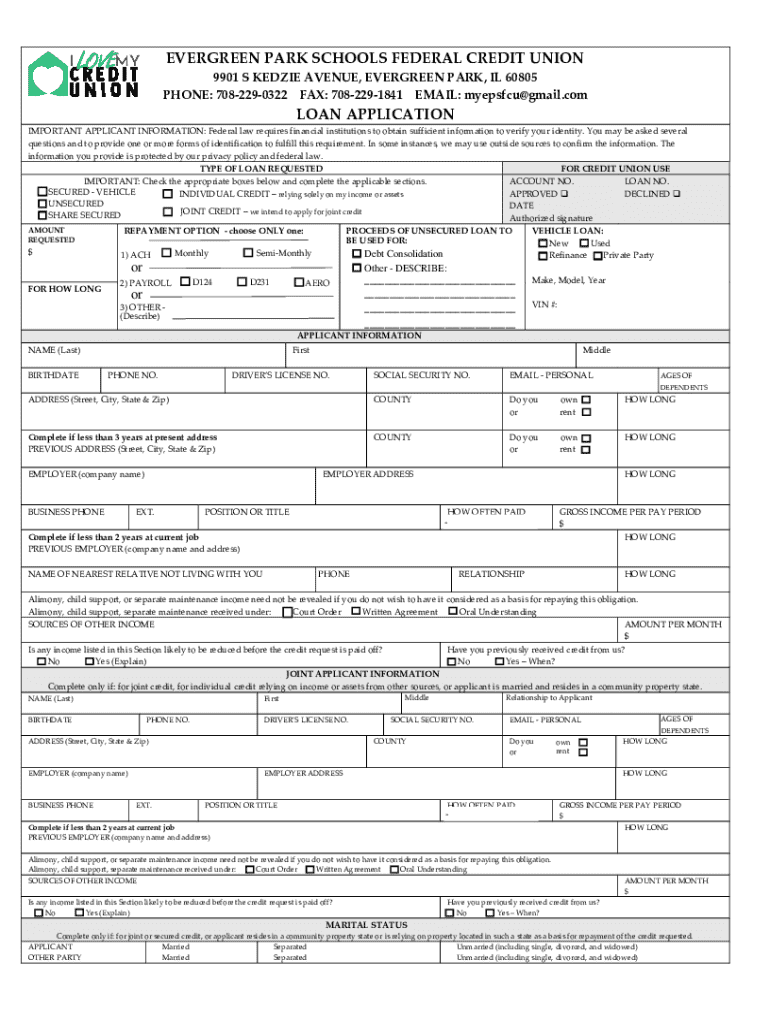

The SBA 504 loan application form is a critical document that businesses must complete to initiate the loan process. This form collects necessary information about the business and the intended use of the funds, serving as a foundation for the loan application package.

Completing the SBA 504 loan application form accurately is vital, as it supports the lender’s assessment of financial viability and overall alignment with eligibility criteria. The form typically includes sections for detailed business and personal information, loan specifications, and necessary financial statements.

Step-by-step guide on filling out the SBA 504 Loan Application Form

Before beginning to fill out the application form, it is crucial to gather all required documentation. This typically includes business financial statements, personal financial statements of owners, a business plan, and any other relevant disclosures that may support the application.

The application form is divided into various sections that collect essential information about the business. Each section must be carefully completed to ensure an accurate representation of the business and its financial needs.

Common pitfalls to avoid

Completing the SBA 504 loan application form is a meticulous process; however, many applicants falter by submitting incomplete forms or failing to include necessary documents. Omitting financial statements or not providing comprehensive responses can delay processing or result in rejection.

Another significant pitfall is the misrepresentation of financial information. Providing inaccurate data, whether intentional or not, can cause complications in the approval process and could lead to legal repercussions. Additionally, not adhering to the specific guidelines provided by the SBA may also hinder your chances of securing a loan.

Editing and collaborating on the SBA 504 Loan Application Form

Editing the SBA 504 loan application form can be seamless with tools like pdfFiller. This platform allows users to fill in the form digitally, making it easier to correct mistakes, update information, and make essential changes in real time.

pdfFiller offers tools for digital signatures, making it simple for all stakeholders to review and authorize the application. Collaboration is further enhanced through options to share the document with partners or advisors, ensuring that all input is considered before finalizing the submission.

eSigning the SBA 504 Loan Application Form

Electronic signatures have streamlined the process of submitting documents, including the SBA 504 loan application form. This adds an extra layer of efficiency, as applicants can sign anywhere, anytime, directly through pdfFiller.

To eSign using pdfFiller, simply follow the prompts to create a digital signature, which can be applied directly to the application form. Security is a paramount feature, ensuring that sensitive personal and financial information remains protected throughout the entire process.

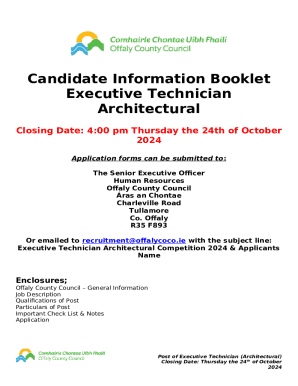

Submitting your completed SBA 504 Loan Application

After completing the SBA 504 loan application form and ensuring that all necessary documents are included, the next step is to submit the application to the appropriate SBA office. This can usually be done via mail or in-person, depending on local practices.

Upon submission, applicants should be prepared for various processing timelines, which can vary significantly based on the local SBA office workload and the complexity of the application. Keeping track of your application's status through the SBA channels is advisable, as it can provide insights into any potential issues or requirements for additional information.

Managing your SBA 504 Loan application post-submission

Once you have submitted your SBA 504 loan application, it is crucial to stay engaged with the process. Monitoring the status of the application will help you know where it stands and if any follow-up actions are necessary from your side.

Responding promptly to any inquiries from the SBA is essential, as this can affect the processing time. If you find a need to amend your application due to changing circumstances or new information coming to light, be sure to communicate this directly to your SBA representative.

Resources and tools for successful SBA 504 Loan Applications

Utilizing tools like pdfFiller not only expedites the SBA 504 loan application process but will also benefit future document management needs. Regular updates and financial calculators on various websites can aid in anticipating loan costs and implications.

Furthermore, connecting with local SBA offices and utilizing their resources can provide invaluable personalized guidance. Local assistance programs may also offer workshops or one-on-one support to navigate the application, ensuring that you are prepared for every step.

Related documents and forms

There are various other forms and documents typically associated with the SBA 504 loan application process. Familiarizing yourself with these can streamline your experience and enhance your confidence in the submission.

Footer navigation

To enhance your experience further, be sure to explore related pages on the pdfFiller website. Accessing support and assistance via their customer service team can also provide personalized guidance tailored to your specific needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit sba 504 loan application on a smartphone?

How can I fill out sba 504 loan application on an iOS device?

Can I edit sba 504 loan application on an Android device?

What is sba 504 loan application?

Who is required to file sba 504 loan application?

How to fill out sba 504 loan application?

What is the purpose of sba 504 loan application?

What information must be reported on sba 504 loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.