Get the free Hospital Indemnity Portability/Continuation Request

Get, Create, Make and Sign hospital indemnity portabilitycontinuation request

Editing hospital indemnity portabilitycontinuation request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hospital indemnity portabilitycontinuation request

How to fill out hospital indemnity portabilitycontinuation request

Who needs hospital indemnity portabilitycontinuation request?

Hospital Indemnity Portability Continuation Request Form: A Comprehensive Guide

Understanding hospital indemnity insurance

Hospital indemnity insurance is a supplemental coverage designed to provide financial support to policyholders during hospital stays. Unlike traditional health insurance, which covers medical expenses, hospital indemnity plans offer cash benefits directly to the insured. This allows individuals to cover additional out-of-pocket expenses, such as deductibles or non-medical costs that arise during hospitalizations.

The key benefits of hospital indemnity plans include financial security during unforeseen medical emergencies, flexibility in spending the benefits, and simplicity in claims processing. As hospital costs continue to rise, having a hospital indemnity insurance policy can significantly lessen the financial burden, allowing individuals to focus on recovery rather than worrying about bills.

Portability in hospital indemnity insurance refers to the ability to maintain coverage when transitioning between jobs or when there are changes in the policyholder's employment status. This essential feature ensures continuity of coverage without gaps, providing peace of mind to policyholders who may require hospitalization during transitional phases.

Importance of continuation coverage

Continuation coverage is a vital option for individuals who need to maintain their hospital indemnity insurance benefits despite changes in their employment status or other life circumstances. It allows individuals to extend their insurance coverage temporarily without needing to reapply or undergo medical underwriting.

Several scenarios may necessitate continuation coverage, including job loss, changes in employment status, or switching to a different insurance provider. Each of these situations can jeopardize access to healthcare benefits if a transition plan isn't in place. Failing to secure continuation coverage can result in unexpected financial strain due to medical costs that arise during this period.

For instance, suppose an individual loses their job and has no continuation coverage. In that case, any subsequent hospitalization could lead to significant out-of-pocket expenses, highlighting the financial implications of not securing this crucial coverage.

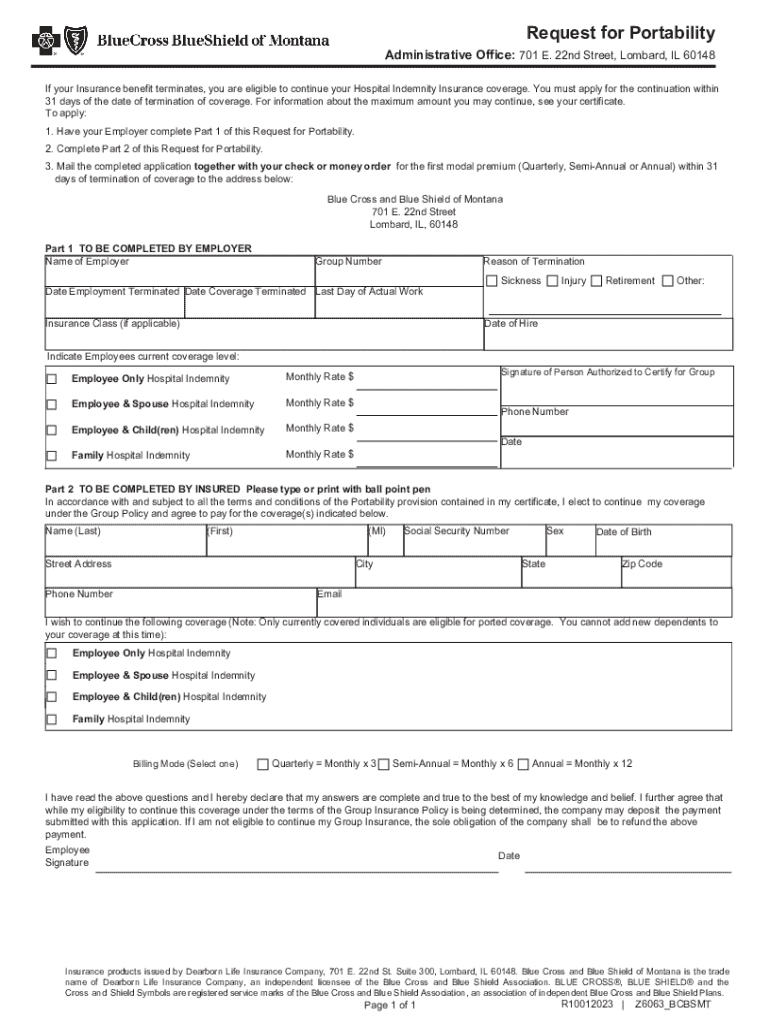

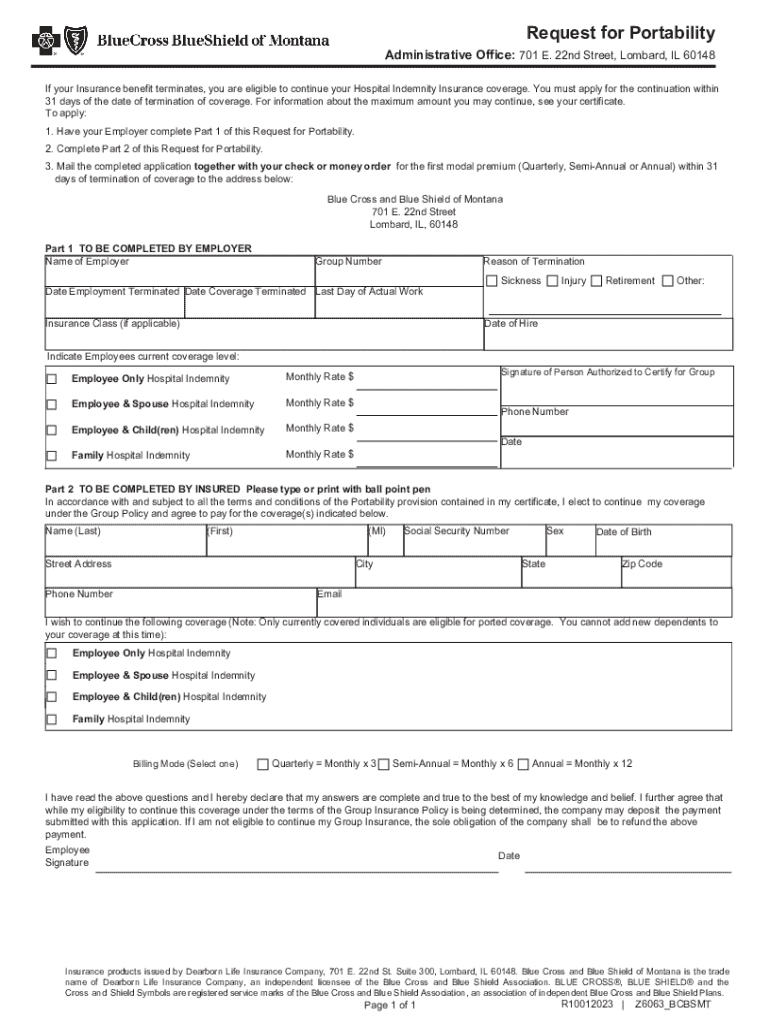

Overview of the portability continuation request form

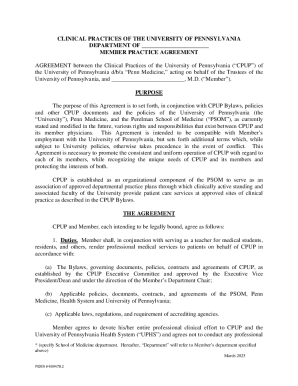

The Portability Continuation Request Form is the official document used to apply for continuation of your hospital indemnity insurance when you transition between jobs or experience other qualifying events. This form is essential for ensuring you maintain uninterrupted coverage during life changes.

This form is intended for individuals covered under a hospital indemnity insurance plan who wish to maintain their benefits. Employees facing job transitions, retirees opting for plans in a new state, or anyone needing to secure their health coverage during military service can utilize this form.

Key terminology often found in the Portability Continuation Request Form includes terms like 'qualified events,' 'coverage options,' and 'health insurance premiums.' Understanding these terms is critical for accurately completing the form and ensuring proper processing of your request.

Step-by-step guide to completing the form

Section 1: Personal Information

The first section requires basic personal information, including your name, address, and contact information. Ensure that this information is accurate as it directly relates to the processing of your request.

Tips for accurate entry in this section include double-checking spelling and verifying that your phone number and email are current to avoid miscommunication with the insurance company.

Section 2: Insurance Information

In this section, you must provide details about your current hospital indemnity policy, including the policy number and the name of the insurance provider. This information helps the insurer verify your existing coverage and process your request efficiently.

Understanding your policy number and associated terms is crucial. Each policy is uniquely identified, and using an incorrect policy number can lead to delays in processing your continuity request.

Section 3: Request details

Here, you will indicate your portability options, whether you wish to continue the same level of benefits or modify them. Important dates and deadlines related to your request should also be noted to ensure that there are no lapses in coverage.

Section 4: Signature and acknowledgment

This final section requires your signature, confirming the information provided is accurate and complete. It is crucial to understand the signature requirement as it legally binds your request.

For those who prefer electronic submission, options for electronic signing using pdfFiller can simplify this process significantly, allowing you to sign from anywhere with an internet connection.

Interactive tools for form management

Utilizing pdfFiller for form editing can greatly enhance your experience when completing the hospital indemnity portability continuation request form. From convenient editing capabilities to e-signature solutions, pdfFiller streamlines the entire process.

Editing your hospital indemnity form on pdfFiller is as simple as uploading the document, making necessary changes, and saving the updates. The tool also allows you to add comments or notes directly on the form, making it easier to track changes or information that needs to be highlighted.

Collaborating with team members on form completion is also made easy. You can share the document with colleagues for input, and secure storage features ensure your forms are kept safe and organized, ready for submission.

Common mistakes to avoid

Completing the portability continuation request form accurately is crucial to avoid delays in processing. Common mistakes include leaving sections incomplete, which can lead to automatic rejection or requests for additional information.

Failing to review the terms of portability is another common pitfall. Before submitting, ensure you understand your options, such as how long your coverage will last and what benefits differ if any changes occur.

Frequently asked questions (FAQs)

One common question involves what to do if your form is rejected. If this occurs, carefully review the feedback provided by your insurer to rectify the issues outlined and resubmit the form promptly.

Another frequently asked question pertains to checking the status of your portability request. Most providers offer online portals where you can view the status or progress of your application, providing peace of mind as you await approval.

Finally, many ask what happens after submission. Generally, once submitted, your request will be assessed and a decision made, which will be communicated via your preferred contact method.

Utilizing pdfFiller for hassle-free document management

One significant advantage of using pdfFiller for document handling is the user-friendly interface it offers. This platform elevates the entire process of completing forms by providing intuitive tools for editing and signing documents.

To navigate the pdfFiller interface effectively, familiarize yourself with its various features, including template documents, e-signatures, and cloud storage options. By incorporating these tools, you can ensure that your documents are handled efficiently and securely.

Many users have shared testimonials about how pdfFiller has simplified their form management processes. From easily accessing necessary forms to collaborating with others, the platform is tailored for individuals and teams seeking a comprehensive document solution.

Additional considerations

When processing portability requests, it's essential to be aware of the typical timeline involved. Generally, the insurer may take several days to weeks to review and process your request, depending on their internal procedures and the completeness of your application.

For further assistance, having contact information readily available for your insurance provider is beneficial. Their customer support team can provide clarity on complicated issues and help guide you through the process of submitting your form.

Ultimately, customer support plays a crucial role in the effective management of your form. Don’t hesitate to reach out with questions or concerns, as they can clarify terms, expedite processes, and ensure you have a stress-free experience managing your hospital indemnity portability continuation request form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my hospital indemnity portabilitycontinuation request directly from Gmail?

Can I sign the hospital indemnity portabilitycontinuation request electronically in Chrome?

How do I fill out hospital indemnity portabilitycontinuation request using my mobile device?

What is hospital indemnity portability continuation request?

Who is required to file hospital indemnity portability continuation request?

How to fill out hospital indemnity portability continuation request?

What is the purpose of hospital indemnity portability continuation request?

What information must be reported on hospital indemnity portability continuation request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.