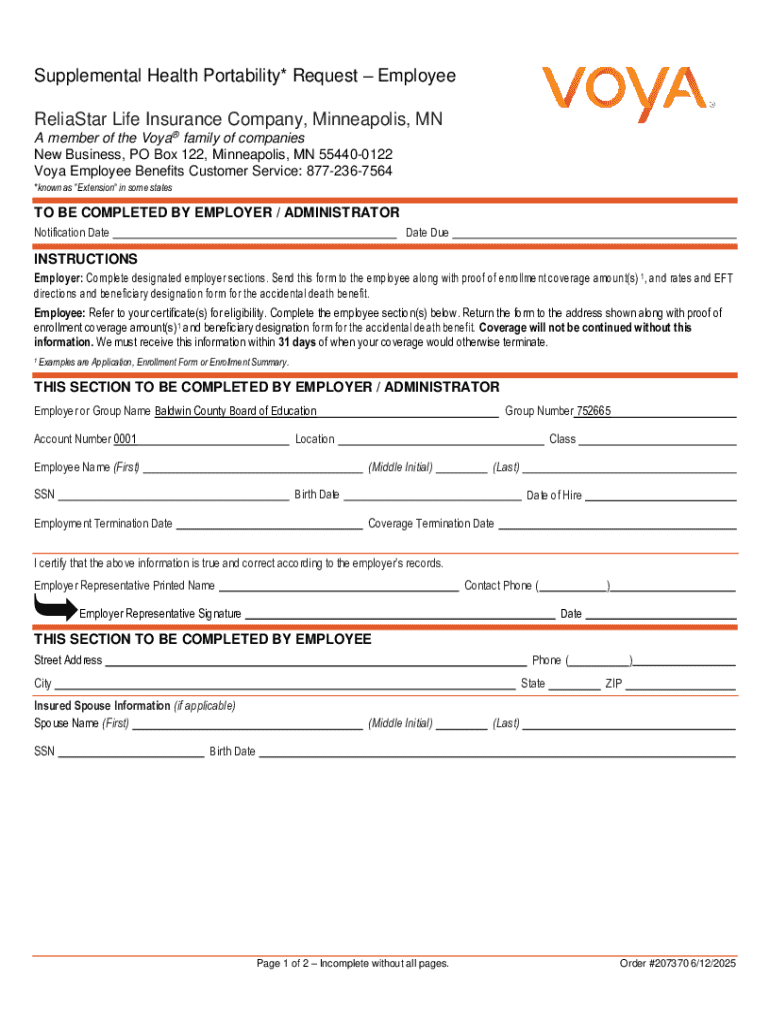

Get the free Short Term Disability Income Insurance Portability* Request

Get, Create, Make and Sign short term disability income

How to edit short term disability income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out short term disability income

How to fill out short term disability income

Who needs short term disability income?

Short Term Disability Income Form: A Comprehensive How-to Guide

Understanding short term disability income

Short term disability income provides financial support to individuals who are temporarily unable to work due to a medical condition, injury, or illness. The purpose of this benefit is to replace a portion of lost income, helping individuals manage their everyday expenses during their recovery. This is vital because many may not have sufficient savings to cover their costs while recovering.

Filing for short term disability is important as it ensures that you receive the support necessary to focus on your health rather than the stress of financial burdens. Moreover, understanding the requirements and processes involved is key to maximizing the potential benefits you can receive.

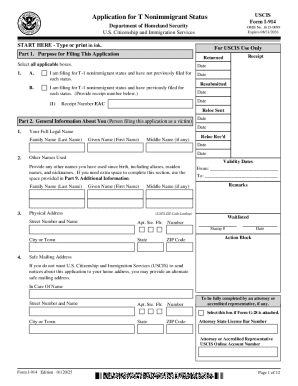

Overview of the short term disability income form

The short term disability income form is a critical document that initiates the claims process for disability benefits. It serves as an official request for financial assistance during a temporary inability to work, detailing necessary information about your health and employment.

Key components of the form typically include:

It’s crucial to avoid common mistakes, such as insufficient detail in medical information or incorrect personal data, as these can delay or even jeopardize your claim.

Preparing to file your short term disability claim

Before submitting your claim, it's essential to determine your eligibility for short term disability benefits. Different states and companies may have varying criteria, and understanding them can save you time and effort. Most plans require that your inability to work is due to a legitimate medical condition verified by your doctor.

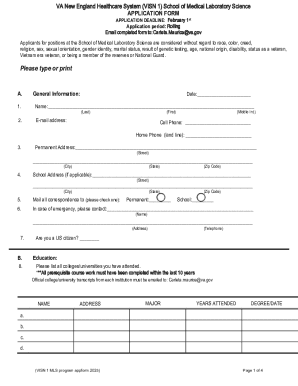

The documentation you'll need typically includes:

To determine if you qualify for benefits, consult your HR department and your insurance provider, or use online eligibility calculators if available.

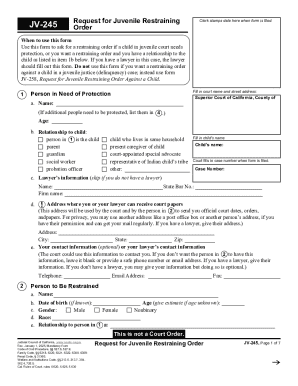

Step-by-step guide to completing the short term disability income form

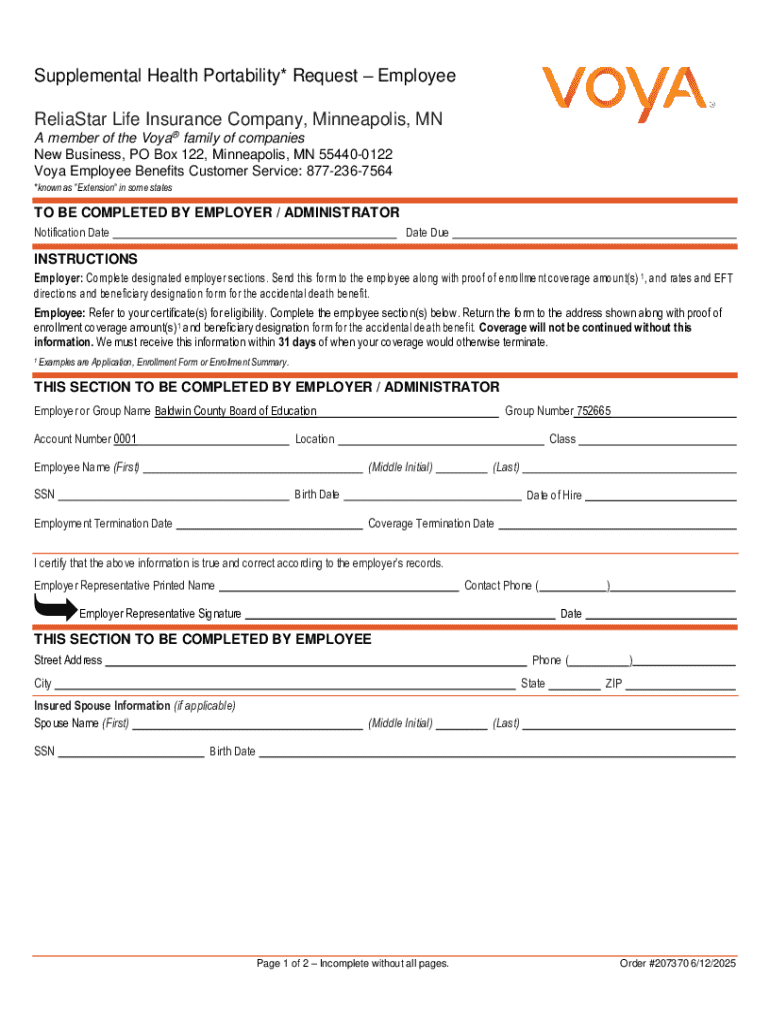

Completing the short term disability income form can be straightforward when you know the steps to take. Start by accessing the form, which is often available online or can be requested in paper format from your HR department.

1. **Accessing the form:** You can typically find it on your employer's benefits portal or insurance provider's website. Online platforms often allow for easier completion and submission, whereas paper forms may be less flexible.

2. **Filling out your personal information:** Input your basic details accurately to avoid processing errors.

3. **Providing medical information:** This portion may need collaboration with your healthcare provider to ensure all necessary details about your medical condition are accurately presented.

4. **Including your employment details:** Make sure to detail your job title, employment duration, and income to support your claim.

5. **Review and double-checking for accuracy:** Before submission, review the entire form for accuracy and completeness. Errors can lead to delays.

6. **Signing the form:** Many platforms now offer eSigning options via pdfFiller, making it easy to finalize your document electronically.

Utilizing pdfFiller tools for easy document management

pdfFiller enhances your experience in managing forms like the short term disability income form by providing a range of editing features. Users can fill in, sign, and even make necessary changes to their documents seamlessly.

Additionally, pdfFiller allows for easy collaboration with teammates who may need input on the document. You can even save and share your completed form directly from the cloud-based platform, ensuring easier access and storage options.

What to expect after submitting your claim

Once your claim for short term disability benefits is submitted, it will undergo a review process. This phase can take several days to weeks, depending on the volume of claims and specific procedures of your insurance provider.

Upon approval, benefits may start to be disbursed shortly after, but the exact timeline can vary significantly. Be prepared for different outcomes:

Frequently asked questions about short term disability claims

Individuals often have specific questions regarding short term disability. For instance, how long benefits can be received generally hinges on the policy terms, but typically range from a few weeks up to six months.

If your claim is denied, be proactive by reviewing the denial reasons and gather the necessary documentation to support your rebuttal. Most insurers allow you to appeal their decisions, which can be imperative for those in need.

Understanding these common queries ensures you stay informed and equipped to manage your claims smoothly.

Engaging with industry professionals

Consulting with medical and legal professionals can provide invaluable insights when filing your short term disability claim. Medical professionals can accurately document your condition while legal experts can guide you through complex policy language.

Having professional guidance not only increases the likelihood of a successful claim but also ensures your rights are protected throughout the process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute short term disability income online?

Can I sign the short term disability income electronically in Chrome?

How do I edit short term disability income straight from my smartphone?

What is short term disability income?

Who is required to file short term disability income?

How to fill out short term disability income?

What is the purpose of short term disability income?

What information must be reported on short term disability income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.