Get the free TREASURER'S

Get, Create, Make and Sign treasurer039s

How to edit treasurer039s online

Uncompromising security for your PDF editing and eSignature needs

How to fill out treasurer039s

How to fill out treasurer039s

Who needs treasurer039s?

Treasurer's Form How-to Guide

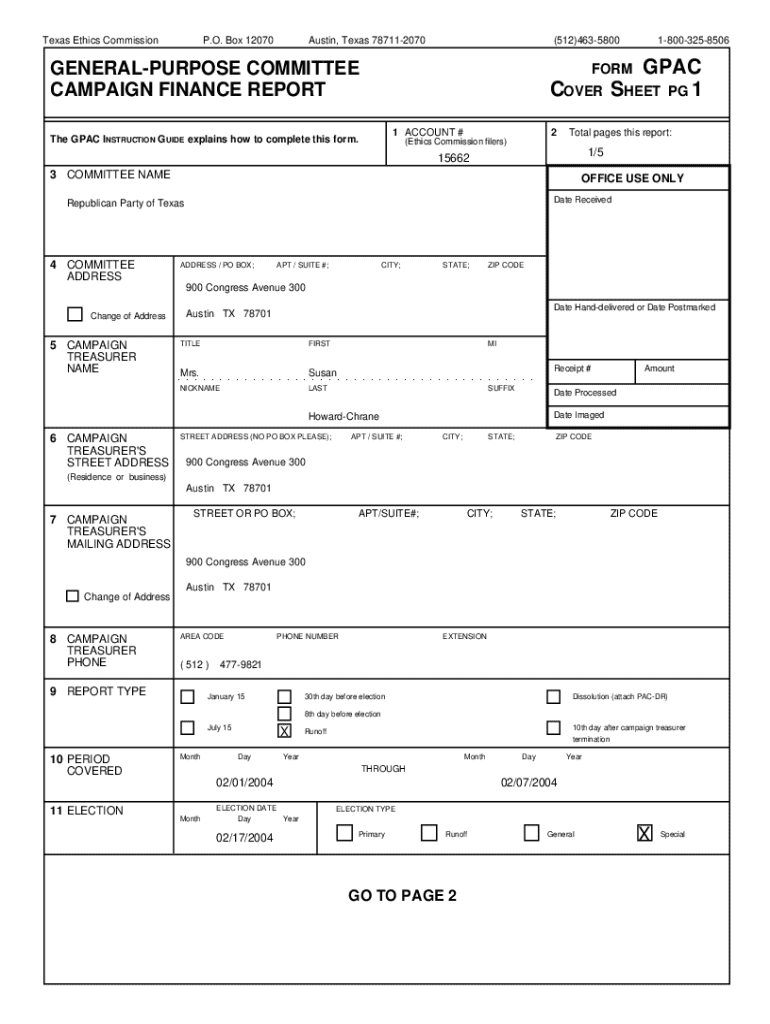

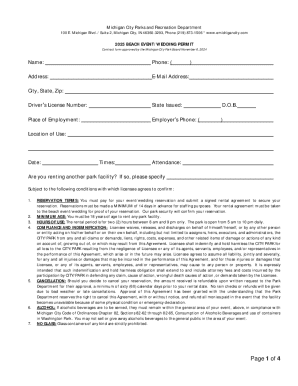

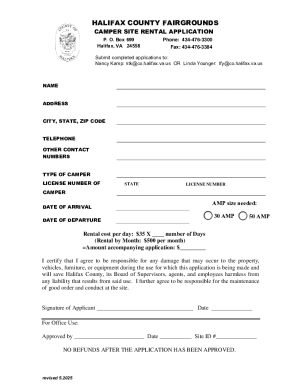

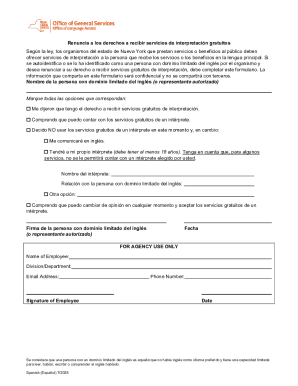

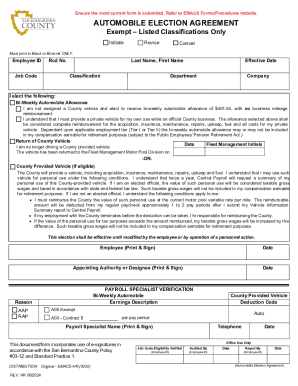

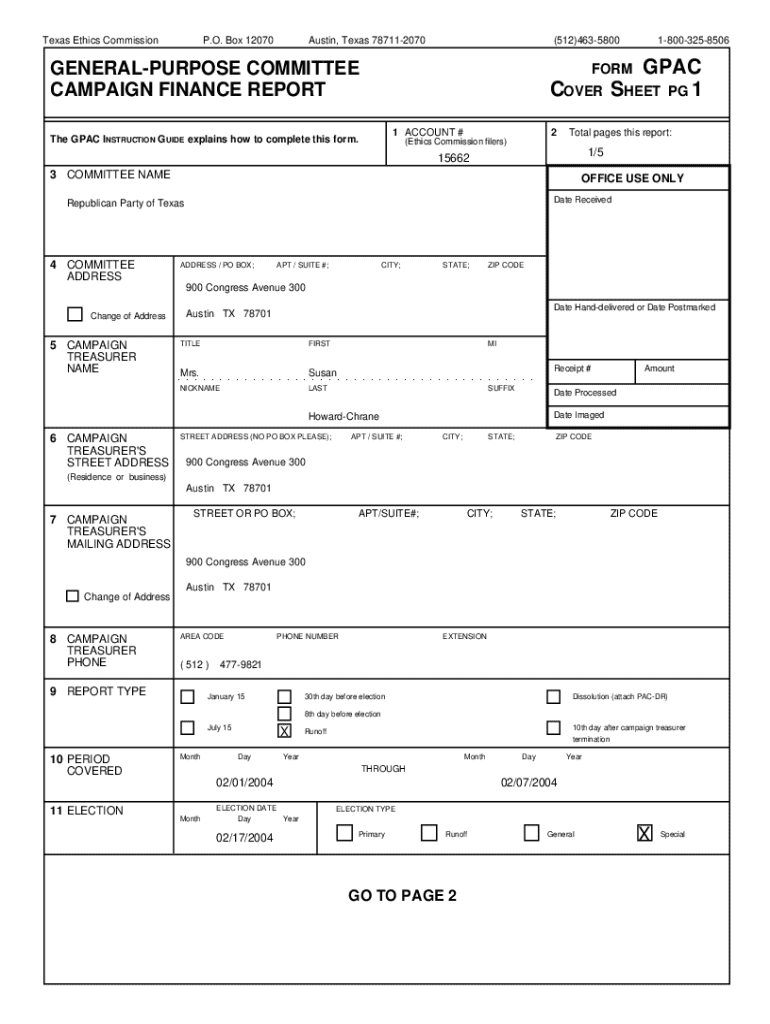

Understanding the treasurer's form

The treasurer's form is a pivotal document used primarily in nonprofit organizations, schools, and financial institutions to maintain transparency and accountability in the management of funds. This form outlines the financial dealings and is usually prepared by the treasurer of the organization. Understanding the treasurer's form is crucial, as it not only reflects the financial condition of the organization but also helps in ensuring compliance with legal and regulatory requirements.

Accurate completion of the treasurer's form cannot be overstated, as discrepancies can lead to financial mismanagement or even legal complications. Hence, the importance of this document is evident, and any errors may result in audits, penalties, or loss of credibility.

Typical use cases for the treasurer's form occur in settings that require detailed financial reporting. Nonprofits utilize it during board meetings to present financial status, educational institutions may rely on it for budget planning, and businesses often request it when applying for funding or loans.

Key components of the treasurer's form

The treasurer's form is comprised of several key sections. Typically, you will find areas designated for reporting income, expenses, outstanding debts, and balances. It presents a snapshot of the fiscal health of the organization as of a specific date.

Understanding the required information is vital. Common components include the date, account descriptions, amounts of income, expenses, and the closing balance. Providing accurate and detailed data is essential to create a true representation of the organization’s financial position.

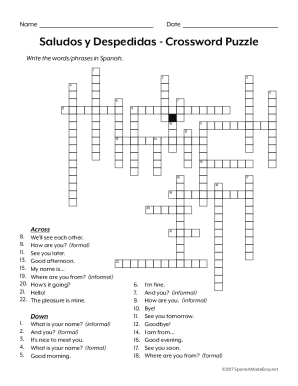

Step-by-step instructions for completing the treasurer's form

Starting on the right foot requires not only knowledge but preparation. In the first step, gather all necessary information, which typically includes identification documents and financial records such as bank statements, invoices, and previous treasurer's forms. This ensures that you have a comprehensive understanding of the organization's financial situation before completing the form.

Next, as you fill out the treasurer's form, ensure you follow detailed guidance for each section. Pay attention to how figures align and verify against your records. It is advisable to utilize software or tools that can help in tracking figures rather than doing so manually to minimize errors.

Finally, reviewing and editing the form before submission is critical. Best practices for self-review include checking each section for accuracy and compliance with any specific requirements your organization may have. Tools like pdfFiller provide excellent editing options that can significantly streamline this process.

Digital tools for managing the treasurer's form

Using digital tools can elevate the efficiency of managing the treasurer's form. pdfFiller’s platform offers a full suite of interactive tools tailored to meet the needs of users. It simplifies the completion, editing, and signing of documents, bringing them together on a single, cloud-based platform.

Some interactive tools available include e-signature options for swift approvals and collaborative features that allow team members to complete sections simultaneously. This not only saves time but also mitigates errors through real-time input.

Editing and formatting the treasurer's form in pdfFiller is straightforward. Users can make necessary adjustments to fields, ensuring that the final document meets the required standards. Additionally, the platform allows users to save and share completed forms easily, promoting collaboration.

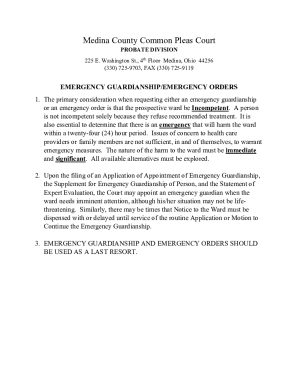

Signing and submitting the treasurer's form

Submitting the treasurer's form properly is just as important as filling it out accurately. Within pdfFiller, several options exist for e-signing, enabling users to give their approval in a quick and secure manner. Ensure that all necessary signatures are in place, as some organizations may require notarization.

After signing, it’s essential to understand how to properly submit your finished form. This may involve submitting online through your organization’s portal or sending it directly to your treasurer via email. Always verify the submission process outlined by your organization to avoid any complications.

Tracking the submission status is crucial. pdfFiller provides notifications to keep you informed about the status of your document, allowing you to feel confident that your information is being processed.

Common questions about the treasurer's form

When completing the treasurer's form, users often have questions about the process. Frequently asked questions might include inquiries about document requirements, formatting specifications, or how to handle discrepancies. Addressing these common concerns helps streamline the form's completion process.

Troubleshooting common issues is essential too. For instance, if an error is identified after submission, knowing the correct procedure to amend the form can save time and hassle. For any additional support, users can refer to the resources provided by their organization or seek guidance from financial professionals.

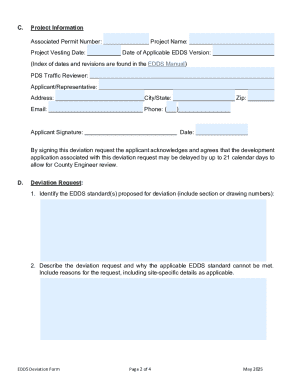

Best practices for document management with the treasurer's form

Properly managing the treasurer's form involves not only filling it out but also organizing and storing it effectively. Completed forms should be stored in a secure location, both physically and digitally. Utilizing cloud storage allows for easy access from anywhere while ensuring that sensitive financial information remains protected.

Additionally, consider leveraging version control practices when storing documents. Keeping track of various iterations of the treasurer's form can help when comparing financial changes over time, making it easier to provide insights and reports. Remember to implement proper security measures, such as encryption and secure passwords, to safeguard this information.

How pdfFiller enhances your experience with the treasurer's form

pdfFiller makes editing PDFs seamless and enhances the overall document management experience. Within its platform, users can access comprehensive solutions for document creation and management, making it ideal for individuals and teams alike.

Moreover, collaboration features enable team members to work together effectively, ensuring that every section of the treasurer's form is accurately completed. This becomes particularly helpful in organizations with multiple stakeholders involved in the financial reporting process.

Getting started with pdfFiller

Starting with pdfFiller is a straightforward process. Signing up for an account is quick, and once registered, users can explore the intuitive interface showcasing key features designed to facilitate document completion.

Navigating through the template library for the treasurer's form is simple, enabling you to access ready-made templates that can minimize the time it takes to get started. Utilizing these templates ensures you always have the most up-to-date version of the form, adhering to specific organizational needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify treasurer039s without leaving Google Drive?

How can I edit treasurer039s on a smartphone?

How do I complete treasurer039s on an Android device?

What is treasurer039s?

Who is required to file treasurer039s?

How to fill out treasurer039s?

What is the purpose of treasurer039s?

What information must be reported on treasurer039s?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.