Get the free Hawaii Tax Department Publishes Revised Historic ...

Get, Create, Make and Sign hawaii tax department publishes

How to edit hawaii tax department publishes online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hawaii tax department publishes

How to fill out hawaii tax department publishes

Who needs hawaii tax department publishes?

Hawaii Tax Department Publishes Form: A Comprehensive Guide

Overview of the Hawaii Tax Department's current publication

The Hawaii Tax Department recently made important updates by publishing new tax forms essential for taxpayers. Staying informed about these forms is critical; it ensures compliance with tax laws and can help individuals and businesses maximize their savings through available credits and deductions. Ignoring these updates can lead to missed opportunities and potential penalties.

Tax announcements often reflect changes in legislation or the introduction of new programs. The publication of these forms serves as a timely reminder for taxpayers that the regulatory environment can shift, making it imperative to stay current to avoid complications during tax seasons.

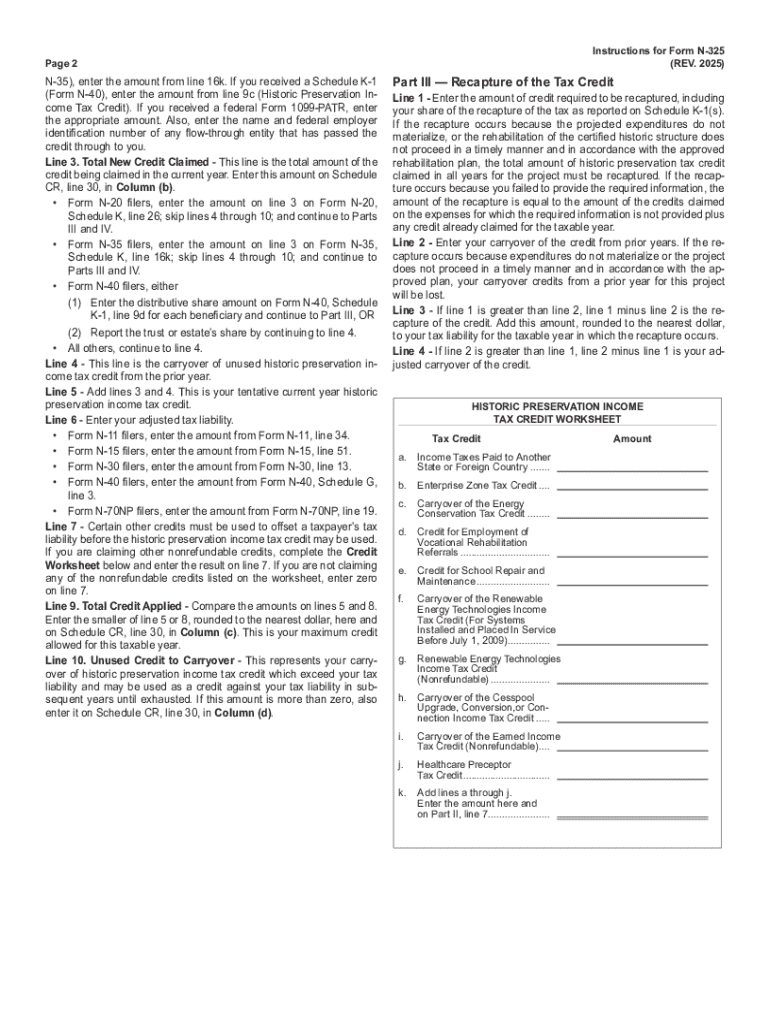

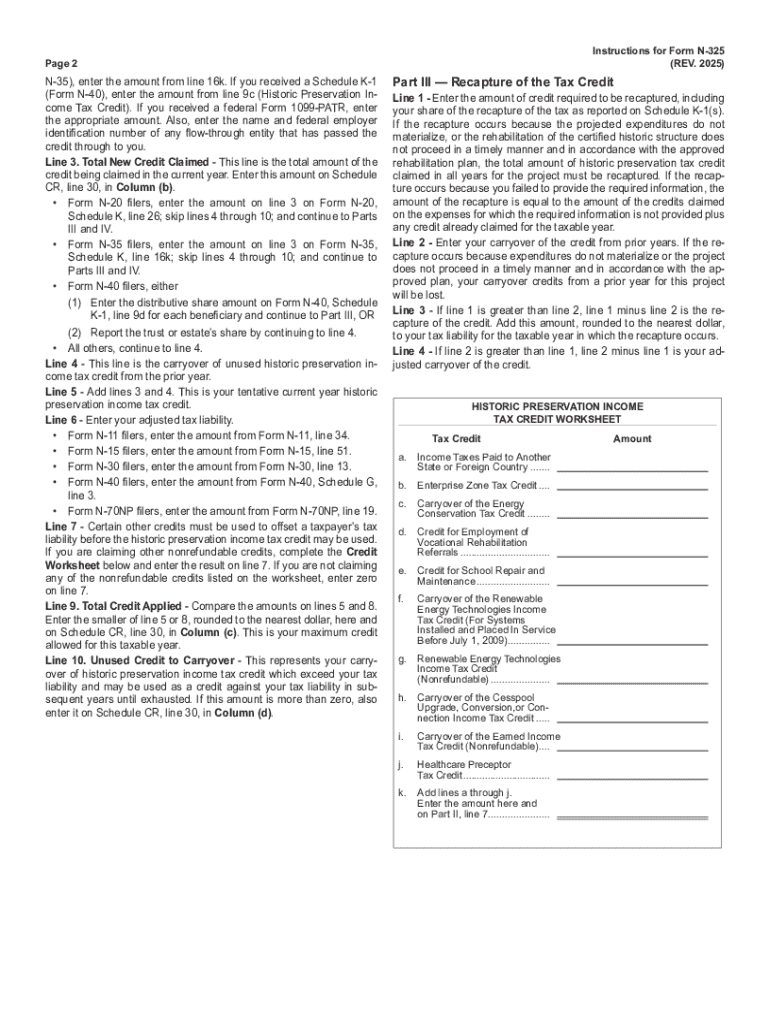

Detailed breakdown of the newly published form

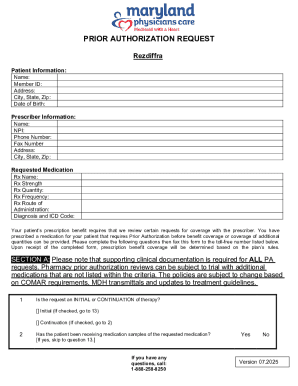

The latest form published by the Hawaii Tax Department is Form N-11, the Individual Income Tax Return. This form is critical for Hawaii residents required to report their annual income to the state tax agency. Identified by the number N-11, it has been crafted specifically to ensure thorough reporting of various income streams, including wages, self-employment income, and dividends.

Individuals who earn income in Hawaii or those who claim any state tax credits must complete and submit this form. The form’s purpose extends beyond mere income reporting; it also serves as the primary vehicle for claiming deductions, making it vital for financial planning.

Key features of the published form

Form N-11 consists of several key sections to streamline the filing process. These include personal information, income reporting, credits, and deductions. Each area allows taxpayers to provide specific details relevant to their financial situations, which the state uses to determine tax obligations.

Eligibility to file Form N-11 applies to all residents of Hawaii whose gross income exceeds the standard deduction limits. Taxpayers must also adhere to filing deadlines; typically, returns are due on April 20th, but extensions may be available under specific circumstances.

Step-by-step instructions for filling out the form

Filling out Form N-11 requires gathering essential documentation. You'll need records of your income such as W-2 forms from employers, 1099 forms for freelance work, and details on any tax credits you're eligible for. Keep these documents handy as you follow these steps:

Common pitfalls to avoid include skipping lines, not attaching required documents, and failing to review calculations; these can delay processing or result in denials.

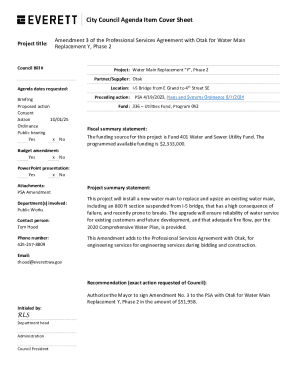

Editing and managing the form with pdfFiller

The convenience of pdfFiller enhances the experience of handling Form N-11. To access the form, simply navigate to the pdfFiller website, where you can find the latest version ready for online completion within a cloud-based platform.

Editing the published form is straightforward with pdfFiller's tools. Follow these steps to make necessary changes:

eSigning the document is as simple as selecting the eSignature option, which allows you to sign electronically, making the entire process efficient and eco-friendly.

Submitting the form

After you’ve completed Form N-11, the next step is to submit it. There are several methods available for submission:

To confirm a successful submission, keep copies for your records and check for receipt confirmation by contacting the Hawaii Tax Department or through the online portal. It’s vital to follow up and ensure your submission was received, especially as deadlines approach.

Common FAQs about the Hawaii Tax Department form

Taxpayers often have several questions about Form N-11. Here are some common FAQs:

For answers and further assistance, you can contact the Hawaii Tax Department directly via email or by visiting their office in Honolulu, Hawaii.

Related information and resources

In addition to Form N-11, there are several other relevant forms available through the Hawaii Tax Department. These closely related forms might include:

The changes from previous years have been substantial, with guidelines evolving each year. Anticipating updates for 2024 while reflecting on changes that took place in 2023 can help taxpayers stay ahead of the game.

Encouraging collaboration and sharing

For teams working together on tax filings, pdfFiller offers collaboration tools that facilitate simultaneous edits and discussions in real-time. Teams can access the form from anywhere and make changes collectively, ensuring everyone is on the same page during tax preparation.

Sharing completed forms securely with stakeholders, tax professionals, or team members is also streamlined through pdfFiller. Simply use the share feature to send links or invite collaborators, keeping your document management secure and organized.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit hawaii tax department publishes online?

How can I edit hawaii tax department publishes on a smartphone?

How do I edit hawaii tax department publishes on an iOS device?

What is Hawaii tax department publishes?

Who is required to file Hawaii tax department publishes?

How to fill out Hawaii tax department publishes?

What is the purpose of Hawaii tax department publishes?

What information must be reported on Hawaii tax department publishes?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.