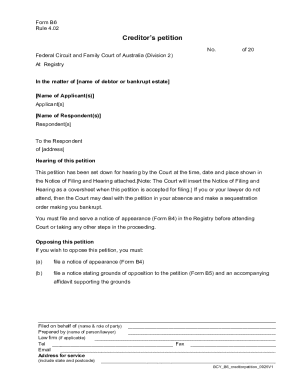

Get the free FORM 1120-SN Schedule K-1N

Get, Create, Make and Sign form 1120-sn schedule k-1n

Editing form 1120-sn schedule k-1n online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1120-sn schedule k-1n

How to fill out form 1120-sn schedule k-1n

Who needs form 1120-sn schedule k-1n?

A Comprehensive Guide to Form 1120-SN Schedule K-1N

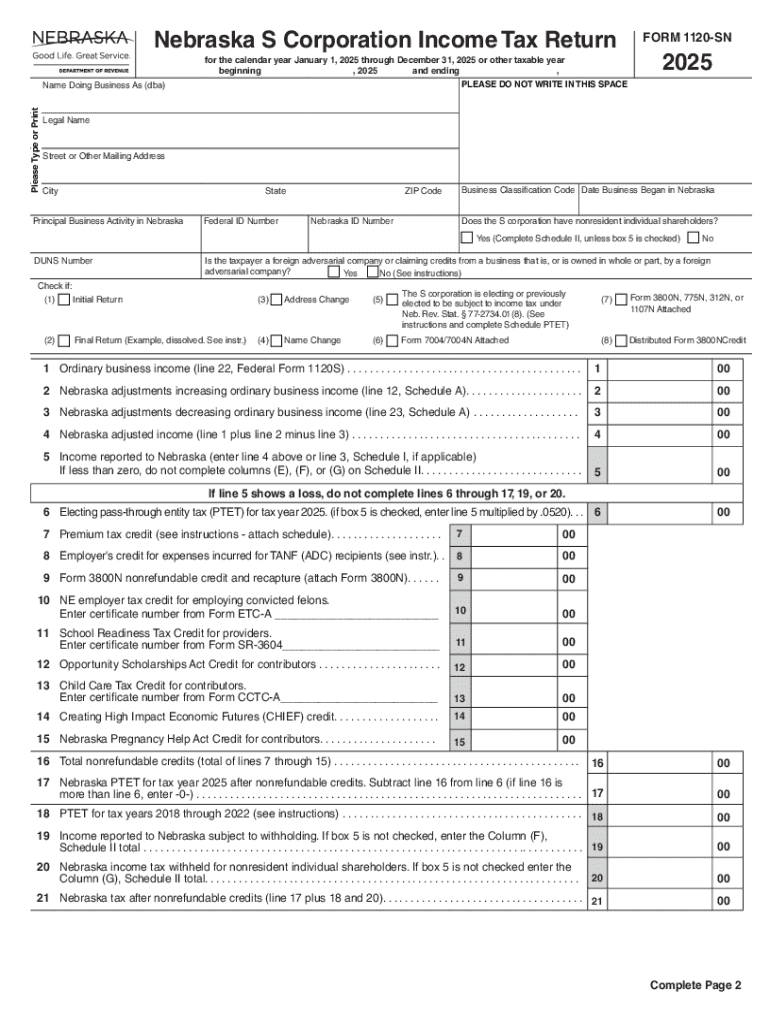

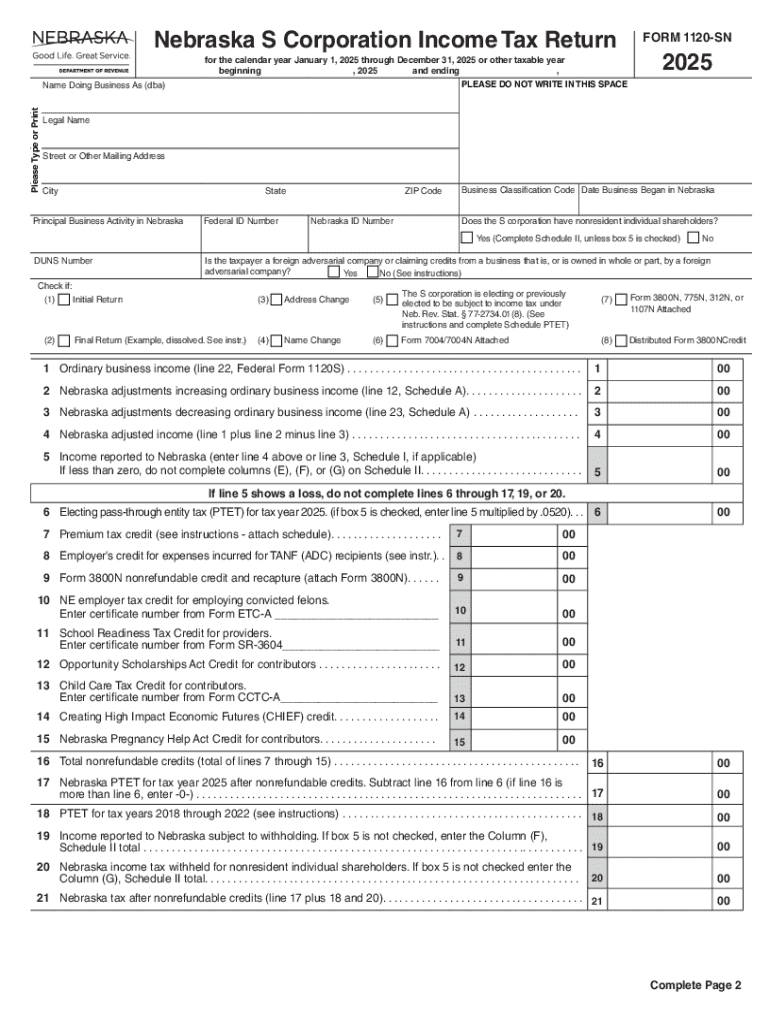

Overview of Form 1120-SN and Schedule K-1N

Form 1120-SN is a vital tax document used by S corporations in Nebraska and other states. It serves the essential purpose of reporting the income, deductions, and credits that pass through to shareholders. For S corporations, the profits and losses are directly passed to shareholders, thereby affecting their personal income tax returns. Schedule K-1N is a key component of Form 1120-SN, as it provides the necessary information for individual shareholders to report their share of the S corporation’s income and distributions on their tax forms.

The importance of Schedule K-1N cannot be overstated. It allows for the proper reporting of income, which impacts how shareholders declare their earnings on their income tax returns. When S corporations file their Form 1120-SN, they issue Schedule K-1N to each shareholder, detailing their specific share of the corporation's net income, losses, deductions, and credits. If you're a shareholder of an S corporation in Nebraska, understanding Schedule K-1N is crucial for accurate income reporting.

Key components of Schedule K-1N

Schedule K-1N consists of three main parts, each serving a different purpose in the tax reporting process. Part I includes details about the S corporation itself, such as its name, address, and identifying number. This ensures that shareholders can verify the information against their records. In Part II, information about the shareholder is specified, including their name, address, and percentage of ownership in the S corporation. Lastly, Part III communicates the shareholder's share of income, deductions, and credits, which is essential for completing their individual income tax returns.

Understanding the terminology used within Schedule K-1N is critical. For example, 'ordinary business income' refers to profits from regular business activities, while 'rental income' is derived from any property leased by the corporation. Familiarity with these terms enables shareholders to accurately report their earnings and ensures compliance with tax regulations.

Step-by-step instructions for filling out Schedule K-1N

To begin completing Schedule K-1N, gather any required documents. This includes the S corporation’s financial statements and past tax returns. Each shareholder should have access to their ownership percentage, which will be crucial for accurately reporting their share of income and losses. Here are the steps to fill out the form:

When filling out Schedule K-1N, accuracy is crucial. Common pitfalls include misreporting income types or incorrectly calculating shares. Pay special attention to the ownership percentages, as this can significantly affect tax outcomes.

Common scenarios affecting Schedule K-1N filings

Several scenarios can complicate the filing of Schedule K-1N, especially when multiple shareholders are involved. Each shareholder must receive a separate K-1 document that reflects their individual share, adjusted for any specific distributions or loans made during the tax year. For instance, if an S corporation has several shareholders, it must allocate income based on their respective ownership percentages. Shareholders must also be aware of how to report lost or negative amounts, which can influence tax liabilities.

Handling distributions is another key area. Distributions can come in the form of cash payments, property distributions, or loans. Each of these scenarios requires different reporting on the Schedule K-1N. If there is a loan to a shareholder, the loan terms must be documented properly. Any losses that a shareholder incurs can offset other income on their tax returns, making clear reporting essential.

Electronic filing and submission options

Today, electronic filing has become a highly efficient way to submit Schedule K-1N. Filing electronically through compatible software can reduce errors and minimize processing time. Many online platforms, including pdfFiller, enhance the filing process by offering user-friendly interfaces and convenient e-filing options. When utilizing electronic filing, ensure that you adhere to format guidelines and submission rules set by the IRS.

The advantages of using e-filing services are substantial. They allow for instant submission confirmation and often provide error-checking features that help identify common mistakes before the form is filed. Most importantly, electronic platforms like pdfFiller support collaborative tools that enable team members to work together seamlessly on document preparation.

Editing and managing Schedule K-1N with pdfFiller

pdfFiller provides powerful editing and management tools for Schedule K-1N forms. Users can easily modify, fill out, and collaborate on documents directly within the platform. To begin using pdfFiller for Schedule K-1N forms, start by uploading your document and selecting the ‘Edit’ option. The platform’s intuitive interface allows for easy population of fields and the addition of necessary signatures.

Some of the most useful features include interactive tools that guide users through filling out forms and remote signing capabilities that enable multiple users to collaborate effectively. These features expedite the workflow and ensure that all necessary parties can streamline the process, making tax season less daunting.

Frequently asked questions (FAQs) about Schedule K-1N

Navigating the complexities of Schedule K-1N can lead to questions about errors, deadlines, and resources. If you discover errors on a K-1N after it has been filed, it’s crucial to contact the S corporation for a corrected form. Timeliness is essential to avoid penalties or incorrect tax filings. As for deadlines, Schedule K-1N must be provided to shareholders by March 15th in the year following the tax year, aligning with the filing date for Form 1120-SN.

For further assistance, the IRS website offers resources for complex situations, and consulting with tax professionals can provide additional guidance tailored to individual circumstances. Stay informed about state-specific requirements as these can greatly impact your filing process.

Navigating state-specific requirements for Schedule K-1N

State-specific requirements for Schedule K-1N can vary significantly. For shareholders in Nebraska, it is essential to understand local laws that govern tax filings. Each state may impose specific deadlines or additional forms that need to be submitted alongside the K-1N. It is crucial for shareholders to consult their state’s tax authority or its website to gather necessary information and stay compliant with local regulations.

Resources, such as state tax websites, often provide links or documents relevant to Schedule K-1N filings, which can offer guidance on what additional steps need to be taken. Therefore, ensuring compliance with both federal and state tax obligations is crucial for shareholders.

Additional resources and tools offered by pdfFiller

pdfFiller enhances the user experience by offering various complementary tools designed to simplify document management. Their tax forms library allows users to access a wide array of essential documents, including Schedule K-1N, making it easier to find and file necessary forms. Additionally, document templates tailored for specific tax scenarios can help guide users through complex tax situations.

Furthermore, pdfFiller integrates seamlessly with other software solutions to streamline work processes. This allows for smooth document flow, making it more efficient for individuals and teams to manage their paperwork, ultimately enhancing productivity during tax season.

The pdfFiller advantage: creating efficient document solutions

pdfFiller stands out by offering a comprehensive platform designed to simplify the document management process for Form 1120-SN and Schedule K-1N. The platform continuously evolves its features, ensuring that users can efficiently manage their tax forms. From rapid editing capabilities to robust collaboration tools, pdfFiller empowers individuals and teams to tackle tax documentation with confidence.

By utilizing pdfFiller's advanced document solutions, users can complete tax forms quickly, reducing the stress often associated with filing taxes. This optimization ultimately contributes to improved compliance and accuracy, ensuring that both individuals and businesses can meet their responsibilities efficiently and on time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 1120-sn schedule k-1n to be eSigned by others?

Can I create an electronic signature for signing my form 1120-sn schedule k-1n in Gmail?

How do I edit form 1120-sn schedule k-1n on an Android device?

What is form 1120-sn schedule k-1n?

Who is required to file form 1120-sn schedule k-1n?

How to fill out form 1120-sn schedule k-1n?

What is the purpose of form 1120-sn schedule k-1n?

What information must be reported on form 1120-sn schedule k-1n?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.