Get the free Online Desktop: Schedule K-1 (Form 1120-S)

Get, Create, Make and Sign online desktop schedule k-1

How to edit online desktop schedule k-1 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out online desktop schedule k-1

How to fill out online desktop schedule k-1

Who needs online desktop schedule k-1?

Comprehensive Guide to the Online Desktop Schedule K-1 Form

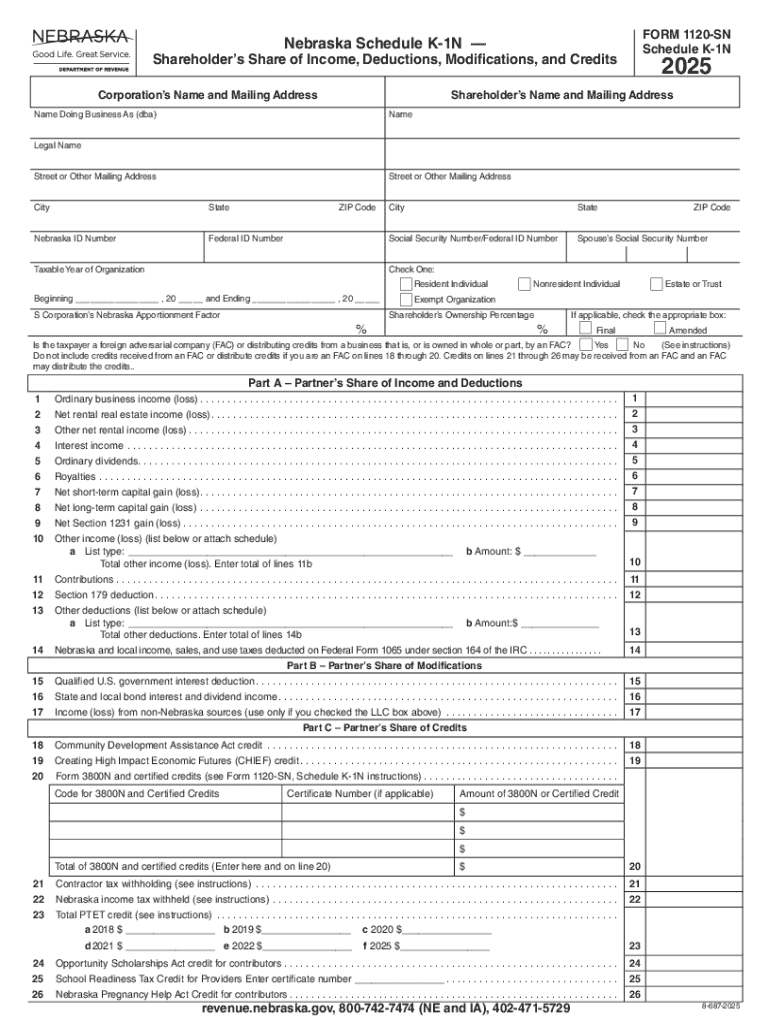

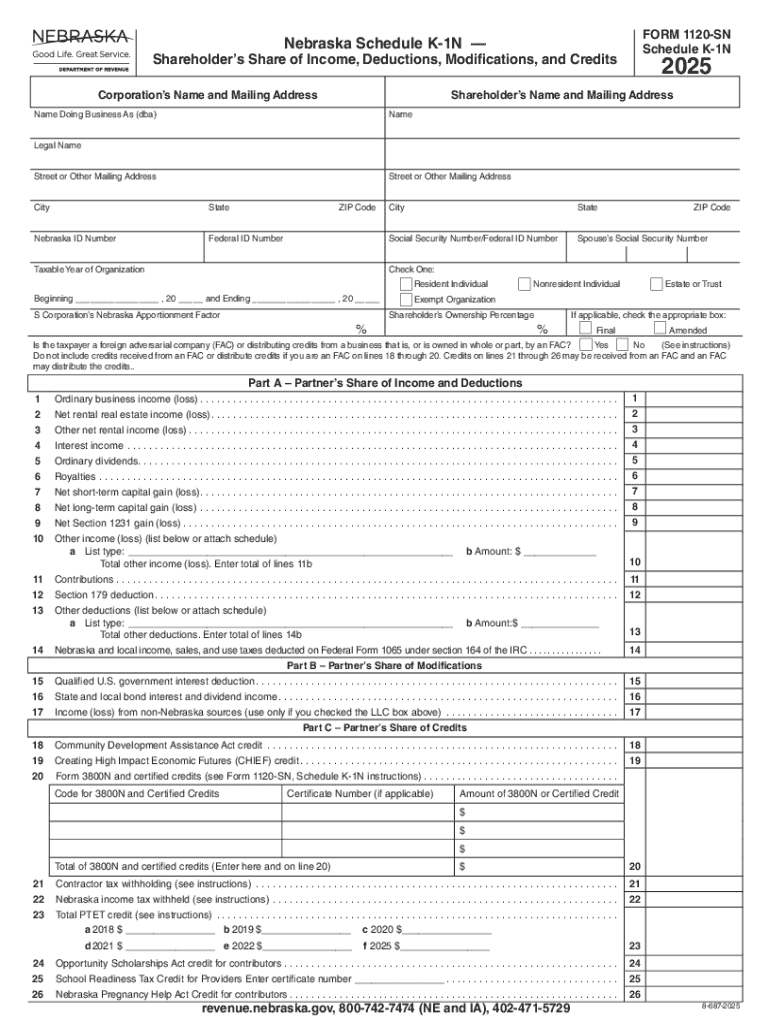

Overview of the K-1 form

The K-1 Form is a vital tax document utilized to report income, deductions, and credits for partners in a partnership, shareholders in S corporations, and beneficiaries of estates. This form serves multiple purposes, including detailing each partner's or shareholder’s share of the income, which is crucial for personal tax responsibility.

Understanding the K-1 Form is essential for ensuring correct tax filings. Any discrepancies in this form can lead to complications with tax returns. As a result, it is imperative to fill it out accurately to avoid penalties or audits from the IRS or state authorities such as Alabama's Department of Revenue.

Key features of the online desktop schedule K-1 form

The online desktop schedule K-1 form provides a user-friendly interface that simplifies the process for users, whether they are individuals or teams. Its intuitive design enhances navigation, making it easier for users to locate necessary fields and complete the form without stress.

Cloud-based accessibility allows users to complete their K-1 forms from anywhere, making it an ideal solution for remote teams. This feature brings flexibility, enabling collaboration among team members no matter their location.

Step-by-step instructions for filling out the K-1 form

To begin filling out the K-1 form, gather all required information such as the partnership agreement, previous K-1 forms, and any related documents. Accurate data input is essential for correct tax reporting. Once you have this information, access the online form through pdfFiller's platform by navigating to the appropriate section.

Upon accessing the form, you will encounter various sections. Each one is designed to capture different aspects of your partnership or S corporation. Here’s a detailed breakdown of what to expect:

Editing and customizing your K-1 form

Prior to submission, it's important to review your K-1 form for accuracy. The online platform allows users to easily edit any fields within the form. If you find discrepancies or additional information that needs to be included, simply click on the respective field and make the necessary changes.

For partners that frequently file K-1 forms, pdfFiller offers customizable templates. Using these templates ensures consistency across forms, making it easier to manage multiple submissions. Standardizing the format helps in alleviating confusion and reducing mistakes in data entry.

eSigning your K-1 form

Implementing secure digital signatures has become a staple in document management, and the K-1 form is no exception. The eSigning process via pdfFiller is straightforward and enhances security, ensuring that only authorized persons can sign the document.

In collaborative environments, the platform allows for multiple parties to sign the form efficiently. This can streamline the process, especially for partnerships that require consensus or signatures from multiple stakeholders.

Managing and storing your K-1 forms

Once completed, managing your K-1 forms effectively is crucial for easy access and data retrieval. The pdfFiller platform provides options to organize completed forms in folders, categorizing them for future reference.

Security is paramount when storing sensitive tax documents. pdfFiller offers secure cloud storage, allowing users to keep their K-1 forms safe from unauthorized access. This option not only secures your documents but also enables you to access them anywhere, promoting efficiency and ease of handling.

Common pitfalls when filling out the K-1 form

Filling out the K-1 form accurately is essential, and several common pitfalls can lead to errors. First, one frequent mistake is neglecting to input all required information in the specific sections, which can result in an incomplete form.

Another common error is miscalculating income share or deductions, resulting in incorrect tax liabilities. Here are some additional tips to ensure a smooth filing process:

FAQs about the online desktop schedule K-1 form

Many users have questions regarding the online desktop schedule K-1 form. Topics often include how to retrieve a forgotten password, navigating the platform, or understanding specific tax implications tied to the K-1 form. Addressing these queries promptly can reduce users' anxiety related to tax filing.

To assist users, pdfFiller offers comprehensive support resources. Their help center is replete with articles and how-to guides, dispelling confusion and answering common questions. User support is also available directly through the platform, ensuring users can receive assistance when needed.

User testimonials and success stories

Many users have shared their positive experiences with the online desktop schedule K-1 form. From individual freelancers to large partnerships, customer feedback highlights the platform's ease of use and the significant time savings it offers.

Real stories regarding successful tax filings illustrate how users, even in complex situations, have benefited from features such as automated calculations and instant collaboration. The confidence users gain from knowing their K-1 forms are accurate and securely stored cannot be overstated.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my online desktop schedule k-1 directly from Gmail?

How can I send online desktop schedule k-1 for eSignature?

How do I make edits in online desktop schedule k-1 without leaving Chrome?

What is online desktop schedule k-1?

Who is required to file online desktop schedule k-1?

How to fill out online desktop schedule k-1?

What is the purpose of online desktop schedule k-1?

What information must be reported on online desktop schedule k-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.