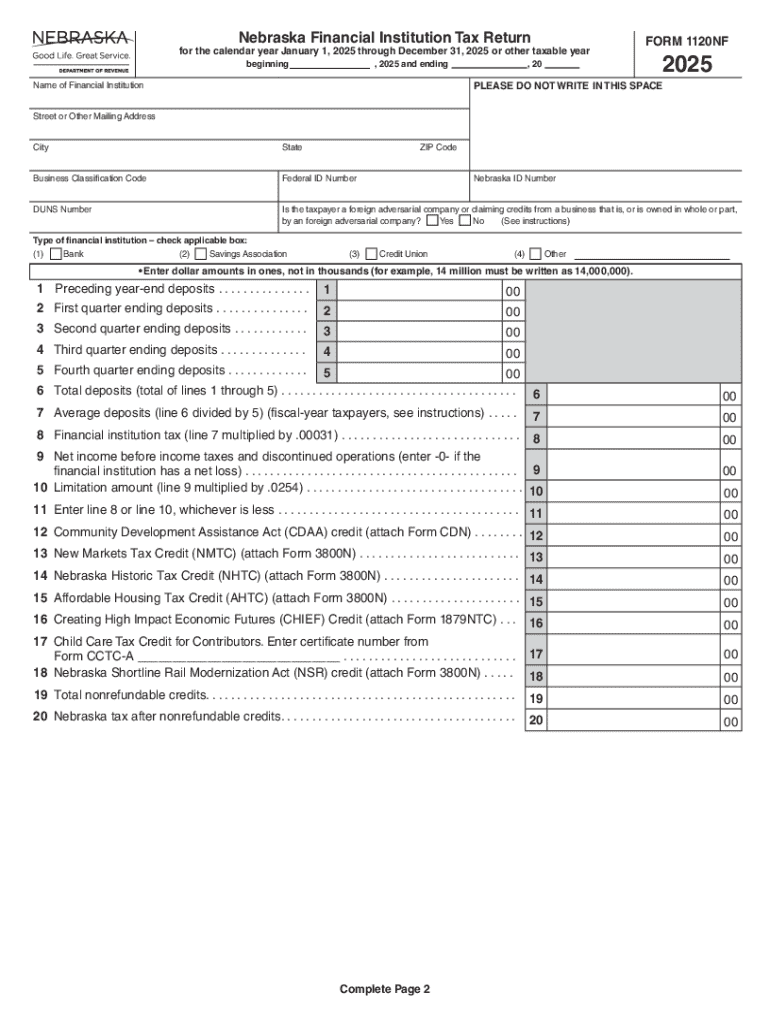

Get the free 2025 Nebraska Financial Institution Tax Return

Get, Create, Make and Sign 2025 nebraska financial institution

Editing 2025 nebraska financial institution online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 nebraska financial institution

How to fill out 2025 nebraska financial institution

Who needs 2025 nebraska financial institution?

A Comprehensive Guide to the 2025 Nebraska Financial Institution Form

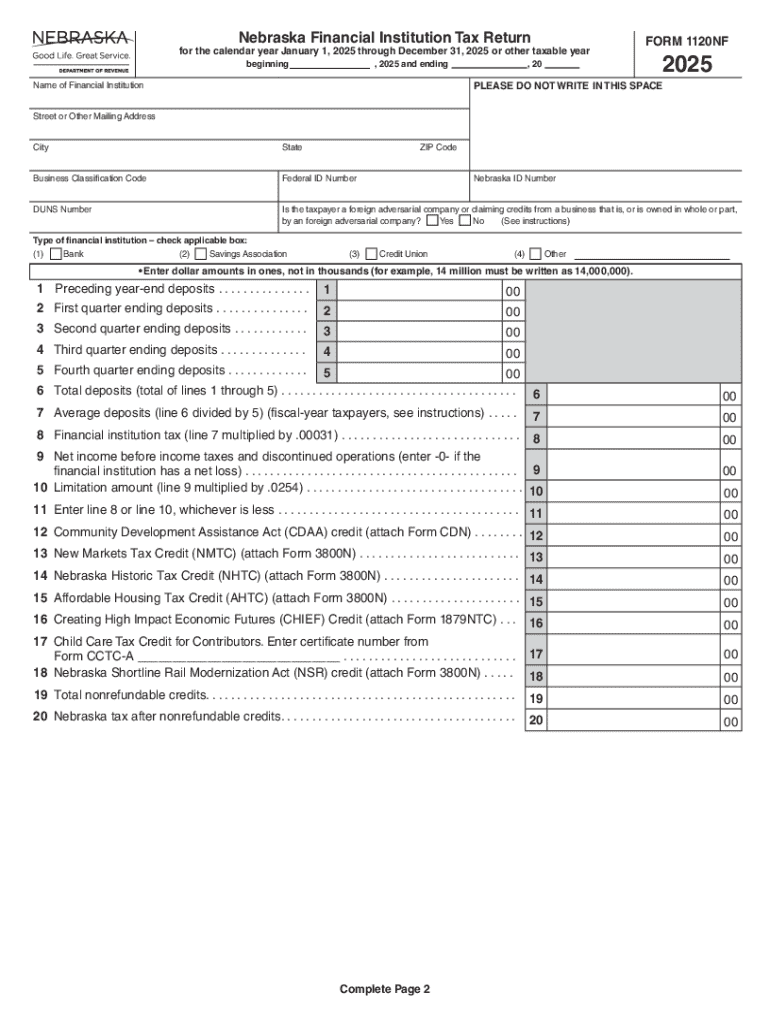

Understanding the purpose of the 2025 Nebraska financial institution form

The 2025 Nebraska financial institution form is a crucial document designed to streamline the reporting processes for financial institutions within the state. This form plays an essential role in ensuring compliance with state regulations, providing transparency in financial operations, and facilitating the assessment of financial institution health. Accurate completion of this form can directly influence the institution's reputation and operation, making it vital for stakeholders to understand its significance.

In 2025, specific requirements have been laid out for the completion of the financial institution form, including detailed reporting mandates and new regulations that institutions must be mindful of. Failing to submit accurate information can lead to significant consequences, including penalties or regulatory scrutiny, thereby impacting the institution's operational capabilities. Ensuring precision in submissions is not just a matter of compliance but is integral to the institution’s standing with regulators and customers alike.

Key changes in the 2025 form compared to previous years

The 2025 Nebraska financial institution form has undergone several critical updates when compared to the 2024 version. One notable change is the introduction of new sections that require enhanced transparency in reporting credit computations and tax credit eligibility. This shift aligns with the state's ongoing efforts to promote financial accountability and better fiscal management.

Additionally, there are updated regulations and requirements that reflect the evolving financial landscape in Nebraska. These changes have been driven by the need for increased scrutiny of financial practices and a push towards digital reporting solutions. Understanding these changes is essential for accurate form completion, and stakeholders should take the time to familiarize themselves with the new requirements to avoid any missteps.

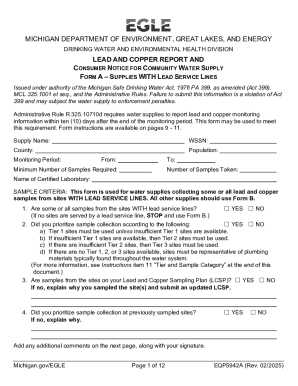

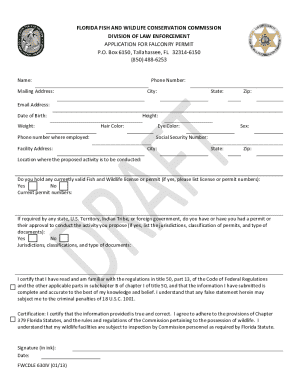

Step-by-step guide to completing the 2025 Nebraska financial institution form

Completing the 2025 Nebraska financial institution form successfully involves a clear, step-by-step approach. Here’s how to navigate the process:

Step 1: Gathering necessary information

Before beginning the form, gather all necessary documents, such as previous year’s financial statements, shareholder records, and tax payment vouchers. Organize this information into categories that match the form's sections. This proactive approach can save time and ensure all necessary data is readily available.

Step 2: Filling out the form

Start completing the form section by section. Pay careful attention to the specific instructions associated with each field. For example, when reporting income, ensure all titular expenses are reflected in your financial statements. A common pitfall is neglecting to report ancillary income or tax credits, which can skew your institution’s financial overview.

Step 3: Reviewing and editing your submission

Once the form is filled out, review all entries meticulously. One effective method is to cross-check against your gathered documents. Utilize pdfFiller’s editing tools to make revisions easily and ensure compliance with all regulatory requirements.

Step 4: Submitting the form

Finally, choose your method of submission, whether online, by mail, or in person. Keep track of important deadlines — typically, forms must be submitted by a specific date to avoid any late penalties. Confirm that you’ve included all required attachments, as incomplete submissions can lead to delays or complications.

Utilizing interactive tools to manage your 2025 form

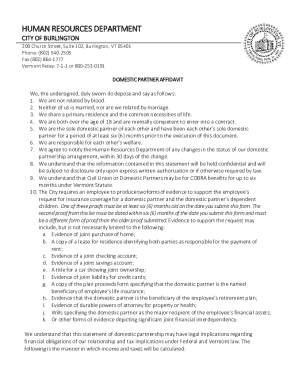

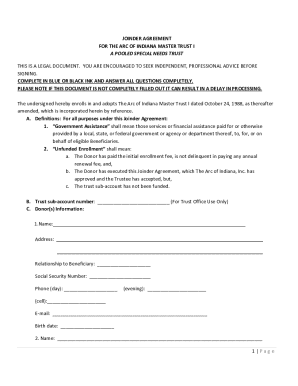

pdfFiller offers a suite of features designed specifically for managing the 2025 Nebraska financial institution form efficiently. Users can edit the form digitally, ensuring that any corrections needed can be made instantly. One of the standout features is the eSignature capability, allowing for quick and secure signature processes without needing to print or scan documents.

Moreover, collaboration tools enable teams to work together on form submissions in real-time. This is particularly beneficial for institutions with multiple stakeholders who need to review or contribute information to the form. Working collaboratively through pdfFiller reduces confusion and accelerates submission timelines.

Common FAQs regarding the 2025 Nebraska financial institution form

Navigating the 2025 Nebraska financial institution form can raise numerous questions. Here are some common FAQs to guide you:

Resources and guidelines for financial institutions

The State of Nebraska provides various resources to assist financial institutions in completing the 2025 financial institution form accurately. These resources often include detailed guidelines, FAQs, and direct links to relevant state departments for additional support.

In addition, financial institutions may opt to use substitute forms when necessary, provided they adhere to the state standards. Institutions must remain informed on these guidelines to ensure compliance. For inquiries, the state has established contact points to facilitate prompt assistance.

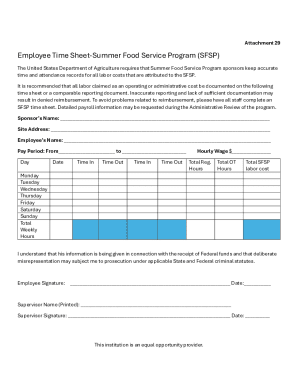

Insights and best practices for teams handling the 2025 form

Effective teamwork is essential when completing the 2025 Nebraska financial institution form. Teams should develop a clear workflow that outlines each member's responsibilities and deadlines to meet submission dates. Regular check-ins can help ensure that everyone is on track and addressing any emerging issues.

Adopting best practices for document management is crucial. Establish a centralized digital workspace, perhaps through tools like pdfFiller, where all relevant documents and drafts can be accessed easily. This organization not only facilitates easier collaboration but also ensures that everyone has access to the most current information.

About pdfFiller: revolutionizing document management

pdfFiller is a leading platform designed to transform document management for users worldwide. Whether it's editing PDFs or managing form submissions, pdfFiller provides a user-friendly interface that simplifies complex processes. Its capabilities extend beyond mere document editing; users can electronically sign documents, collaborate with team members, and access files from any device.

Numerous users have reported enhanced productivity and streamlined operations due to pdfFiller's intuitive tools. Support and training options are readily available for new users, ensuring they can leverage the full capabilities of the platform to manage documents efficiently.

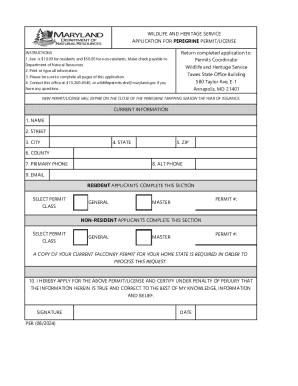

Other relevant forms to consider for Nebraska financial institutions

In addition to the 2025 Nebraska financial institution form, other forms may be pertinent for financial institutions operating within the state. For example, institutions may need to submit various tax-related documents, employment verification forms, or state-specific compliance documentation.

It’s essential to maintain awareness of each form's requirements and deadlines. Institutions should also regularly check for updates to regulations to ensure they remain compliant, as state-updated guidelines can significantly affect the operational landscape.

Contact support for filling out the financial institution form

Should you encounter challenges while filling out the 2025 Nebraska financial institution form, reaching out for assistance is crucial. The state provides channels for contacting support for specific inquiries regarding the form. Additionally, pdfFiller's customer support is available to help users navigate technical issues or questions related to document management.

Engaging with online communities may also offer peer support, where individuals can share experiences and solutions to common submission challenges. Utilizing these resources can enhance confidence in navigating the financial institution form's complexities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025 nebraska financial institution for eSignature?

Can I sign the 2025 nebraska financial institution electronically in Chrome?

How do I edit 2025 nebraska financial institution on an iOS device?

What is 2025 nebraska financial institution?

Who is required to file 2025 nebraska financial institution?

How to fill out 2025 nebraska financial institution?

What is the purpose of 2025 nebraska financial institution?

What information must be reported on 2025 nebraska financial institution?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.