Get the free Tax Payment Voucher and

Get, Create, Make and Sign tax payment voucher and

Editing tax payment voucher and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax payment voucher and

How to fill out tax payment voucher and

Who needs tax payment voucher and?

A comprehensive guide to tax payment vouchers and forms

Understanding tax payment vouchers

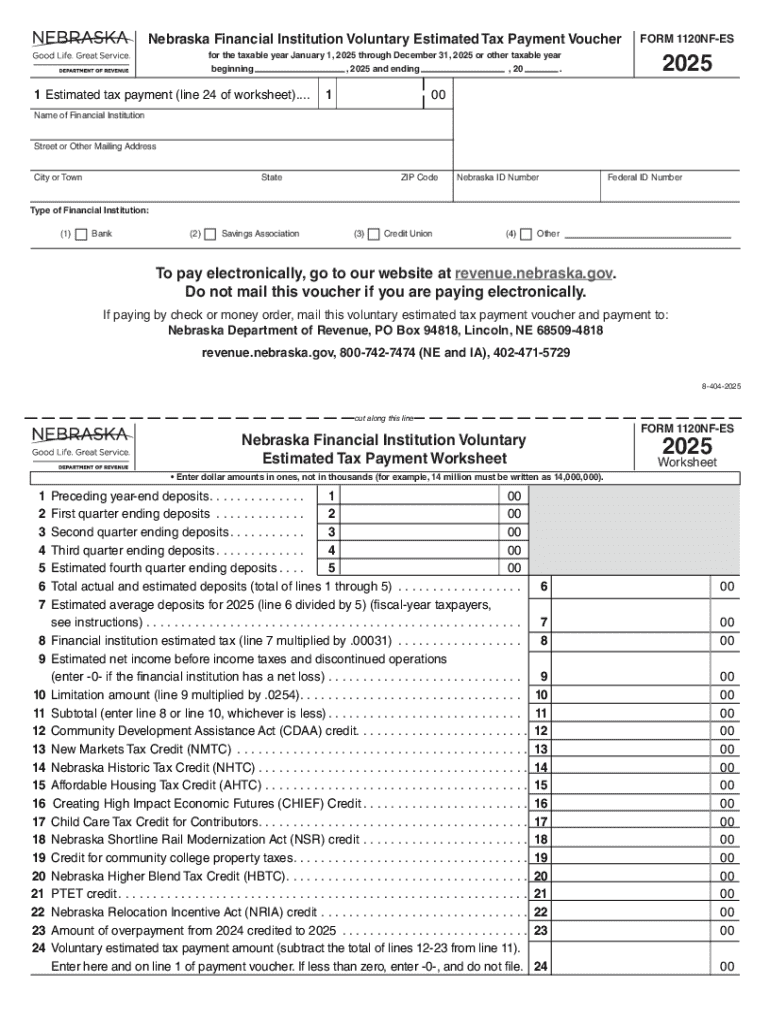

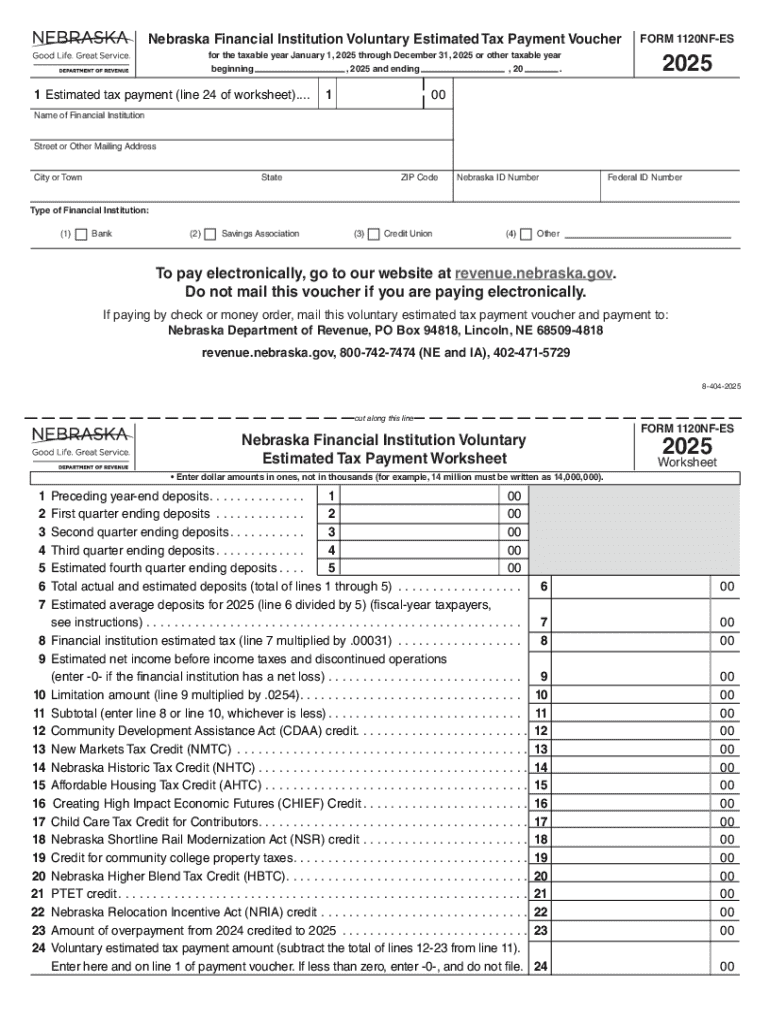

A tax payment voucher is a document that facilitates the payment of taxes due to government authorities. Its primary function is to provide a physical or electronic means for taxpayers to submit payment concerning various taxes, including income tax, property tax, and more. This voucher serves as a receipt that confirms payment has been made, making it essential for maintaining compliance with tax obligations.

The importance of tax payment vouchers cannot be overstated. They help taxpayers stay organized and ensure accurate records during audits or inquiries. Furthermore, payment vouchers simplify the process of tracking payments and can be necessary for businesses and individuals alike to substantiate their payment history.

The significance of tax payment forms

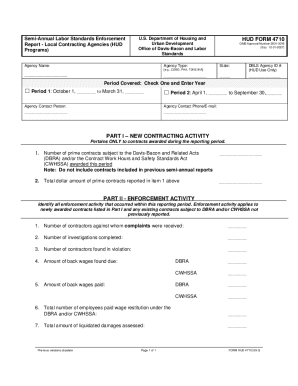

Tax payment forms are critical documents that detail the specifics of your tax obligations, including amounts owed, tax periods, and any relevant tax identification numbers. Different forms may be required based on your location, tax category, and the type of payment method chosen. Therefore, understanding the form requirements is paramount to ensuring compliance with local or state regulations.

Failing to submit the correct tax payment forms or providing inaccurate information can lead to significant consequences. Potential penalties may include late fees, interest charges, and complications in your tax records, which can create long-term repercussions. It's vital for taxpayers to familiarize themselves with the specific requirements to avoid these pitfalls.

Preparing to fill out your tax payment voucher and form

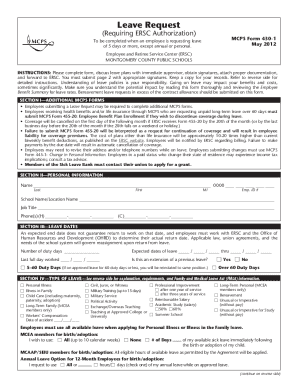

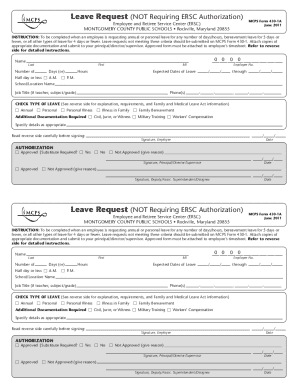

Before completing your tax payment voucher and form, it’s essential to gather all necessary information. This includes personal identification details, such as your Social Security Number or tax ID, as well as relevant tax information, like income amounts and deductions. Financial documents, including your bank statement or last year’s tax return, may also be needed to ensure accuracy when reporting your current tax obligations.

Identifying the correct tax payment form is crucial for processing your payment correctly. Depending on your situation—such as whether you are filing personal or business taxes—you need to ensure you are using the appropriate form. Resources like local tax authority websites or pdfFiller can assist you in determining which forms apply to your specific circumstances.

Step-by-step instructions for completing your voucher and form

Filling out the tax payment voucher involves several steps. Start by entering your personal information in the designated section, including your name, address, and tax identification number. Following this, detail the type of tax you're paying and the associated amount owed. Be diligent in ensuring that every line item is accurately filled out to avoid any potential issues with your submission.

Completing the tax payment form requires similar attention to detail. Sections will often include specifics about deductions, income sources like unemployment income, and any credits you may qualify for. Utilize examples of correctly filled forms as guides and ensure your entries align with factual amounts reflected on your financial documentation.

Before submission, reviewing and verifying all information is critical. Ensure that all calculations are correct, and that your entries are clear. A simple mistake could lead to delayed processing or penalties. Taking the time to double-check will help in maintaining the accuracy of your tax records.

Submission options for your tax payment voucher and form

You can submit your tax payment voucher and form electronically or by mail. Choosing electronic submission is increasingly popular due to its speed and convenience. Using online services provided by pdfFiller allows you to input your information directly into the form, enabling seamless payment processing. This method not only speeds up the submission process but also provides immediate confirmation of payment.

If you opt for traditional paper submission, ensure that you package your documents correctly. Use a sturdy envelope for mailing your tax payment voucher and form, and make sure to address it accurately according to the instructions provided by the tax authority. Also, consider using certified mail to add a layer of proof that your documents were submitted.

Managing records after payment

After making your tax payments, it’s essential to keep a record of confirmations. This proof of transaction will serve as verification should any disputes arise. You can utilize services such as pdfFiller to store these documents digitally, ensuring that they are easily accessible whenever needed.

Reviewing your tax account status is also important. Many tax authorities offer online services where you can check if your payment has been processed successfully. This ability to monitor your tax account can help you stay informed and responsive in case of any discrepancies. Explore the resources available through pdfFiller to manage any issues effectively.

Common FAQs about tax payment vouchers and forms

When dealing with tax payment vouchers and forms, many individuals and teams often have similar questions. Common concerns include how to accurately fill in forms, where to find the appropriate forms, and steps to take if errors occur post-submission. It’s advisable to keep a handy list of FAQs, so you can quickly refer to these key points as needed.

If you find yourself in a situation that requires expert assistance, do not hesitate to consult a tax advisor. Finding reputable tax professionals can greatly alleviate the stress associated with tax preparation and filing. Utilize resources available at platforms like pdfFiller to connect with qualified professionals.

Utilizing pdfFiller for tax document management

pdfFiller boasts features that greatly enhance your experience when managing tax payment vouchers and forms. For instance, e-signature capabilities allow you to sign documents electronically, facilitating quick approvals without the need for printing. Collaboration tools enable multiple users to review and edit documents in real time, making it ideal for teams preparing tax documents.

The ability to access your documents from anywhere, using any device, adds to the convenience provided by pdfFiller. This feature ensures that team members can work on important forms, regardless of their location. Customer testimonials reflect the positive impact of pdfFiller on document management for more streamlined tax preparation.

Getting help with the tax payment process

If you require assistance with managing your tax payment voucher and form, reaching out for support is crucial. You can contact customer support at pdfFiller directly for specialized assistance with any concerns you may have. Moreover, online help and documentation are always available, offering FAQs, guides, and other essential resources.

Additionally, consider engaging with community support and forums related to tax forms and payments. Participating in these platforms allows you to share experiences, gain insights, and discover tips from fellow users of pdfFiller who have tackled similar challenges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax payment voucher and in Gmail?

How do I make changes in tax payment voucher and?

Can I edit tax payment voucher and on an Android device?

What is a tax payment voucher?

Who is required to file a tax payment voucher?

How to fill out a tax payment voucher?

What is the purpose of a tax payment voucher?

What information must be reported on a tax payment voucher?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.