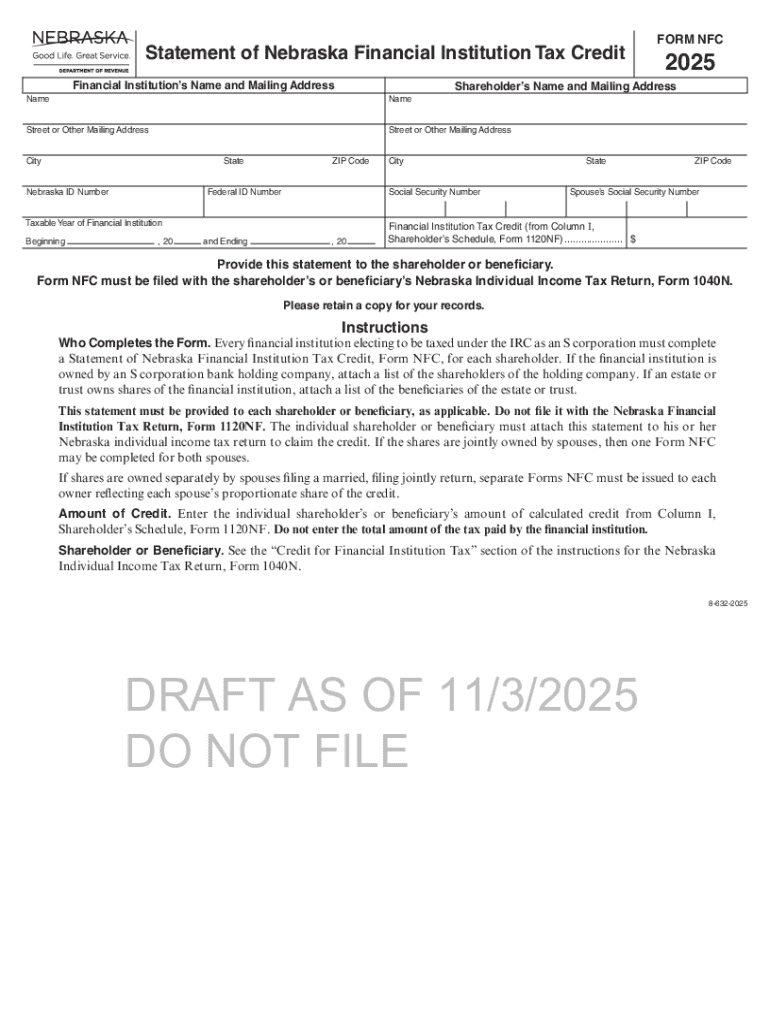

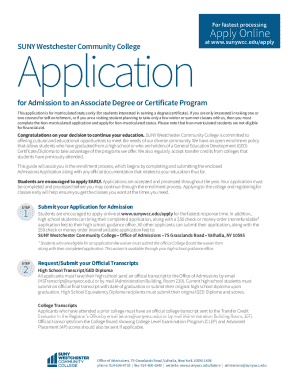

Get the free Online Nebraska Financial Institution Tax Return ...

Get, Create, Make and Sign online nebraska financial institution

Editing online nebraska financial institution online

Uncompromising security for your PDF editing and eSignature needs

How to fill out online nebraska financial institution

How to fill out online nebraska financial institution

Who needs online nebraska financial institution?

A comprehensive guide to the online Nebraska financial institution form

Understanding the online Nebraska financial institution form

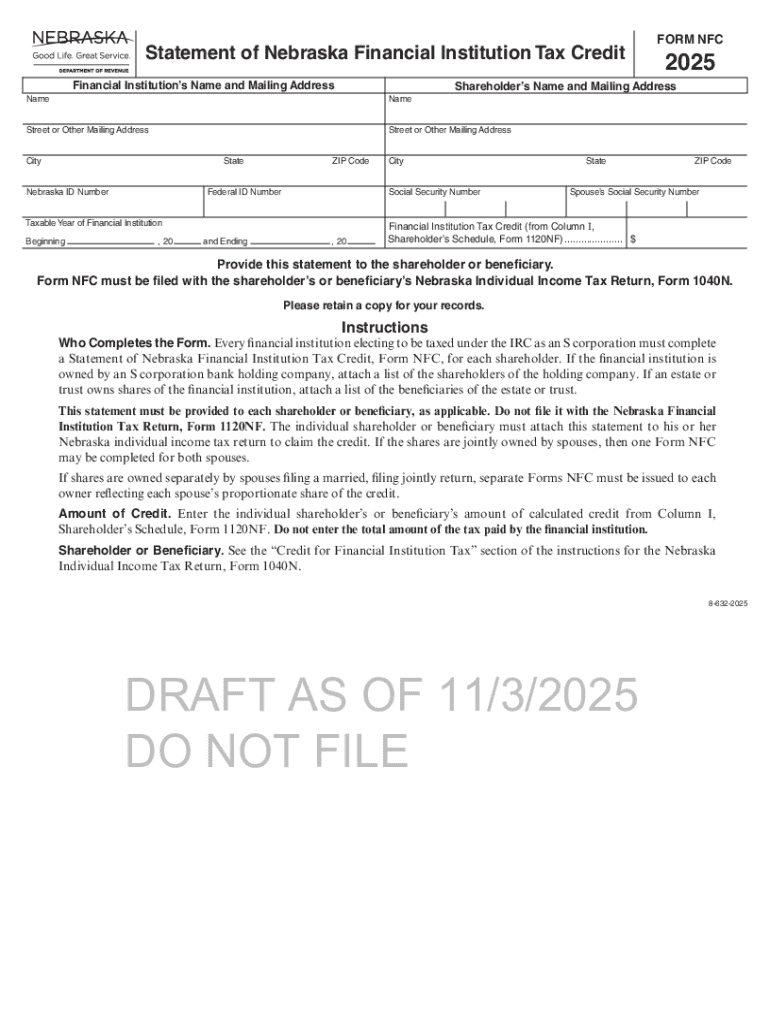

The online Nebraska financial institution form is a critical document that financial organizations within the state must complete to comply with local regulations. It serves several purposes, including reporting, applications, and maintaining compliance with Nebraska's financial laws. This form is particularly significant because it formalizes the operations of financial institutions, ensuring they meet local regulatory standards.

The importance of this form cannot be overstated; it safeguards both consumers and the financial system. Financial institutions must submit this form to the Nebraska Department of Banking and Finance to avoid penalties or legal complications.

Key features of this form include digital accessibility and compatibility with various PDF editing tools. Users can access the form online, fill it out digitally, and submit it without the need for printing, making it both convenient and efficient. Moreover, its compatibility with PDF editing tools ensures users can easily complete and manage the form using platforms like pdfFiller.

Prerequisites for filling out the form

Before you begin filling out the online Nebraska financial institution form, it's crucial to gather all necessary information and documents. This typically includes essential financial data like your institution's name, address, EIN, and financial performance metrics. Additionally, understanding Nebraska-specific regulations will help you navigate the requirements effectively. Failure to provide accurate information may hinder your submission.

Setting up your pdfFiller account is another step in preparing for form completion. Creating an account is simple—it involves providing basic information and choosing a subscription plan that suits your needs. Once set up, users gain access to several features such as form templates, eSigning, and document management tools.

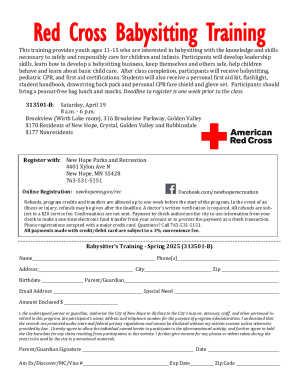

Step-by-step instructions for filling out the online form

Accessing the online Nebraska financial institution form is straightforward. To find the form on pdfFiller, simply log into your account and use the search function, or navigate directly to the templates section for Nebraska forms. Once located, click on the form to start editing it.

The actual filling process involves detailed field-by-field instructions. As you go through each section, be mindful to accurately fill in required fields marked with asterisks. Common sections include the legal name, type of financial institution, and specific financial data. To enhance accuracy and compliance, it’s wise to double-check entries against the data you gathered earlier.

Utilizing pdfFiller’s editing tools can also improve your experience. The platform allows you to highlight relevant sections, add text fields where necessary, and review your entries collaboratively. This is especially beneficial for financial institutions with multiple stakeholders involved in the submission.

Common mistakes to avoid

Understanding the common pitfalls associated with the online Nebraska financial institution form can save your institution time and avoid delays. Common misinterpretations often include inaccuracies in naming the institution or confusing financial metrics. These small errors can lead to significant compliance issues.

Another frequent mistake arises during the submission stage. After filling out the form, many users neglect to verify its completeness and correctness, which can delay processing. Employ a checklist to ensure all required fields are completed and all information is correct before submission.

eSigning and finalizing your form

eSigning your online Nebraska financial institution form is crucial for its legal validity. By incorporating eSignatures, financial institutions can expedite the submission process while ensuring compliance with electronic signature laws. pdfFiller streamlines this process by allowing users to add their signature directly on the platform.

To seamlessly eSign your document using pdfFiller, begin by clicking on the eSignature tab in the editing menu. You can choose to draw your signature using a mouse or stylus, upload an image of your handwritten signature, or select from a pre-saved digital signature template.

Submitting the form

Submitting your completed online Nebraska financial institution form is the final step in the process. Once your form is fully complete and eSigned, navigate to the submission section on pdfFiller. You’ll have options to submit the form electronically to the Nebraska Department of Banking and Finance or download a copy for your records.

After submission, it’s important to confirm that your form has been received. You should receive an automated confirmation email from the Department. If you don’t receive this, follow up with their office to ensure that your submission was successfully processed.

Troubleshooting and support

Encountering issues while filling out the online Nebraska financial institution form is not uncommon. Some users may experience difficulties accessing the form, submitting it, or verifying their eSignature. Addressing these challenges can typically be resolved by double-checking your internet connection and ensuring that all required fields are filled correctly.

In scenarios needing further assistance, pdfFiller offers customer support which can be accessed directly through the platform. You can visit their help section or contact the support team for expedited assistance.

Managing your completed forms

Once your online Nebraska financial institution form is completed and submitted, it's crucial to organize your documents effectively. pdfFiller provides excellent tools for storing and managing your forms, allowing you to categorize them for easy access in the future. Consider utilizing folders or tags within the platform to help keep your documents orderly.

Furthermore, for future reference and reuse, pdfFiller allows users to duplicate completed forms. This strategy can save time and streamline repeated submissions, whether it's for annual reports or other regulatory needs, such as mailing bingo, pickle cards, or keno applications.

Understanding legal and compliance considerations

Completing the online Nebraska financial institution form involves rigorous attention to legal and compliance factors. Financial institutions must maintain adherence to both state and federal regulations concerning privacy, reporting, and operational transparency. Non-compliance not only incurs penalties but damages an institution's reputation within the industry.

Legal resources for financial institutions include consulting with compliance experts and legal counsel specializing in Nebraska’s framework. Staying abreast of changes to legislation is vital in ensuring compliance and understanding the implications of submitted forms on your regulatory standing.

Enhancing your document management with pdfFiller

pdfFiller not only allows for completing the online Nebraska financial institution form but also features additional tools that enhance your document management capabilities. Users can explore templates for various reporting forms, such as applications for cigarette tax, estate tax, lodging tax, and other financial obligations specific to Nebraska.

The platform's collaborative tools enable multiple users to work on the same document in real-time, making it ideal for institutions that rely on teamwork to maintain compliance and accuracy across all submissions.

Insights on financial institution taxes in Nebraska

Understanding the financial tax landscape in Nebraska is crucial for institutions. Nebraska imposes various taxes applicable to financial institutions, including income tax, and special fees like the tire fee and litter fee, which may influence operational costs. Having accurate records and timely submissions, facilitated by forms like the online Nebraska financial institution form, can significantly impact compliance and financial obligations.

Successfully completing forms and reports not only ensures compliance but also enhances fiscal responsibility. Accurate documentation is essential in mitigating penalties and ensuring that all financial obligations, including taxation through programs like the cigarette tax, are met.

Interactive tools and resources

The pdfFiller platform is equipped with interactive tools that enhance user satisfaction and efficiency when managing forms. Users can take advantage of features designed to simplify the completion and submission processes. These include auto-fill capabilities, responsive design for mobile access, and step-by-step guidance throughout the document completion process.

Additionally, users can explore various related forms and templates, making the pdfFiller platform a versatile solution for managing all types of financial documentation required in Nebraska.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my online nebraska financial institution directly from Gmail?

How do I execute online nebraska financial institution online?

Can I create an eSignature for the online nebraska financial institution in Gmail?

What is online nebraska financial institution?

Who is required to file online nebraska financial institution?

How to fill out online nebraska financial institution?

What is the purpose of online nebraska financial institution?

What information must be reported on online nebraska financial institution?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.