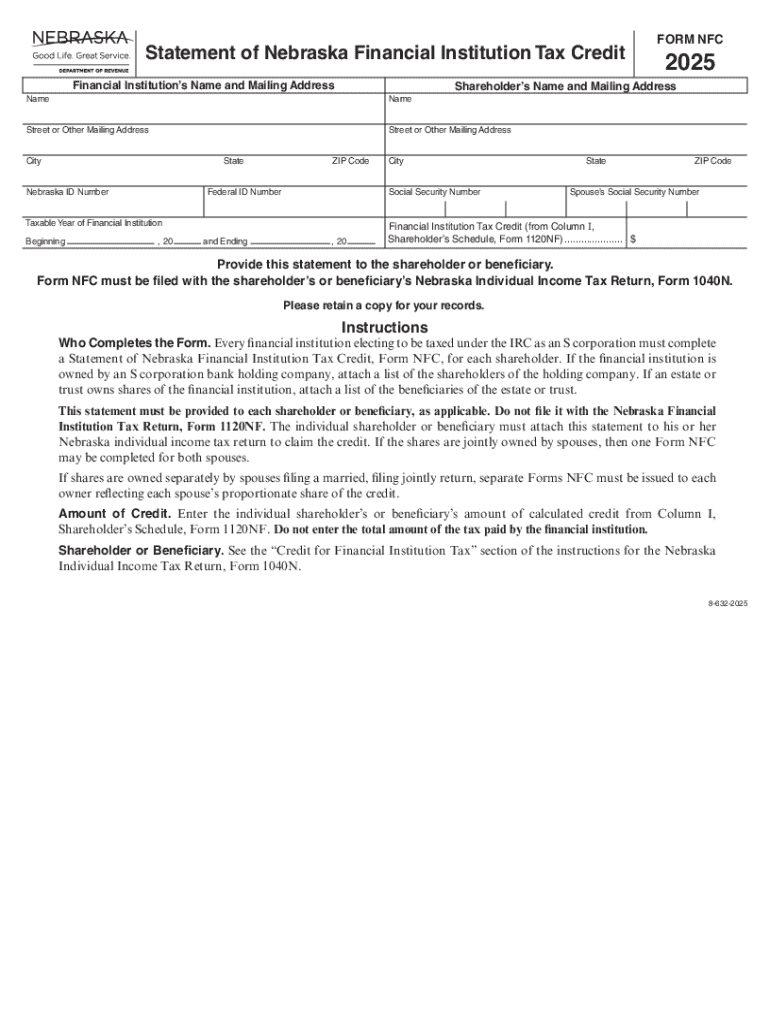

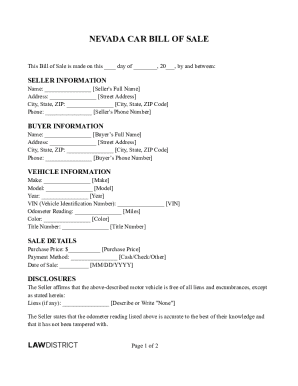

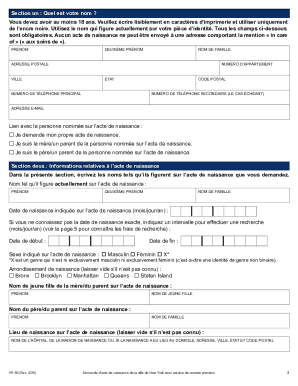

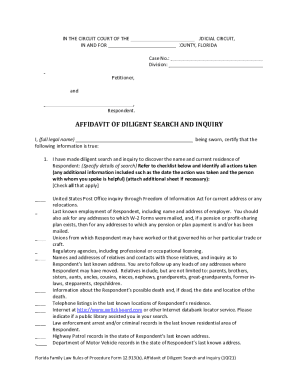

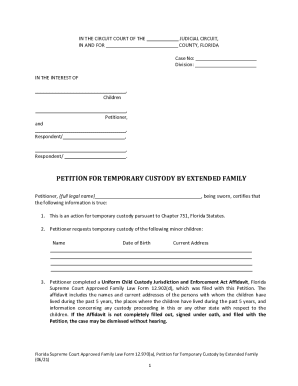

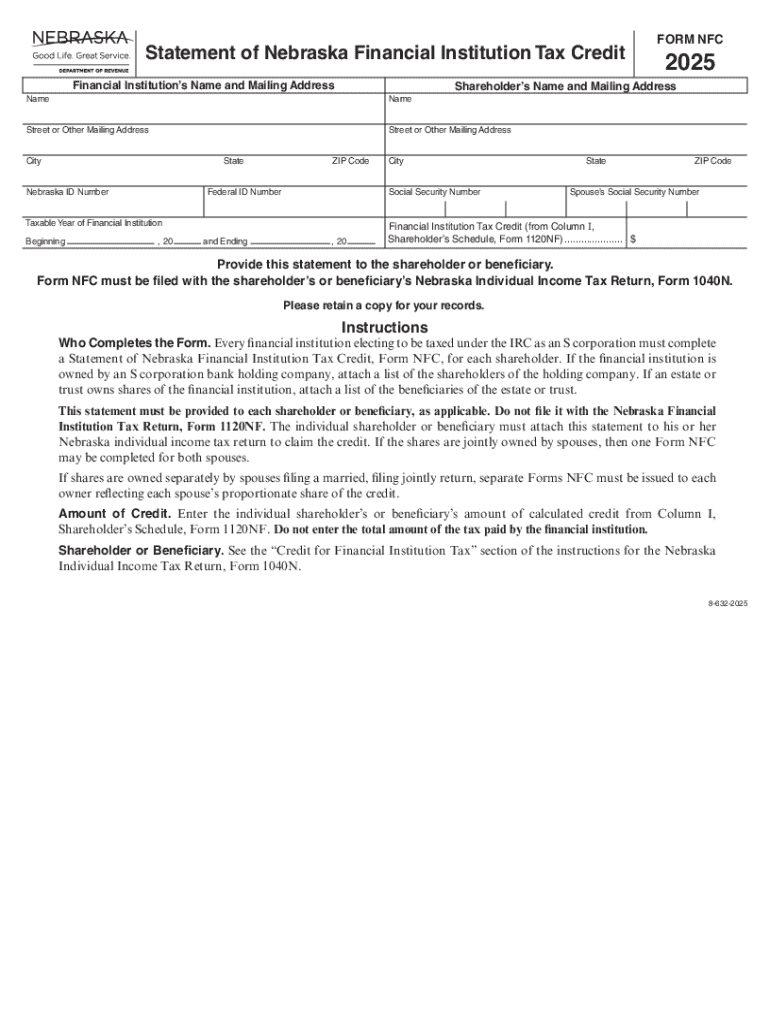

Get the free Taxable Year of Financial Institution

Get, Create, Make and Sign taxable year of financial

Editing taxable year of financial online

Uncompromising security for your PDF editing and eSignature needs

How to fill out taxable year of financial

How to fill out taxable year of financial

Who needs taxable year of financial?

Taxable Year of Financial Form: A Comprehensive Guide

Understanding the taxable year

A taxable year defines the accounting period for which taxes are reported to the government. It is essential in financial reporting and compliance as it determines when tax obligations arise and how income and expenses are recorded. Selecting the right taxable year is crucial for maintaining streamlined finances and ensuring adherence to tax regulations.

The importance of the taxable year cannot be overstated. For businesses and individuals alike, the taxable year fundamentally shapes the strategy for tax planning. Different types of taxable years include the calendar year, running from January 1 to December 31, and the fiscal year, which can vary based on the organization’s operational calendar. The choice between these can significantly influence cash flow, reporting deadlines, and the overall efficiency of financial operations.

Factors influencing the choice of taxable year often include business structure and income cycles. For instance, a retail business experiencing seasonal income may benefit from a fiscal year, aligning tax reporting with revenue peaks. Understanding these elements can lead to more strategic financial decisions.

Choosing the right taxable year for your financial form

Selecting the appropriate taxable year is critical for both individuals and businesses. Individuals often consider their income stream, projected unemployment benefits, and tax credits when deciding on a taxable year. For businesses, considerations may include seasonal sales variations, financial reporting requirements, and the alignment of tax obligations with operational cycles.

Common mistakes in selecting a taxable year can lead to complications during tax season. An organization that opts for a fiscal year not aligned with the market out may find themselves facing discrepancies in income recognition, causing potential audit risks. Proper understanding of financial goals, combined with tax planning, can mitigate these challenges effectively.

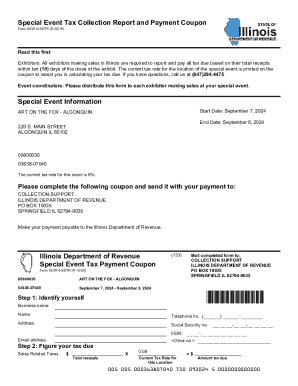

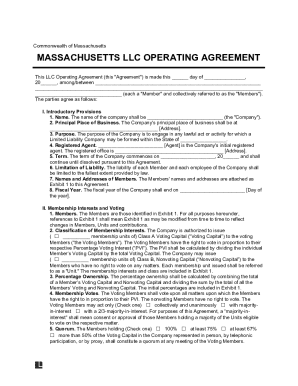

Taxable year and financial forms: An overview

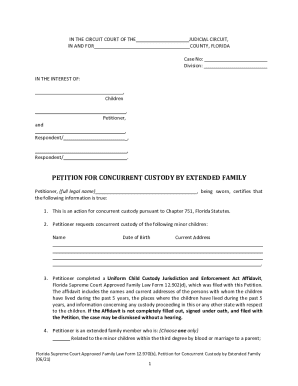

Financial forms encompassing taxable years include individual tax returns (like the 1040 form), corporate tax filings (such as form 1120), and partnership tax returns (like form 1065). Each of these forms adheres to specific deadlines that vary based on the chosen taxable year. For example, individuals typically need to file their returns by April 15 each year, while businesses can have different deadlines based on their fiscal year end.

Understanding how a taxable year impacts form preparation and filing deadlines is fundamental in achieving compliance. Failure to align taxable years with financial reporting can result in tax penalties and interest on unpaid taxes. Thus, ensuring correct form completion according to the chosen taxable year is vital for accurate record-keeping and meeting obligations.

Filling out financial forms for each taxable year

When completing financial forms, certain sections are directly influenced by the taxable year designation. It’s critical to accurately input income and expenses for the specific year that aligns with tax obligations. Use the correct tax form templates and ensure that you get guidance on sections that require special attention due to your taxable year choice.

Tools like pdfFiller provide interactive features to assist users in filling out forms accurately. Their collaboration tools enable teams to work together seamlessly on document management, ensuring everyone is on the same page regarding taxable year selections and corresponding financial forms.

Common scenarios: Taxable year adjustments

Each business may encounter scenarios necessitating a change in their taxable year. Transitioning from a calendar year to a fiscal year can provide better alignment with business operations, but it requires approval from the IRS and the submission of additional documentation. Likewise, filing for an extension can impact the taxable year; it’s essential to evaluate the implications this may hold over tax reporting.

Navigating overlapping taxable years is another complexity to consider. Special provisions exist for situations where a taxable year overlap may cause confusion or misreporting. Having a detailed approach towards understanding how such scenarios impact financial statements allows for more effective tax planning.

Managing financial records in relation to taxable year

Maintaining organized financial records is paramount for effective tax management. Best practices for document management involve systematic categorization based on taxable years. Implementing cloud-based solutions like pdfFiller for storing documents enhances accessibility and simplifies the review process during tax season.

Developing a strategy to organize records for different taxable years prevents potential issues during audits. Labeling files correctly by taxable year helps in easy retrieval and ensures compliance with all documentation requirements, including property tax, sales tax, or unemployment tax forms.

Navigating tax audits and taxable years

Understanding what auditors look for in taxable years is crucial for effective audit preparedness. Auditors examine income recognition, payment patterns, and compliance with deadlines. Mismanagement of a taxable year can serve as a red flag, prompting deeper scrutiny.

Common audit triggers related to taxable year mismanagement include inconsistencies in income records, failure to adhere to established deadlines, and insufficient documentation. Utilizing available resources for preparing for an audit can bolster readiness, ensuring all necessary forms are correctly filled out and available.

Taxable year updates and legislative changes

Keeping abreast of recent changes impacting taxable years is vital for compliance. New regulations can influence filing practices and the categorization of various tax expenditures like utility services or educational contributions. Upcoming legislation can significantly affect financial reporting, making awareness and adaptability key components of successful tax planning.

Being proactive about understanding how legislative changes impact financial forms ensures that businesses and individuals alike can adjust their strategies accordingly. This awareness helps in maximizing available tax credits or allowances related to contributions, making effective tax management possible.

Frequently asked questions about taxable years

Taxable years often lead to multiple questions among taxpayers. One common query is the difference between a taxable year and a reporting year, which relates directly to the distinctions between income recognition and tax obligations. Understanding how a taxable year affects businesses is vital for planning purposes, especially in managing cash flows and obligations.

Another frequent question is regarding the ability to change one's taxable year. Such changes are permissible, but they require proper documentation and approval from taxing authorities to ensure compliance with regulations. For teams handling taxes, being well-informed about these inquiries can greatly enhance readiness and reduce the likelihood of errors.

Conclusion and final thoughts on taxable years

The future trends in taxable year reporting hint at an increased integration of technology in tax management. With digital solutions such as pdfFiller, users can manage documents seamlessly, auto-fill essential information tied to taxable years, and ensure compliance more effectively. As methodologies evolve, leveraging technology will empower users to navigate the complexities of tax reporting proficiently.

As the landscape surrounding taxable years evolves, staying informed about best practices and legislative updates is crucial. pdfFiller continues to lead the way by offering tools that simplify the document management process, making tax preparation not only easier but also more efficient for individuals and teams alike.

Appendices and resource links

For further assistance, appendices will provide templates for the various tax forms discussed and a glossary of key terms related to taxable years. Detailed resource links to relevant IRS guidance and publications are included to support taxpayers in their journey of tax compliance and financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute taxable year of financial online?

How do I edit taxable year of financial online?

How do I fill out taxable year of financial using my mobile device?

What is taxable year of financial?

Who is required to file taxable year of financial?

How to fill out taxable year of financial?

What is the purpose of taxable year of financial?

What information must be reported on taxable year of financial?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.