Get the free FINSA Client information - labha investment advisors s.a.

Get, Create, Make and Sign finsa client information

How to edit finsa client information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out finsa client information

How to fill out finsa client information

Who needs finsa client information?

Understanding the Finsa Client Information Form for Efficient Client Management

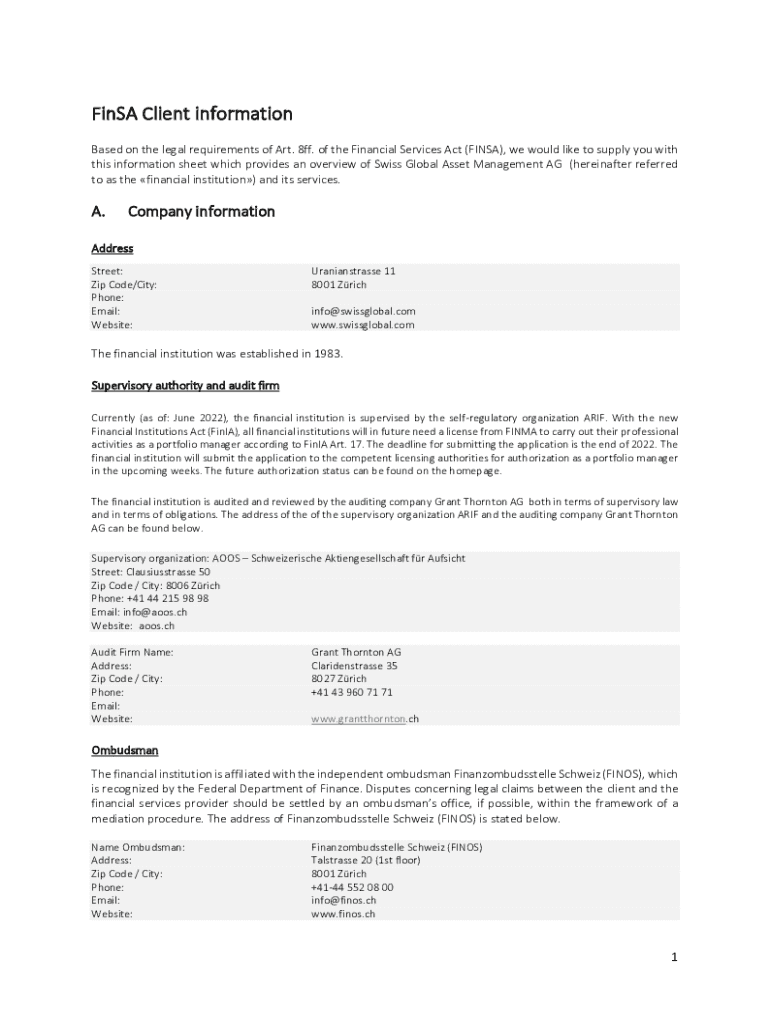

Overview of the Finsa Client Information Form

The Finsa Client Information Form is a critical tool designed to gather essential data from clients during the onboarding process. Its primary purpose is to facilitate effective financial assessments and ensure that the services provided align with the client's needs and preferences. The form plays a significant role in the financial services landscape by streamlining the collection of important information, ultimately leading to enhanced client relationships and successful financial outcomes.

Both individuals and teams engaged in financial services or client management will find this form beneficial. Organizations, especially those in regulated industries, require precise client documentation to meet compliance standards, manage risk, and provide tailored services. Thus, understanding how to leverage the Finsa Client Information Form is essential for finance professionals.

Importance of accurate client information

Accurate client information is foundational to any successful financial service operation. Enhanced client relationship management leads to improved client satisfaction, fostering trust and increasing loyalty. Moreover, obtaining precise information mitigates risks that arise from inaccuracies, such as miscommunication or mismatched services.

From a legal standpoint, maintaining accuracy is paramount for compliance with various regulations such as Anti-Money Laundering (AML) and Know Your Customer (KYC) laws. Failure to collect and manage accurate client data can result in punitive penalties, loss of reputation, and potentially, legal action against financial institutions. Thus, investing time and effort into collecting accurate client information through the Finsa Client Information Form is not just beneficial but necessary.

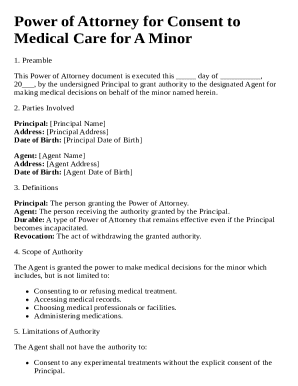

Detailed walkthrough of the Finsa Client Information Form

Accessing the Finsa Client Information Form is straightforward thanks to pdfFiller's user-friendly platform. Simply navigate to pdfFiller, search for the form using the search bar, and you’ll find it ready to be filled out. Once you locate the form, you can begin entering information directly or download it as a PDF for more traditional methods of completion.

The form is divided into key sections that each serve distinct purposes. The **Contact Information** section is important as having up-to-date contact details ensures timely communication. Next, the **Financial Background** section requests vital information about the client’s financial history, which may require supporting documentation to verify accuracy. The **Investment Preferences** section collects insights into the client's goals and risk appetites, greatly influencing tailored investment strategies.

In addition to these sections, there are **Compliance Acknowledgments** that clarify privacy policies and legal agreements clients must agree to. To ensure a thorough understanding and completion, consider these tips: double-check contact details, be transparent about financial history, and clearly communicate investment preferences. This will minimize errors and support effective financial strategies.

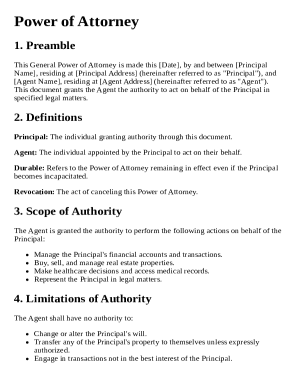

Editing and managing the Finsa Client Information Form

pdfFiller provides a wealth of tools for editing the Finsa Client Information Form. Features such as adding text, annotations, and other modifications allow for customization to meet specific client needs. This flexibility ensures that the document remains relevant and useful for both clients and the firms working with them.

Once the form is completed, there are various options for saving and storing it securely. Cloud-based storage options available in pdfFiller ensure that your documents can be retrieved from anywhere, alleviating issues related to hardware limitations or geographic constraints. Moreover, this cloud-based document management system enhances collaboration, enabling users to access and edit documents at their convenience.

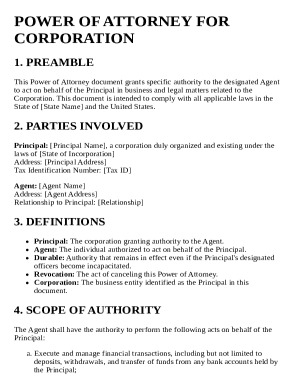

Collaborating with team members

Collaboration is key in ensuring that the Finsa Client Information Form is completed accurately. The pdfFiller platform allows users to share the form seamlessly with colleagues for input. Simply use the sharing option to send the document, enabling multiple team members to contribute their insights and expertise.

The importance of collaborative editing cannot be overstated; it enhances the accuracy of the information collected and takes advantage of diverse expertise within a team. Team members can review each other's inputs, which fosters higher-quality submissions and strong client relations resulting from enriched understanding.

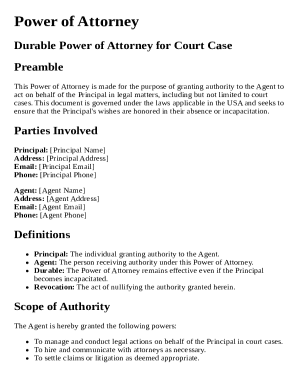

Signing the Finsa Client Information Form

The Finsa Client Information Form can be securely signed using the eSignature features available in pdfFiller. Users can easily add their signature electronically, ensuring that both the signing process is updated to meet digital requirements while retaining legal validity. This feature simplifies the administrative burden associated with physical signature collection.

Secure signing is pivotal for compliance with various eSignature regulations like the ESIGN Act and UETA. By using electronic signatures, organizations not only streamline their processes but also enhance security and reduce unnecessary paperwork. This modern approach to documentation saves time and promotes a smoother client experience.

Troubleshooting common issues

When filling out the Finsa Client Information Form, users may encounter common issues such as input errors or misunderstandings about required information. To alleviate these challenges, it is important to read each section carefully and ensure that all required fields are completed to avoid delays in processing.

Additionally, if technical difficulties arise while using pdfFiller, reference the FAQ section or support resources available on the platform. Common concerns pertain to account access, document saving, or sharing functionalities. By familiarizing oneself with these aspects, users can efficiently navigate potential issues and keep the documentation process on track.

Monitoring client information after submission

Understanding what happens after submitting the Finsa Client Information Form is crucial for effective data management. Once submitted, the data is processed according to the organization’s policies, and the next steps in client onboarding are initiated. Maintaining transparency at this stage helps in fostering trust between the client and the financial organization.

Moreover, updating client information regularly is essential. Procedures for revising information should be clear and accessible, enabling teams to keep client records accurate and current. Implementing routine checks or reminders can help in continuously maintaining up-to-date client information, which is vital for compliance and effective service delivery.

Conclusion: Leveraging the Finsa Client Information Form for success

Proper documentation using the Finsa Client Information Form provides a strategic advantage in client management. By effectively gathering and managing client data, organizations can enhance relationships and deliver tailored services. In the long run, utilizing the Finsa form not only supports compliance but also facilitates a deeper understanding of clients’ needs and preferences.

Thus, by leveraging tools like the pdfFiller for accessing, editing, and managing the Finsa Client Information Form, finance professionals and organizations can navigate the complexities of client documentation with confidence, ensuring successful client outcomes and compliance with regulatory requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit finsa client information in Chrome?

How do I edit finsa client information straight from my smartphone?

How do I fill out finsa client information on an Android device?

What is finsa client information?

Who is required to file finsa client information?

How to fill out finsa client information?

What is the purpose of finsa client information?

What information must be reported on finsa client information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.