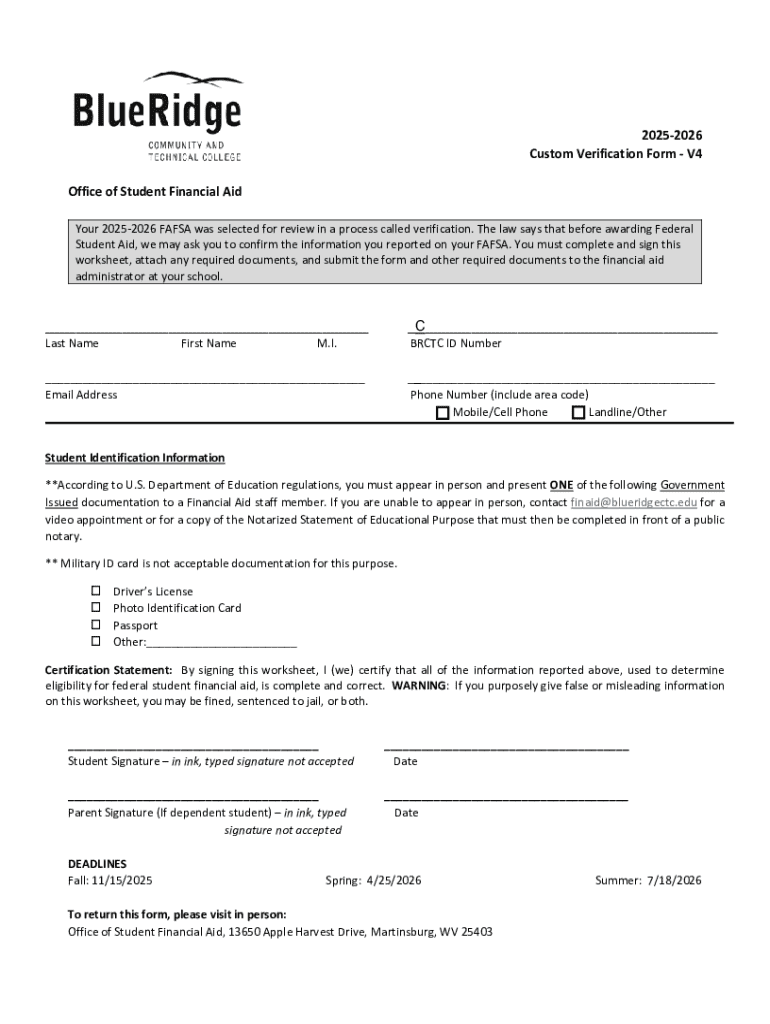

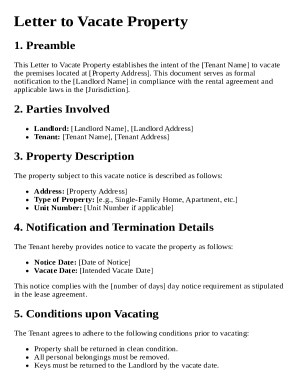

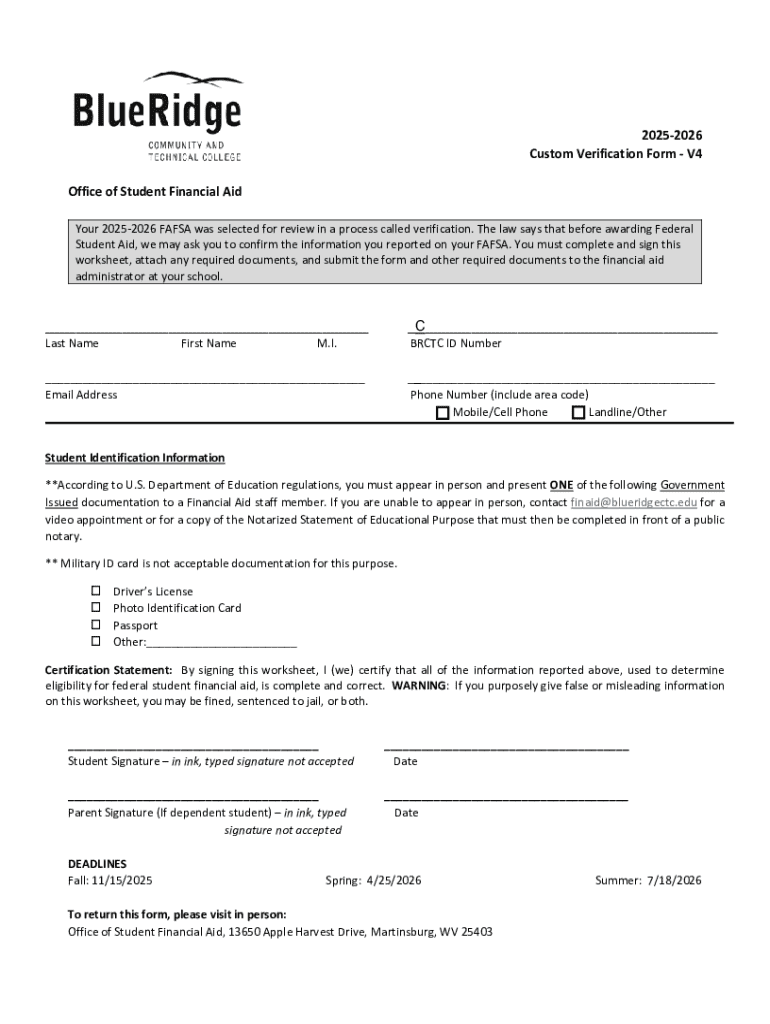

Get the free 2025-2026 Custom Verification Form - V4 Office of Student ...

Get, Create, Make and Sign 2025-2026 custom verification form

How to edit 2025-2026 custom verification form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025-2026 custom verification form

How to fill out 2025-2026 custom verification form

Who needs 2025-2026 custom verification form?

Comprehensive Guide to the 2 Custom Verification Form

Understanding the 2 custom verification form

The 2 custom verification form is a crucial document used primarily by educational institutions, including schools and departments of education, to verify the eligibility for federal Title IV aid. Its purpose is to confirm income, family size, and other important factors that affect financial aid eligibility. By filling out this form, applicants ensure that their financial aid packages are accurate and tailored to their specific financial situation.

Completing the verification process is not just a formality; it is essential for ensuring that students receive the correct amount of financial aid. Inaccuracies or omissions can lead to delays in aid disbursement or, worse, the loss of qualification for funding. Understanding who needs to fill out the custom verification form is equally vital. Generally, any student applying for federal aid who is selected for verification must submit this form. This includes not only dependent students but also independent students who may have unique circumstances.

Key updates for the 2 form

Each year brings changes to verification requirements, and the 2 custom verification form is no exception. Key updates from previous years include additional documentation requirements that reflect new federal guidelines. For instance, applicants may be required to provide more detailed income-related documents compared to previous years in response to increasing concern over fraud and integrity in financial aid processes.

New requirements may include specific types of income documentation that weren’t previously necessary, such as alternative income verification due to pandemic-related job losses. This shift is designed to accommodate various applicants' circumstances, ensuring that everyone has a fair chance at receiving aid. Understanding how these changes impact both applicants and stakeholders is essential; institutions must adapt their processes to ensure compliance while maintaining support systems for students.

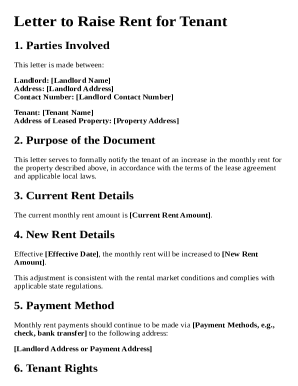

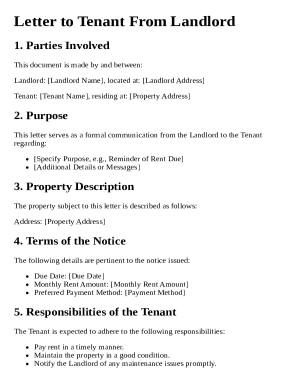

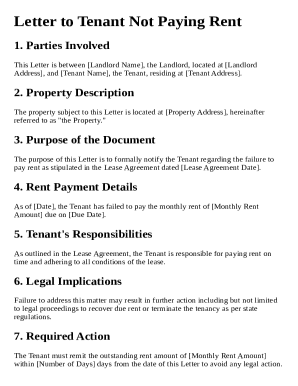

Step-by-step instructions for completing the custom verification form

Before diving into the completion of the custom verification form, it's essential to prepare adequately. Start by gathering all necessary items, such as income tax returns, W-2 forms, and any additional documentation that reflects family size and financial circumstances. Having everything at your fingertips would save time and reduce headaches during the application process.

Understanding each section of the form is equally important. The verification form typically comprises several key sections, including personal information, income and tax information, and family size documentation. Ensuring that you comprehend what each section entails can prevent errors and omissions that could delay the verification process. A detailed walkthrough of each section helps clarify what information is needed.

Interpreting verification items

Verification items are specific elements within the custom verification form that necessitate confirmation from the applicant. Understanding these items, including income figures and family size, is paramount for a successful educational aid application. Certain situations, such as discrepancies between reported income and tax data, may trigger verification requests. Being proactive in identifying potential red flags in your form submission can save time.

When responding to verification requests, it is vital to provide any requested documentation promptly and accurately. This includes keeping communication lines open with the relevant financial aid offices. Ensuring you have a thorough understanding of what constitutes verification items helps in addressing any concerns efficiently.

Acceptable documentation

The successful completion of the 2 custom verification form hinges on the accuracy and appropriateness of the documentation you submit. Various types of acceptable documentation include income tax returns, W-2 forms, and 1099s, which outline your income details for the year. In specific cases, you might also want to submit other supporting documents, such as bank statements or pay stubs.

When collecting and submitting documentation, pay attention to the guidelines provided by your educational institution. Digital submissions are often preferred, allowing for streamlined processing. However, it’s crucial to follow best practices for securing your personal information, such as using encrypted platforms and double-checking the sender's legitimacy.

Special considerations and exclusions

There are unique situations that may exempt certain individuals from the verification process. Special circumstances—like recent job loss, disability, or significant changes in income—can play a crucial role in avoiding mandatory verification for some students. Understanding these exclusions can help in the decision-making process when applying for federal aid.

Financial situations deemed unusual—such as significant medical expenses or other outlays affecting income—could also lead to special exemptions. If you believe you fall into one of these categories, it’s important to consult your department of education or financial aid office for guidance on the next steps.

Additional resources for verification assistance

In navigating the custom verification form, assistance and resources are readily available. Many institutions offer online support services, including live chat options, to help applicants with the intricacies of the form and document submission processes. Additionally, community forums where users share their experiences can provide valuable insights into navigating similar challenges.

Utilizing tools like pdfFiller can streamline your document management process. Features such as editing, eSigning, and secure cloud storage make it easy to handle your paperwork. Collaboration with team members or family on the verification form is simplified, enhancing both efficiency and organization.

FAQs regarding the 2 custom verification form

Frequently asked questions about the verification process help clarify common concerns. Many applicants wonder about the difference between regular verification and custom verification—a distinction that is essential for understanding the specific requirements of the 2 custom verification form. Others may inquire about deadlines, the timeframe for processing, and how to handle lack of documents.

Clarifying misconceptions surrounding verification is equally important. Many believe that providing incorrect information will immediately disqualify them, but often, there are opportunities to rectify errors before final decisions are made. Familiarizing yourself with these nuances will arm you with the necessary knowledge to navigate verification confidently.

Staying informed on verification policies and procedures

To effectively manage your financial aid process, staying updated on verification policies is crucial. Regularly checking official education department communications and institutional announcements can ensure that you are informed of any changes. Many schools provide email newsletters or updates to help applicants remain aware of verification requirements.

Tracking changes in verification requirements annually is vital, especially as regulations evolve. Being proactive in your research can prevent last-minute surprises when submitting your verification form or dealing with requests for additional documentation.

Utilizing pdfFiller effectively for your verification needs

pdfFiller offers users unparalleled benefits for form management, particularly for the verification process. By leveraging the platform’s features, such as easy editing, digital signing, and collaborative tools, users can significantly simplify the often daunting task of completing the 2 custom verification form.

Interactive features on pdfFiller make filling out your verification form a more straightforward experience. For instance, options to share your completed documents directly with your school can eliminate unnecessary delays. This unified, cloud-based approach fosters an organized environment for managing your essential paperwork while protecting your sensitive information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025-2026 custom verification form to be eSigned by others?

How can I edit 2025-2026 custom verification form on a smartphone?

How do I edit 2025-2026 custom verification form on an iOS device?

What is 2025-2026 custom verification form?

Who is required to file 2025-2026 custom verification form?

How to fill out 2025-2026 custom verification form?

What is the purpose of 2025-2026 custom verification form?

What information must be reported on 2025-2026 custom verification form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.