Get the free 14240 W

Get, Create, Make and Sign 14240 w

Editing 14240 w online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 14240 w

How to fill out 14240 w

Who needs 14240 w?

14240 W Form - How-to Guide Long-Read

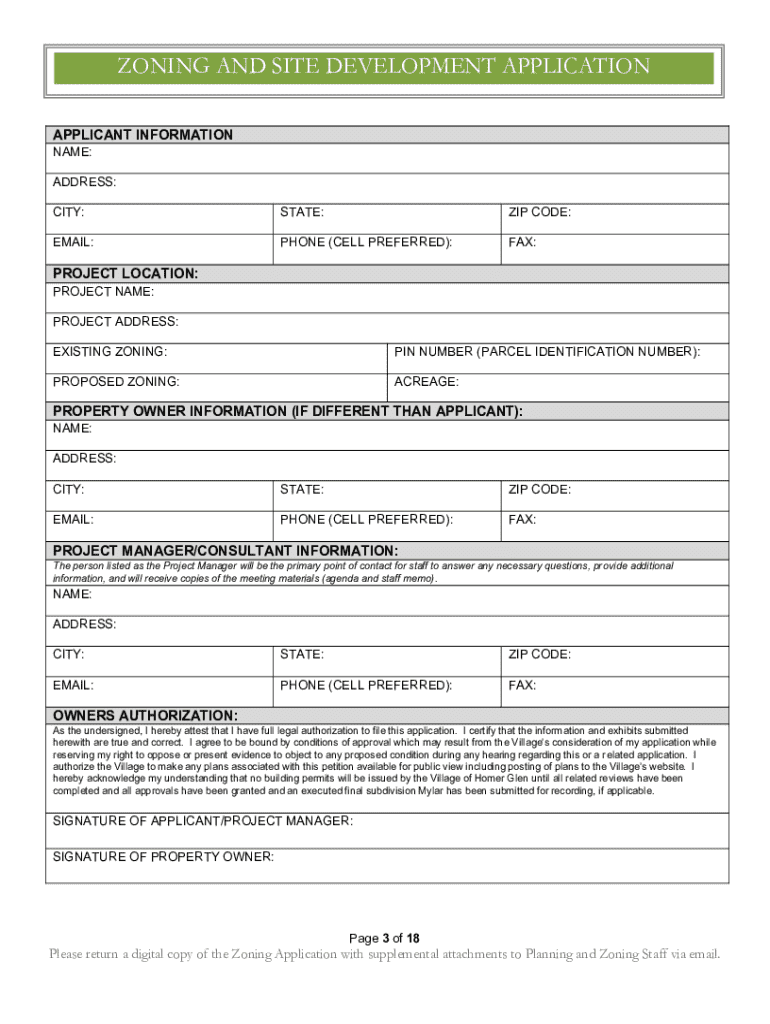

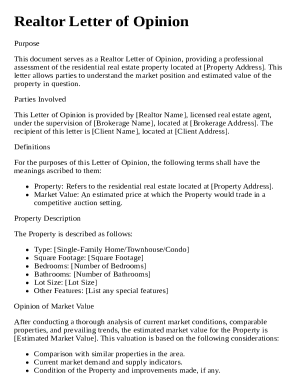

Understanding the 14240 W Form

The 14240 W Form is a crucial document used in the realm of federal tax reporting in the United States. This form is typically associated with reporting various types of income, exemptions, and deductions, serving to streamline communications between individual taxpayers and the IRS. As tax laws evolve, the significance of accurately completing the 14240 W Form cannot be overstated; it ensures compliance with current regulations and smooths the process of tax filing.

In the context of tax documentation, the 14240 W Form provides a structured format for taxpayers to declare their financial information. Its comprehensive sections cover various income sources and deductions, allowing the IRS to process returns efficiently. Properly filling out this form not only avoids potential discrepancies but also aids taxpayers in maximizing their claims and deductions appropriately.

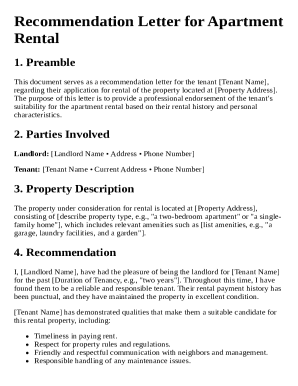

Who needs to use the 14240 W Form?

Understanding who must fill out the 14240 W Form is pivotal for compliance and efficiency in tax filing. Generally, individuals and entities with taxable income that falls under the United States' jurisdiction need to use this form. Target audiences include freelancers, business owners, and employees who have multiple income streams, as well as anyone seeking deductions for expenses incurred during the tax year.

Scenarios that might prompt the use of the 14240 W Form vary widely. For instance, self-employed individuals must accurately report self-employment income and associated expenses, while employees working multiple jobs may need to consolidate income information across various employers. Understanding these nuances helps ensure no income is omitted, resulting in proper tax computation.

Key features and benefits of the 14240 W Form

The 14240 W Form encompasses multiple features designed to enhance user experience and comply with tax requirements. Key sections include Personal Information, Income Details, Deductions, and Exemptions. Each section has a specific focus aimed at gathering comprehensive data. Moreover, the form is regularly updated to reflect changes in tax law, providing users with peace of mind knowing that their submissions align with current regulations.

The benefits of using the 14240 W Form extend beyond mere compliance. Streamlining tax submissions becomes easier with this centralized form, reducing the likelihood of errors that can lead to audits or penalties. Furthermore, claiming accurate deductions ensures that users maximize their tax filings, potentially translating into significant financial savings.

Interactive tools for 14240 W Form completion

Utilizing online tools can significantly enhance the experience of filling out the 14240 W Form. pdfFiller offers a comprehensive platform that allows users to fill out forms from any internet-enabled device seamlessly. Features include auto-fill options based on previous entries and the ability to maintain organized templates, making the process intuitive and efficient.

Creating, saving, and sharing completed forms is facilitated through straightforward functionalities. Users can effortlessly email or export finished documents, enhancing collaboration and efficiency. This means that teams can work together without the constraints of geographical barriers, as all necessary documents can be accessed in real time.

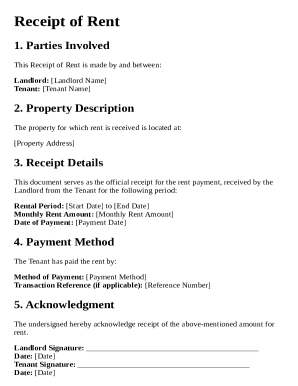

Step-by-step instructions to fill out the 14240 W Form

Preparation is vital before diving into filling out the 14240 W Form. It's essential to gather all relevant documents, such as W-2s, 1099s, receipts for deductions, and other income-related documentation. Users should educate themselves on their eligibility for various deductions and exemptions to ensure they capitalize on all legitimate claims.

When filling out the form, begin with Personal Information, ensuring accuracy in name, address, and social security numbers. The Income Details section should capture all income streams comprehensively, while the Deductions and Exemptions section should be filled in carefully, making sure to back claims with appropriate documentation. Be aware of common pitfalls, such as misreporting income or forgetting to sign the form.

Once completed, validate all entries carefully. Look for inconsistencies or errors that might hinder the submission's acceptance. Finally, electronic submission can often expedite the process, and knowing the correct method to sign and submit your form is crucial.

Editing and managing the 14240 W Form

Mistakes can occur even in the most meticulously filled forms. For submission amendments using the 14240 W Form, it's essential to follow specific guidelines to ensure you correct errors properly. Users should familiarize themselves with the process of filing an amended return and understand the potential implications of these corrections.

Managing versions and edits of the 14240 W Form is also crucial. pdfFiller offers features that track changes and maintain different versions, allowing users to refer back to previous submissions if needed. Storing forms securely in the cloud ensures access and security, reducing the risks associated with misplaced documents.

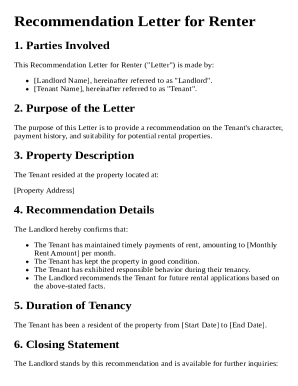

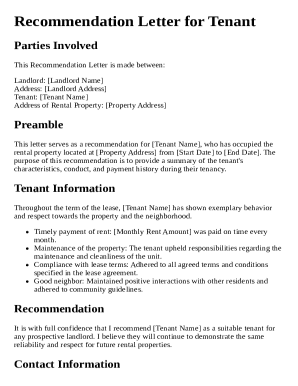

eSigning the 14240 W Form

eSigning refers to the process of applying an electronic signature to documents. The legal status of eSignatures is recognized in many countries, including the U.S., facilitating the digital signing of important tax forms. The 14240 W Form can be securely signed using various eSigning platforms.

Using pdfFiller, you can add your electronic signature easily. This process ensures that your submission adheres to eSignature regulations, making it legal and binding. Essential steps include selecting the eSignature option, placing your signature in the appropriate area on the form, and confirming the signed document for submission.

FAQs about the 14240 W Form

Many questions arise around the 14240 W Form, especially from first-time users. One common concern is what to do if the form is lost. In such cases, you can obtain a replacement from the IRS or utilize your stored digital version from platforms like pdfFiller for re-printing purposes.

Another frequent inquiry centers around discrepancies in the information provided. If errors are discovered post-submission, be sure to consult the appropriate amendment guidelines. First-time filers should prepare ahead by educating themselves on the various deductions and ensuring all necessary documents are collected prior to initiating the application process.

Contact and support for the 14240 W Form

If you encounter any challenges with the 14240 W Form, a variety of support options are available. pdfFiller offers a wealth of resources, including tutorials and customer support through email and phone. These channels can provide assistance with specific questions or technical issues encountered during the form-filling process.

Community forums are also an excellent avenue for users to share their experiences and solutions related to the 14240 W Form. Engaging with tax professionals is advisable for more complex situations. When in doubt, seeking professional assistance ensures compliance and eases the anxiety associated with tax filing.

Best practices for document management

Organizing tax documents effectively is vital for a stress-free tax season. Employing systematic approaches to maintaining your documents minimizes the risk of loss. Use dedicated folders for different tax years, and categorize by type—income, deductions, and receipts—ensuring ease of access during filing.

Leveraging cloud-based solutions like pdfFiller enhances document security and accessibility. By keeping your forms stored online, you can access them from anywhere, minimizing the chances of losing important documents and enabling seamless collaboration with others if needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 14240 w directly from Gmail?

How do I complete 14240 w online?

How do I edit 14240 w on an iOS device?

What is 14240 w?

Who is required to file 14240 w?

How to fill out 14240 w?

What is the purpose of 14240 w?

What information must be reported on 14240 w?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.